The best traders.

This section is devoted to describing the success stories of famous traders and the strategies they used. Is it so difficult to succeed in trading? What is needed for this? The main secrets of profitable trading on the stock exchange.

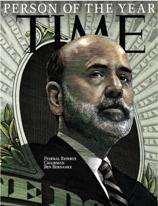

Financier Ben Shalom Bernanke

Ben Shalom Bernanke is one of the most prominent personalities of our time. Ben Shalom Bernanke served two terms as head of the US Federal Reserve and exerted a global influence on the world economy.

Ben has a tremendous scientific track record, and in the field of economics he is one of the best experts in the world.

For his activities at the post of the Fed, he received the nickname “Helicopter Ben”, since he repeatedly compared inflation to a helicopter from which simply huge amounts of money are thrown out.

Bernanke's biography is an excellent example of how determination and perseverance can influence the future career of every person, because he himself, step by step, working hard, came to his goal.

Ben Shalom Bernark has Jewish roots, but was born in the town of Augusta, Georgia back in 1953.

Trader Manager John Bogle

John Bogle is a famous managing trader who became the founder of one of the world's largest mutual funds.

John is not just a well-promoted person, but a real practicing investor who has made a huge contribution to the development of investing.

The book he wrote, “Mutual Funds from a Common Sense Point of View.

New Imperatives for the Intelligent Investor sheds light on the complex field of mutual fund investing, and the practical advice given in the book is still relevant today. Bogle received the rather funny nickname “Saint Jack” from his ill-wishers, since his truthful statements about his competitors, as well as his enormous openness in conversations with journalists, gave rise to many leaks of important information and cast a shadow on the entire industry, which his competitors clearly did not like.

However, any achievements of this greatest investor were preceded by a difficult life path, which we will try to introduce you to in this article.

Trader Tom DeMark

Often in the biographies of famous traders there is nothing in terms of achievements other than seven-digit profitability figures. Many were simply lucky, others simply knew how to skillfully manage a team and gathered an excellent team around them.

In fact, such traders can get on the list of the richest people and be invited to a couple of television broadcasts, but after finishing their career the world simply forgets about them.

Trader Tom Demark is the most ardent inventor and ardent ideologist of technical analysis.

If we talk about Tom’s achievements, we can safely mention a dozen different trading indicators he created, which are actively used in both the foreign exchange and stock markets. Demark was also able to share his knowledge and skills by writing a wonderful practical book on trading, “ Technical analysis - a new science .”

This book has become a guide for many beginners in mastering short-term and medium-term trading, because it is during these time periods that, according to DeMark, technical analysis is most effective. After that, Tom Demark wrote his name in huge letters in the history of the development of technical analysis, but his life path is as interesting as his successes.

Trader Alexander Gerchik

Studying the autobiographies of successful traders allows beginners not only to gain a boost of energy and strength, but also to analyze the mistakes of their idols.

When you look at almost any biography, you can to some extent see yourself, since all the pros were once beginners and, as a rule, had a rather difficult path to becoming.

By reading the autobiography and analyzing the mistakes of your idols, you can avoid unnecessary losses as much as possible, because you have already encountered a similar situation, albeit not on your own.

Trader Alexander Gerchik is one of the brightest traders of our time, since he has been trading without loss for many years.

Alexander Gerchik is famous among traders not only for his achievements as a trader, but also for his books, as well as his approach to training, where Gerchik lays out the whole truth and ins and outs of the stock exchange world.

Glenn Neely from failed trader to consultant.

Glenn Neely is a well-known figure in the stock exchange world. Glenn Neely's greatest contribution was his refinement of the Eliot Wave Theory, which was shown to the world in his published book Mastering Eliot Wave Analysis.

The author not only brought theoretical clarity by removing the factor of subjectivity in Eliot's theory, but also developed new shorter models that have more accurate characteristics.

If we talk about the biography of Glenn Neely, despite his enormous contribution to the development of technical analysis and enormous worldwide fame, his life path remains a mystery to this day.

In his speeches, Glenn Neely avoids talking about his family and past in every possible way, clearly setting the date 1981 as the beginning of his stock exchange journey.

Linda Raschke

Many people mistakenly believe that only men can achieve success on the stock exchange. Agree, if you look at success stories, and even just at photographs of trading floors, it is quite difficult to meet representatives of the fairer sex.

The fact is that in the early stages of the development of exchange trading, it was important not only to have analytical skills, but also physical ones, because you had to fight your way through a huge crowd in order to get interesting data and leave a request for opening positions.

Thus, it was quite difficult for representatives of the fairer sex to compete in such conditions.

The change in exchanges and the transition to electronic trading completely changed this situation, and an increasing number of women began to master the exchange business. Linda Raschke is a famous trader, the author of many trading strategies and systems, as well as the author of dozens of textbooks on stock trading.

Today, Linda Raschke has become not just a legend of the stock exchange world, but also an active trader and the head of the company LBRGroup, which manages billions of dollars in investments. The most interesting thing is that Linda knew from childhood what she wanted to become and made every effort to achieve her goal, and her life became an example for a million housewives.

Nassim Nicholas Taleb

Nassim Nicholas Taleb is a famous trader, philosopher and scientist. Nassim Nicholas continues to be not only a well-known theorist, but also acts as a practicing trader and founder of Empiric L-El-Si.

His hedge fund brought billions in profits to its investors during the most difficult crisis.

His books were translated into 17 different languages, and Nicholas himself was recognized as a genius of the stock exchange world. Nicholas had a special interest in statistics, namely random events that could affect the world economy.

Nassim Nicholas Taleb was born in 1960 in Lebanon in the city of Amoun.

Nassim's family belonged to the Orthodox caste and represented their interests at various political levels. So his grandfather and great-grandfather were the deputies of the prime minister of Lebanon, and his paternal grandfather was the most important supreme judge in Lebanon. If we talk directly about his parents, his father was a famous oncologist. In general, Nassim grew up in a wealthy noble family.

Martin Schwartz - solo trader

Increasingly, in various stock exchange magazines you can find the thesis that traders trading intraday never achieve stable success, and a series of profitable transactions will sooner or later be blocked by a series of unprofitable ones.

However, this myth and prejudice is shattered after reading the success story of Martin Schwartz, who showed by his example that intraday trading allows you to make stunning profits.

Martin Schwartz is an example of the most disciplined trader who achieved success through hard work.

However, Schwartz, like any person, did not immediately ascend to Olympus, and his life path will be an interesting lesson for all technical traders. Martin Schwartz was born into a very poor family, so a difficult life led him to hard work.

So, since childhood, Schwartz worked at various jobs, namely, mowing neighbors’ lawns and also removing snow for just $10. Even at a young age, Schwartz relied on education, so at school he was an excellent student. After finishing school, he successfully graduated from college and then graduated with honors from Columbia University. After he graduated, Martin joined the army and served in the US Navy.

Christopher Gardner

Some success stories are so inspiring and increase people's motivation that even large-budget films are made based on them, not to mention books written on behalf of the author.

Christopher Gardner's story inspired so many people that even Hollywood actor Wil Smith played him in a movie called The Pursuit of Happyness, depicting Gardner's difficult journey in pursuit of his dream of becoming a brokerage broker.

Today, Christopher Gardner is a millionaire and philanthropist who helps people who go through similar difficulties overcome them.

The brokerage company he created catapulted Christopher Gardner to the top and became the embodiment of his decades-long meta.

However, it is not for nothing that a film was made based on Christopher Gardner’s autobiography, because his success story is unique and reflects how a focused person can achieve his goals. Christopher Gardner was born on February 9, 1956 in Milwaukee, Wisconsin. If we talk about childhood, Christopher lived in a very dysfunctional and poor family. Right from birth, Christopher Gardner never saw his father, since he left the family when Gardner’s mother was still pregnant.

Peter Lynch

Peter Lynch is the manager of one of the largest hedge funds, who, thanks to his unique approach, was able to maintain the fund's profitability for 13 years, and the growth of his assets through stock purchases made his fund the largest in the world.

Peter Lynch is a star in the world of investing, and the books he wrote ( OVERWALL STREET ) reveal all the cards on stock selection and proper investing.

It is also worth noting that Peter Lynch is the cleanest investor who has not been involved in any major scandals with regulators, so there is simply no doubt about his success story.

However, before rising to extraordinary heights, he had to go through a rather difficult school of life, which will be discussed in this article.

Charles Dow - the man who changed the stock market forever

Charles Dow made a huge contribution to the development of the stock exchange and radically changed the perception of traders and investors to the movement of stocks and other assets in the commodity and derivatives markets.

Charles Dow also went down in history as the creator of the most important barometer of the US economy - the Dow Jones Index.

Dow was born on November 6, 1851 into a family of poor farmers.

Since childhood, Charles did not particularly like his parents’ main source of income, and even more so the prospect of continuing the family business scared him very much. That is why at the age of 18, without any education, a young man leaves his home and farm and gets a job as a journalist in a small provincial newspaper.