Should you admit that you are a trader?

One of the most valuable things in life is peace of mind, and one of the components of peace of mind is how people treat you.

Once I started earning money as a trader, I began to consider it my specialty, and when asked, "What do you do for a living?" I'd confidently answer, "Trader."

This answer, in most cases, only evoked negative emotions in people, which affected their attitudes toward me.

Some began to consider me a slacker who sits at home and does nothing and began suggesting I get a real job; others assumed I had a huge amount of extra money and tried to borrow it.

But in one case or another, my honesty was punished by these people's negative attitudes toward me.

Two brokers in one trading platform

Working with MetaTrader, you never cease to be amazed by its functionality and technical analysis capabilities.

The developers of the trading platform have truly done everything to make traders' lives easier.

Even after several years of use, you continually discover new features and capabilities.

Some features were simply overlooked before, while others have only recently appeared thanks to software updates.

One such feature is the ability to trade multiple accounts from different brokers on a single trading platform.

What can you see in the Market Overview window?

The MetaTrader trading platform offers tremendous capabilities for trading and technical analysis, but most traders only use a fraction of its available features.

It's just that newcomers to Forex tend to want to trade right away, rather than study the trading platform's instructions .

After all, mastering the order placement technique is sufficient to open trades, while other aspects seem unimportant.

In fact, sometimes just a few mouse clicks are enough to make your work more convenient.

The default settings set by the developers don't always fully utilize their functionality, and this applies to the "Market Watch" window as well.

By default, this window only displays currency pair quotes with the Bid and Ask prices:

Concepts You Can Ignore When Trading Forex

The most valuable asset in any successful person's work is time. It's always in short supply, and you start to feel like you're doing something unnecessary.

After trading for a long time, you also realize there are many things you can do without,

freeing up time for more important things or simply saving it for rest and entertainment.

Traders often do a lot of unnecessary manipulation, monitor parameters they don't use in trading, and acquire unnecessary knowledge.

Therefore, it's so important to know what's unnecessary in Forex trading and what you can do without.

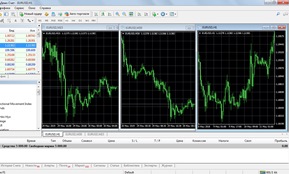

Setting up 3 screens in the MT4 platform

Trading using the well-known strategy of Soviet-born American trader Alexander Elder involves simultaneously using three charts with different timeframes for the same asset.

According to the strategy's developer, working with multiple timeframes allows for effective filtering of false signals for opening trading positions.

For a comfortable visual perception of the charts, it is recommended to configure the platform so that all three timeframes are displayed in a single terminal window.

However, many novice traders experience difficulty setting up charts, although there are many options for doing this quickly and easily.

How do I add three charts for the same currency?

How does one-click trading work?

One-click trading is a feature provided by trading platform developers that allows traders to place a trade order within 1-2 seconds.

When trading highly volatile financial instruments, this feature allows traders to avoid slippage and enter the market at the current price.

One-click trading is an indispensable tool for short-term intraday traders.

And also for those who prefer to open orders with insignificant target levels during the release of macroeconomic news.

According to unofficial statistics, most novice traders use short-term methods to profit from asset pricing.

Setting Take Profit for sell trades

Using safety orders is an integral part of trading. It allows traders to precisely implement their trading plan.

In many trading strategy descriptions, the authors recommend setting Stop Loss and Take Profit at important local levels.

Finding the right level that matches the current market situation is crucial.

Therefore, various analytical tools are used to accurately determine these levels:

• Bill Williams fractals;

Fibonacci grid ;

• cluster charts combined with volume delta.

The latter tool is quite complex and is only available on paid analytical platforms. MetaTrader terminal developers do not provide cluster charts.

Key features of asset value formation

In fact, there is an unspoken pattern in the pricing of financial instruments, confirmed by statistical data.

Best stop loss size

One of the most important aspects of Forex trading is risk reduction. Untimely exits are the main cause of large losses.

To combat losses, a familiar tool to every trader was invented: a stop-loss order.

More precisely, it's one of the settings set when opening a trade in the new order panel of the trading platform.

The importance of setting a stop-loss is clear; the key is the size of the order.

There are many options, and each trader chooses the one that best suits their strategy .

Forex profitability map.

The main question that interests every newcomer to Forex is how much money they can make.

Numerous articles have been written on this topic, providing theoretical calculations of probable earnings based on the author's own assumptions.

As with everything, theory doesn't always correspond to reality, so if you really want to know how much you can earn on Forex, use a profitability chart.

It shows the probable monthly profit for the most attractive currency pairs.

You can choose the month for which statistics will be displayed; only the basic conditions remain unchanged.

The initial data shown in the diagram:

How to minimize losses in Forex

Most newbies looking to make money on Forex for some reason believe they can easily turn a thousand dollars into a million.

And they can do it in just a couple of months, then enjoy life on the islands by the warm ocean.

Unfulfilled expectations are the cause of disappointment and the loss of even existing funds.

To minimize losses in Forex, especially at the beginning of your career, you should understand how much you can realistically earn without risking your own money.

In reality, it's not that much; traders who have been working consistently for many years earn no more than 50% per annum. So

where do these multi-million dollar incomes, yachts, houses, and limousines come from?

Leverage for scalping.

A trend doesn't always have a clearly defined direction; there are periods when the price moves horizontally for several days.

However, its fluctuations in one direction don't exceed 10 pips (with a four-digit quote). In this case, there are two options: change the trading asset or use scalping.

This strategy yields the best results during a flat period, as the exchange rate fluctuations follow a consistent pattern.

However, to profit from a 10-pip movement, you need a large capital base or high leverage.

For example, if you take the EUR/USD currency pair, a 1-pip price change will earn you $10 if you open a 1-lot trade.

Let's learn trading on our own.

In the post-Soviet space, most people are accustomed to the idea that in order to master any profession, you need to graduate from university.

But the reality right now is that going to university is just wasted time, at least 80 percent of it.

This judgment applies perfectly to trading; many of the famous financiers, and especially traders, did not have any special education.

The main thing is to correctly draw up a training plan and, so that studying does not seem monotonous, combine theory with practical classes.

That is, if you have read how to open a deal in the trading terminal, you need to do it in practice right away.

The Most Effective and Dangerous Trading Tactics

Currently, there are a variety of trading tactics that can, to varying degrees, make Forex trading more effective.

Clearly, not all techniques yield the same results, and some can lead to wasted funds or even losses.

The key is to quickly distinguish profitable tactics from dangerous ones and avoid using them in your trading. This is quite difficult, as many dangerous tactics are advertised as the most profitable.

Therefore, those that can be used without significant risk include:

- Pending orders

- Addition

- Partial closure

How long can you hold a stock exchange position?

Some traders position themselves with investors and don't want to profit from short-term movements, sitting in front of a computer all day.

They want to make a single successful trade and hold the position for several months, waiting for the price to reach its maximum.

It would seem that strategy and the current trend play the most important role here, and the position itself will exist until the trader closes it or until a stop order is triggered.

But unfortunately, this isn't always the case, or rather, not everywhere.

The lifespan of positions on currency pairs,

as most brokers assure us, is practically unlimited; at least, that's the answer we received from almost all brokerage firms .

Macroeconomic indicators in MT5 and how to use them in trading.

Fundamental analysis, unlike technical analysis, provides a clear understanding of the underlying causes of price movements, as investors and bankers are guided by economic indicators, not trends and indicators.

Thus, macroeconomic indicators provide the vector and message that both traders and investors must follow.

However, fundamental analysis requires traders to constantly monitor the news release time, making decisions based on the release of macroeconomic indicators.

Unfortunately, the traditional MT4 platform is far from ideal for news trading, as traders must rely on third-party information sources, which inevitably slows down their reaction times.

One-click trading – using the terminal's full capabilities

A novice trader, like a sponge, absorbs irrelevant information, forgetting the most important.

Indeed, at first, a trader is eager to dive right in and learn the practical side of analysis, which is usually what they do first.

However, in their pursuit of knowledge, newcomers neglect the trading platform's functionality, which leads to traders limiting their actions.

They are unaware that these features, from the very beginning, can solve many problems and challenges they may encounter.

One such feature, which every trader has seen but doesn't fully understand, is One Click Trading.

One Click Trading is an auxiliary feature of the MT4 and MT5 trading terminals that allows you to bypass the standard process of opening a trade with multiple confirmations and execute trades with a single click directly on the chart.

Metatrader Alerts - Setting Up Signals in the Trading Platform

Most trading strategies require complete immersion in the trader's trading process. However, for many, trading is nothing more than a supplementary source of income.

Therefore, as much as we may not want to, we have to devote minimal time to trading compared to what a real strategy requires.

It's also worth remembering that the trading process itself is quite routine, as the most difficult part isn't actually opening trades, but waiting for the exact moment when the necessary conditions are met.

Experienced traders use indicators with built-in alerts for such purposes, or commission them from a programmer.

However, many people don't know about one feature of the Metatrader trading terminal: the ability to enable sound alerts when certain price conditions are met, which you can set yourself.

Alpari Advisor – Broker Requirements and Restrictions for Trading Advisors

The key reasons why traders lose money are rooted in their own lack of information.

Ninety-nine percent of traders are simply unaware of the trading conditions for their accounts, let alone the massive, dozen-page agreement they agree to without reading.

In many cases, such negligence leads to nothing, but there are situations where, after trading successfully for a long time, a trader at the most prestigious and reliable brokerage firm is denied withdrawal of their earnings.

Restrictions on certain trading or actions are present at all companies, and these regulations are designed to ensure the technical operation of the broker's equipment without interruption.

If a trader violates these rules, profits may be forfeited or the account may be completely blocked.

Advanced order management system

Trading in financial markets is a competition between exchange participants, where money flows between them based on the results achieved.

Therefore, traders constantly seek trading advantages that will allow them to stay one step ahead.

Some find this advantage in a unique system that provides signals slightly earlier than others or is highly accurate, while others gain it through excellent trading conditions.

Regardless, hundreds of factors can influence a trader's performance, and any advantage you gain can dramatically improve your trading.

Alpari 's advanced order management system .

What are "Libraries for MetaTrader 4"?

Surely, many novice traders don't consider the functionality that awaits them when choosing a broker or trading terminal.

Indeed, for many beginners, and even experienced traders, progress is practically unimportant; a price chart and a couple of indicators are sufficient, and sometimes nothing more than price action is needed.

However, the market is becoming increasingly complex year after year, and its movements are becoming less and less logical.

Therefore, traders are forced to consider gaining an advantage over other market participants, allowing them to open trades faster, conduct better analysis, and stay one step ahead.

It is precisely this pursuit of advantage that has driven the automation of processes in the forex market to the level we see today.

False breakout

The fundamental, undeniable law of the market is that price takes levels into account as it moves.

Yes, whether it's a trader trading on the news or an investment banker at one of the world's largest companies, they all take psychological levels into account.

This very property of price to take levels into account has become the key factor underlying the construction of hundreds of breakout strategies.

It's worth noting that the principle of trading based on levels, regardless of the strategy's content, is virtually identical.

However, using this obvious law in practice is not so straightforward, as in reality, false breakouts are more common than genuine price breakouts.

Consequently, traders who blindly trade breakouts sooner or later begin to lose their deposits. What causes this process?

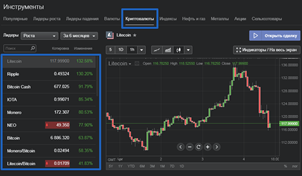

Online platform for cryptocurrency trading

The emergence of trading platforms has dramatically increased the popularity of stock trading, making it accessible to anyone.

If we take the stock market as an example, the first thing that comes to mind is the Quik trading terminal. In the case of the forex market, it's the MetaTrader 4 or MetaTrader 5 terminal.

Regardless, traders trading on these two global markets have a professional environment for market analysis, strategy development, automation, and, most importantly, implementation.

Unfortunately, traditional cryptocurrency trading lacks such functionality, as even the largest centers offer a simple candlestick chart with a couple of time frames.

Naturally, in such conditions, traders seeking effective and profitable trading must resort to auxiliary online platforms that assist in market analysis.

Optimizing an Expert Advisor or How to Make Your Expert Advisor More Profitable

There is always a debate about the advisability of using automated trading strategies and advisors in the Forex market.

You've probably also come across statements like, "All advisors eventually drain your deposit!" Do you think this is just another rant from people obsessed with manual trading?

No, in fact, any advisor without exception, if you don’t interfere with its work, will sooner or later drain your deposit.

But at the same time, let's face it and ask ourselves a very simple question: do you know an example of at least one manual strategieswhich, without any changes, could generate profit on a permanent basis?

You've likely never encountered such strategies, and neither has our team. What's the point of abandoning expert advisor trading if it's a manual strategy, and the trading expert will sooner or later lose your deposit if you don't intervene and make any changes to its logic?

The best binary options

The abundance of choice can sometimes leave beginners confused, as it's not enough to simply enter the market, top up your account, and start trading.

You can achieve your desired success by choosing only the best binary options, the best instruments, and the best trading conditions.

Much of this depends on your broker, but nothing is stopping you from choosing the right company and the asset you'll be working with in the future.

That's why following these rules will increase your chances of success. Next, we'll look at the selection criteria that will help you make the right choice.

By time

When choosing a trading asset, it is very important to pay attention to the expiration date of the option offered by the broker.

Free Cryptocurrency Signals Based on Technical Analysis

Today, the vast majority of traders are actively buying up cryptocurrencies, anticipating their further growth.

Regardless of the source of information a trader uses, they'll almost always come across buy recommendations. In fact, some companies have even created funds and are actively buying this asset.

However, if you look at the truth, you'll realize that all these recommendations are primarily aimed at long-term investors, because no matter the market or asset, it will always rise and fall.

Cryptocurrencies are no exception, and almost every sharp rise is followed by equally sharp pullbacks, which a trader is simply bound to profit from.

It's important to understand that a trader is a speculator, so their signals should be based on technical analysis, which allows them to profit from all market movements, especially in cryptocurrencies.

Talking MetaTrader: Making the platform a pleasant experience

When actively using the MT4 and MT5 trading platforms, you've probably noticed that the terminal constantly emits sound alerts.

Whether it's connecting to the server and publishing news or triggering a market signal if your indicator supports this feature.

You'll agree that the sound alerts feature is very useful and makes our trading much more convenient, allowing us to stay informed about any events occurring in the trading terminal.

However, many people find these types of audio alerts completely irritating, as not only are the sounds very harsh and jarring, but it's also sometimes very difficult to figure out what exactly the platform is notifying us about.

However, few people know that the MT4 terminal can literally talk.

The platform's settings are so flexible that you can easily replace all the annoying sound alerts and insert your own recordings and commands. This article will show you how.

Best Forex Scripts

The trading process, depending on the trader's tactics and trading style, requires performing numerous routine actions daily, which significantly take up our time.

Calculating a trading lot, calculating zones for placing profit and stop orders, closing a series of orders, and setting a grid—all these operations can take up to 50 percent of your trading time every day.

However, for long-term traders the loss of time is not so noticeable, then if you use a grid or scalping strategy, you simply can’t do without special assistants.

Today, hundreds of different scripts have been created that perform various tasks for traders.

How to optimize an advisor

Unfortunately, there are virtually no trading advisors in the financial markets that can consistently deliver stable results and don't require reconfiguration or optimization.

For many beginners, the concept of optimization may conjure up something complex and incomprehensible. In reality, optimization is simply adjusting parameters to current market conditions.

So, when a trader adjusts a certain indicator on history, he is also engaged in optimization, but it just looks a little different.

Why is it necessary to conduct optimization?

The fact is that the market moves in cycles of sorts and tends to pick up certain paces and maneuvers that have been repeated before.

Thus, many beginners, and even professionals, often encounter a situation where a forgotten draining advisor suddenly begins to bring in huge profits, while the latest development, on the contrary, begins drain the deposit.

Alpari's Trader's Calculator

During trading, almost every novice trader encounters a situation where, while opening a position with the same volume in the same direction with the same stops and profits, but on different currency pairs, you receive dramatically different profits or losses in the deposit currency.

This situation typically leads to an imbalance in trading, because even though a strategy may yield 60 percent winning trades in multi-currency trading, you simply don't cover the loss with a new profitable trade, despite the profit in points being almost equal to or even greater than the stop order.

Thus, a seemingly successful strategy in multi-currency trading systematically drains the trader's deposit. You're probably wondering why this happens.

The fact is that many traders, both experienced and novice, often ignore all the minor nuances when calculating a lot.

The best Forex terminal: choosing the right trading software

The trading terminal is a trader's work environment, the tool through which the entire trading and market analysis process occurs. As strange as it may sound, your future success directly depends on the choice of a particular platform, and if you're new to the market, the speed of your learning curve is directly affected by the platform.

A trading platform allows you to realize all your potential, and in some cases, significantly limit it.

While until recently the number of different trading programs could easily be counted on one hand, today, in pursuit of improved customer service, various brokers are constantly creating new applications, each with its own unique features.

Each platform has its own unique appeal, so depending on your goals, it's advisable to choose the best Forex terminal that meets your requirements.

The most popular trading platform today is considered the Meta Trader 4 trading terminal. This platform has a simple and unobtrusive design, extensive functionality, and vast trading capabilities.

Non-standard timeframe in MT4

Every trader at the beginning of their development is faced with the problem of choosing a specific asset and time frame.

While choosing an asset is fairly straightforward—you only need to trade an instrument whose movement structure you understand and can explain—the choice of timeframe largely depends on the trader's preferences.

I'm sure everyone has encountered this situation: we don't have much time for trading, so we work on higher timeframes. When we have free time, we all switch to five-minute timeframes and try to extract as much profit as possible from the market.

Unfortunately, this kind of back-and-forth creates enormous chaos in our trading, and our results are typically significantly lower in this chaos.

Page 2 of 4