The Wyckoff Price Cycle, Part Two

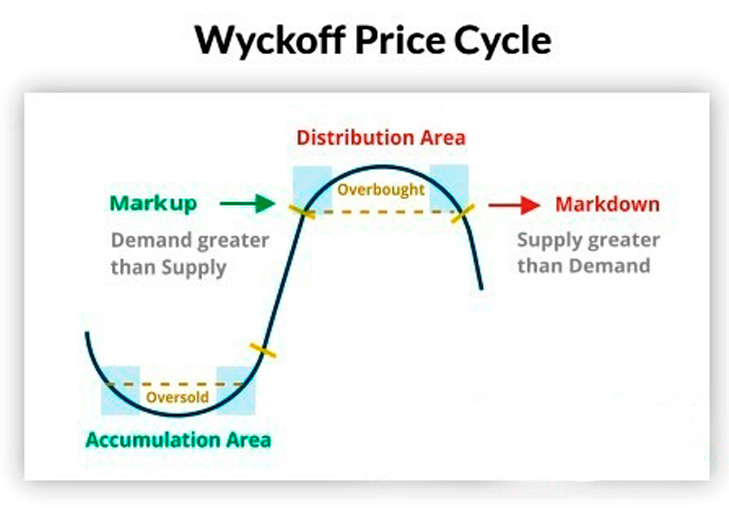

According to Wyckoff, investors can understand and predict markets through supply and demand analysis, which is done by studying price, volume, and time behavior.

He described a diagram of the stages of the price cycle, thereby determining the most favorable time to enter.

Accordingly, the time to open a buy order falls at the end of the preparation for an upward trend (the end of the accumulation phase).

And the time to enter a sell position is at the end of the preparation for a downward trend (the end of the segmentation period).

4 stages of the price cycle or Wyckoff price movement

Accumulation phase

This is the period when major market players begin to accumulate assets. Large sums of money are poured into the market gradually, preventing the price from reacting too strongly.

In the accumulation phase, the market tends to move sideways, also known as flat .

Bullish phase

Once the market exits the accumulation phase, a bullish phase begins. After a significant amount of selling has occurred, and the selling force has weakened, buyers quickly push the price higher, forming a new trend.

A bull market phase encourages those outside the market to buy shares, causing demand to exceed supply, pushing prices even higher:

However, during this bullish phase, it is not necessary that the price always goes up, but the market will have short periods of accumulation (reaccumulation, pause) or small declines ( correction ), then the price will move sideways or down for a short period of time before resuming this bullish phase.

Stage of dissemination

Once the demand for shares had been satisfied, high-income investors began to distribute their assets among latecomers, selling shares to lock in profits.

This stage is also skillfully carried out by market makers so that the price does not fall quickly and the shares maintain their price.

Sales period

Market makers began selling more shares, pushing the market down, which prompted other investors to also sell shares, resulting in supply exceeding demand, causing the price to fall.

Compared to the period of accumulation and price growth, the bearish phase is faster and more intense, because in this phase, investors typically want to quickly sell assets to exit their positions:

Just like in a bullish phase, the market does not always go down during a bearish phase, but there will be short periods of time where the market will redistribute or correct upwards (also known as a temporary retracement) before the downtrend continues.

At the end of the bearish phase, the market will resume the cycle with a new accumulation phase.

Wyckoff chart in two important phases of the price cycle: accumulation and distribution.

One of the main goals of the Wyckoff method is to find the right entry point for the best risk-reward ratio.

Wyckoff defines a trading range (TR) as the point where the previous trend (upward or downward) stops and there is a relative balance of supply and demand in the market:

In a trading range, the market's "major forces" prepare their bullish or bearish strategy during periods of accumulation and distribution.

In the accumulation or distribution phase of the TR, buying and selling activity is very active, however, in the accumulation phase, more shares are bought than sold, and in the distribution phase, more shares are bought than sold.

The degree of accumulation or distribution will determine the strength of the price breakout from the TR zone.

A trader using the Wyckoff method achieves success by correctly assessing the direction and strength of the price as it breaks out of the TR zone.

This method will provide traders with guidance on identifying events and price behavior during each accumulation and distribution period, thereby determining price targets for the next trend.

To achieve this, the Wyckoff method divides the accumulation and distribution period into many different sub-periods, describing the price behavior in each of these sub-periods.

To be continued