What is the Wyckoff Method in trading, part one: the basic principles and 3 laws

Most of us have encountered two methods of market analysis: fundamental and technical.

Each method uses a variety of different tools, but in general, fundamental analysis is about explaining the reasons for trend movements, while technical analysis is about analyzing the history of price movements.

In addition to the two methods we are familiar with, there is another approach to market analysis – the Wyckoff method.

This method includes a variety of trading principles, theories and techniques that allow investors to make rational decisions rather than acting on emotions.

About the father of the Wyckoff method

Wyckoff's full name was Richard DeMille Wyckoff (November 2, 1873 – March 7, 1934). At the age of 15, he began his career in the financial markets as an order-taking clerk at a brokerage firm in New York City.

After more than 10 years of experience, he opened his own brokerage firm.

Studying successful traders of his time, such as Jesse Livermore, E.H. Harriman, James R. Keene, Otto Kahn, and J.P. Morgan, he developed the Wyckoff Method through systematic analysis.

rules and principles of capital management , were used to create the system .

Richard applied his method to financial markets, particularly stocks, which allowed him to significantly increase his wealth.

Richard applied his method to financial markets, particularly stocks, which allowed him to significantly increase his wealth.

In addition to his stock market activities, Wyckoff is the founder and editor of the renowned financial publication, The Wall Street Journal. In 1930, he founded an academy that later became the Wyckoff American Practice.

This academy offers training courses on the theory and practical approach to Wyckoff's trading, including selecting promising stocks, placing buy and sell orders, analyzing the phases of variables, price action... Today, these courses are still taught by his students, such as Hank Pruden and Bob Evans.

Although the Wyckoff method was originally applied to stocks, it is still used in various types of financial markets.

The Wyckoff Method remains an important part of the graduate program at Golden Gate University in San Francisco, USA, and is successfully used by many investors in their daily trading.

Basic principles of the Wyckoff method

The Wyckoff Method is a series of trading rules, principles, and techniques designed to help traders evaluate the overall market, find promising stocks, and set trading goals.

Since its inception, many trading models have emerged, including two very well-known methods that are widely used in the market, namely the Spring and Upthrust model and the Spring and Upthrust method. (Price analysis).

However, in this article we will not go into a deep analysis of these two methods, but will mainly introduce you to the basic elements of the Wyckoff method, helping you to better understand this school of analysis at the initial stage.

The following sections of the article will describe the main elements of the Wyckoff method:

- The 3 Basic Laws of the Wyckoff Method

- Price cycle

- Diagram

- The concept of "Composite Man".

- 5 steps to the market

3 laws of the Wyckoff method

The Wyckoff methodology is based on three rules that influence all aspects of market analysis.

Such as identifying current and future trends, choosing the best stocks to trade, determining trading ranges and forecasting profit targets.

The law of supply and demand

The law of supply and demand determines price direction. This is the central principle of the Wyckoff Method.

When demand exceeds supply, the price increases, and when supply exceeds demand, the price decreases.

You can think of this rule simply this way: demand equals the number of buyers, supply equals the number of sellers. When there are more buyers than sellers, demand for the product is high, and the price will be higher. Conversely, when there are more sellers than buyers, meaning supply exceeds demand, the price will decrease.

This rule works in any market and is fundamental, not just part of the Wyckoff method.

Based on this rule, investors can study the balance between supply and demand by comparing the corresponding prices and trading volumes.

Although this is a fairly simple and straightforward rule, accurately assessing the balance of supply and demand on a chart and understanding its impact on the market is quite difficult; it requires a detailed analysis of historical data and the current situation.

The law of cause and effect

This rule helps to determine target prices by assessing the potential level of a certain trend.

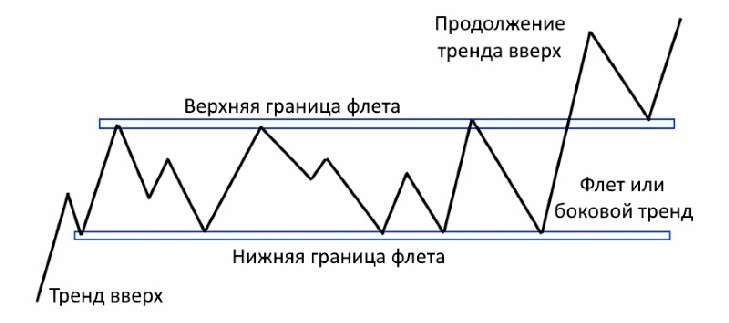

To describe this pattern, Wyckoff uses a point and figure chart, where the cause is measured by the number of pips that move sideways on the chart (the accumulation/distribution period), and the effect is measured by the distance the price moves according to that number of pips (after exiting the accumulation/distribution phase).

We will dwell on this point in more detail in the next part of the article.

The longer the price moves sideways, the stronger the trend will be when the price breaks out of the flat .

The Law of Effort and Result

The Law of Effort-Result warns of the possibility of a trend reversal in the near future.

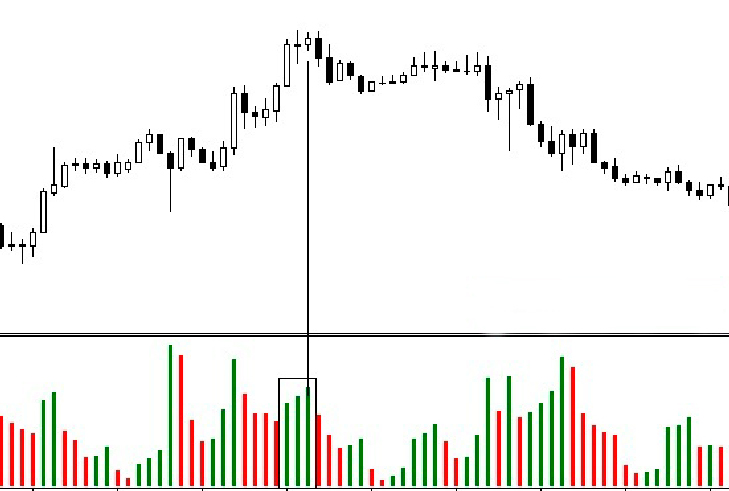

The price-volume relationship is one of the important signals that a trend may stall or reverse.

After a sharp decline in trading volumes, three sessions of increasing volumes followed, but the price growth occurred at a much slower pace and there was no breakout of the previous maximum, which led to a trend reversal.

The second part of the article - https://time-forex.com/tehanaliz/cenovoy-cykl