The VWMA averaging indicator is an excellent analog of the simple moving average

The moving average is the tool upon which the first forex indicators were built, which began to be used long before the advent of online trading.

Just think: a simple line showing the average price over a certain period allows you to look at the price without bias, reject unnecessary market noise, and, most importantly, identify trends and their changes promptly.

However, the same moving average has one major drawback: its calculation takes into account all candles for a given period, without taking into account the actual weight of each candle.

To overcome this drawback, a new type of averaging was created that takes market volume into account, and the VWMA is built on this foundation.

The VWMA averaging indicator is a trend-following technical analysis tool that is no different in its application principles from a moving average. However, the averaging and calculation process takes volume into account, and in the case of the forex market, tick volume.

It is also worth noting that VWMA can serve as a basis for both scalping strategies, as well as for long-term ones, so the tool can be applied on absolutely any time frame known to you.

Installing the VWMA indicator in MT4

The idea of taking volume into account when calculating a moving average is far from new, but this indicator was only implemented in 2016 exclusively for the MT4 trading terminal.

It's worth noting that the VWMA averaging indicator is distributed completely free of charge, and the tool was published in the official MT4 developer library, allowing you to use two installation methods.

The first method, and the simplest one, is implemented using the built-in library in your MT4. To install the indicator via the library, launch your trading terminal and go to the "Terminal" panel, where you can find up-to-date balance information.

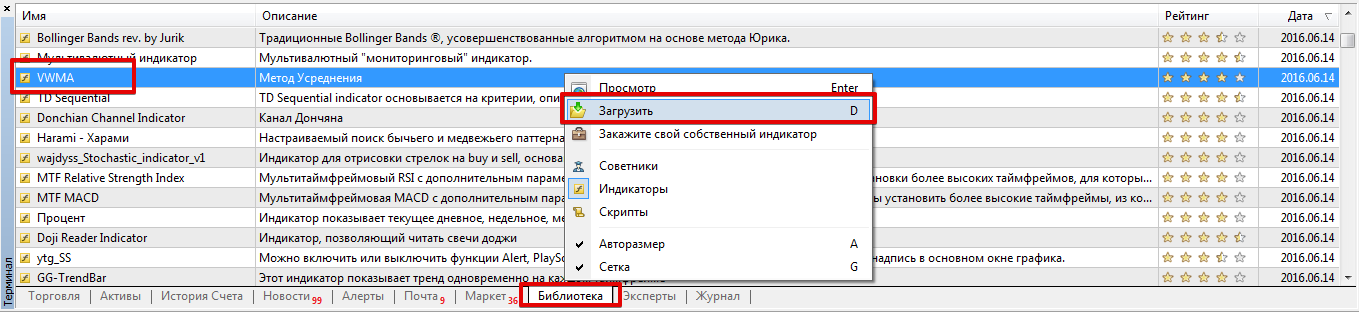

Next, you'll need to open the "Library" tab and sort the list so that only indicators are displayed. Find VWMA in the resulting list and download it using the additional menu, as shown in the image below:

If installing via the library is difficult, you can use the second method, which is to install via the standard data directory.

To do this, simply scroll to the end of the article and download the indicator file, then place it in the appropriate folder in the terminal's data directory, specifically the "indicators" folder. After restarting the platform or updating it, the VWMA indicator will appear in the list of custom indicators in the navigator panel. To start using it, simply drag the instrument name onto the chart.

The VWMA

indicator is simply a modernized version of the Moving Average , with the only fundamental difference being that VWMA uses volume, while the Moving Average does not.

Therefore, the application principles and position opening signals remain identical.

Since the moving average is primarily a trend indicator, traders most often use it as a filter.

The direction of the trend can be indicated by both the price position relative to the line and the slope of the line.

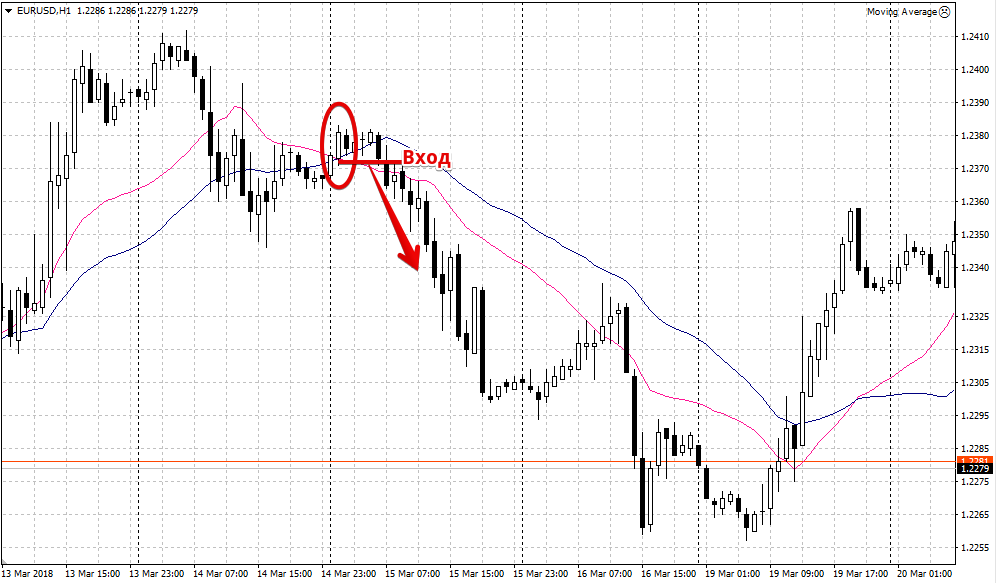

So, if the price is above the VWMA, we can assume an upward market movement, and if it's below, a downward movement. The slope is also important, as the greater the slope, the stronger the trend.

Many traders also use a VWMA with a fast and slow period to assess the trend; if the fast VWMA is above the slow one, the trend is upward, and if it's below, the trend is downward.

The intersection of the lines indicates the entry point and a change in the market trend.

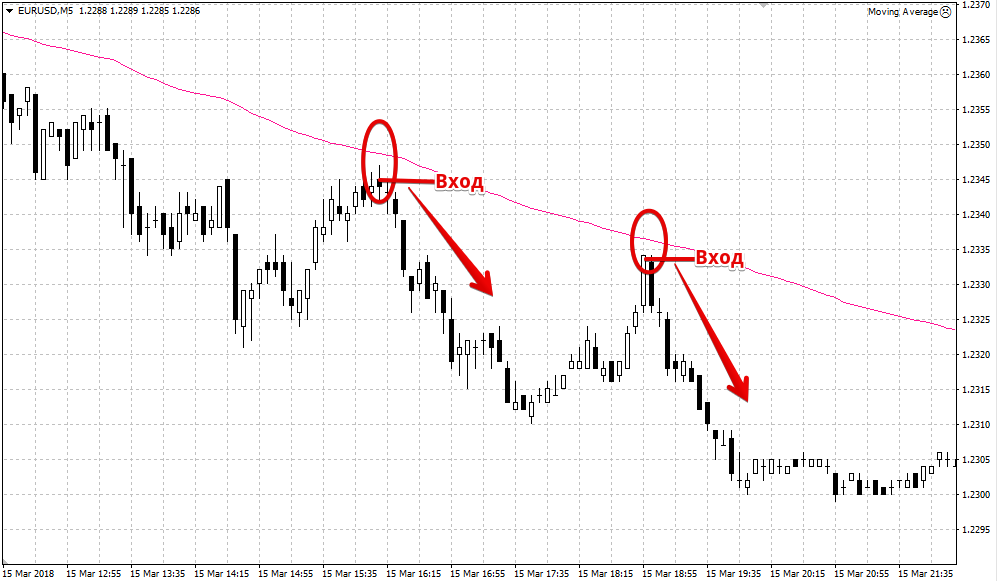

VWMA can often be viewed as a support or resistance line, especially when using very long periods on small time frames.

Therefore, a trader can use the indicator in two ways: trading a breakout or a rebound. When trading a breakout, a buy signal is a price crossing the line from below, while a sell signal is a price crossing the line from above.

When trading a rebound, it's important to pay attention to the overall trend direction and trade strictly in its direction, contrary to the short-term trend. Example:

In conclusion, it's worth noting that the VWMA averaging indicator is an excellent modification of the standard moving average . However, it's important to understand that in Forex, only tick volume is available, and its information content is significantly lower than the standard one.

Download the VWMA averaging indicator .