The best traders.

This section is devoted to describing the success stories of famous traders and the strategies they used. Is it so difficult to succeed in trading? What is needed for this? The main secrets of profitable trading on the stock exchange.

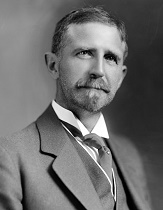

Trader Analyst Roger W. Babson

Roger W. Babson is a famous stock market analyst who, thanks to his personal trading, was able to earn a huge fortune and even compete for the presidency of the United States with Roosevelt himself.

Roger W. Babson was a well-rounded man who wrote more than twenty books in the field of business as well as investing.

It is worth noting that it was Babson who became the first harbinger of the stock market crash, and his combination of statistics and the laws of physics during the analysis of trading assets caused bewilderment and misunderstanding among his colleagues.

While many scoffed at his approach and comments on the crash, Babson earned himself not only capital, but also enormous prestige in the financial world.

It is worth noting that Roger W. Babson was an excellent careerist, which may have allowed him to write his name in history forever.

Trader Larry Pesavento

Most novice traders, and even more experienced exchange participants, have the mistaken opinion that in order to survive in the market you need to come up with your own unique approach.

Unfortunately, almost everyone thinks this way, and textbooks on stock exchange literature repeatedly point out the importance of creating your own strategy.

As a rule, this way of thinking does not allow a person to develop and instead of progressing using someone else’s experience as a basis, the trader tries to create a bicycle that has already been created a long time ago.

Larry Pesavento is an excellent example of a consistent trader who took Hartley's idea and his Butterfly pattern as a basis, and carried out a wide range of research.

Thanks to the work carried out, Pesavento was able to supplement the Hartley series with his own patterns, and also significantly increase the efficiency of using them by supplementing them with Fibonacci numbers.

Robert T Kiyosaki. The man who turned his shortcomings into millions of dollars

It’s probably difficult to surprise anyone with the name of such a famous person as Robert T Kiyosaki.

His motivational speeches have been delivered in most developed countries around the world, and his books have helped millions of entrepreneurs, as well as bankrupt investors around the world, get back on their feet.

It is Robert T Kiosaki who teaches us to think of ordinary people as rich, since it is the very way of thinking that prevents us from realizing ourselves.

Despite the fact that Kiyosaki is subject to constant criticism, unlike other charismatic speakers, he independently went from an ordinary person to a multimillionaire, and along the way he more than once became bankrupt and found himself in huge debts.

That is why Robert’s speeches have a huge impact on society, because he teaches what he himself experienced.

Kiyosaki was born on April 8, 1947 on the sunny Hawaiian island of Hilo. Robert's family was provided for thanks to the income of the main breadwinner of the family, namely his father Ralph H. Kiyosaki.

Richard Wyckoff. Father of volumetric analysis

Today, technical analysis of markets is at the peak of its development, and all this is due to the fact that more than 50 years ago there were people with extraordinary views who were able to formulate their idea.

One of the pioneers in the field of technical analysis at the end of the 20th century was Richard Wyckoff; he gave the world the basics of volumetric analysis, which in subsequent years was transformed into a separate VSA technique.

Let's take a closer look at the biography of this wonderful man.

Biography. Career

Richard Wyckoff was born on November 2, 1873. There is no mention of the legend’s childhood and adolescence.

The only thing that all bibliographers know for sure is that the family was very poor, so from childhood Richard had to work hard in order to somehow help his family.

Richard Wyckoff got involved with the stock exchange through the work he did on one of the exchange floors.

Trader Steve Faussett. The brightest life of a millionaire

Yes, they bought themselves mansions, expensive cars and even the love of luxurious women, but very rarely one can see the madness that an ordinary person wants to embody, even if he had a couple of millions under his belt.

Charitable foundations and balls are nothing more than a screen behind which rich people hide, trying to please society.

Living their rich and boring life, all that remains of them is their name and data on how much a person once earned, nothing more.

However, this description of the average rich person is completely opposite to trader Steve Fossett, who was able to live his life so brightly and crazyly that he entered his achievements into the Guinness Book of Records.

Opposition trader Kyle Bass

When studying success stories on the stock exchange, one constant axiom can be noticed, which is that in most cases the successes were achieved by those who bought undervalued shares and then controlled their price.

The growth of the economies of the United States and Europe allowed many traders to earn fabulous sums by doing practically nothing, but only holding shares of promising enterprises.

Today this approach is a dead end, but at the same time the bears began to reach the podium.

Opposition trader Kyle Bass is a great example of a modern bull who has achieved his success by shorting and betting the market.

Kyle Bass was born on September 7, 1969 in Miami, Florida. His family had a good income, since his father was the manager of a large hotel, Fontable.

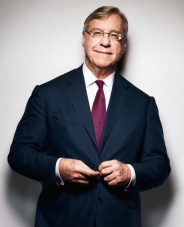

Trader and Analyst Kenneth J. Tower

Today, there are many types of technical analysis, ranging from the use of popular reversal patterns and indicators, to fractal and volumetric market analysis.

A lot of books have been written about each type of analysis, but few of them provide practical rather than superficial information. Kenneth J.

Tower became famous all over the world for lifting the curtain on one of the most complex and unique chart analyzes - tic-tac-toe. Kenneth J.

Tower is the co-author of many books on technical analysis, and is a private guest on such American channels as CNN, Fox and many others, where he regularly shares the market situation and provides his forecasts.

Kenneth J. Tower regularly conducts training seminars all over the world, and his students have been able to achieve unprecedented heights after learning tic-tac-toe charts.

Financier Leo Melamed. The Trader Who Changed the Stock Market Forever

In the process of studying the success stories of various traders, it is impossible to ignore the legend of trader Leo Melamed.

Thanks to his efforts, the stock exchange forever changed its appearance, moving away from trading in a huge hall to global network trading.

However, Leo Melamed not only changed the appearance of the exchange, but its very essence, creating derivatives or in more accessible language derivatives.

The contribution of this man to the development of the stock exchange world is simply enormous, but this would never have happened if he had not had to go through the most difficult life path, which we want to introduce you to.

Leo Melamed was born in Poland on May 20, 1932. When the boy was only seven years old, the world was overwhelmed by the Second World War, and Hitler’s troops at that time entered Poland.

Trader Jim Chanos. The biggest bear in financial markets

If you study the success stories of many traders, the idea appears that they were all typical “Bulls”, namely they managed to find undervalued stocks and after buying them they became millionaires in a matter of months.

However, it was extremely rare to come across a success story when a trader, without any insider information, managed to predict the collapse of a company or economy and make a profit from these events.

Of course, you can give the example of George Soros, but he was repeatedly accused of using insider information, and the so-called Black Friday could not have been an accidental victory, as many believe.

However, if all hedge funds are constantly busy searching for undervalued shares, then the Kynikos fund and its head, founder Jim Chanos, are the largest short sellers who make money on the weaknesses and vulnerabilities of companies and states.

Jim Chanos has a truly flair for finding scam companies and magically making money from their bankruptcy.

Talented trader and manager David Einhorn

David Einhorn is currently one of the most respected hedge fund managers, as well as the owner of Greenlight Capital, whose fortune is estimated at more than $6 billion.

Einhorn is considered one of the most open managers, since he always actively comments on his transactions and pays due attention to the press, justifying his decisions.

Einhorn’s word has such enormous authority that after his statements about the weakness and strength of a particular company, one can always observe the reaction of investors in a matter of minutes, which is why many shareholders of the affected companies dislike him so much.

Actually, David Einhorn has a huge track record, so the story of his success will be not only interesting for you, but also educational.

David was born on November 20, 1968 in New Jersey. His family was quite wealthy, which later affected his studies and career.

Trader Benjamin Graham

Benjamin Graham is one of the old-timers in the investment business, and his contribution to the development of future investors is simply enormous.

It was Benjamin Graham who became the teacher and inspirer of millions of traders around the world, and the most successful student of this trader was Warren Buffett himself.

Graham is the author of the so-called investor bible, in which Graham was the first to separate speculators on the stock exchange from investors, and also spoke in detail about his method of selecting certain stocks.

The track record of this trader and investor simply speaks for itself, but no less interesting is the life path of this great man, after reading which you can learn certain lessons for yourself.

Benjamin Graham was born on January 8, 1894. The future investor's first homeland was London, but when the young man was just over a year old, his parents decided to emigrate to the United States.