Rating of the best Forex advisors

Every trader uses the same tools, the same books, indicators, analytical data, but gets completely different results.

Using the same indicators, traders create hundreds of strategies that differ radically from each other, both in their operating principles and in their effectiveness.

Using the same indicators, traders create hundreds of strategies that differ radically from each other, both in their operating principles and in their effectiveness.

Naturally, such different views on price movements are the very engine that drives technical analysis to evolve.

It's no surprise, then, that hundreds of different Forex advisors are available today, with new robots appearing year after year.

Therefore, it can be quite difficult for beginners who have decided to switch to automated trading to find and select something worthwhile, since even testing it and ensuring it works can take a huge amount of time.

To make the task easier, it's best to use a Forex advisor rating.

Top Forex Advisors

Mactor is a 2018 development based on an indicator strategy based on the standard MACD, as well as a grid-based order management model based on Martingale.

The robot tracks trends and opens positions strictly in their direction, which allows for a minimal reduction in the number of martingale triggers and trades opened against the market.

One of the robot's distinctive advantages is its omnivorous nature, as the expert can work with all currency pairs and on any timeframe, provided, of course, you reconfigure it first.

The robot also adapts perfectly to the trader's needs, as by optimizing the parameters, it can be made quite conservative or, conversely, aggressive for high-risk deposit growth.

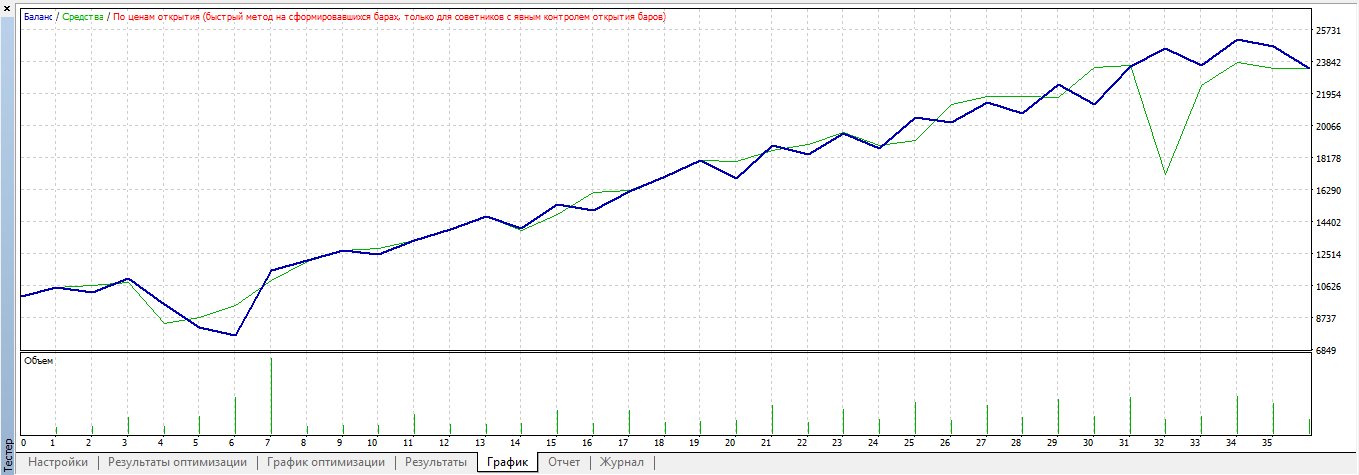

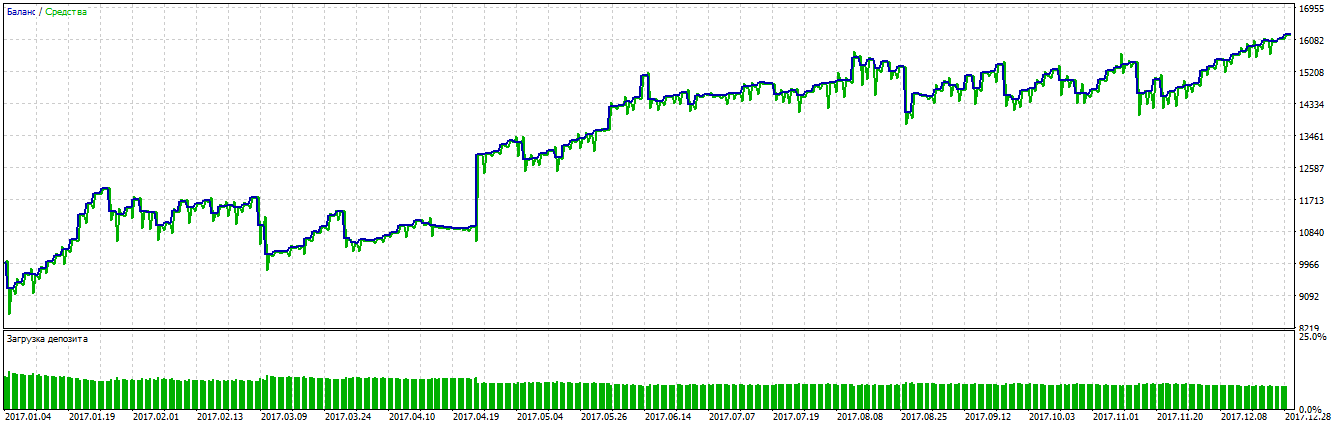

Profitability can range from a few tens of percent to hundreds of percent or even higher. The downside of this robot is its relatively high drawdown and increased deposit requirements. Profitability chart:

BF Smart Scalper EA is a complex scalping expert advisor designed for intraday trading. The robot is based on several technical indicators, but its key feature is its ability to account for changes in volatility; its trades are always responded to by a surge in price activity.

Initially, the robot finds a global trend by comparing two moving averages, then receives a signal based on a breakout of the Bollinger Band, after which it opens its trade by checking the actual market activity and measuring volatility.

This robot is also a new product of 2018, and it has even been published in the MT4 market.

Its advantage is the complete absence of martingale and dangerous capital management models, which allows it to be used even with a small deposit.

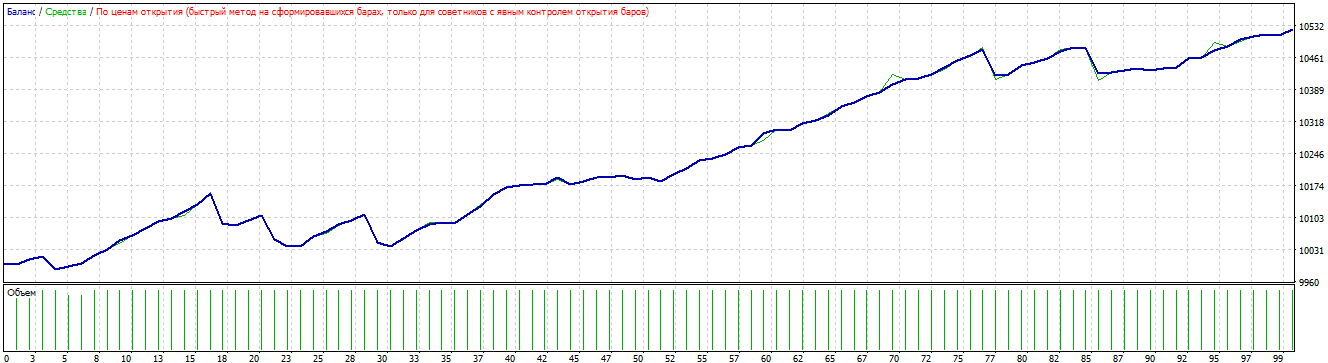

The lack of a martingale also prevents the robot from losing its entire deposit in one go, and most importantly, the working drawdown is very low. BF Smart Scalper EA is a conservative robot, and its profitability chart looks like this:

3. AlliHeik

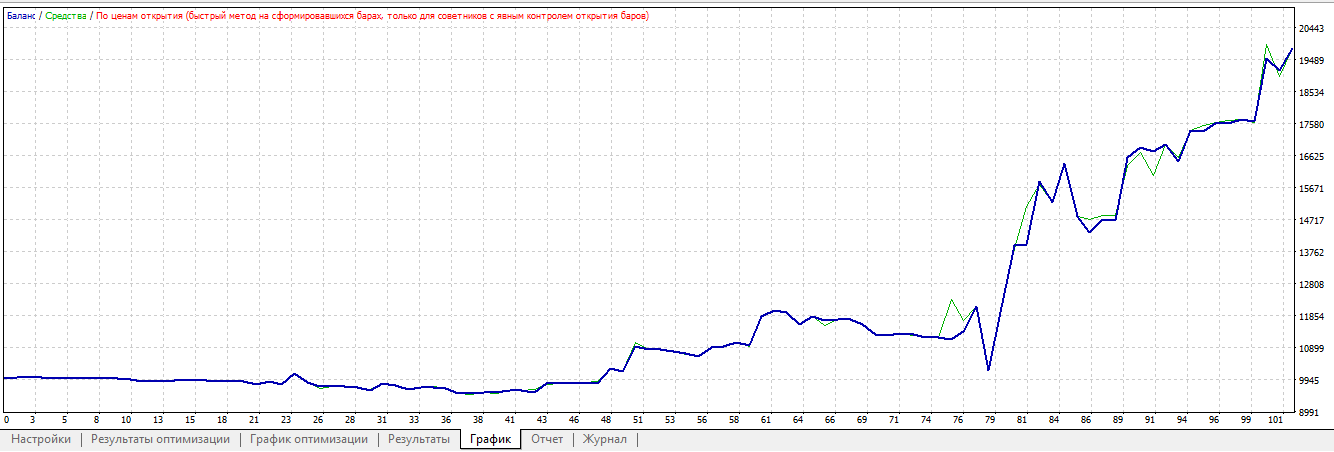

AlliHeik is a trading robot designed to track highly volatile cryptocurrency movements, specifically Bitcoin.

The robot is created using an indicator strategy that uses the famous "Alligator" indicator developed by Bill Williams, as well as the equally well-known Heiken Ashi Smoothed indicator.

In fact, this expert is a very striking and typical example of a trend-following advisor that does not use dangerous capital management models.

The robot's advantages include precise risk control, high potential profitability, and omnivorousness, as it can be reconfigured for any cryptocurrency in your MT4.

Xarax is a representative of a new generation of robots, the first version of which was developed quite recently, namely in 2017.

To make it clear, Xarax is a pure mathematical robot that does not use any technical indicators.

So, from the moment it is applied to the chart, the robot opens two oppositely directed trades, after which it closes the first with a profit, and brings the second into the plus by averaging according to the martingale.

One of the advisor's fundamental advantages is its very simple, yet effective, decision-making algorithm.

Thanks to this, the robot can be adjusted to any trading conditions, allowing the expert to demonstrate excellent profitability on virtually all currency pairs.

The disadvantage, as with all martingales, is a very high drawdown.

Larry Conners RSI is an automated version of the strategy from Linda Raschke's book, which belonged to trader Larry Conners.

The robot is a trend-following one, as it is designed to trade in the direction of a trend determined by moving averages and RSI.

The robot does not use dangerous capital models and can be adjusted to trade on all trading assets.

In conclusion, it's worth noting that this Forex advisor rating is for informational purposes only, so be sure to double-check the experts' profitability in the tester and on a demo account before trading with real money.