Is it possible to cheat in Forex and why you shouldn't do it?

Forex is an international currency exchange market where tens of millions of transactions are made every day.

It is a huge and complex market, with both large financial institutions and individual traders operating in it.

Forex trading requires specific skills and knowledge, so making money isn't easy. After unsuccessful attempts, many traders are tempted to cheat the Forex market, meaning they can make money regardless of exchange rate fluctuations.

Typically in these cases they try to make money using various schemes, such as:

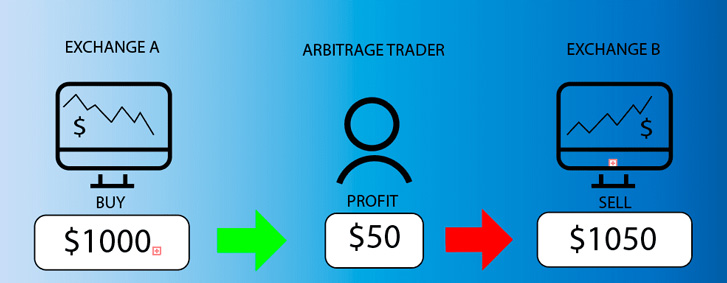

The essence of currency or cryptocurrency arbitrage is that in some cases the selling price of a currency in one place is lower than the purchase price of that currency in another.

For example, if Bitcoin is selling at $35,000 on one exchange and $35,100 on another, you're making money not from the price increase, but from the price difference. Despite the apparent simplicity of the implementation, making money requires not only a large sum of money but also taking into account all the overhead costs and fees.

Schemes are also used whereby one currency is first exchanged for another, and then for a third or even a fourth, resulting in a profit.

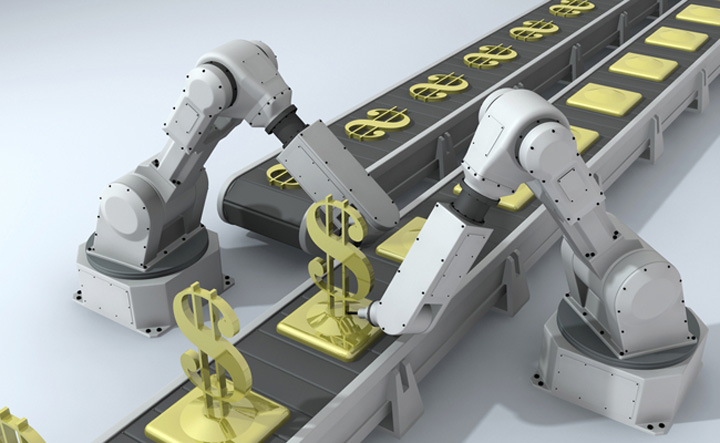

Advisors – opening transactions using special software, so-called trading robots.

It is also a completely legal way to cheat the Forex market to some extent, through brokers who allow trading with advisors .

The essence of this "deception" is that scripts analyze the market and open trades faster than a regular person. This gives them an advantage over other forex market participants and increases their chances of making a profit.

The main difficulty is choosing a suitable advisor and setting it up for trading a specific asset.

Trading platform manipulation – some traders try to manipulate their broker through the trading platform, but such attempts are futile and illegal.

Deposit information is stored on the broker's server, and the platform only manages trade openings. You might as well try to hack the bank's server, and the penalties for such activity are the same.

Quote manipulation – liquidity providers vary from broker to broker, so quotes often differ across trading platforms or websites.

A legitimate way to cheat on Forex is to find a source that displays quotes slightly faster than they appear on your trading platform. This way, you'll be able to "see the future" and engage in scalping .

Swap profits – a positive swap allows you to profit from the difference in interest rates, where you receive a profit for rolling over your position.

You can find out how much you can earn on a positive swap from this article – Carry Trade Strategy Carry Trade

But when using this strategy, there is exchange rate risk, that is, you make a buy trade expecting a positive swap, but the price of the currency pair falls and eats up all your profit from the positive swap.

To deceive Forex, they use a locking , where a transaction is simultaneously opened in the opposite direction, but in a way that does not accrue swap.

For example, you buy the EURCHF pair on the trading platform with a positive swap on long trades, and buy the same amount of Swiss francs in your bank account. As a result, the trade is locked, and the net profit is only the swap.

The Carry Trade strategy is quite complex and requires large sums of money to achieve significant profits.

In conclusion, it's not so easy to cheat the Forex market. Legal methods won't yield much profit, and illegal ones can lead to punishment. Therefore, it's better to spend time learning how to trade than searching for ways to cheat the Forex market.