The best traders.

This section is devoted to describing the success stories of famous traders and the strategies they used. Is it so difficult to succeed in trading? What is needed for this? The main secrets of profitable trading on the stock exchange.

Trader Mario Gabelli

Mario Gabelli is one of the most popular traders and investors among journalists.

Constant visits to the most popular financial television shows, direct openness to journalists and stories about the dark life on Wall Street made him a star on such major television channels as CNBC and CNN.

Mario's catchphrases became quotes in major financial publishing houses, and his expert opinion was considered one of the most influential.

Mario Gabelli was born on June 19, 1942 in New York in one of the most violent areas at that time, the Bronx. His family were labor immigrants and came from Italy to the United States long before the birth of their son.

It is worth noting that Mario grew up in the most ordinary, average family, namely his father worked as a cook in one of the local restaurants, and his mother was an ordinary housewife.

Financier Carl Icahn. The path from raider to Trump adviser

The financial world, and especially the stock market, is cruel and merciless. In an interview, the greatest billionaire Carl Icahn once said that there are no friends on Wall Street, but only enemies, and if you want to find a friend, it’s better to buy a dog.

The words of a trader and investor with more than 55 years of experience in this field completely reveal the ins and outs of a stock exchange career.

After all, behind a beautiful suit and a neat appearance there is a very dirty struggle for money, and the higher your goal, the more you will have to get your hands dirty.

One of the toughest players, who is also called the executioner of companies, is Carl Icahn.

Actually, now this merciless raider is a direct adviser to the current US President Donald Trump, and his biography is an excellent example of all the toughness of the stock exchange world.

Carl Icahn was born in 1936 in Brooklyn. The family of the future financier was of average income, namely his mother was the most ordinary teacher in a public school, and his father cherished the dream of an opera career, but in the end he became just a singer.

Trader Stepan Demura

In the process of studying the stories of successful people who were able to reach financial Olympus thanks to the stock exchange, you will see that in most cases they are either Americans or Europeans.

If you try to find traders from the post-Soviet space, you will find that there are only a few successful people who have made a name for themselves on the stock exchange.

Of course, there are many reasons why this happens, but probably the most important one is, until recently, the lack of access to the stock exchange.

One of the prominent representatives of Russian traders who was able to achieve success in the current difficult conditions is Stepan Demura.

Stepan Demura was born on August 12, 1967.

Since childhood, Stepan showed great interest in economics, mathematics, and physics. It is also worth noting that Stepan was very fond of logic, and it was he who always tried to argue his opinion and knew how to think in more global categories.

Analyst John Bollinger. The path from cinematographer to financial markets

Every trader associates the name Bollinger with the bands of the same name, which are used in technical analysis.

A multitasking tool that made it possible to solve the problem of interpreting the current trend in conjunction with determining volatility in the market, it became simply an indispensable part of many trading strategies for different categories of traders.

The most interesting thing is that the tool does not lose its relevance to this day and is used by the widest mass of traders.

However, few people know that John Bollinger himself, before entering stock exchange history, was very far from financial markets; moreover, he did not even like mathematics, but preferred art.

John Bollinger was born in France in 1950. From childhood, he showed an unusual interest in art, namely, he was fascinated by photography, paintings, but he had the greatest love for cinematography.

Trader Robert R. Prechter

Robert R. Prechter went down in trading history as the best trader of the decade with his phenomenal performance in the Open Stock Trading Championship.

Many of the forecasts he created came true in the most unimaginable ways, and thanks to them, many investors were able to earn colossal amounts of money.

It is worth noting that Robert entered his name into history thanks to the books he published, in which he revealed the whole essence of wave theory, as well as the practice of its application not only in financial markets, but also in sociology and psychology.

It was Robert R. Prechter who first linked the behavior of financial markets with the social behavior of ordinary people.

Moreover, his observations were presented in a separate book, where the author himself clearly gave an example of the development of culture and fashion that coincided with the active growth of the stock exchange. Robert R.

Prechter is an excellent example of a talented person who was able to take his destiny into his own hands, and his biography is an excellent example for many beginners.

James Gorman - Best Financial Advisor

Very often, many bibliographers ignore stories of success in the financial market that are not associated with the creation of their own companies and billion-dollar fortunes.

However, in our time, when the profession of a trader and manager no longer evokes so many controversial emotions, a good manager is simply worth his weight in gold for huge corporations.

Many of the greatest managers never owned their own hedge funds, but their fees were so large that they would be the envy of any large entrepreneur.

Moreover, when working in the world's largest corporations, a person receives no less income, and this despite the fact that there is absolutely no risk of loss of equity, unless force majeure circumstances are avoided.

Trader Greg Coffey

On the Internet you can find a lot of stories of achieving success on the stock exchange, however, as a rule, they all relate to a certain moment when a person, by chance, was able to climb to the top of Olympus.

It is worth understanding that sometimes a timely exit from the market is the best outcome, and 41-year-old retiree Greg Coffey is an excellent example of this, because he ended his career when everyone believed that he was at the dawn of his strength.

Greg Coffey is an Australian by birth, having been born in Sydney, Australia on April 25, 1971. After spending childhood in their homeland, the family moved to the USA to attend Macquarie University.

At the university I studied current research that was necessary for all insurers in order to determine tariffs, as well as for tax authorities.

Career ladder

After receiving his Bachelor's degree from Macquarie University, Greg managed to pass the qualifying competition and get an internship at Macquarie Bank. A successful start to his career after a year of work in 1994 allowed him to exchange a safe haven for research work at Bankers Trust.

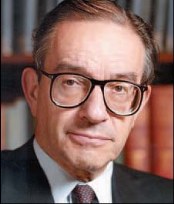

Alan Greenspan. Career as a financier.

Alan Greenspan is considered one of the most scandalous figures, whose name is associated with the global crisis of 2006, when the US mortgage bubble burst and a series of large banks with global capital collapsed, which affected the whole world.

Yes, it was this man who stood at the helm of the US Federal Reserve Service, which many experts accused of inaction when everyone clearly knew that the inflated soap bubble was about to burst.

However, despite such accusations, Greenspan repeatedly saved the US economy from collapse, for which he was valued as a highly qualified specialist under various governments.

Alan Greenspan spent 18.5 years as head of the Fed, which undoubtedly characterizes him as a hardworking person and a patriot of his country.

Alan Greenspan was born in 1926 in the famous Washington Heights neighborhood of New York. His family were descendants of migrants with Jewish roots. Soon after Alan's birth, the parents could not find a common language and decided to divorce.

Trader Boone Pickens. Oil and gas raider

As he accumulates capital, any self-respecting trader begins to buy blocks of shares in large companies in order to provide himself with a safe way out of risky trading.

However, in order to gain leverage and the ability to influence companies, many have to resort to so-called financial raiding.

When having a certain block of shares and the support of the company’s personnel, the processes of merger and takeover of companies begin.

It is very important to understand that raiding in the stock exchange world has nothing to do with the forceful seizure of factories and companies, which we can observe in real life, since all events take place within the framework of the law.

One of the most famous raiders in the oil and gas industry is trader Boone Pickens, whose net worth today exceeds $1.2 billion.

Trader Kweku Adoboli. The main anti-hero of the modern stock exchange world

Many exchange-traded funds and investment banks fail not because of weak market conditions, a crisis or external unfavorable factors, but due to the fraudulent actions of their own traders.

The fact is that the overwhelming number of traders work in financial organizations for a rate plus a bonus for excess profits.

At the same time, they earn millions for company owners, and they have billions of dollars in turnover.

Naturally, at a certain point, human greed begins to take over the trader, which leads to unauthorized opening of positions and the desire to use the company’s resource for one’s own purposes.

However, not only traders are to blame, because sometimes company management forces traders to cross the line of the law just to get additional income.

Trader and Manager John Neff. Stock market legend

Many traders have repeatedly heard about such famous figures as Soros and Buffet, who, thanks to their approaches and achievements, created huge investment funds and forever wrote their names in history during their lifetime.

Naturally, the people who created such funds came to the fore, becoming role models for millions of investors around the world.

However, behind such famous figures, for some reason we do not consider those simple workers who throughout their lives were loyal to their companies, earning billions of dollars for them.

One of these greatest traders was John Neff, who was able to earn his investors more than 13 percent per annum for 30 years.

John Neff was born in the famous town of Ohio, USA in 1931. His family was very ordinary and far from the stock exchange.