Without indicator scalping. From theory to practice

Unfortunately, many traders to this day conduct discussions and disputes among themselves about the effectiveness of one or another tool that analyzes the market.

One part of traders are adherents technical analysis and recognize only indicators, another part of traders plunges headlong into fundamental analysis, however, there is a third category of traders who practice without indicator trading.

The most interesting thing is that despite all the controversy, each tool and approach to market analysis is simply individual, regardless of trading techniques.

The only thing that remains unchanged in the minds of traders is that it is impossible to scalp without auxiliary tools in the Forex market, and as a result, it is almost impossible to find strategies without using indicators in the market noise.

A completely logical question arises: is scalping on Forex possible without indicators and what tools can become its basis?

The best conditions for scalping.

Like most trading strategies, scalping on Forex requires certain trading conditions, under which the efficiency of trading will significantly increase.

the efficiency of trading will significantly increase.

The best conditions for scalping give the trader some advantages, and completely free of charge, the main thing is to know what you should first pay attention to when studying this issue.

And so, what makes scalping more effective:

• Floating spread – this issue is especially important if pipsing , where every point of the spread is important.

With a floating spread, you can catch moments when the size of this commission is practically equal to 0. Moreover, this is not just a theory, but a real fact that has been tested in practice more than once.

“Scalping on news” strategy. Is this trading option possible?

News and publication of economic statistics are comparable to a car engine, which, despite the presence of many other components and mechanisms, is the most important element that forces the market to move.

Unfortunately, many traders do not want to realize the fact that news and economic statistics are the very source data.

They are the ones that can be studied by investors and large investment companies, whose transactions actually set the market in motion.

The “News Scalping” strategy is a trading tactic that is designed to capture a strong price impulse that occurs when news is published.

How real is Bitcoin scalping, features of the strategy

Scalping is one of the most attractive areas in trading, which provides the trader with a fairly high profitability, which can be several times higher than the average profitability of any trend or intraday trading strategy .

However, having a clear algorithm of actions, namely a strategy, is far from sufficient to work with such a method of market analysis.

The fact is that the effectiveness of a scalper depends largely on the trading conditions of the broker, as well as the specifics of the selected asset.

So, if one strategy can show excellent results for one currency pair, it is far from a fact that such a strategy will show continuous losses for a completely different trading asset.

There is a direct relationship between the choice of asset and the effectiveness of the strategy, and in this article you will find out how promising Bitcoin scalping is and whether it is advisable to work with this cryptocurrency using scalping strategies.

Scalping by order book, a simple and effective earning strategy

Scalping is one of the most common trading tactics in both the stock exchange and the forex market.

Many traders confuse the concept of scalping with intraday trading, considering opening orders with small targets and stops to be the basis of this strategy.

In fact, such a blurring of the concept of scalping happened because there is no such depth of market in the Forex market, which simply led to a substitution of concepts.

This order book is present on the stock exchange, which allows you to assess the real market situation and make transactions with a target in a couple of ticks.

Platforms for scalping by order book

It is no secret to most traders that the MT4 and MT5 trading platforms have a fictitious order book, in which you will never see either the volume of transactions or the cash flows behind the sellers or buyers.

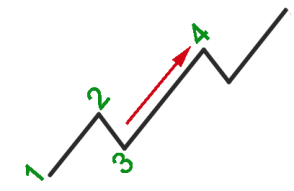

Scalping on pullbacks

Scalping, like any trading tactic, involves searching for entry points into the market. Everyone has their own approaches to finding these points, but, as a rule, it all comes down to trading on pullbacks.

Everyone has their own approaches to finding these points, but, as a rule, it all comes down to trading on pullbacks.

No, of course, there are various scalping tactics in a channel or narrow range, but as practice shows, trading in the direction of the main trend and searching for entry points in its direction turns out to be the most effective.

Unlike trading in a narrow range or flat part of the market, all trading is carried out with short stop orders, and due to compliance with the eternal rule “The trend is your friend,” you will very rarely encounter an entry against the market, and the size of the profit will repeatedly exceed the size of the risk.

Scalping during a flat

For most market participants, the onset of a flat is almost always associated with losses. It so happened that our upbringing as traders is focused on trend trading, and the emphasis is always on the fact that the trend is our friend.

It so happened that our upbringing as traders is focused on trend trading, and the emphasis is always on the fact that the trend is our friend.

In theory, following the trend is always a profitable tactic, however, in recent years in the forex market we can see mostly sideways movement with emerging micro trends that both quickly arise and quickly turn into sideways movement.

This state of the market has thrown many traders off track, since the eternal problem of knocking out stop orders due to a strong wide flat does not allow trend strategies to fully reveal their potential.

While the vast majority suffer losses, there are those who, on the contrary, make money during a flat, using scalping to rake in profits even on the slightest fluctuations in the chart.

Scalping without indicators, as one of the most profitable options

Each trading technique has its advantages and disadvantages. Scalping is a highly profitable trading style that is achieved by trading on market noise and price fluctuations that occur intraday.

Scalping is a highly profitable trading style that is achieved by trading on market noise and price fluctuations that occur intraday.

Every market noise and the slightest deviation of quotes to the side allows the trader to enter positions and take several points of profit.

However, few of you probably thought that market noise is very difficult to predict, and the high volatility that is created during news releases can greatly shake you and your nerves, not to mention the possible risks incurred.

The strategy implies dynamic trading with a large number of transactions. Therefore, when communicating with pros in this area, almost anyone will tell you that 90 percent of a scalper’s success depends on thoughtful capital management and the ability to quickly and callously cut unprofitable orders.

Which broker limits scalping?

Scalping is a very aggressive trading style that involves simultaneously opening a significant number of orders with minimal expiration dates. That is, the duration of the transaction is a matter of minutes, and sometimes tens of seconds.

a significant number of orders with minimal expiration dates. That is, the duration of the transaction is a matter of minutes, and sometimes tens of seconds.

As a rule, fans of scalping invest serious sums in trading; in addition, due to the significant cash flow in their accounts, they bring enormous profits to the broker.

However, brokerage houses are increasingly blocking the trading deposits of scalpers, despite the fact that traders working using this method bring good dividends.

Naturally, such a combination of circumstances raises a completely logical question: why do brokers not want to cooperate with scalpers?

How not to lose your deposit when trading scalping.

Scalping has become the favorite strategy of most traders because of its maximum profitability; if not for its riskiness, then probably almost all traders would choose this particular option of exchange trading.

riskiness, then probably almost all traders would choose this particular option of exchange trading.

The main danger of scalping trading is the loss of the deposit, not drawdown, but the complete loss of all funds when the transaction is closed forcibly with a stop out.

If it were not for the frequent stories about the complete loss of funds, it is unlikely that any of the traders would refuse to earn 1000% profit every month.

It is almost impossible to completely eliminate the possibility of a drain; it can be reduced to a minimum using fairly simple methods. • We never use all available funds in trading; there should be only part of the funds on the account - from 30 to 50 percent. Don’t risk the entire amount, always leave yourself a chance to correct mistakes.

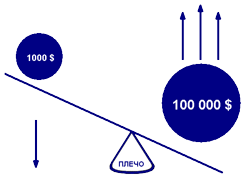

Leverage for scalping.

Some traders, when deciding to trade with scalping, think that the main thing in this strategy is the minimum duration of transactions, but in fact, the leading role is played by the size of the leverage.

in fact, the leading role is played by the size of the leverage.

Leverage for scalping should allow you to get the maximum profit in a minimum time period.

At the same time, a pattern is always monitored: the shorter your duration of transactions, the greater the leverage, and, accordingly, the volume of transactions that you can use in your trading.

For greater clarity, let's look at this issue using specific examples.

Scalping with tops.

The previous article described how to use trend confirmation candles in scalping, but one of the distinctive features of scalping is that when using this strategy you can trade both with the trend and against it.

of scalping is that when using this strategy you can trade both with the trend and against it.

Entering the market at a reversal will allow you to easily take a few points of profit before the next change in price movement.

One of the most attractive candles indicating a reversal are candlestick tops ; these are candles with practically no body, which indicates a slowdown in the trend and a high probability of a reversal in the short term.

How to choose a broker with the lowest spread.

When trading Forex, spread size plays a decisive role in most profitable strategies especially with Scalping, so how do you choose a brokerage company with the smallest spread size?

a brokerage company with the smallest spread size?

After all, most brokers use floating spreads, indicating the smallest size in the specifications. At the same time, the difference between the maximum and minimum spread is sometimes tens of points. How not to lose money, especially if you use an advisor in your trading and cannot constantly control the commission when opening each transaction.

There are several approaches to solving the problem, each of them is purely individual, so you will have to choose.

• Broker or account with a fixed spread - in this case, you can be sure that if the size of the commission changes, it will be no more than a point or two. At first glance, a fixed spread is always larger than a floating one, but on average the difference is not so big and you are protected from accidentally opening a transaction with an extended spread, and the extension can reach 20-30 points.

Scalping on the move.

As has been noted more than once, the main problem when scalping is entering the market; it is quite difficult for a trader to understand on what basis to make a decision to open a transaction.

what basis to make a decision to open a transaction.

Some rely on intuition, others use indicators for scalping , but trading on intuition almost always ends in failure, and indicators often give false signals.

You can learn how to scalp if you understand the main principle of opening trades when scalping and learn how to apply it.

The simplest entry option for scalping is to catch pullbacks and enter after the start of a trend movement; the method can only be used if there is a stable trend without sudden price movements.

Scalping using candlestick patterns.

The main problem when trading using the scalping system is finding points to enter the market; signals for longer time frames do not always work here, so you have to look for your own solutions.

time frames do not always work here, so you have to look for your own solutions.

One of the common options is to use candlestick analysis, although this method works more effectively on M5 and M15, and accordingly longer time periods.

Transactions are opened after the appearance of candles or candlestick patterns indicating the continuation of the trend, since it is candlesticks that confirm the trend that give fewer false signals.

Mini scalping.

Having heard about scalping, we all imagine earnings of tens, or even hundreds of thousands of dollars. Most beginners are haunted by the fame of Larry Williams, who made more than a million in a year with $10,000.

Larry Williams, who made more than a million in a year with $10,000.

But one of the features of scalping is that it is much easier to make 10 out of 1 dollar than to make 100,000 out of 10,000; there are several reasons for this phenomenon.

Firstly, this is the psychological pressure of large sums; a trader working with a large deposit becomes more careful, begins to doubt more when opening transactions, and, oddly enough, makes mistakes more often.

and mistakes with such a trading strategy result in drawdowns or even loss of the deposit. Secondly, a significant increase in the deposit in a short time immediately attracts the attention of the broker, and not every company will allow the scalper to make money. After this, communication problems, accusations of private trading and other troubles begin to appear.

Page 2 of 4