When to close positions in Forex.

There are many methods for closing Forex positions, but typically, this action is based on two factors: achieving the required profit level and exceeding the loss threshold.

this action is based on two factors: achieving the required profit level and exceeding the loss threshold.

Consequently, Forex positions are closed either by triggering stop orders (take profit, stop loss, trailing stop), or manually at the trader's discretion.

How to close losing positions has been discussed many times, so we'll only briefly touch on this point, clarifying the main points.

Closing losing positions.

Forex risk management perspective , is that the loss from a single unsuccessful trade should not exceed 2-3%, but this option is suitable for fairly large deposits and when using low leverage.

Where to get money for trading on the stock exchange

Almost everyone is familiar with the saying, "Money makes money," so the problem of increasing working capital in Forex is especially pressing. A trader's account balance primarily determines such indicators as earnings and risk.

working capital in Forex is especially pressing. A trader's account balance primarily determines such indicators as earnings and risk.

There are numerous ways to attract additional funds and thereby increase your profits. However, this should only be done after you've already achieved positive financial results over several months.

In Forex, you can lose $1 as quickly as $10,000, so don't attract additional funds to your account until you've learned how to make money.

Selecting a currency pair.

When starting to trade on the Forex currency market, the first step is to choose the trading instrument that will generate profit. Each trader makes this choice based on their own criteria.

When starting to trade on the Forex currency market, the first step is to choose the trading instrument that will generate profit. Each trader makes this choice based on their own criteria.

For example, Americans and Japanese traders prefer to trade their national currencies, or more precisely, pairs that include them. Some focus solely on the spread, while others simply choose the most popular trading instruments.

The choice of a currency pair, based on generally accepted criteria, is based on such indicators as liquidity, volatility, spread size, swap commission size, availability of technical analysis tools and automated trading programs.

Tips for a beginner Forex trader.

There are a number of essential tips and recommendations for a beginning Forex trader that will not only help you profit from currency trading but also prevent you from quickly losing your initial deposit. I mean "not quickly losing," as you'll lose your first deposit no matter what, but the longer you continue this process, the more beneficial it will be.

There are a number of essential tips and recommendations for a beginning Forex trader that will not only help you profit from currency trading but also prevent you from quickly losing your initial deposit. I mean "not quickly losing," as you'll lose your first deposit no matter what, but the longer you continue this process, the more beneficial it will be.

These Forex tips will be of interest not only to beginner traders but also to professionals. After all, it's impossible to know everything. Sharing experiences is what allows you to achieve trading excellence. Now let's move on to specific recommendations:

Forex risks and ways to combat them

When starting Forex trading, every trader should be aware that this type of trading is characterized by increased risk, and instead of the long-awaited profit, there is always the possibility of losing your own money.

Forex risks can include not only unpredictable changes in exchange rates, but also purely technical factors that are independent of the trader's skill.

Therefore, this issue should be approached with particular care, as it's always easier to prevent potential danger than to try to compensate for losses later.

The main risks in forex are currency, organizational, and technical.

Let's move on to a more detailed review of them and ways to reduce these dangers.

How to choose a PAMM account and manager

The Internet is one of the most profitable ways to invest your own money, and one way to earn money is by investing in PAMM accounts.

This option is typically used by former traders who understand that Forex is not a scam; it's just that earning money on the currency exchange requires a wealth of knowledge and practical experience.

But the question of how to choose a PAMM account often arises for the average person who simply wants to profitably invest their money in stock trading.

You can make the right choice if you know a few things to pay attention to first. Surprisingly, it's not the profitability of the transactions, but the stability of the manager's work.

As well as several other aspects, which we will dwell on in more detail in this article.

Requotes and slippage

When working on the foreign exchange market, there are many technical aspects, without knowledge of which it is simply impossible to achieve the planned profit.

It should be taken into account that there are times when a transaction simply does not open or opens at a completely different price than the one you specified in the order.

These two points have long been familiar to any trader and are called requotes and slippage.

A requote is a refusal to execute an order at the requested price. Instead of opening a trade, you see a message on your screen like "The price has changed, and the order cannot be executed at the requested price." Then comes the question of whether to accept the new price or not.

As a result, you find yourself far from a good place to enter the market.

This is especially unpleasant if you are trading using a short-term strategy, where every point of profit is important, and if a rejection occurs, you sometimes even have to change the direction of the transaction.

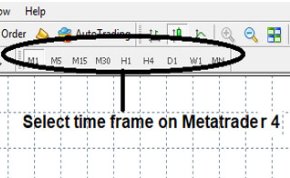

Which timeframe is better?

Timeframe is a time interval that characterizes the movement of the exchange rate over a certain period of time.

The effectiveness of opening positions and many other nuances will depend on how accurately you determine which time frame is best for you.

Each option has its own characteristics and requirements for leverage, deposit size, and the applied forex trading strategy.

There are several options for dividing the timeframe depending on the chosen strategy for working on the Forex currency market. Each option is based on the amount of funds at the trader's disposal, the availability of free time for trading, and experience in the currency market.

Choosing a timeframe is a rather complex process; when doing so, you should carefully analyze your trading strategy and all its tactical aspects.

You should first decide whether you will work exclusively during the day or carry over positions to the next day.

Key qualities of a broker

To choose the right broker for Forex trading, you first need to know what qualities to pay attention to.

It should be taken into account that what is on a company’s website does not always correspond to reality.

Many important points can only be verified in practice, and sometimes it is too late to change anything.

Therefore, before making a final choice, you need to carefully weigh all the pros and cons, and only then make a decision and fund your trading account.

At the same time, one should always remember that the main quality of any broker is its reliability.

In my practice, I once encountered a company that positioned itself as a large dealing center. I was very surprised to discover that the company's website had only existed for three months, and its traffic was only 10 people a day.

For practical trading, the most important qualities of a forex broker are:

Best market entry points

To make a profit on Forex, you need to not only choose the right direction for a trade, but also enter the market at the right time, or, in other words, find entry points.

This determines how much profit you will get from one trade, whether you will be able to take the entire trend or only a small part of it.

Entry points into the stock market are the most favorable places where a transaction will be opened; they can have not only price but also time parameters.

There are several effective ways to find entry points into the market, each of which should be applied depending on the current situation, making decisions based on market analysis.

It is important to remember that it is better to wait and earn more than to rush and lose profits.

Lot size on different exchanges

Trading on the foreign exchange market requires taking into account many different nuances that determine the profitability and risk of trading operations.

Moreover, some “little details” can play a decisive role in a certain situation on the exchange and significantly change the possible financial result of trading.

The Forex lot size is precisely the significant point that should be taken into account when calculating the volumes of future transactions.

The main thing is to correctly determine the ratio of the value of this indicator and your own deposit, to identify the optimal indicator taking into account the risk and the desired profitability of operations.

Many traders don't even realize how important this parameter is in the initial stages of trading, trying to make a deal with the maximum volume.

In this article, I will try to explain the easiest way to calculate the optimal Forex lot size.

Is there a breakeven point in Forex trading?

The main goal of any trader is to reduce the number of unprofitable transactions and thereby increase the overall level of profit.

It should be noted that completely breakeven Forex trading is practically impossible; one can only minimize potential losses, thereby improving the overall financial result over a certain period of time.

To solve this problem, you need to understand the main causes of losses when trading on the forex market, as preventing a problem is much easier than fixing it later.

Profitable forex trading is all about taking a smart approach to risk management.

The risks vary, so for maximum effect, all possible options should be considered.

Forex trading without a deposit

There are tons of reviews about Forex trading, some of whom believe it's a complete scam, while others boast of making millions. The only way to figure out the truth is to try trading for yourself.

There are tons of reviews about Forex trading, some of whom believe it's a complete scam, while others boast of making millions. The only way to figure out the truth is to try trading for yourself.

Moreover, it is not at all necessary to have a large initial capital; if desired, you can earn money on Forex without a deposit, that is, practically from scratch.

Trading Forex without a deposit involves choosing one of two options: receiving a no-deposit bonus (a small amount, but immediately available), participating in tournaments (substantial prizes, but you'll have to work hard), or attracting an investor.

Don't think that working with other people's money is much easier; additional psychological pressure always occurs when trading with an investor's money, and finding such an investor is quite difficult.

1. Receiving a no-deposit bonus – the bonus is usually only a few dollars, ranging from $5 to $30. But with skill and luck, you can multiply your deposit several times over.

Forex tips to help you make your trading profitable

Forex trading has become incredibly popular these days, with new people eager to take up online trading every day. But they have no idea that in practice, things aren't as simple as they seem in brokerage companies' advertising brochures.

This is why most novice players end up without money on the very first day of trading, and the main reason for this phenomenon is not experience.

Forex recommendations are nothing more than a short list of the most essential tips for trading on the foreign exchange market, which will be especially useful for beginner traders.

In this article, I'll provide a few simple Forex recommendations that will prevent you from losing your deposit at the initial stage of trading.

If you follow these recommendations, the risk of losing your initial capital is reduced several times.

Profitable trading is entirely possible; the key is to understand the process and incorporate the experience of others into your own work. Now let's move on to the question itself.

Trend-following trading strategies, indicators, and templates

Trend trading is one of the most common and safest methods in Forex; there is nothing simpler than entering into a trade in the direction of the prevailing trend and waiting for the profit to reach the planned level.

But everything is simple only at first glance, because the trend does not move in a straight line, and it is quite difficult to choose the direction of the transaction.

In addition, it is necessary to take into account a lot of other indicators that characterize this trend, the main one being the strength of the existing trend, how long it can last and what caused this movement.

It is also important to remember that for any time period there is a direction, which can also be a rollback for a longer time frame.

We will discuss the specific features of trend trading in this article.

Mobile Forex and stock market trading in just a few clicks

It's not always possible to trade Forex from a desktop computer or laptop; sometimes they're simply not at hand, and you need to urgently close an order or, conversely, open a new deal.

This is precisely where a trading terminal installed on a smartphone, iPhone, tablet, or other mobile device comes in handy.

Mobile trading – full-fledged Forex trading using mobile devices with an internet connection – allows you to monitor the status of open orders at any time and enter the market at the most opportune moments.

It's advisable not to use this option as your only option; the desktop trading terminal still offers greater capabilities than its mobile version.

Now let's move on to what you need to trade from a mobile device.

Intraday trading in the Forex currency market

There are quite a lot of strategies for trading on the Forex currency market, but they can all be divided into two main groups.

The first includes those that do not require transferring the position to the next day, the second includes longer-term transactions.

Day trading allows you to earn maximum profits even with a small starting capital; it is this type of trading that has enabled most famous traders to make their fortunes.

In this article, we will talk about the most common type of trading, namely, intraday trading.

It's the method most novice traders choose due to its apparent simplicity. However, statistics show that long-term trades yield the greatest profits.

First of all, I would like to focus on the main pros and cons of intraday trading on Forex:

How to Guarantee Your Profits on Forex

The question "How to make money on Forex" is the first thing that worries any beginning trader, and the answer is quite complex.

To become a successful trader, you will first need some time and personal practical trading experience.

Of no small importance is knowledge of the fundamentals of exchange rate movements, namely the factors that cause changes in the price of a currency.

Anyone can make money, but for some reason, most novice traders end up leaving their money on the currency exchange, the main reason for this being an incorrectly chosen trading strategy.

In this article, I'll try to cover the basics of trading and share a simple trading strategy that, in most cases, brings quite good results.

Page 4 of 4

- To the beginning

- Back

- 1

- 2

- 3

- 4

- Forward

- To the end