Useful Forex articles about trading

In this section you will find more than a hundred Forex articles devoted to trading on the Forex currency exchange, as well as trading on other financial markets. The given articles about Forex will be useful both to a novice trader and to a person already familiar with this type of activity.

Leaders in oil production

Many traders bypass CFDs or oil futures because they are deeply convinced that this instrument is quite difficult to predict, and if you delve into different brands and types, then it’s just a dark forest.

difficult to predict, and if you delve into different brands and types, then it’s just a dark forest.

In fact, there is nothing complicated in oil trading, and the forecast itself is practically no different from analyzing fundamental statistics for countries, as happens when trading currency pairs.

For forecasting and successful trading using oil, a very important factor is timely tracking of information on reducing or increasing the volume of oil production in the main exporting countries.

Actually, in order to understand which countries to work with, you need to know the leaders in oil production, who dictate the market price.

Working on Forex for a beginner, options and real earnings

The specialty of a trader has recently attracted more and more people, working on Forex brings a lot of income, the fact is that by becoming a trader you have the opportunity to earn not just a lot, but a lot.

One of the clear examples is the record of Larry Williams, who managed to increase his deposit from $10,000 to 1,140,000 in a year. Even if

you don’t have such a large amount to start trading, even 11,000 from $100 in a year is not bad.

At the same time, we should not forget that you can work on Forex not only as a trader; in practice, there are many other, no less profitable opportunities.

Moreover, some of these options are less risky compared to regular trading, and can bring no less money.

Working in Forex is not only profitable, but also prestigious; it’s not for nothing that traders are called white-collar workers, and the exchanges themselves are located in the most respectable areas of large cities.

Trend indicators

A trend is one of the most important market conditions, thanks to which traders make money. Indeed, a trend is always characterized by a purposeful movement either up or down, so if it is identified in a timely manner and a position is opened in its direction, profit will not be long in coming.

Indeed, a trend is always characterized by a purposeful movement either up or down, so if it is identified in a timely manner and a position is opened in its direction, profit will not be long in coming.

It would seem that there is nothing easier than seeing the direction of the market and trading in its direction. However, in practice, everything is much more complicated, since you will never get a clear direction of the market, and if its outline has become very clear, then, as a rule, this movement is coming to an end.

Even Dow many years ago said that when a trend becomes very obvious, and all players begin to move in its direction by inertia, a turning point occurs, because a smarter player with capital, and this includes banks, already understands in advance that the asset overrated and start working against the crowd.

The difference between oscillators and indicators

In the first stages of learning to trade, few people pay attention to the characteristics and subtleties of various indicators.

indicators.

In most cases, over a long period of time, almost every beginner looks at indicators as some kind of lines that, when crossed, give a signal to buy or sell.

By the way, more experienced traders are also guilty of such short-sightedness. As a rule, such a view leads to only one outcome, and it is fatal for your account.

This is due to the fact that you make your trades on the basis of not reasoned facts, but only because the line crossed something or went somehow differently than usual. For you these are lines and drawings, nothing more.

Earn money on Forex without investments, without risking your own money

Those who think that making money on Forex without investments are just a fiction or a publicity stunt are completely mistaken.

In fact, there are several ways to make money in stock trading without having your own money, and it should be noted that this is a very real opportunity and quite good money.

The main thing that you will need to do is learn trading; this process is not easy and takes some time.

After studying, you choose which path you will take; this could be receiving no-deposit bonuses or participating in special competitions on demo accounts.

Each option has its positive and negative sides, and we will talk about them in more detail.

Earning money on Forex without investments gives you a chance to improve your financial situation without risking anything and at the same time get a trader's specialty, and the knowledge gained during training will be useful to you for working in any financial field.

Personal example of making money on Forex

On the Internet, the myth is very actively walking that only banks and large players earn on the Forex market whose capital is measured by millions of dollars.

large players earn on the Forex market whose capital is measured by millions of dollars.

Moreover, this statement of simple traders is compared with a small fish, which is maximum what is capable of avoiding danger in time, and in most cases it is a conventional food.

Such allegations with a philosophical context can be seen on any forex forum or site where the failure of the trader is looking for a global excuse, but cannot understand that he himself is the reason for his mistakes.

Also, traders are constantly trying to come up with complex algorithms, complicating their lives and not understanding that simple capital rules that are written by smart people work in books to this day, because the market consists of people, which means that all the qualities of a person who are unchanged for centuries are characteristic.

To finally debunk the myth that it is impossible to make money on the Forex market, I decided to show a personal example of making money on Forex. Of course, in this article you will not see all the financial ins and outs, but using the example of some transactions, you will be convinced that this is not only possible, but also not so difficult.

How to trade gold in the MetaTrader 4 terminal

Raise any first-grade student from his desk and ask him to name at least one expensive metal, he will immediately say gold.

metal, he will immediately say gold.

All of us in our lives have at least once thought about buying this precious metal, and not necessarily in bullion. Any housewife knows that as long as she has at least one piece of gold jewelry in the house, she won’t mind any extreme situation, because at any moment she can find money.

Thus, from childhood we are inadvertently taught to invest in gold, because no matter how much humanity mines it, it always grows in price.

Until recently, investing in gold was extremely difficult. At the household level, everyone tried to buy expensive gold products, and businesses, despite all the commissions and costs, tried to buy bars made from this metal from state banks.

Oil price and exchange rates

Many analysts argue that there is no direct interaction between the price of oil and exchange rates. They justify their statements by the fact that the oil price is affected only by production volumes without any additional influencing factors. This thesis held for a long time, but the update of new lows for oil revealed some patterns that more experienced traders had long suspected.

They justify their statements by the fact that the oil price is affected only by production volumes without any additional influencing factors. This thesis held for a long time, but the update of new lows for oil revealed some patterns that more experienced traders had long suspected.

We all understand that oil is a product without which the chemical industry cannot exist, therefore any country in this world depends directly on the price of oil.

Of course, different countries and their currencies interact differently, but the pattern is clearly visible. For example, countries that do not own black gold are highly dependent on exports, and an increase in the exchange rate will negatively affect the country’s budget, which is directly related to the national currency.

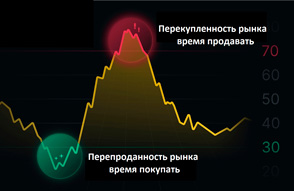

Overbought and Oversold in trading - indicator for analysis

In many of the author’s books, we are often told that the price that we can observe in the form of a chart is the result of the battle between the Bulls and the Bears.

Indeed, if you look at the market and throw away all the terminology, you understand that the price is formed by both the demand that comes from buyers and the supply from sellers.

In fact, the result of such mutual cooperation, and maybe often competition of both parties, leads to the formation of a schedule. Why do you ask the competition?

Yes, everything is very simple, imagine that a trader is an ordinary trader on the market. What are sellers trying to do? Sell as expensive as possible, and the buyer tries to buy as cheap as possible.

What prevents you from becoming a trader.

Or why someone earns millions, while others only dream about them.

When you turn 20, it seems that all roads are open and there is nothing that you cannot achieve in your life.

At 30, judgments are more pessimistic, goals are more down-to-earth. At 40, rarely does anyone expect to make a career or dramatically change their life for the better. But it turns out that you can achieve a lot at any age, the main thing is to know what is stopping you on the path to success, in our case to a career as a trader.

• Motivation - or rather its absence, the presence of desires always motivates goal setting. A person who doesn’t want anything is unlikely to achieve anything, so make your wildest wishes and they will definitely come true if you do something for it.

The Best Selection of Binary Options Options

The most technical simple, at the moment, way to earn on the exchange is binary options, but not every beginner knows that there are several options for such trade.

every beginner knows that there are several options for such trade.

Each of them differs not only technically, but also the size of the remuneration received, as well as the conditions for receiving payments.

Consider the optional trade on the example of the brokerage company Alpari, the leader of the financial market, the broker enables his customers to work with such options as - above, touching, range, spread.

Dynamics of oil prices 2014-2015.

For almost every trader who has been working on the stock exchange for many years and tracks major global instruments such as gold and oil, 2014 was a turning point in their worldview. Oil throughout the world is rightly called black gold, considering that its reserves may be depleted over time.

global instruments such as gold and oil, 2014 was a turning point in their worldview. Oil throughout the world is rightly called black gold, considering that its reserves may be depleted over time.

Almost every country in this world, in one way or another, depends on fluctuations in oil prices. Whatever one may say, the entire industry is somehow dependent on refined oil products, and therefore directly on the oil itself.

Even the recent collapse of the ruble in Russia is associated with a fall in the price of black gold. So what was the turning point in the consciousness of traders? Why can't so many of us simply accept such a rapid decline in oil prices?

Classification of oil.

There are several main groups into which oil is classified; this was done to unify this energy carrier during exchange trading.

exchange trading.

The classification is primarily influenced by the composition of the oil, namely the amount of various impurities; the so-called grade depends on them.

The main types of oil that are traded on stock exchanges are Brent, WTI, Urals, these designations are deciphered as follows: Brent

is the most common brand of oil, sometimes it is also called the standard, it is on its basis that prices for other types of oil are formed, this happens by taking away a discount or adding a premium to higher quality varieties.

Correlation of gold with oil and dollar

For about a century, leading analysts have been monitoring the clear relationship between the price of gold and the rates of most world currencies and the price of some assets, among which oil comes first.

some assets, among which oil comes first.

That is, one of the guidelines when forecasting exchange rates for the world's leading currencies and futures can be such a precious metal as gold.

The correlation is easily identified if you simultaneously open several charts of assets necessary for comparison, and the following parameters should be observed:

• Time frame - on all charts should be the same, for example, one day or D1.

Binary options as an option for stock trading.

When considering the topic of stock trading, one cannot ignore binary options trading, since this type of trading has recently been gaining popularity among traders at a breakneck pace.

recently been gaining popularity among traders at a breakneck pace.

What is this earning option, what is the basis for making a profit and what nuances should be taken into account when trading?

Binary options are a type of contract during the conclusion of which the amount of loss and profit is known in advance, for example, if the forecast comes true, you receive 90% of the contract amount, and if the transaction is unsuccessful, you lose 95%.

Distinctive features of binary options are:

Should you buy Volkswagen shares?

Volkswagen shares have become something of a haven for investors in recent years. The constant annual growth rate, relatively good dividends, which reached $2.5 per share, made investments in this asset so attractive that few large funds could refuse to keep a certain amount of the asset in their investment portfolio.

The constant annual growth rate, relatively good dividends, which reached $2.5 per share, made investments in this asset so attractive that few large funds could refuse to keep a certain amount of the asset in their investment portfolio.

The German automobile concern has firmly established itself in the international automobile market thanks to the quality of its product and the relatively reasonable price of cars of this class that various Japanese and American brands did not provide much competition.

Unfortunately, such an idyll for investors did not last very long, and the recent fall and depreciation of shares by 50 percent was simply shock therapy.

You probably have a question, why did this happen? If you haven't been following the news feed, I suggest you refresh your memory.

Verum Option – the best way to make money on the Internet

The Verum Option company presented an innovative tool that, in terms of profitability and reliability, confidently eclipsed investing in FOREX.

reliability, confidently eclipsed investing in FOREX.

Every day more and more people are trying to increase their money on the Internet, which, in turn, has generated hundreds of investment proposals.

However, the entry of Verum Option into the market marked a real revolution in the field of online earnings, since clients were offered the most innovative product of our time with a number of undeniable advantages. We are talking about binary options trading.

First of all, Verum Option has opened up a fundamentally new level of reliability for Internet users. Against the backdrop of risky investing in the FOREX market, the Verum Option platform for the first time made it possible to earn money online, that is, completely transparently.

Trading without a trend.

According to most professional traders and analysts, the Forex trend is in a flat state 70% of the time.

flat state 70% of the time.

That is, the price moves almost horizontally without obvious changes. It seemed that trading in such conditions was practically impossible, but some traders are just waiting for this moment to start making money.

What are the advantages in this market state?

• Price channel - most often during a flat, a simply ideal price channel is formed, perfect for pipsing . You can earn no more than a few points per trade, but when using high leverage these are quite significant points.

Practical secrets of trading

The main secrets of Forex trading are to reduce trading risks and use the most effective methods of money management.

Thanks to their use, the level of profit received significantly increases and the risk of complete loss of the entire deposit amount is reduced.

Trading secrets are equally effective both when trading on Forex and when used on other financial markets; they can be divided into two main groups.

The first includes recommendations regarding money management, and the second contains advice directly on the implementation of trading itself.

After reading this article, you are unlikely to find the grail, but you are guaranteed to be able to reduce the current level of unprofitable trades and increase the profitability of successfully opened positions.

Bonuses when replenishing your Forex account.

Currently, a direct war has unfolded among brokerage companies; each of them offers the best trading conditions and unprecedented bonuses when replenishing an account.

conditions and unprecedented bonuses when replenishing an account.

If you do not have enough personal funds for trading and you decide to trade using bonuses, the main thing is not only to choose a broker with the most favorable offer, but also that the broker is truly reliable.

Therefore, it is not always worth buying into tempting offers from newly created companies, but it is never too late to take advantage of a bonus from a trusted broker.

How much can you earn on Forex?

There are many legends on the Internet about huge earnings on the currency exchange; novice traders are always interested in the question - how much do they earn on Forex?

The answer here depends on many components; first of all, the size of the initial capital plays a role, but if you wish, you can consider a similar aspect taking into account relative values.

It is impossible to say unambiguously how much one earns on the Forex exchange; the amount of earnings ranges from 5% to 1000% per month, it all depends on what trading strategy is used for trading.

Most professional traders conduct safe trading, earning only 5% per month of the amount invested, which at first glance does not seem like much, but if the deposit size is $1 million, then the profit no longer looks ridiculous.

The absolute record for profitability for the year belongs to Larry Williams; he increased his initial deposit from $10,000 to $1,400,000 or 14,000%, that is, the amount of initial capital increased exactly 140 times in 12 months.

Forex records.

Everyone knows that thanks to trading, many of the foreign tycoons acquired their wealth, turning thousands of dollars first into millions, and then into billions.

and then into billions.

True, it should be noted that most of the current billionaires made their fortune not so much through virtuoso trading, but by attracting funds from investors. Their trust funds rarely yield more than 20-30 percent per annum.

Forex records are based on examples of real trading using the most highly profitable trading strategies and tactics.

The dollar exchange rate and the price of oil, the relationship.

Recently, the price of oil has become the number one topic on all news channels; black gold continues to rapidly rise in price, thereby causing panic and movement in the financial markets.

causing panic and movement in the financial markets.

Many people wonder if there is a relationship between the US dollar exchange rate and the price of oil?

Yes, there is, in most cases, a close relationship can be found between these two trading instruments, because the United States is one of the largest oil producers, so changes in oil prices cannot but affect the national currency of the United States.

It would seem that a decrease in oil prices should entail a decrease in the dollar exchange rate, but everything is just the opposite.

Participation in Forex tournaments.

To advertise brokerage companies and stimulate traders' desire to trade, most brokers hold regular tournaments on demo or real accounts.

real accounts.

What does participating in such competitions give a trader and is there any point in wasting time on tournaments at all, or is it better to trade quietly?

improving your own strategies. Firstly, you should answer the question - “What are the benefits of participating in Forex tournaments?”

Forex trading for beginner traders

In order to make money on the Forex currency market, it is not always necessary to study the entire theory of trading; in practice, it is quite enough to simply develop your own strategy and follow it throughout the entire time.

You don't have to make a fancy plan; sometimes simple solutions work just fine.

The first steps are the most difficult in any business, this statement also applies to Forex trading, so for a novice trader it is important to know a number of things that will help not only save your deposit in the first month of work, but also earn money.

Forex trading for beginners should be carried out with minimal risk, even if at first you will not earn a lot, but you will not lose all your available funds,

Therefore, you should slightly change your approach to trading, setting the goal of the first months not to earn big money, but to learn to feel the market and manage transactions.

Forex with a deposit from 100 to 1000 dollars.

Almost 99% of newcomers to Forex have no more than $1,000 at their disposal, and some even less.

Therefore, most people are interested in the question: what are the features of trading with such a deposit, how much can you earn and is it worth trading with such amounts?

We are all accustomed to the fact that it is mainly millionaires, or at least their representatives, who trade on exchanges, but a distinctive feature of Forex trading is the use of leverage, with its help you can significantly expand your capabilities.

So let's start small.

100 dollars in Forex is more suitable for a test of strength, rather than for full-fledged trading, but if you apply the right strategy, you can use even this amount quite effectively.

Stages of Forex transactions.

Forex trading can be divided into several stages - opening a transaction, maintaining it and completing the transaction.

the transaction.

Most traders pay attention only to the first and last stages, entrusting the maintenance of positions to stop orders.

Usually this scheme works, but still, additional attention to existing deals won’t hurt either. In order to understand the essence of each stage, you should clearly understand what tasks each action poses to the trader.

A profitable investment.

Once you have available funds, the question immediately arises - How to find the most profitable investment of money? As it turns out, there are quite a few options, but the availability of some depends on the amount of capital invested and the complexity of the investment process.

A profitable investment should not only be profitable, but also the most accessible; not everyone can understand the complex realities of the stock market or save enough money to buy real estate.

Therefore, in this article we will talk about investing small amounts of 100 or more US dollars.

The best example is always your own, so it is your own experience that will form the basis of this article.

Order execution speed and some other important points.

When working on a virtual exchange, there are a lot of nuances that some traders do not pay attention to, while others, on the contrary, overemphasize them.

on the contrary, overemphasize them.

An incorrect approach leads to the fact that a trader chooses the wrong broker or pays more, losing probable profits.

Additional trading conditions include such indicators as the speed of order execution, their activation and the minimum size of stop orders.

The speed of order execution usually ranges from 0.5 to 5 seconds; this indicator is especially important when using scalping, since a delay in execution of even a couple of seconds leads to the loss of several points of profit. And when scalping, every point earned is important.

Options trading - another scam or an opportunity to make money?

Recently, you can increasingly see advertisements for options trading as an alternative to making money on Forex.

The main advantages of this type of earnings are the simplicity of transactions, the absence of the need to conduct market analysis, and the elimination of the factor of psychological pressure on the trader.

In addition, most options brokers assure that this option for making profits is more profitable than standard trading using leverage.

Let's start analyzing the issue from the last moment.

Probability theory in Forex.

Almost every person is familiar with the concept of “Probability Theory”, but when you first get acquainted with Forex, the question immediately arises - why does this theory not work?

arises - why does this theory not work?

After all, based on the fact that the trader has only two options for the direction of the transaction, their ratio should be 1:1, that is, in 50% they should bring profit, and in the remaining 50% losses.

But the situation is far from being in favor of profit; rather, on the contrary, novice traders almost instantly lose their deposits, and the ratio of unprofitable trades to profitable ones usually fluctuates 7:3 - 8:2.

The theory of probability in Forex does not work for several reasons: