Long and short days.

This definition of Japanese candlesticks is quite common in candlestick analysis literature; these terms can be considered basic, providing a general description of the candlestick formed.

can be considered basic, providing a general description of the candlestick formed.

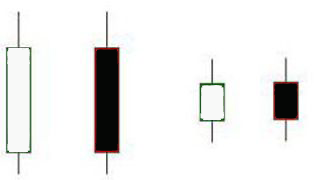

Long days have a long black or white body, indicating that the price has traveled a significant distance in a day or other time period.

The main role is played by the distance between the opening price and the closing price, but the maximum (minimum) price value is also not ignored.

Short days – as the name suggests, in this case, the candle has a relatively short body and small shadows, indicating that there was no significant price movement during this period. These candles most often reflect a flat .

time frame are typically compared ; this approach allows one to identify the hours or days of highest or lowest market activity.