UNIMILLION – we tried for a long time, but not without success

Greetings, dear visitors. As always, in this section, I've decided to share an experimental test of the UNIMILLION expert advisor . I've previously described the advisor itself in the Expert Advisors section, so I won't go into further detail.

Let me just remind you that the expert advisor uses a position reversal tactic with a doubled lot size. Specifically, when a profit is reached, the expert advisor opens a trade with the specified initial lot size, and when a stop loss is reached, it opens an order in the opposite direction with a lot size doubled.

Overall, the strategy is simple; however, the advisor is limited to four reversals. If all four reversals are unsuccessful, the expert accepts the loss and restarts with the initial lot.

As with all tests conducted by our team, a demo account was opened to simulate a typical beginner with only one hundred dollars in a cent account .

Since we rent a server to test this kind of new product, the expert was on the market the entire time, so we guarantee the quality of the test.

Testing began on May 27, 2015, and continued through July 3, 2015, on the EUR/USD currency pair on a five-minute chart. All settings were left at default. At the start of testing, the expert advisor successfully closed a couple of orders, but for some reason, one standard-lot order stalled for a full month, accumulating a 240-point loss. I don't know why the expert advisor glitched, but after I manually intervened and closed the order, it continued trading. You can see the results of the first two weeks of testing in the image below:

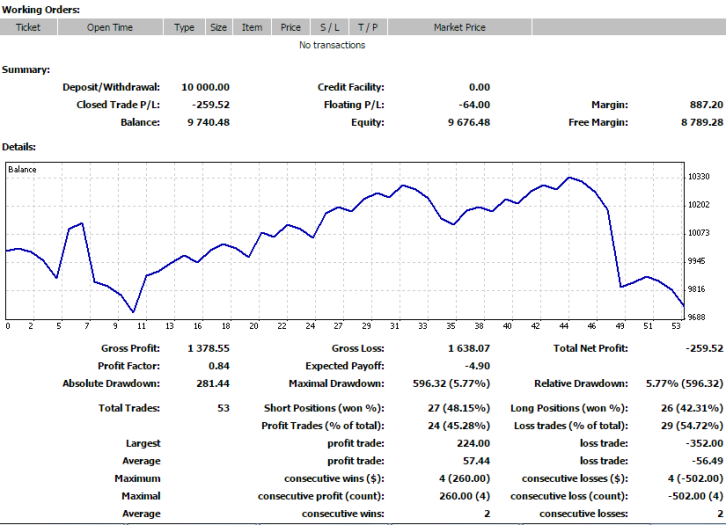

The chart initially showed a glitch, but after my intervention, the EA started working and began to pull the balance line upward. However, this didn't last long, and unfortunately, the EA hit a series of saws ( flats ) and repeatedly closed a series of losing orders. You can see the current report in the image below:

The chart initially showed a glitch, but after my intervention, the EA started working and began to pull the balance line upward. However, this didn't last long, and unfortunately, the EA hit a series of saws ( flats ) and repeatedly closed a series of losing orders. You can see the current report in the image below:

The expert's hard work was shattered in just one day due to severe volatility within a narrow range. Perhaps if the expert had been able to perform at least 7-10 reversals, it would have recovered from this situation, but unfortunately, you can't argue with an algorithm. The result, of course, wasn't disastrous, as the loss was only two and a half percent, and the maximum drawdown barely reached six percent.

After digging into the news and analyzing all the fundamental factors , it became clear that the daily profit drain occurred because the market was anticipating whether Greece would receive a loan or default. This anticipation led to this range.

Even though the expert advisor failed to achieve positive results, I wouldn't write it off. The reason for the loss is now clear, and if it is, it can be fixed. Therefore, I recommend disabling the expert advisor during important news releases, especially those that lead to prolonged market consolidation. Don't be afraid to test and tweak the expert advisor, as the algorithm itself should potentially generate stable profits in trending markets! Thank you for your attention, and happy testing!