Top 10 indicators for trading in the metatrader trading platform

Modern trading on Forex or any other market is almost impossible to imagine without the use of technical analysis indicators.

Most of the created tools are intended for installation in the metatreder trading platform, and this is not surprising because this program is the most popular today.

At the moment, Metatrader 5, by default, has 38 technical analysis indicators and oscillators installed.

Each of which, in its own way, analyzes the trend and helps the trader in stock trading, but among the presented tools there are also their leaders, so to speak, the top 10 best.

At the moment, we can highlight the top 10 indicators that can be found in MT5

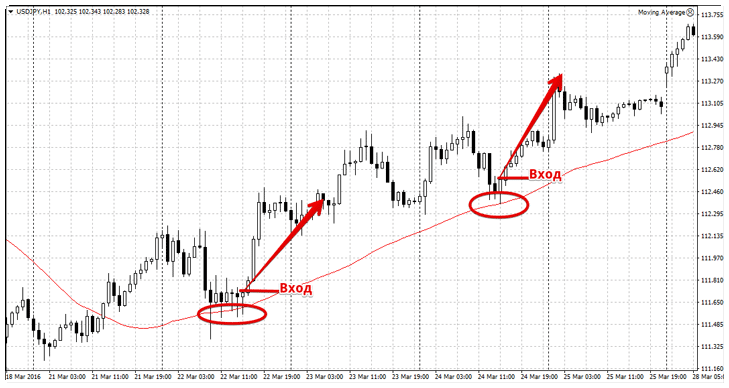

A simple moving average (SMA) is an indicator that calculates the average price over a certain period of time. The SMA can be used to determine trend, support and resistance, and to predict future prices.

More information about the indicator - https://time-forex.com/indikators/indikator-sma

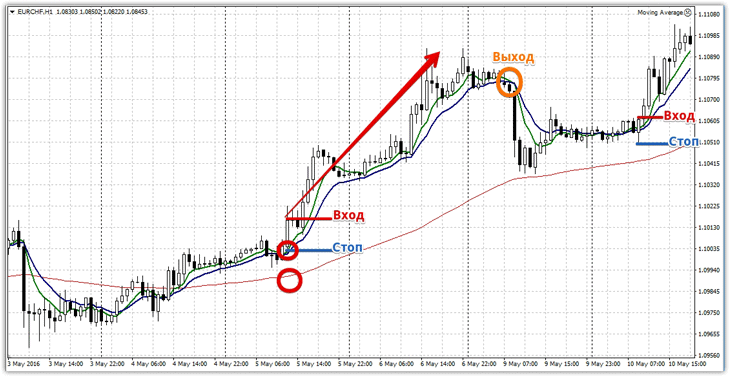

Exponential Moving Average (EMA) is an indicator that also calculates the average of prices, but with a greater weighting function on later prices. The EMA is more sensitive to price changes than the SMA and can be used to identify smaller trends.

Strategy for this indicator - https://time-forex.com/strategy/st-ema

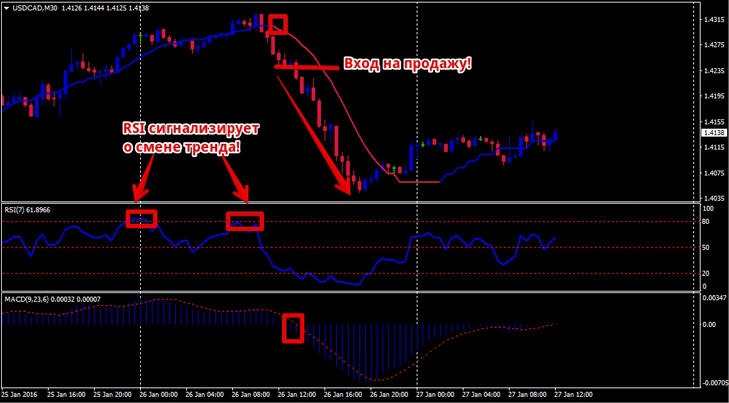

Relative Strength Index (RSI) is an oscillator that measures the rate of price change. RSI can be used to determine whether a market is overbought and oversold, and to predict future prices.

An example of a strategy on RSI - https://time-forex.com/strategy/st-rsi

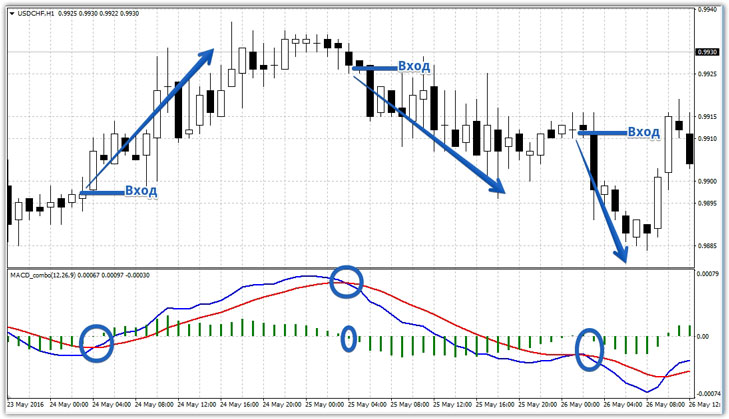

The Moving Average Convergence Divergence (MACD) indicator is an oscillator that measures the difference between two moving averages. MACD can be used to determine trend, support and resistance, and predict future prices.

Improved indicator - https://time-forex.com/indikators/macd-combo

Volume indicator is an indicator that measures trading volume. Volume can be used to confirm a trend as well as predict future prices.

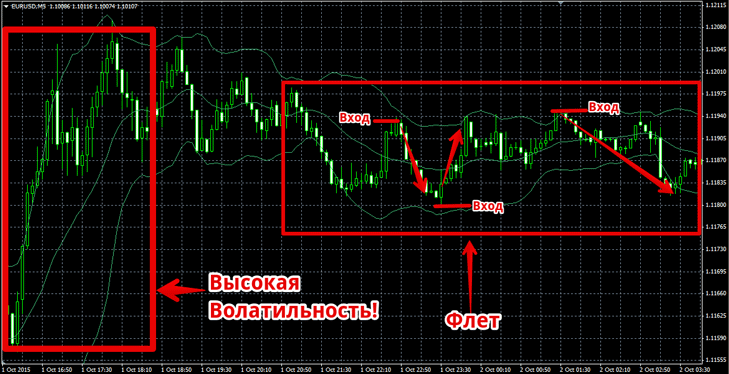

The Bollinger Band (BB) indicator is an indicator that measures the deviation of price from the average price. BB can be used to determine whether a market is overbought and oversold, and to predict future prices.

Bollinger Bands Strategy - https://time-forex.com/strategy/st-bollindgera

The ADX indicator is an indicator that measures the strength of a trend. ADX can be used to identify long-term and short-term trends, as well as predict future prices.

How the ADX script works - https://time-forex.com/indikators/average-directional-movement-index

The stochastic indicator is an oscillator that measures the price position relative to a certain price range. Stochastic can be used to determine whether a market is overbought and oversold, as well as to predict future prices.

A simple strategy based on Stochastic - https://time-forex.com/strategy/strategiy-stohastik

I would put this tool in first place in the top 10 indicators from the trading platform, since I am almost always satisfied with the results of its use.

The Williams %R indicator is an oscillator that measures the price position relative to a certain support level. Williams %R can be used to determine whether a market is overbought and oversold, and to predict future prices.

Improved version - https://time-forex.com/indikators/multi-williams

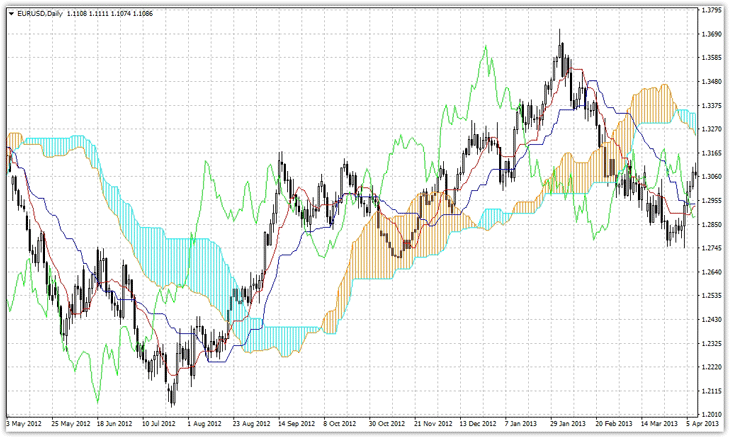

Ichimoku Kinko Hyo (Japanese: 一目均衡表, "one look - overall balance") is a Japanese technical indicator that combines several different indicators, such as moving averages, trend lines and the Ichimoku cloud. It was developed by Goichi Hosoda in the 1960s.

The Ichimoku indicator can be used to determine trend, support and resistance, and predict future prices. Details about the indicator - https://time-forex.com/indikators/in-ichimoku

There are other, no less interesting indicators that are not included in the top 10, but to use them you must first download the required tool and then install it in the trading platform.

Rating of popular indicators according to our website - https://time-forex.com/info/reyting-indik

But despite how effective the listed technical analysis indicators may seem, the greatest profitability in trading can be achieved if you also take into account fundamental analysis data when opening transactions.