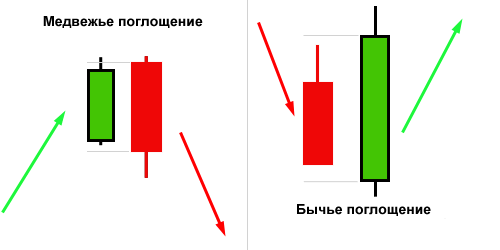

Bearish and bullish engulfing.

Engulfing combinations are among the most powerful reversal candlestick patterns, due to the very process by which they form. Bearish and bullish engulfing combinations are mirror images of each other and appear depending on the trend direction. When they form, the first candlestick to appear is a trending candlestick with a small body and short shadows. This typically indicates a decrease in volatility on the selected time frame.

Bearish and bullish engulfing combinations are mirror images of each other and appear depending on the trend direction. When they form, the first candlestick to appear is a trending candlestick with a small body and short shadows. This typically indicates a decrease in volatility on the selected time frame.

Bearish engulfing.

It appears during a pronounced uptrend, the price begins to slow, and a small candlestick forms, sometimes called a doji . This is followed by a sharp price decline, which forms a long candlestick, sometimes several times longer than the doji.

This is why these patterns are called "engulfings."

The signal is strengthened if the bearish engulfing pattern was preceded by a prolonged uptrend and the third candlestick is also bearish.

Bullish engulfing.

This is a signal indicating a high probability of an uptrend, appearing on charts with a downtrend.

The first candlestick is a small bearish candlestick, followed by a long bullish candlestick that completely covers the body and shadow of the previous one.

The shorter the body of the first candlestick and the longer the body of the second, the stronger the signal. This also applies to bearish engulfing candlesticks.

It should be noted that the "Engulfing" candlestick pattern can be used on timeframes longer than one hour, but not longer than one week.