The best traders.

This section is devoted to describing the success stories of famous traders and the strategies they used. Is it so difficult to succeed in trading? What is needed for this? The main secrets of profitable trading on the stock exchange.

Manager Louis Bacon. A true connoisseur of nature

Many successful people, businessmen, traders and investors show their love for Mother Nature in their own unique way.

Some people cut down forests while boasting of thousands of dollars in donations for cleaning up garbage and planting new seedlings, while others actually sponsor various environmental projects and remain in the shadows.

Louis Bacon, being a successful billionaire manager, is one of the leaders in the field of environmental philanthropy.

Moreover, he is the founder of a special fund that invests in young and promising projects aimed at protecting the environment.

The life path of this billionaire, a trader and manager by profession, can become an excellent example to follow not only among novice traders, but also for any person who is thinking about his future.

Woman trader Muriel Siebert. Success despite the system

Today, the stereotype that financial markets are created only for men is practically dispelled, since a huge number of women have long shown that their trading efficiency is far from worse, and in some cases is an order of magnitude higher.

Unfortunately, gender inequality on the stock exchange was very acute, to the point that a woman was not considered a trader at all.

The opposition was so great that this inequality was also manifested in wages, which were clearly not in favor of the weaker sex.

Naturally, in such conditions, many women gave up their dream of financial independence, but there were also those who, contrary to established foundations, continued to move towards their goal. You will get acquainted with the biography of one of these women in this article.

The main character of our story, Muriel Siebert, was born on September 12, 1928. She lived in Ohio, in the town of Cleveland, in a Jewish, low-income family.

The father was the only breadwinner in the family, while the mother stayed at home with two children and raised them.

Businessman and manager Gennady Nikolaevich Timchenko. One of the largest oil traders in Russia

Many people remember the Soviet Union as an ideal utopia, although in fact they only remember a couple of years of the existence of this state, or have even heard about it from the memories of their parents.

The equality of people in society, the exaltation of the working person and working profession, salaries that in theory allow you to buy a lot - both pensioners and young people who never lived in the USSR are nostalgic for all this to this day.

However, it was the collapse of this state that allowed truly talented and enterprising people, whose potential capabilities were constrained, to leave the general system of equalization.

In this article you will get acquainted with the biography of a brilliant man, a native of the system, who was able to maximize his abilities and enter the hundred richest people on the Forbes list.

Gennady Timchenko was born on November 9, 1952 in the city of Gyumri, in the then Armenian USSR. It’s very difficult to call Gennady Nikolaevich’s childhood childhood.

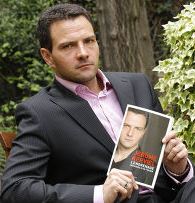

Trader Jerome Kerviel. Scapegoat or victim of greed and stress?

Beginning traders almost always need their heroes. Millions in earnings, successful careers and simply excellent personal lives of successful managers become excellent examples for beginners to follow.

However, the trading world is filled not only with positive stories with a beautiful ending, but also with stories of fall, even imprisonment.

In this article you will meet another anti-hero who deprived thousands of French investors of their money, but at the same time turned out to be nothing more than a scapegoat for an angry public.

early years

Jerome Kerviel was born in the French town of Pont-l'Abbe on January 11, 1977. The Kerviel family was far from rich and almost always teetered on the brink of poverty, since in addition to Jerome, there was also an older brother in the family, and the parents had working professions.

Trader and investor Guy Adami. Millionaire with a great love for journalism.

In this article you will get acquainted with the biography of trader Guy Adami, who loves journalists and if not for his profession as a trader, he would most likely become a TV presenter.

early years

Adami was born on December 18, 1963 in New York. His family was far from poor, but in addition to Adami, there were four more children in the family, so he had to work since childhood.

The most interesting thing is that the future millionaire was born into a family of lawyers; his parents met while still students at law college.

The main breadwinner in the family was the father, Guy Adami, who worked for more than twenty years in the local department of justice, he was a judge in the small village of Croton-on-Hudson.

From childhood, Guy Adami was a persistent student and showed great love for sports. Moreover, he served as team captain at his school and also served as captain of the basketball team.

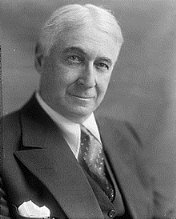

The story of a financier - Bernard Baruch. Man facing the crowd

In his writings, Bernard Baruch wrote that despite the fact that each individual may have high intelligence and reason sensibly, the moment the crowd begins to move, almost everyone without exception follows it.

On the stock exchange, the herd instinct manifests itself in all its glory, because a trend is a reflection of the mood of the crowd, so to speak, the realization of its expectations.

Bernard Baruch in his book gave a clear answer to how he managed to achieve success on the stock exchange - he ceased to be part of the crowd. He bought when everyone was selling and sold when everyone was buying.

Fear, panic and the herd instinct force one to take rash actions, and when everyone lost en masse, Baruch earned millions.

early years

The future genius was born in 1870 in South Carolina, the city of Camden. He grew up in a quite wealthy family, since his father at that time was an outstanding surgeon who laid the foundation for the rehabilitation of patients with the help of physiotherapy.

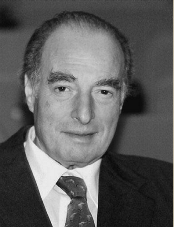

Trader and financier Mark Rich

A trader is not only a stock trader, futures or other securities, he is first and foremost a trader who, thanks to his ingenuity, intelligence and approach, makes a lot of money.

The most interesting thing is that all billionaire traders are embarrassed and keep silent about their dark past, but hide behind beautiful statistics and financial statements in order to explain how they earned billions.

However, behind every purchase and sales agreement there is bribery, collusion and pressure. In this article you will get acquainted with the biography of one of the most scandalous traders, Mark Rich, who adhered to a very simple principle of operation, namely, the cloudier the water, the bigger fish you can catch.

The Early Years of Marc Rich

Marc Rich was born in 1934 in Antwerp, Belgium. Despite the fact that Mark Rich himself pointed out that his family was very poor, according to the investigations of many journalists, these words were far from the truth.

Finance Manager David Shaw

The exchange industry allows almost every person to earn huge money, regardless of what profession or skills they had before making their first transaction.

However, despite the abundance of different approaches to its analysis, people associated with the exact sciences, and especially mathematicians and economists, most often achieve success.

The acquired logical thinking skills become an excellent basis for acquiring new knowledge and skills.

The most surprising thing about the biographies of successful people is the fact that successful teachers, scientists or people closely associated with programming suddenly leave their comfort zone and achieve stunning success in stock trading.

Actually in this article you will get acquainted with the biography of David Shaw, one of the most influential billionaires in the United States of America.

Tom Steyer. Influential manager with international ambitions

In this article you will get acquainted with the biography of one of the most successful managers, who during his lifetime began to make the world a better place.

Tom Steyer was born on June 27, 1957 in Manhattan. Since childhood, he showed a love for sports, and especially football.

It is worth noting that the future billionaire grew up in a quite wealthy family. Tom's mother worked as a teacher, and his father worked as a lawyer and was a partner in the law firm Sullivan & Cromwell.

Thanks to his father's diligence, Tom Steyer began his education at the Buckley School, which is considered one of the most prestigious schools for boys in the United States. It is worth noting that among the graduates of this school were the children of the Rockefellers, Roosevelts and even Trump Jr.

Showing excellent athletic abilities as well as academic skills, Tom's parents were well aware of the future career opportunities for their son.

Therefore, after finishing the ninth grade, it was decided to transfer his son to Phillips Exeter Academy, the end of which opened the way to admission to Yale University.

Trader Daniel Loeb. The right investor

In the process of studying the investment strategies of famous traders and investors, you can see that all methods in the investment world are good.

Insider information, pressure on the board of directors and even corporate raiding - almost every major player has similar stories. Daniel Loeb, who practices the practice of putting pressure on the board of directors, was no exception.

However, if many investors come to skim the cream off already successful enterprises, then Daniel Loeb is the very person who buys up shares of companies that show a negative trend, not because of the crisis or the enterprise itself, but because of weak management.

Loeb is not just a speculator, but first and foremost a manager, and all his actions and investments are aimed primarily at the comfort of the company, due to which there is a further increase in stock prices.

early years

Daniel Loeb was born on December 18, 1961. He lived throughout his childhood in Santa Monica, California. He grew up in a very wealthy and at the same time famous family. His mother was a historian, but was more concerned with children.

Trader and analyst John Murphy

Each exchange segment has its own leader, whose name is known to almost all traders.

So, if we talk about hedge funds, then almost every trader will clearly name the name Soros, if we talk about stocks, then any economist distant from the stock exchange will name the name Buffet.

However, if these two international names showed that it is possible to achieve success on the stock exchange, then John Murphy is the very person who demonstrated exactly how to do this.

It was thanks to John Murphy that millions of people around the world learned about technical analysis, and his book, which was translated into eight languages, became a kind of bible for any trader practicing technical analysis.

John is an active supporter of technical analysis; moreover, it was he who stood at its origins and was one of the first traders who actively applied his own theory in practice.