Forex volume.

The concept of volume is quite common in technical analysis of financial markets; it is this indicator that serves as the main confirmation of an emerging or current trend.

Forex volume characterizes the number of transactions for a given currency pair, as well as the total value of trades concluded over a given period of time.

However, it's advisable to only consider volume changes over short timeframes, as this indicator doesn't always accurately reflect the current situation and can lead to erroneous actions.

Basic types of volume analysis in Forex.

• The total amount of transactions and their number – growth almost always confirms the emerging trend, indicating that the current price suits the majority of buyers and sellers.

In addition, this factor also exerts some psychological pressure, especially in situations where most traders can obtain real data on the number of transactions. However, complete information is only available on the interbank currency market, while on Forex, one has to make do with the data provided by some brokerage companies.

One option for tracking the total number of transactions is the " Forex Volume Indicator " – this script is essentially an oscillator that displays data in the form of changing bars. You can judge the accuracy of its operation only based on your own experience.

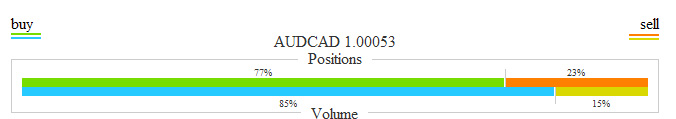

• Number of open long and short positions – thanks to a special informer, you can find out how many buy or sell orders are currently open for a specific currency pair. However, it is not the number of positions that is displayed, but their ratio to each other.

For example, for the AUDCAD currency pair, 77% of buy positions are open, while 23% of sell positions are open. These indicators may confirm an existing upward trend or a high probability of a reversal of the existing downward trend.

Key points.

When analyzing forex volumes, the following patterns are observed:

Increasing volumes confirm an increase in supply or demand and the validity of the current price of the currency pair.

A decline in volume indicates a decline in interest, in which case the market may reverse the trend or enter a flat market. In either case, it is advisable to refrain from opening new positions during such periods.

By installing a volume indicator or assessing the ratio of open positions, you can independently draw the right conclusions about the direction of your next trade.