Partial position closing tactics.

When trading Forex, you often encounter a situation where a successful trade becomes unprofitable after a sharp trend reversal.

unprofitable after a sharp trend reversal.

You're left regretting that you didn't close the position in a timely manner, but at the time, you were thinking about maximizing your profit and there was no indication of a potential reversal.

In such a situation, it's best to find a compromise that allows you to profit without closing a promising order.

This can be achieved by partially closing the position, without opening any counter orders, which would increase the spread and further complicate your trade.

The partial position closure tactic involves modifying an existing order, using the technical capabilities of the trader's terminal.

A concrete example will make the process clearer:

Open a standard market order of 1 lot , set a stop loss and current profit, and begin monitoring the market.

Once a profit is made, we proceed to a partial closure of the position. The key is to make the profit at least a couple of dozen pips. In our case, let's say 40.

To do this, in the "Trade" tab of your trading terminal, click on the line with information about open orders.

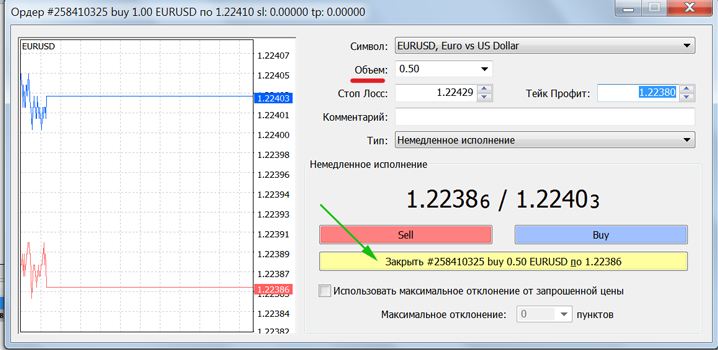

Afterwards, you'll see a window where you can change the "Volume" to half the previously opened order—in our case, 0.50. If this volume isn't listed in the prompts, simply enter the value manually.

Then click the bottom yellow line labeled "Close with order parameters." This will leave you with an open position of only 0.5 lots. You'll make a profit of 20 pips, or about $100.

To consolidate your gains, you can move the stop-loss order on the remaining position to the breakeven zone, thereby eliminating the very possibility of losses.