Scalping - optimal volumes of opened trades

Online trading on the stock exchange has gained particular popularity due to the ability to use scalping strategies.

Earnings on short-term transactions and with high leverage allows you to get thousands of percent profit per year.

At first glance, there seems to be nothing simpler than scalping, in which there is no need to make long-term market forecasts, but you just need to open short-term transactions with the maximum volume.

But just with volumes, not everything is clear; many beginners are interested in the question of position size, because both the size of profit and the risk of opening transactions depend on this.

How real is scalping on gold, the size of the commission and the strategy that helps you make money

It is generally accepted that the best asset for trading using the scalping strategy is the eur/usd currency pair since it has the smallest spread.

But this judgment is one hundred percent correct only when we are talking about the shortest transactions or pips.

In fact, you can scalp on almost any asset, the main thing is that the speed of price movement and time are enough for it to be tight, so that the financial result of the transaction becomes positive.

Gold trading is no exception to this rule, especially since, thanks to the use of CFDs, the commission on this asset is reduced every year.

Scalping on a cent account, if such trading makes sense

Every year the number of brokers with cent accounts increases, and even reputable brokerage companies have similar options.

The main purpose of cent accounts is to test new strategies, but at the same time, some traders wonder whether they can be used for scalping.

Indeed, in contrast to standard strategies, scalping has slightly different earnings laws and profits can amount to hundreds and sometimes thousands of percent per month.

Is it really possible to make money on a cent account using scalping, or is this more of a platform for testing a new strategy?

How significant is the scalping commission on Forex and how to minimize it

I am often asked how important is the size of the scalping commission from a broker when trading on Forex or the stock exchange.

I usually answer that the size of the spread has almost no effect on the outcome of the transaction, because now brokers open positions almost free of charge, with rare exceptions, for some assets.

But after I had to trade using scalping on Forex, my opinion changed dramatically; in this strategy, size still matters.

Until this moment, I only suspected how much a broker earns, but here all the assumptions exceeded any expectations.

Scalping commission size using a specific example

For trading, we chose one of the most liquid currency pairs with a minimum spread and which almost always has a normal trend, well, at least one that is sufficient for our strategy.

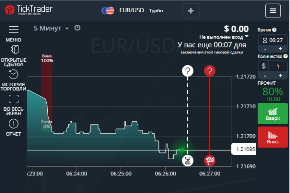

Tick Trader platform for trading on ticks

The smallest movement of Forex prices is called tic, in other words, this is the distance between neighboring quotes.

The moment is widely used in exchange trading, there are even a whole strategies based on ticks.

To implement it, traders use special indicators that are added to the standard trading platform.

This is not always convenient, and the quality of the scripts leaves much to be desired, but progress does not stand still and a separate trading platform has already appeared, intended exclusively for trading on ticks.

This software product will be the best choice if you are a support for short -term trade using tick graphs.

The main points of organizing scalping

Forex scalping is an excellent strategy for those who want to make a lot of money quickly and are not afraid of risk and hard work.

Many beginners think that scalping can be a fairly simple activity, because it does not require careful market analysis and long-term forecasts.

The main thing is to open and close short-term transactions on time and withdraw profits, that’s the whole trading strategy.

In fact, short-term trading consists of a mass of important nuances that should be taken into account when organizing the trading process.

In this case, it is the organization of the process that is important, and not the clearly drawn up plan itself, which is quite difficult to implement during scalping.

Crane Scalper indicator

One of the most popular mistakes of novice traders is the use of indicators in areas of the markets that are unusual for them.

The most popular and profitable area of trading - scalping on Forex - requires the use of special technical indicators that are designed to work with market noise.

The Crane Scalper indicator is a technical analysis tool that is designed to work on small time frames and is a signal tool.

It is worth noting that the Crane Scalper indicator was put on public display in 2016 by one of the active participants in Forex forums and is distributed completely free of charge.

The indicator itself is universal and can be used on any currency pair or time frame, but you should understand that the main priority for its use is trading on small time frames.

Super profitable pips

If your deposit does not exceed several hundred dollars, the desire to earn more than the fear of losing what you have, then pipsing is your choice.

of losing what you have, then pipsing is your choice.

Piping is the most profitable and riskiest strategy in stock trading; some classify it as scalping on Forex, while others distinguish it as a separate trading strategy.

Profit from pips can reach 500 percent or more in one session, but at the same time this is the most relaxed type of trading on the stock exchange; you can lose your money even faster than you earn.

Features of pipsing in Forex

Earnings are 20-50 points from one transaction with a 5-digit quote, but since the maximum leverage is used, even these couple of points can give a significant profit

Scalping on futures, features of applying the strategy in practice

Almost every novice trader has at least once heard about this style of trading called scalping.

The main distinguishing feature of this trading method is its high profitability, compared to passive investments and long-term earning strategies.

The main distinguishing feature of this trading method is its high profitability, compared to passive investments and long-term earning strategies.

Successful scalping on futures can actually be the key to monthly growth of your initial investment by 15-20%.

However, we should not forget that high risks are an integral part of short-term trading with the fixation of insignificant financial results.

What is scalping in the futures market?

The use of scalping strategies in practice involves working with low chart periods and opening trades with an insignificant financial result recorded.

Piping strategies for profitable trading on M1, indicators and signals

Pipsovka as a trading style is the most profitable, however, at the same time the most labor-intensive. Trading in a chaotic market, where market noise makes up 90 percent of the time, requires a trader with nerves of steel and special skills.

It is in pip trading that you as a trader have no time to hesitate, since every second of delay takes away a couple of points of profit, which, as a rule, at best does not exceed 10-15 pips per trade, or even less.

Naturally, in order for pips strategies to bring stable profits, you will need to be systematic, namely, use special trading tactics that are designed specifically for pips on the minute chart.

The strategy for pipsing on M1, which we want to offer you, is a universal tool that is designed for trading almost any currency pair on the Forex market.

Scalping in the stock market: secrets of using short-term trading

Most supporters of trading currency pairs on Forex are convinced that significant investments will be required to make money on the stock exchange.

This opinion was formed mainly under the influence of the popularity of the “Buy and Hold” strategy .

By which long-term transactions are opened and a small leverage is used, since market noise simply will not allow you to work differently.

The essence of this trading system is to buy from 3 to 10 of the most liquid assets, that is, shares of companies with large capitalization - blue chips, and sell them at a more favorable price.

Scalping strategies with the greatest effectiveness of application

It would seem that scalping trading is simply trading on short time periods, but in addition there is an additional division into certain substrategies.

substrategies.

The concept of trading on short time intervals is quite broad and covers an interval ranging from several seconds to 15-20 minutes; almost any transaction that fits into this interval can be classified as scalping.

Scalping strategies are conventionally divided into three groups - pipsing, classic and scalping with the lowest risk. It is clear that each of these options has its own distinctive features.

Each of the options can only be applied based on the current situation on the forex market, only this will allow you to achieve the greatest efficiency

Some secrets of pipsing.

detailed descriptions of this type of trading

detailed descriptions of this type of trading

are quite rare in the literature First of all, it follows that when pipsing, profits and losses rarely exceed 10-15 points, and most often the trader is happy with 5 points of profit per trade.

It is difficult to apply analysis here; trading is based more on logic and intuition, but at the same time, we do not forget about the basic rules of money management and risk management.

Now let's move on to a more detailed review of pipsing recommendations. Keep in mind that all recommendations are given for four-digit quotes; for five-digit ones, we simply add 0.

How to speed up scalping

One of the most important indicators that are important when using the scalping strategy on Forex is the speed of order execution; it is instant execution that allows you to take a couple of points of profit more.

instant execution that allows you to take a couple of points of profit more.

These few points later add up to tens and hundreds, which, translated into real money, gives quite a profit.

There are several techniques that can significantly speed up the execution of orders in a trader’s trading terminal.

1. The broker with the fastest order execution - in most cases, it depends on the broker how quickly your order will be executed; the speed range is quite large and usually ranges from 0.2 to 3 seconds.

It’s clear that if all your orders open and close in 3 seconds, you can forget about profit.

XMT SCALPER Advisor

Trading on the stock exchange always requires the progress of the trader, his strategy, advisor, and most importantly, mental abilities.

However, progress in a certain area, even technical analysis, is not so easy, because all the effective tools have long been invented and laid out for everyone to see.

Of course, presenting to the world something insanely new and effective in the field of trading is not so easy, but why hide it, not all of us are scientists with phenomenal abilities to invent something.

However, almost anyone can take someone else’s idea or development as a basis and eliminate its shortcomings, while adding something fundamentally new.

The XMT SCALPER advisor is an excellent example of how an expert, half-forgotten by the public, was revived and improved by a foreign programmer, which ultimately led to the creation of a fundamentally new scalper.

Exchange Scalping - what is the essence of this strategy?

This strategy has been extremely popular both in Forex and other financial markets for several years now.

financial markets for several years now.

It is this that allows you to get maximum profit through the use of leverage.

Scalping is trading on the shortest time frames, with the conclusion of a large number of short-term transactions.

The profit in this case may be only a few points, but as a result of the maximum ratio between the trader’s deposit and the volume of transactions, the profit increases hundreds of times.

Page 1 of 4

- To the begining

- Back

- 1

- 2

- 3

- 4

- Forward

- In the end