How to determine a trend visually or using indicators

Trend trading is the basis of most strategies currently used in Forex, so one of the pressing questions is how to determine the trend, or more precisely, its direction over a given time period.

one of the pressing questions is how to determine the trend, or more precisely, its direction over a given time period.

To more accurately understand this issue, you should clearly understand what a trend is and what its direction depends on, as well as understand some of the features of determining its movement.

First of all, it should be noted that the direction of the trend directly depends on the time period on which you conduct technical analysis.

That is, if a price increase was observed during the day, this does not mean that it grew continuously without significant fluctuations.

It is this aspect that plays a fundamental role in determining the price movement on the working timeframe.

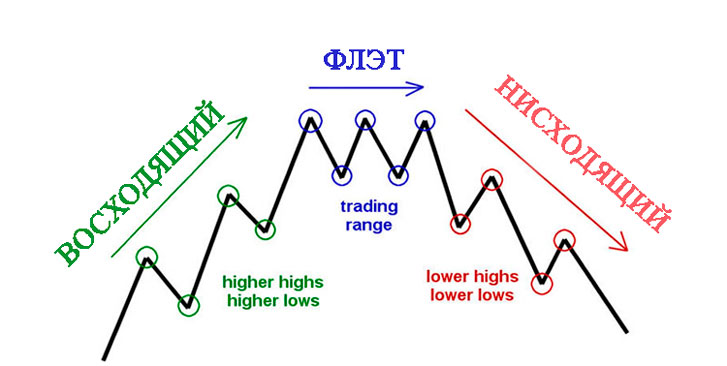

Stock market trend options

Ascending – each price peak is higher than the previous one.

Descending – each price drop below the previous value.

Flat – the price practically does not change, it is quite difficult to determine the trend at this time, since the price moves almost parallel to the time line.

It follows that before starting an analysis to determine the trend in Forex, you first need to select a trading time frame and determine the possible duration of the transaction.

The most correct approach at this stage would be to analyze not only the required time frame, but also two adjacent ones; for example, we take H1 as the main time interval, and H4 and M30 as two auxiliary ones.

The ideal option is if the same trend is present on all three time periods, in which case you can safely open a trade in the direction of the price movement.

In other situations, the following scenarios are possible:

• On M30 and H1 – ascending, on H4 descending – a correction is occurring or a price reversal has occurred, you should wait with opening a transaction or open an order for a short time.

• On M30 – ascending, on H1 and H4 – descending, the situation is similar to the first case.

To determine whether a reversal or correction is occurring in the market, you can look at the latest news feed. If there are no visible reasons for a change in the direction of the trend movement, then the price will soon return to its main course.

To be completely sure of the direction of the trend, you need to know the reason why it arose; this could be important news or an internal situation in the market (increased demand or supply).

Tools such as price channels can also be used to determine the trend; with their help, it is easy to determine where the price is in relation to the channel boundaries:

A breakout of one of the boundaries may indicate either a beginning reversal or a settlement of the existing trend.

Read more about price channels here - http://time-forex.com/terminy/price-channel

How to determine a trend - the answer to this question can be entrusted to special technical indicators that will do all the analytical work for you. Some of these scripts provide a fairly accurate assessment of the market situation.