EMA WMA RSI Advisor

The EMA WMA RSI advisor is a fairly simple yet effective development that was made publicly available in 2010. EMA WMA RSI is a fully automated advisor created by a Russian enthusiastic trader with the pseudonym Chimilion, who continues to delight traders with his interesting developments on various Forex forums.

made publicly available in 2010. EMA WMA RSI is a fully automated advisor created by a Russian enthusiastic trader with the pseudonym Chimilion, who continues to delight traders with his interesting developments on various Forex forums.

The EMA WMA RSI Advisor is a trend robot that works using simple indicators, namely moving averages and RSI .

It's worth noting that the advisor's technical foundation allows it to be applied to any trading asset. However, it's important to remember that it was primarily developed for major currency pairs.

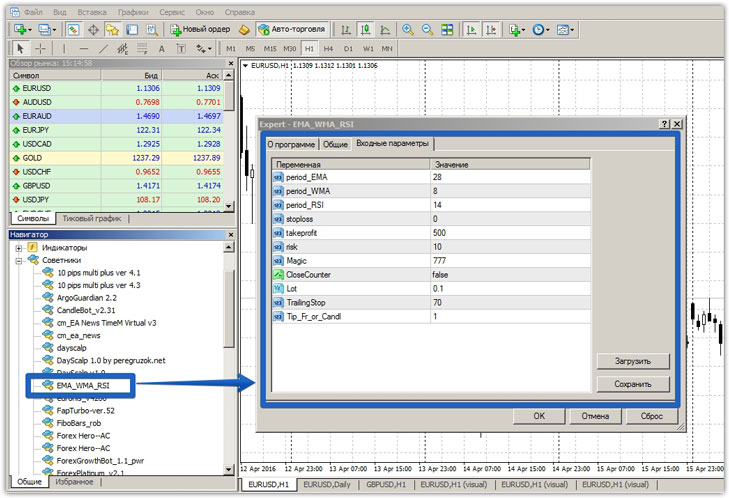

Installing EMA WMA RSI

There are various versions of these advisors available online, but reading forum reviews reveals that only the first version is the most stable. EMA WMA RSI is designed for use with the Meta Trader 4 trading platform, so it should be installed first.

It's crucial to update after installation. To do this, you can either restart the platform or click "Update" in the additional menu in the navigator panel. After the update, the Expert Advisor will appear in the list, so to get started, simply drag it onto the chart of any currency pair you need.

Strategy and settings

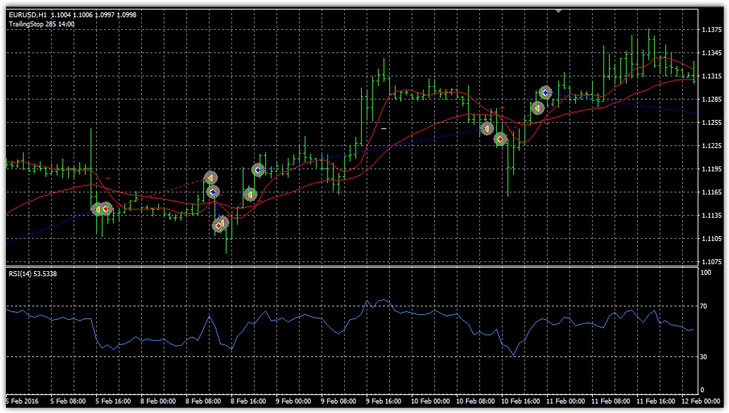

The basic entry point is the crossover of the fast moving average with the slow one. If this occurs from the bottom up, the EA buys, and if it crosses from the top down, it sells. To eliminate false signals that arise in a sideways market, the RSI indicator is integrated into the EA.

So, if the line of this oscillator is above level 50, the advisor will only buy, and if below, it will only sell.

If the Expert Advisor opens a trade and a signal appears in the opposite direction, the EMA WMA RSI will not close the previous position but will open a new one based on the signal. The operating principle is clearly visible in the strategy tester's visualization:

When it comes to settings and optimization, even someone with little experience in automated trading can figure them out.

The "period EMA" line specifies the period of the slow moving average, and the "period WMA" line specifies the period of the weighted fast moving average. As mentioned earlier, the EA has a filter, so you can set the RSI period in the settings.

stop-loss line specifies the stop order value in points, and the take-profit line specifies the profit amount in points. The advisor also offers two money management options: fixed-lot trading or risk-based trading.

If you specify a position volume in the Lot line, the EA will operate with a static lot. To enable a dynamic lot, which will increase as your capital grows, specify the risk percentage of your deposit in the Risk line.

In the Close Counter line, you can enable reverse ordering. Specifically, if a market signal appears in the opposite direction, the expert advisor will close the order and open a new one based on the signal. The Trailing Stop specifies the trailing stop in points, and you can change the trailing stop type in the Tip Fr or Candl line.

So, if you enter 1 in the Fr or Candl line, then trailing will be by candles, and if 0, then by fractals.

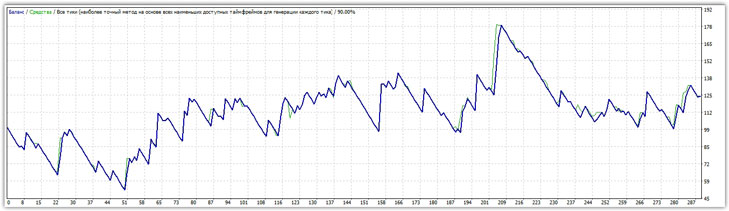

Testing in the EMA WMA RSI strategy tester

The advisor was tested for the entire year of 2015 using default settings. We chose a very small initial capital of $100, and the test was conducted on the hourly chart of the EUR/USD currency pair. Test results:

As you can see from the chart, despite the fact that the expert is clearly outdated, and its system dates back to 2010, it was able to bring in 24 percent of the deposit, but was on the verge of losing money due to a 50 percent drawdown.

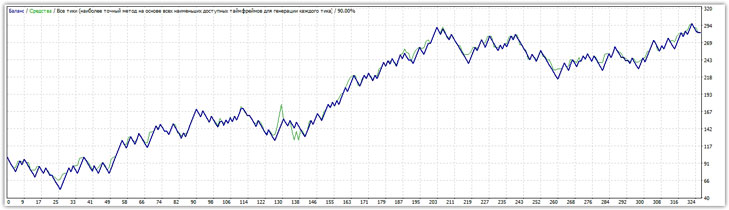

This result is quite convincing, so we decided to optimize all the basic parameters. The post-optimization test results are below:

With just a simple optimization, the EA earned almost $200 with a starting capital of $100. However, it's worth mentioning a downside: no matter how we optimized, the drawdown never dropped below 30 percent.

In conclusion, I would like to note that thanks to a simple trading strategy that is focused on trend trading, the EMA WMA RSI advisor not only retained its profitability, but after simple optimization for the currency pair, it is ready to generate quite high and stable profits.