Why traders choose AMarkets

AMarkets is a popular

brokerage The company offers high-quality service around the clock and has been successfully operating for 11 years.

AMarkets is one of those organizations whose primary focus is the quality of its work and the well-being of its clients.

The company is a member of The Financial Commission. The company places great importance on the safe placement of its clients' funds.

AMarkets was one of the first organizations to receive Category A membership in The Financial Commission, a self-regulatory organization in the financial markets.

This self-regulatory organization (SRO) regulates disputes between traders, investors, and brokers who are members of The Financial Commission. The organization also provides a compensation fund of EUR 20,000 for each complaint.

AMarkets was one of the first brokers to endorse The Financial Commission's idea of implementing voluntary order execution audits and certification. This was made possible by the Verify My Trade (VMT) service.

Anyone can click the Verify My Trade Execution Certification , which will take them to a page where they will find the date of their last audit and its results. AMarkets' order execution audits are conducted monthly using VMT.

AMarkets account types

AMarkets brokerage company offers the following account types:

1. Fixed . This account has fixed spreads, which is its key differentiator. Their size starts from 3 pips.

Leverage reaches 1:1000. There are no fees for withdrawals and deposits. For Russian citizens, the minimum deposit is at least $100.

2. Standard . This is a standard account; there are no fees. The broker has increased leverage to 1:1000. The minimum order size is 0.01 lots, with a 0.01 increment.

The account can be replenished with the following currencies: dollars, euros, or rubles. Currency pairs are available for trading on this account type, as well as CFDs on metals, commodities, and indices.

3. ECN . This account has virtually no spread, as transactions are sent directly to the interbank market. Therefore, orders are executed at a high level via Market execution . To begin trading on this account, the minimum deposit is $200.

3. ECN . This account has virtually no spread, as transactions are sent directly to the interbank market. Therefore, orders are executed at a high level via Market execution . To begin trading on this account, the minimum deposit is $200.

4. Institutional . This account type is best suited for professional traders with larger funds at their disposal.

It offers a zero spread, a wide range of trading instruments, and access to the FIX API and market depth. To use this account type, the minimum deposit required is $100,000.

A Bitcoin account is also available , which can be opened from your Personal Account. There is no minimum deposit; the recommended investment is 1 BTC. A key feature of this account is the ability to open three orders simultaneously.

Advanced technologies protect Forex

AMarkets keeps up with the times. It offers clients a wide selection of promising and in-demand financial instruments for trading, including dozens of currency pairs, global indices, cryptocurrency, and commodities.

AMarkets is rightfully considered one of the most technologically advanced companies in this industry. Thanks to its partnership with X Open Hub liquidity providers, the company has reduced transaction processing speed to 0.03 seconds.

Thanks to the high transaction speed, requotes , and spreads have been reduced to 0.2.

It's worth noting that the company offers high speed not only in transaction processing but also in withdrawals. Profits can be instantly withdrawn to WebMoney wallets. Incidentally, the broker refunds commissions on deposits and withdrawals.

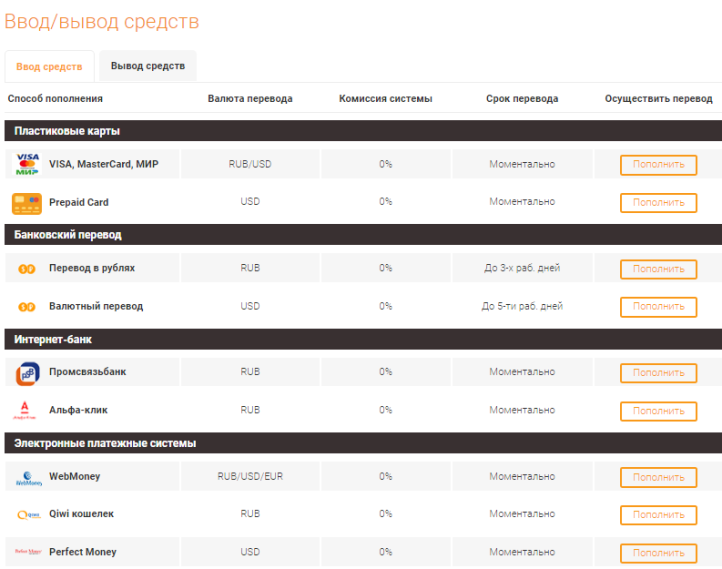

Deposits and withdrawals

Funds can be deposited and withdrawn via popular payment systems: Webmoney, Perfectmoney, Okpay, YandexMoney, and Qiwi; or via VISA or MasterCard bank cards. You can also top up your account using Russian online banking.

Withdrawals take no more than a couple of hours. For more information on deposit and withdrawal terms, please follow this link .

PAMM accounts and the AMarkets affiliate program

Investors can use the PAMM service, which offers ratings to find the most suitable trader-manager for passive income. The list of investors is transparent and includes information on account profitability and drawdown.

There's a profitable, three-tier affiliate program for website owners and partners. It allows you to earn a commission for the activity of referred participants.

Partners work with the broker under two models: webmaster and agent.

If you choose the first model, the company pays a one-time fee for registering each client. The webmaster receives an additional fee if the referred client funds their account.

If you choose the "Agent" model, your earnings depend on the trading volume of the referred clients. Agents' rewards are credited daily to your personal account wallet, after which the funds can be immediately withdrawn using any convenient method.

Agents can also refer investors to PAMM and receive additional compensation in the form of a share of the manager's commission on profitable trades.

Company indicators or know-how

Computer technology is paramount in financial markets, making the selection of indicators quite complex as new algorithms for processing market data emerge.

This broker has also outpaced its competitors in this area. The company's specialists have developed indicators that are widely used by clients.

These include the Cayman indicator , which shows who is currently dominating the market—buyers or sellers—and the "Total Positions" indicator, which provides data on open trades by the broker's clients.

The main advantage of the proposed tools is that they are not just standard algorithms that average statistical values and merely embellish the price chart.

The broker has managed to offer its clients truly interesting analytical tools that can assist in trading.

Bonuses

AMarkets offers its clients the following bonuses:

" Invite a Friend ." For each friend invited, traders receive $10. The company also offers new clients a 25% bonus on every deposit of $100 or more. To use the bonus, participants must be over 18 years old and have a verified personal account.

" Earn on a demo account, just like on a real account ." The broker allows you to transfer profits earned on a demo account to a real account. Open a demo account and trade profitably for five days.

Then, deposit an amount equal to or greater than the profit earned on the demo account into your real account, and transfer the profit from the demo account with the help of a personal manager. Bonus funds can be withdrawn once a certain trading volume is reached.

" AMarkets Transfer Bonus ." By switching from your existing broker to AMarkets, you can receive a 25% bonus. You'll also enjoy favorable trading conditions: no minimum deposit for international clients (for Russian citizens, it must be at least $100), a wide range of trading instruments, low spreads, a personal account manager, and much more.

" Deposit Double ." Open an account with AMarkets and deposit any amount, and the broker will double your deposit. This promotion is only available to new clients. Bonus funds can be withdrawn after reaching the required trading volume.

Conclusions about the broker

The company's management improves trading conditions year after year, and the number of new clients grows weekly. Many of them achieve good results, as evidenced by the percentage of successful traders . Everyone can find what they need here.

Traders enjoy ideal trading conditions: low spreads and fast execution speeds for forex, commodities, stocks, and bonds. The company has developed indicators that facilitate trading.

A variety of promotions and bonuses, along with up-to-date analytics from the research department, speak to Amarkets' customer-focused approach.