INOUT ADVISOR – testing in the tester is not real trading!

Greetings, dear visitors. Today, I'd like to share my impressions of testing the INOUT expert advisor. The essence of this expert advisor is that it's based on signals from the IVAR oscillator indicator. This indicator is quite popular among traders, so the release of an advisor based on it is welcome news for its fans.

A martingale was also added to the expert advisor to increase profits significantly. I previously reviewed this expert advisor in the " Forex Advisors " section, so you can find more detailed information on setting up and optimizing its parameters in the relevant article.

I previously tested the expert advisor in the strategy tester, but as our experience with the FOREX WARRIOR expert advisor , reality can differ greatly from preliminary testing. You can see the results of the preliminary test in the strategy tester in the image below:

The tester's results were truly impressive, so my team and I immediately decided to test the expert advisor under real trading conditions. For this purpose, we opened a demo account, which simulates a beginner trader's balance of $100 on a cent account or $10,000 on a classic trading account.

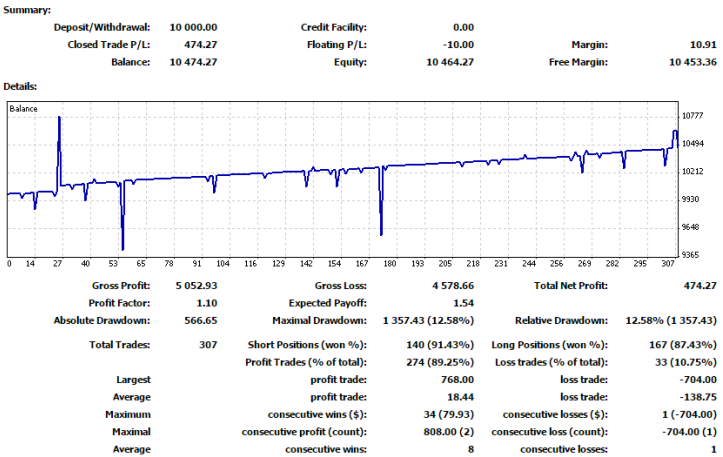

To ensure an objective test without any intervention, the expert advisor was installed on a VPS server , allowing it to trade 24/7. The test itself, on a five-minute chart for a currency pair, began on July 15, 2015, and ended on July 30, 2015. You might say this is too short, but I'll tell you that the test isn't conducted to maximize profits, but simply to assess its tendencies and trading style. You can see the test results in the image below:

The first thing that immediately catches your eye is the large drawdowns on the chart. Indeed, over 15 days of trading, the expert advisor earned only five percent of the deposit, with the maximum drawdown reaching almost 13 percent of the deposit.

Looking at the winning percentage of 89%, it's surprising why the drawdown is so low given the strategy's effectiveness. It didn't take long to find the answer. The problem is, the expert advisor sets a profit target of just a few pips and takes profit on minimal movements. However, when the price moves against us, the martingale triggers and takes profits of a couple of pips, causing wildly unjustified drawdowns.

This approach explains the expert's low profitability indicator, which, in turn, was 1.10. The number of trades, which amounted to a whopping 307, also came under suspicion. It seems the expert was designed not to generate profit from trading, but to profit from spread rebates .

At the end of the article, I'd like to add that this expert advisor is definitely not recommended for large accounts. Its profit-to-drawdown ratio, as well as the number of trades and their impact on your psychological state, simply leave much to be desired. This expert advisor is suitable for a couple hundred dollars on a cent account; otherwise, the potential profit simply doesn't justify the potential losses. Thank you for your attention, and good luck!