Where can I find out the exact spread size?

The spread size is important if you trade using strategies that require opening a large number of orders.

Or if you use high leverage in your trading, as it increases not only the volume of trades but also the broker's commission.

There are also assets for which spreads can vary significantly between brokers, such as cryptocurrencies or precious metals.

Therefore, it's always a good idea to know in advance what spread you'll have to pay when opening a trade on a given asset.

Traders have several options for determining this value and then taking it into account when opening trades.

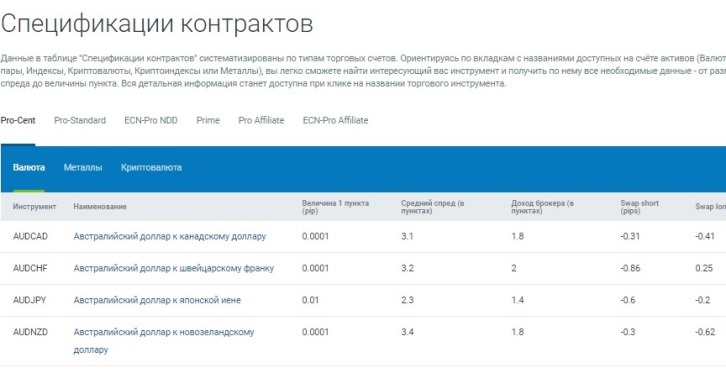

Here you can find the approximate spread and swap commission for various assets, depending on the account being traded.

Here you can find the approximate spread and swap commission for various assets, depending on the account being traded.

It's important to note that the amount will only be approximate (average), as the spread is often floating and depends on the current liquidity of the currency pair.

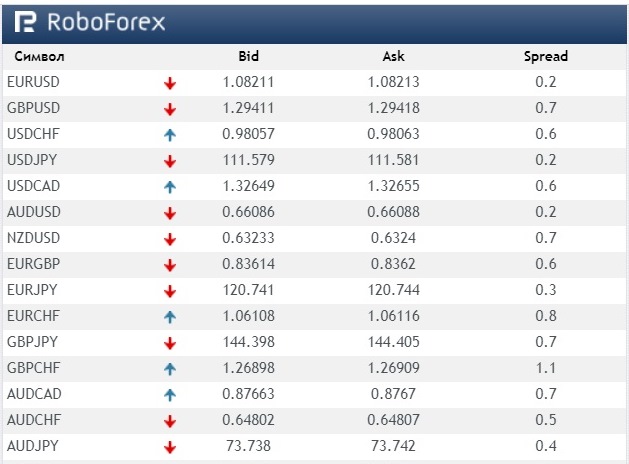

The second option is to look at the quote on the broker's website or on the websites of its partners:

These quotes are less informative, but they do show the current spread size, as well as the buy and sell prices of the selected currency pair.

These quotes are less informative, but they do show the current spread size, as well as the buy and sell prices of the selected currency pair.

Quotes are convenient to use because they're always at hand. Simply click the saved link - http://time-forex.com/kotirovki - and you'll know the current exchange rate and commission.

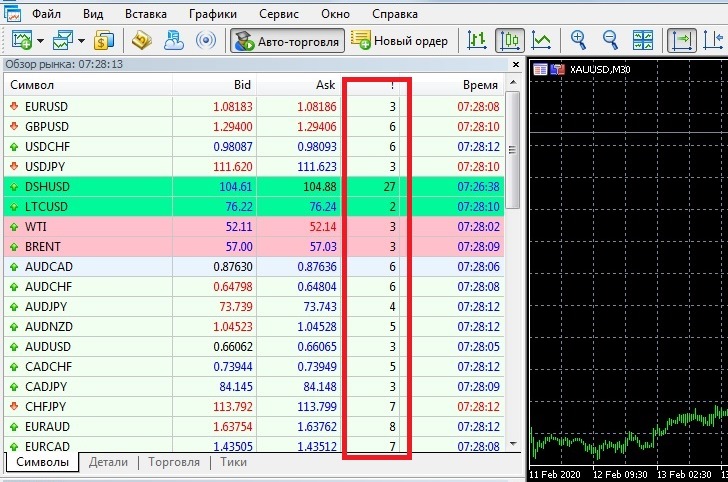

A third option is the "Market Watch" window, which is located in the trader's trading platform:

These quotes are used directly during trading. In addition to the spread size, you can also find out the specifications for the selected instrument, such as swap, trading time, lot size, etc.

These quotes are used directly during trading. In addition to the spread size, you can also find out the specifications for the selected instrument, such as swap, trading time, lot size, etc.

The Market Watch features are described in more detail here: http://time-forex.com/sovet/obzor-rynka

Each of the above options is used depending on what you want to know and for what purpose.

If you're comparing spreads for the same currency pair across different brokers, it's more convenient to use the contract specifications directly on the brokers' websites.

If you're simply interested in the current quote and the difference between the buy and sell prices, then online quotes on your preferred website are suitable.