Trading on pullbacks.

Almost every other article on Forex trading recommends trend-following trading, as trend-following trading is less risky.

is less risky.

However, instead of the promised profit, traders only receive stop-loss orders. As soon as a new trade is opened, the trend immediately reverses, raising suspicions about the dealing center's dishonesty.

However, there's nothing criminal about this phenomenon, as these are normal pullbacks or trend corrections.

Why do most authors so insistently recommend opening trades with the trend? Because their articles focus on trading on medium- and long-term timeframes, and most traders engage in intraday trading using fairly high leverage.

Therefore, stop losses are set as close as possible to the current price, which causes them to be triggered frequently.

What if you don't want to change your trade volumes? Try trading pullbacks.

Trading pullbacks is a well-known tactic that allows for a more guaranteed profit in short-term trading, often used in scalping .

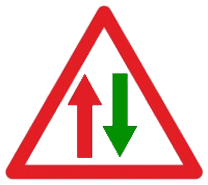

What's the essence of this tactic? It's quite simple: first, determine the current trend, then wait for a correction, and open a short-term trade in the opposite direction.

Entry points are reversals near the support or resistance line, as well as signals from the stochastic indicator .

The trade is held, taking into account the average duration of pullbacks for the day, reaching the support or resistance line, and beginning a trend movement.

Typically, using this tactic, profits exceeding a few dozen pips on M1, or even just a couple of pips, are rare, but the number of successful trades is typically much higher.