Forex and Stock Market Terms

This section contains key terms related to Forex trading, which will help a novice trader quickly understand the essence of the work.

Forex terms describe key aspects of the currency market. There aren't many of them, so it's a good idea to familiarize yourself with their descriptions before you begin. This will make trading more understandable and easier. Each term is described in detail, with practical examples of its use.

Carry trade (carry trade).

You can make money on Forex not only by predicting the direction of exchange rates, but also by simply exploiting the difference in interest rates between the currencies included in a currency pair.

Carry trade is a trading strategy in which the main profit driver is the difference between deposit and loan rates in different countries. Depending on the direction of the trade, this trading option can yield a considerable profit.

Hedging in Forex.

One of the most well-known risk reduction options is forex hedging. It's not only the most well-known option, but also the most controversial. Some traders reject it outright, while others profit solely through it.

Hedging is a method of reducing financial risks in which two transactions are opened in different directions, but in the same volume and for a similar group of assets.

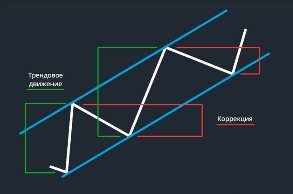

What is a Forex correction and how to determine its size?

As has been noted many times, the main thing when trading on Forex is to determine the existing direction of the trend.

It should be noted that this movement does not always occur in the direction of the existing trend; in addition to the main direction, there is also a correction.

Forex correction is a price rollback against the main direction of the trend, over a certain time period.

Such movements occur both randomly and relatively regularly, and their size depends primarily on the timeframe. A correction in Forex also depends on how sharp and strong the move in the direction of the trend was.

In practical trading, this phenomenon cannot be ignored, as it is often the reason for premature stop loss triggering.

Forex leverage: what it is and how to use it

Thanks to leverage, it's now possible to earn decent money on Forex or the stock market, even with a small capital base.

Leverage is an indicator of the ratio of equity to borrowed funds that a broker can provide to make transactions.

Essentially, this is a free loan, calculated based on the trader's deposit. The loan amount can range from 1:1 to 1:2000.

Forex leverage allows you to maximize the volume of transactions, which proportionally increases the amount of profit you can receive from currency trading.

Everything will become clearer if we look at Forex leverage using specific examples:

Forex correlation, currency pair correlation table, special indicators

It has long been noted that the movement of exchange rates on Forex for different pairs can be interconnected; this relationship is called correlation.

Forex correlation refers to a stable relationship between the exchange rates of various currencies on the foreign exchange market. In practice, this relationship between currency pairs is typically used, significantly simplifying the trading process.

The strategy is quite widespread and has earned the trust of more than one generation of traders on various global exchanges.

When trading on the foreign exchange market, you've probably noticed more than once that as soon as one currency rises, others follow suit, or, conversely, as soon as a trading instrument begins to fall in price, some other currencies only strengthen their positions.

Forex deposit

When trading Forex, there are several important factors that characterize a currency transaction. One of the most important is Forex collateral, which is the trader's own funds.

Forex collateral is the margin required to open a trade, i.e., the amount required in a trader's account to open a new trade, taking into account leverage. The "Free Margins" indicator in the trader's trading terminal is used for calculations.

Forex consolidation.

Forex trading is rife with confusing terms that often appear in analytical data and market reviews. One such term is Forex trend consolidation.

data and market reviews. One such term is Forex trend consolidation.

Forex consolidation is a slowdown in price movement after a sharp change. The price reaches a certain minimum or maximum, then slows down.

The reasons preceding consolidation include the release of important economic events, the rate reacts sharply to the news, but the movement doesn't last indefinitely, and gradually the price begins to dissatisfy either sellers or buyers.

Hedge fund - investment features.

Anyone who has had an account with a foreign bank probably knows how low the interest rates offered on deposits are. On average, it's only 1% per year, and often the amount is even less. Therefore, foreign investors have no choice but to look for alternative investment options.

only 1% per year, and often the amount is even less. Therefore, foreign investors have no choice but to look for alternative investment options.

A hedge fund is an investment company that accepts clients' money and invests it in various types of highly profitable assets (stocks, bonds, currencies, precious metals, futures contracts, etc.).

An example of such a fund is Soros Fund Management LLC, founded by George Soros, who until recently actively engaged in stock market speculation and accumulated billions of investors' funds. Someone who has learned to make money on the stock market attracts investors' money to increase working capital, because it makes no difference whether trading millions or billions. The trading strategy remains the same.

Intraday (intraday trading)

All Forex trading, based on the duration of trades, can be divided into three main types: intraday trading, medium-term trading, and swing trading.

Intraday trading is trading exclusively within a single 24-hour period, whereby orders are opened and closed on the same calendar date. In this type of trading, all positions are opened and closed within the same 24-hour period, and their duration can range from 1 minute to 23.59 hours.

Investment portfolio

The topic of investment is especially relevant in the modern world. Free capital must be put to work and generate profit. There are many options for investing money, but the main rule is risk diversification.

many options for investing money, but the main rule is risk diversification.

An investment portfolio is a collection of different investments, each with varying levels of risk and return. These investments can be both tangible (goods) and intangible (intellectual property).

Therefore, it's best not to choose just one investment; even the most reliable investment can result in losses. Therefore, the best option is to distribute an investor's funds evenly across several assets.

liquidity (forex liquidity)

The concept of liquidity is found in virtually all areas of financial activity, and it is no stranger to the forex market, where it is measured as the demand for a chosen trading instrument.

Liquidity (forex liquidity) – characterizes the popularity of a particular currency pair on the forex market. It typically depends on the level of supply and demand for a given instrument and how quickly a placed order finds a counter order in a similar currency.

Order by limit.

When placing a new pending buy order in a trader's trading terminal, you always face the question of which order type to choose: buy stop or buy limit.

Order by limit (buy limit order) – allows you to buy currency below the current Forex price level. Placing this order may seem counterintuitive at first glance, but this action requires the use of a special trading strategy, which we will discuss below.

long position (long position).

There are several different names for the positions opened when trading on Forex. The order directions are generally referred to as buy and sell, but other names are also common, such as long or short position.

A long position is a transaction on the stock exchange (stock, currency, or commodity) in which the underlying asset is purchased. When performing this transaction, the investor only profits if the purchased instrument grows.

Margin Call.

Since trading on the exchange almost always involves leverage, there's a risk of losing not only the trader's funds but also the broker's loan. To prevent this, dealing centers use their own stop orders to protect themselves from losses. One such order is the Margin Call.

A Margin Call is a specific loss threshold for a trade, upon reaching which the broker can decide to forcibly close all open orders early.

What is a lot on Forex? A calculator for calculating the size

For the convenience of users, all transactions on the Forex currency market are concluded in standardized volumes, so-called lots.

Lot forex is a standard volume with a strictly defined size for a single transaction on the foreign exchange market. It is used to simplify calculations and round off the amounts of currency purchase or sale transactions.

One lot on Forex is 100,000 units of the base currency, which is listed first in the currency pair, i.e., the instrument for which the quotation is carried out.

For example, when buying euros for US dollars, the EURUSD quote is used, the base currency in this currency pair is the European currency, therefore 1 lot for this transaction will be equal to 100,000 Euros.

Online trading

The opportunities for earning money online are simply astonishing in their diversity. One such option is online trading, which allows you to make a profit by selling and buying various types of assets.

Online trading is the trading of currencies, stocks, or other instruments using specialized software and via the Internet.

A distinctive feature of this type of income is that you do not need to personally visit the brokerage company's office to work.

All operations, from registration, identity verification, and opening of transactions themselves, are carried out exclusively online.

Online trading requires minimal equipment, and the software is provided completely free of charge.

This type of income gives you a unique opportunity to master a new, highly profitable profession as a trader.

What is margin in Forex and stock exchanges or broker margin?

Recently, trading on the stock exchange has become particularly attractive thanks to margin trading, which allows traders to significantly increase their funds using leverage.

To fully understand the process, you need to understand what margin is on Forex or other financial or commodity exchanges.

Broker margin is the amount of funds that a broker provides to a trader as a loan for trading on a currency, commodity, or stock exchange.

These funds cannot be used for other purposes or simply withdrawn from the brokerage company; they are a targeted loan that can only be used to conduct a stock exchange transaction.

Market Execution (market execution of orders).

Trading on the exchange involves two types of order execution: market and instant. Market Execution is in no way inferior to Instant Execution, despite the assurances of some forex brokers.

Market Execution (market execution of orders) – implies that the placed order will be executed at the current market price, which may differ from the order price by a set deviation amount.

Margin trading.

Nowadays, trading on the forex market is possible with virtually any starting capital, but a trader's own funds aren't always sufficient to generate significant profits. Margin trading is used to increase the volume of trades and, consequently, profits.

Margin trading is trading on the exchange using leverage, which is provided free of charge to broker clients and allows for significant increases in transaction amounts.

Martingale (Martingale).

This term can be found in both gambling and forex trading, and there is much debate and discussion surrounding this trading system, but what exactly is Martingale?.

Martingale is a system of capital, money or investment management in which, after losses, the investment amount only increases.

Mini Forex - Features of Trading on Mini Accounts

Brokerage company advertisements often include the phrase "Forex trading from scratch," but this advertising phrase can sometimes be quite far from the truth, as when trading, it's not just the initial deposit that matters, but also the minimum lot size.

In this case, mini Forex or trading on cent accounts comes to the rescue, allowing you to gain invaluable experience without risking large sums.

Mini Forex (mini forex) – trading on the foreign exchange market using special accounts with a lot size reduced by 100 times and, accordingly, the trader's deposit currency.

At the same time, there are no significant technical differences in the execution of transactions, and order execution is no different from trading on regular accounts.

Money Management - application features.

The term "Money Management" is often perceived as something complicated and related to large sums of money.

Money Management – capital management, measures to protect existing funds, and ways to increase their value.

In fact, all capital management in Forex can be boiled down to a few simple points:

• The deposit amount with a broker is only 50% of your total available funds; the other 50% is best kept in a bank account or invested (the percentage is higher). You should not risk your entire capital under any circumstances, even if the amount of funds does not exceed several hundred dollars.

Liquidity of a currency (currency pair).

Quite often, a Forex trader encounters a broker's message: "Due to low liquidity, the spread on such... currency pairs will be increased." What is currency pair liquidity and what factors influence this indicator?.

Currency liquidity is the amount of supply and demand for a given means of payment, its popularity among sellers and buyers, that is, how quickly you can exchange a given currency for another.

Order forex (Forex order).

All currency purchase and sale transactions via a trader's trading terminal are performed using Forex orders, so it's crucial for a trader to understand the different types of these orders and how they are executed.

A forex order is an order to open a new position on the foreign exchange market or to perform actions on an existing one. Its classification depends on the objectives of the order.

Pending order

When trading Forex, you can't be constantly connected to your trading terminal. A favorable market entry opportunity can arise at any time. A pending order is used to open a position at this precise moment.

A pending order is an order to open a new position that will only be executed if certain conditions are met – the price reaches a certain level or the required time arrives.

Overbought (forex overbought).

Price levels on any exchange are regulated by supply and demand for a given group of commodities, and the over-the-counter forex market is no exception. Sometimes, by analyzing its state, one can understand where the price will move next and open a trade in the right direction. One such condition is overbought.

Overbought (forex overbought) is a market condition in which demand for a particular asset (in this case, currency) has reached its maximum level. This means that buyers who were satisfied with the current price have already entered into transactions to purchase the currency at the current rate.

Overnight trading (forex night trading).

When trading on the exchange, many traders gradually realize that the number of successful trades depends not only on correctly predicting the trend, but also on the time of day when trading takes place. Therefore, it is sometimes customary to divide the trading process into day and night trading.

Overnight trading (forex night trading) refers to buying or selling currency between 9:00 PM and 8:00 AM local time. However, it's not necessary to carry the trade over to the next day; the key indicator of overnight trading is the time it's executed, not the duration of the trades.

Leverage in Forex

The reason many traders' accounts are wiped out is not due to a poor trading strategy or market situation, but rather a simple lack of knowledge of the fundamental terms and operating principles of the broker providing you with services for accessing the interbank market.

One of the most important concepts that a trader must be able to use correctly is leverage in Forex margin security, as well as the concept of true leverage.

You should pay special attention to leverage and margin, as these are two key factors that can affect the profitability of your trading.

Forex leverage: its origin and calculation principles

Oversold (forex oversold).

Supply and demand always actively influence pricing in any market. The greater the supply of similar goods, the lower the price of a given asset. Conversely, with increased demand and limited supply, the price only rises. In forex, this aspect should be considered in relation to existing contracts, so the basic concepts here are oversold and overbought.

Oversold (forex oversold) – a predominance of currency short contracts, which leads to a halt in price decline, as the currency pair's value ceases to fall. In this situation, a reversal of the downtrend becomes more likely.

Breakout of the level on Forex.

Beginners often hear about breakout strategies, and most professional traders acknowledge their high effectiveness. What is a breakout in Forex, and how is it used in trading?.

A breakout is when the price breaks through a certain price limit, which for a time served as a barrier to further growth or decline. It was near this boundary that the price had previously reversed, but then the breakout occurred, and the currency pair's price surged further.

Forex drawdown and ways to reduce it.

When trading Forex, no one is immune to losses. There are no strategies that are completely free of losses. In practice, a successful trade often turns into a losing one, resulting in a deposit drawdown.

A Forex drawdown is a decrease in equity resulting from losses incurred from unsuccessful trades over a certain period of time. It can be expressed as either a relative or absolute value.

Profit factor (profit factor).

When testing new Forex trading strategies and automated advisors, you often encounter the concept of profit factor. This indicator best characterizes a trader's performance.

Profit factor is a relative indicator that shows the ratio of profit earned over a given period to losses. Calculating it is quite simple: simply divide profit for the reporting period by losses for the same period—the profit/loss ratio.

Rebate (rebate).

There are many ways to earn additional bonuses when trading forex or stocks, one of which is a rebate system that provides a refund of a portion of the commission paid.

A forex rebate is a discount or compensation that allows a trader to recoup part of the spread paid when trading on the foreign exchange market, significantly reducing additional costs.

Forex rollback.

The Forex trend never moves in a straight line, as statistics show, a trend is 70% composed of pullbacks and only 30% is the main trend.

A Forex pullback is a price correction in the opposite direction of the main trend, followed by a resumption of movement in the direction of the prevailing trend. The magnitude of such a movement directly depends on the time frame being traded: the longer the time frame being analyzed, the longer the pullbacks.

Rollover on Forex.

Any trader who has to carry an open position over to the next day inevitably encounters this concept, so it's important to know what a rollover actually is and take its size into account when trading.

Rollover is the difference between the interest rates of the currencies that make up the currency pair used in a transaction. It can be either positive or negative, depending on the rate and the direction of the transaction.

Point (point) forex.

The seemingly simple question "What is a Forex pip?" sometimes leads to a host of misunderstandings and additional questions, as each currency pair has its own pip value, and its size is also influenced by other factors.

Point (point) forex - sometimes also called a pip, this is the last digit in the quote of a currency pair, which characterizes the minimum possible change in the exchange rate in relation to the currencies in the currency pair.

Price channel.

Price channel trading is one of the most popular strategies in the stock and forex markets. This strategy allows one to assess the dynamics of a trend over a given time period.

A price channel is an area on a currency pair chart bounded by two lines. One of these lines represents the minimum price values, and the other, the maximum.

Requote (requote).

In addition to the risk of losses due to currency risk, trading on Forex also presents a host of other problems that can hinder trading, one of which is the occurrence of requotes.

A requote is a refusal in the trader's trading terminal to execute an order due to a price change. Typically, in this case, you enter the message, "The order cannot be executed because the market price has changed. Do you accept the new price?"

Swap free (trading without swaps).

Swaps, or overnight fees, have always discouraged most traders from extending day trades. Recently, swap-free accounts have emerged, eliminating this fee.

Swap-free – trading in which the difference between national bank rates is not taken into account, and the fee for transferring positions is fixed.

Sell limit.

When trading on the forex market, you can not only open urgent trades but also place pending orders that will only trigger when a specified price level is reached. Sell limits are one such order. The specifics of setting them will be discussed below.

Sell limit – a pending order to sell, opened if the price reaches the specified value or becomes higher than it.

Sell stop.

When trading on the Forex currency market, both instant and pending orders are used, and the latter have several variants, one of which is the sell-stop order.

A sell stop is a pending order to sell the base currency . It involves opening a position if the price falls below a specified level. It is typically placed during a downtrend, but other placement options are also available.

Short position (short position).

When trading on the exchange, there are only two possible trade directions: buy or sell. You either buy or sell the underlying asset. This is why an open trade is called a short or long position.

A short position is a transaction to sell an asset (currency, stocks, commodities, or raw materials). In this transaction, a trader sells an asset they don't own, hoping to buy it back later at a more favorable price. This type of transaction is sometimes referred to as a "sell" transaction, as it's more understandable to non-professionals.

Resistance level (resistance level).

One of the most important concepts used in technical analysis on Forex is resistance. This indicator underlies many trading strategies and is widely used in stock trading.

Resistance level (resistance level) is a point or line on the chart of a currency pair that characterizes the maximum price value for a certain period of time, upon reaching which the trend reverses.

Risk control (forex risk management).

One of the most important components of Forex trading is risk management, and a novice trader may not even realize how important this issue is and how it affects the overall financial results of trading.

Forex risk management involves a comprehensive set of measures designed to reduce financial losses from both external and internal factors.

Slippage (forex slippage).

When trading on the forex or stock exchange, unpleasant situations often arise that significantly complicate a trader's work and sometimes lead to losses.

Price slippage is one such situation.

Slippage (forex slippage) is the execution of an order at a price different from the current quote. It can have either a positive or negative value depending on the trend direction and the type of position being opened.

Spread (forex spread).

Currency trading is always conducted through specialized intermediaries, brokers, or dealing centers, who charge a commission for their services, known as a spread.

Spread (forex spread) is the difference between the price at which you can currently buy or sell a currency. It's usually calculated using a simple formula: the ask price minus the bid price, which results in the current spread for a given currency pair.

Stop out is a forced closing of a position by a broker

The main attraction of trading on the forex market is the use of leverage provided by a broker, which allows you to significantly increase the funds available for trading.

In order to protect their funds from loss, the broker uses stop out.

Stop out is an order to forcefully close a trader's position once the loss reaches a certain level specified in the trading conditions.

Serves to protect the broker's funds when using borrowed funds from the broker to support an order of a larger volume than the trader's deposit.

Each brokerage company independently sets the loss value, upon reaching which the order will be automatically closed.

Swap (swap or fee for transferring a position).

Despite brokers' insistence that the only commission on the foreign exchange market is the forex spread, there is also a fee for carrying positions overnight. Unlike the spread, however, this type of commission can be either negative or positive.

Swap – the difference between the rates of the currencies that make up the currency pair – is charged only if the position is rolled over overnight and if the interest on the loan is greater than the accrual on the deposit. If you roll over a position from Friday to Monday, this fee is tripled.

Take profit (take profit).

As Forex trading statistics show, most traders tend to maintain unprofitable trades until the last minute and close profitable ones quite quickly, without receiving the lion's share of the profit. Therefore, it is so important to immediately, before opening a new order, fix the amount of possible profit by setting the parameters of the take profit order.

Take profit is an auxiliary order that closes a position as soon as the price reaches a specified value, thereby fixing the achieved profit level.

Flat market (flat on Forex).

The price of a currency pair always has a certain direction of movement: the exchange rate sometimes rises, sometimes, on the contrary, it rapidly moves down, but there are also periods when the quote practically does not change; this market state is usually called a flat.

A flat market is a relative lull on a currency or stock exchange, when the trend moves only horizontally and the price of the selected asset remains virtually unchanged.

Page 2 of 3