Two brokers in one trading platform

Working with the MetaTrader program, you never cease to be amazed by its functionality and technical analysis capabilities.

The developers of the trading platform have really done almost everything to make the trader’s work easier.

Moreover, even after several years of using it, you discover more and more new functions and capabilities.

Some functions I simply didn’t pay attention to before, but some appeared not long ago, thanks to program updates.

One of these opportunities is to use several accounts from different brokers for trading in one trading platform.

What you can see in the market overview window

The MetaTrader trading platform has enormous capabilities for trading and technical analysis, but most traders use only a part of its available functions.

It just so happens that when a beginner comes to Forex, he immediately wants to trade, and not study the instructions for the trading platform .

After all, to open deals, it is enough to master only the technique of placing orders, and the other points seem unimportant.

In fact, sometimes all it takes is just a couple of clicks to make your work more comfortable.

The full functionality is not always provided by the default settings set by the developers, this also applies to the “Market Watch” window:

By default, this window displays only quotes of currency pairs with the Bid and Ask prices:

Concepts you can ignore when trading Forex

The most valuable thing in the work of any successful person is time; there is always not enough of it, and you begin to think that you are doing something unnecessary.

Having been involved in trading for a long time, you also understand that there are many things that you can do without in this business.

Thus, freeing up time for more important things or simply saving it for relaxation and entertainment.

Traders often perform a lot of unnecessary manipulations, monitor parameters that they do not use in trading, and gain unnecessary knowledge.

Therefore, it is so important to know what is superfluous when trading Forex, and what you can do without.

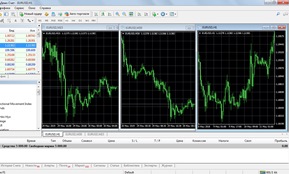

Setting up 3 screens in the MT4 platform

Trading according to the well-known strategy of the American trader of Soviet origin, Alexander Elder, involves the simultaneous use of 3 charts with different time periods of the same asset.

According to the strategy developer, working with multiple timeframes allows you to effectively filter false signals for opening trading positions.

For a comfortable visual perception of charts, it is recommended to configure the platform in such a way that all 3 timeframes are displayed in one terminal window.

However, many novice traders have difficulty setting up charts, although there are many options for how to do this simply and quickly.

How to add three charts for one currency?

How does one-click trading work?

One-click trading is an option provided by the developers of trading platforms, through which a trader has the opportunity to place a trading order within 1-2 seconds.

When working with financial instruments of high volatility, using this option allows you to prevent slippage and enter the market at the current price.

One-click trading can be called an indispensable tool for supporters of short-term intraday trading.

And also for those who like to open orders with minor target levels when macroeconomic news is published.

According to unofficial statistics, most novice traders use in practice short-term methods of making money on asset pricing.

Setting Take Profit for sell transactions

The use of safety orders is an integral part of trading.

This allows the trading participant to accurately implement the trading plan. In the descriptions of many trading strategies, the authors recommend setting Stop Loss and Take Profit at important local levels.

It is very important to find the right level that matches the current market situation.

Therefore, to correctly determine them, various analytical tools are used:

• Bill Williams fractals;

• Fibonacci ;

• cluster graphs in combination with volume delta.

The latter tool is quite complex and is only available on paid analytics platforms. The developers of MetaTrader terminals do not provide cluster charts.

Key features of asset value formation

In fact, there is an unspoken pattern in the pricing of financial instruments, confirmed by statistical data.

Best stop loss size

One of the most important aspects of Forex trading is risk reduction; poorly timed trades are the main cause of large losses.

To combat losses, a tool known to every trader was invented - a stop loss order.

To be more precise, it is one of the settings that is set when opening a deal in the new order panel in the trading platform.

There is no doubt that you need to place a stop loss; the whole question is the size of this order.

There are a lot of options based on which each trader independently chooses the appropriate option for his strategy .

Profitability map for Forex.

The main question that interests every beginner who comes to Forex is how much you can earn here.

A lot of articles have been written on this topic, which provide theoretical calculations of probable earnings based on the author’s conclusions.

As elsewhere, the theory here does not always correspond to the truth, so if you really want to find out how much you can earn on Forex, use the profitability card.

Which indicates the likely profit for the month for the most interesting currency pairs.

In this case, you can independently select the month for which statistics will be displayed; only the basic conditions remain unchanged.

Initial data indicated in the diagram:

How to minimize Forex losses

For some reason, most beginners who want to make money on Forex believe that they can easily make a million out of a thousand dollars.

And do this in just a couple of months, and then enjoy life on the islands near the warm ocean.

It is unjustified expectations that become the cause of all disappointments and loss of even existing money.

In order to minimize losses on Forex, especially at the initial stage of your career, you should imagine how much you can actually earn without putting your money at risk.

In fact, not so much; traders who have been working steadily for many years earn no more than 50% per annum.

Where do multi-million dollar incomes, yachts, houses and limousines come from?

Leverage for pipsing.

A trend does not always have a clear direction; there are periods when the price moves in a horizontal direction for several days.

Moreover, its fluctuations in one direction do not exceed 10 points (with a four-digit quote), in this case there are two options - change the trading asset or use pips.

It is during a flat that this strategy gives the best results, since rate fluctuations are repeated according to the same pattern.

But to make money on a 10-point movement, you need to have a lot of money or use a lot of leverage.

Since if we take the euro/dollar currency pair as an example, a price change of 1 point will bring you 10 dollars if you opened a deal with a volume of 1 lot.

Learn to trade on your own.

In the post-Soviet space, most people are accustomed to the fact that in order to master any profession they need to graduate from university.

But at the moment the reality is that studying at university is just wasted time, at least 80 percent of it.

This judgment is perfect for trading; many of the famous financiers, and especially traders, did not have special education.

The main thing is to correctly draw up a training plan and so that the studies do not seem monotonous, combine theory with practical exercises.

That is, if you read how a deal is opened in a trading terminal, you immediately need to do it in practice.

The most effective and dangerous trading tactics

At the moment, there are a lot of different trading tactics that can make Forex trading more effective to one degree or another.

It is clear that not all methods of work give the same result, and some lead to the loss of the deposit or cause losses.

The main thing is to distinguish profitable tactics from dangerous ones in time and not to use them in your robot; this is quite difficult to do, since many of the dangerous tactics are advertised as the most profitable.

And so, those that can be used without much risk include:

- Pending orders

- Addition

- Partial closure

How long can you hold a stock position?

Some traders position themselves with investors and want to make money not on short-term movements by sitting at the monitor all day.

And make a successful trade once and hold the position for several months, waiting for the price to reach its maximum level.

It would seem that only the strategy and the current existing trend play the main role here, and the position itself will exist until it is closed by the trader, or until the stop order is triggered.

But unfortunately, not everything is like that, or rather, not everything is like that everywhere.

Lifetime of positions on currency pairs.

As most brokers assure, it is practically unlimited, at least this is the answer we received from almost all brokerage companies .

Macroeconomic indicators in MT5 and how to use them in trading.

Fundamental analysis, unlike technical analysis, provides a clear understanding of the reasons for what is happening with the price, because the minds of investors and bankers are controlled not by lines and indicators, but by economic indicators.

Thus, macroeconomic indicators are the very vector and message that is necessarily monitored by both traders and investors.

However, the peculiarity of fundamental analysis is such that to implement it, the trader must constantly keep his finger on the pulse and know the time of publication of the news, making certain decisions after the publication of macroeconomic indicators.

Unfortunately, the traditional MT4 platform is far from ideal in terms of implementing news trading, because the trader has to use third-party sources of information, which undoubtedly slows down the reaction.

One click trading – use the terminal’s capabilities to the fullest

A novice trader, like a sponge, absorbs information that is of a secondary nature, forgetting about the most important.

Indeed, at first, a trader wants to rush into battle, study the practical side of analysis, which, as a rule, is done first.

However, in the pursuit of knowledge, beginners do not study the functionality of the trading platform, which leads to the fact that the trader begins to limit himself in actions.

Not realizing that from the very beginning the functionality is capable of solving many problems and challenges that it may encounter.

One of these functions, which all traders without exception have seen, but do not fully understand why it is needed, is One click trading.

One click trading is an auxiliary function of the MT4 and MT5 trading terminals, which allows you to bypass the standard scheme of opening a transaction with multiple confirmations and carry out transactions with one click of the mouse directly on the chart.

Metatrader alerts - setting up signals in the trading platform

Most trading strategies require complete immersion in the trader's trading process.

However, trading for many is nothing more than an additional source of income. Therefore, no matter how much we want it, we have to devote a minimum of time to trading compared to what a real strategy requires.

Also, do not forget that the trading process itself is quite routine, because the most difficult thing in it is not to open transactions, but to wait for the exact moment when the necessary conditions are met.

Experienced traders use indicators with built-in alerts for such purposes, or order them from a programmer.

However, many do not know about one function of the Metatrader trading terminal - the ability to turn on sound alerts when certain price conditions are met, which you can set personally.

Advisor for Alpari - requirements and restrictions of the broker when trading advisors

The key reasons why traders lose their money lie in the lack of awareness of the traders themselves.

The fact is that 99 percent of traders simply do not know the trading conditions on the account they open, not to mention that huge agreement of ten pages, which everyone agrees to without reading.

In many cases, such negligence does not lead to anything, but there are situations when, after successfully trading for a long time, a trader at the most prestigious and reliable brokerage company is refused to withdraw his earnings.

Restrictions on certain trading or actions are present in all companies without exception, and the regulations are written in such a way as to ensure the technical component of the operation of the broker’s equipment without any interruptions.

If a trader violates these rules, profits may be canceled or the account may be completely blocked.

Advanced order management system

Trading in financial markets is a kind of competition between exchange participants, where money flows from each other depending on the result obtained.

Therefore, traders are constantly trying to find advantages in trading that would allow them to be one step ahead.

Some people find this advantage in a unique system that gives signals a little earlier than others or is highly accurate, while others get them thanks to excellent trading conditions.

One way or another, hundreds of factors can influence a trader’s performance, and any advantage that you have can radically improve your trading.

One of the important advantages can be the advanced order management system from Alpari .

What are “Libraries for MetaTrader 4”

Surely many novice traders, when choosing a broker or trading terminal, do not think about what functionality awaits them ahead.

Indeed, for many beginners, and even experienced traders, progress is practically unimportant; a price chart and a couple of indicators are enough for them, and sometimes they don’t need anything at all except the price.

However, from year to year the market becomes more and more complex, and less and less logic can be observed in its movements.

Therefore, a trader has to think about gaining advantages over other market participants, which would allow him to open transactions faster, conduct better analysis and be one step ahead.

It was the pursuit of advantage that stimulated the automation of processes in the foreign exchange market to the level that we can observe now.

False breakout

The main undeniable pattern of the market is that the price takes levels into account during its movement.

Yes, whether you are a news trader or an investment banker in one of the largest companies in the world, they all take psychological levels into account.

It is the property of price to take levels into account that has become the key factor on the basis of which hundreds of breakout strategies have been built.

Moreover, it is worth noting that the very principle of trading based on levels, regardless of what content the strategy has, is almost the same.

However, using this obvious pattern in practice is not so easy, because in reality you can more often encounter a false breakout than a real price breakout.

As a result, traders who trade blindly for a breakout sooner or later begin to lose their deposit. For what reason does this process occur?

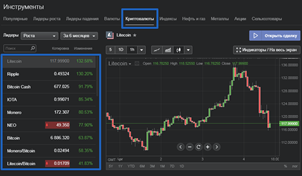

Online platform for trading cryptocurrencies

The emergence of trading platforms has greatly increased the popularity of stock trading, making it accessible to anyone.

If we take the stock market as an example, the first thing you remember is the Quick trading terminal, in the case of the foreign exchange market - the MetaTrader 4 or MetaTrader 5 terminal. One way or another,

traders trading on these two global markets have a professional environment for analyzing the market, building strategies, automation and most importantly, implementation of these strategies.

Unfortunately, classic cryptocurrency trading does not have such functionality, because even the largest centers provide a simple candlestick chart with a couple of time frames.

Naturally, in such conditions, traders who want to conduct effective and profitable trading have to resort to auxiliary online platforms that help in market analysis.

Expert Advisor Optimization or How to Make an Expert Advisor More Profitable

There is always a debate about the appropriateness of application around the automation of trading strategies and the use of advisors in the Forex market.

Surely you have also come across the following statements: “All advisors lose their deposit sooner or later”! Do you think this is another nonsense of people obsessed with manual trading?

No, in fact, any advisor, without exception, if you do not interfere with its work, will sooner or later lose your deposit.

But at the same time, let's face the truth and ask ourselves a very simple question, do you know an example of at least one manual strategies, which, without any changes, could generate profit on an ongoing basis?

Most likely, you have not come across such strategies, and neither has our team. What is the point then of refusing to trade with advisors, if it is a manual strategy, that the trading expert will sooner or later lose the deposit, if you do not interfere and do not make any changes to the logic?

Best binary options

The abundance of choice sometimes confuses beginners, because it is not enough to just come to this market, make a deposit and start trading.

The desired success can be achieved by choosing only the best binary options, the best instruments and the best trading conditions.

This largely depends on your broker, but no one is stopping you from correctly choosing not only the company itself, but also the asset with which you will work in the future.

That is why, following these rules will increase the chances of success. Next, we will consider the selection criteria, based on which you can make the right choice.

By time

In the process of choosing a trading asset, it is very important to pay attention to what the option expiration offered by the broker is.

Free Signals for cryptocurrencies based on technical analysis

Today, the overwhelming number of traders are actively purchasing cryptocurrencies, anticipating their further growth.

Whatever source of information a trader takes, almost everywhere you can find a recommendation to buy; moreover, some companies have even created funds and are actively buying this asset.

However, if you face the truth, you can understand that all these recommendations are primarily designed for long-term investors, because no matter what market or asset you take, it will always fall and rise.

Cryptocurrencies are no exception, and after almost every sharp growth we can all observe no less sharp pullbacks, from which a trader is simply obliged to make money.

It is worth understanding that a trader is a speculator, so the sources of his signals should be based on technical analysis, which would allow him to take profit from all market movements, and especially in cryptocurrencies.

Talking metatrader. We make working with the platform pleasant to the ear

When actively using the MT4 and MT5 trading platforms, you have probably noticed that the terminal constantly produces sound alerts.

Be it connecting to the server and publishing news or the appearance of a market signal, if your indicator supports this function.

Agree, the sound notification function is very useful and makes our trading much more convenient, allowing us not to miss any events that occur in the trading terminal.

Nevertheless, for many, such sound notifications cause complete irritation, since not only is the sound very sharp and hurts the ears, but sometimes it is very difficult to understand what exactly the platform is notifying us about.

However, few people know that the MT4 terminal can literally talk.

The flexibility of the platform settings is so great that you can easily change all the sound alerts that are boring to you and insert your own entries and commands, and in this article you will learn how to do this.

The best scripts for Forex

The trading process, depending on the trader’s tactics and trading style, forces you to perform many routine actions every day, which significantly take up our time.

Calculating a trading lot, calculating zones for setting profit and stop orders, closing a series of orders and setting a grid - all these operations can take up to 50 percent of your trading time every day.

However, if for long-term traders the loss of time is not so noticeable, then if you use a grid or scalping strategy, you simply cannot do without special assistants.

To date, hundreds of different scripts have been created that perform certain tasks for traders.

How to optimize an advisor

Unfortunately, there are practically no trading advisors in the financial markets that could constantly produce stable results and would not require reconfiguration or optimization.

For many beginners, the concept of optimization may be associated with something complex and incomprehensible. In fact, optimization is a simple adjustment of parameters to the current market conditions.

So, when a trader adjusts a certain indicator on history, he is also engaged in optimization, but it just looks a little different.

Why optimization is necessary

The fact is that the market moves in a kind of cycles and it tends to pick up certain paces and maneuvers that were repeated earlier.

Thus, many beginners, and even pros, often encounter a situation when a forgotten draining advisor suddenly begins to bring huge profits, and the newest development, on the contrary, begins to drain the deposit.

Trader's calculator from Alpari

In the process of trading, almost every novice trader is faced with a situation where, when opening a position with the same volume in the same direction with equal stops and profits, but on different currency pairs, you receive radically different profits or losses in the deposit currency.

This situation usually leads to an imbalance in trading, since despite the fact that the strategy can give 60 percent of profitable trades in multi-currency trading, you simply do not cover the loss with a new profitable trade, despite the fact that the profit in points is almost equal to or even greater than the stop order .

Thus, a completely successful strategy for multi-currency trading systematically drains the trader’s deposit.

You probably have a question, why is this happening? The fact is that many traders, experienced and beginners, often discard all the small nuances in the process of calculating a lot.

The best terminal for Forex, the right choice of trading program

The trading terminal is the trader’s working environment, his tool through which the entire process of trading and market analysis takes place. As strange as it may sound, your future success directly depends on the choice of one or another platform, and if you are new to the market, then the speed of your learning directly depends on the platform.

It is the trading platform that allows you to realize all your possibilities, and in some cases, severely limit you.

If until recently the number of types of trading programs could easily be counted on the fingers of one hand, now various brokers, in pursuit of improving service for clients, are creating more and more new applications that have a number of their own features.

Each platform has its own unique flavor, so depending on the goal you are pursuing, it is advisable to choose the best Forex terminal according to your requirements.

The most popular trading platform today is considered to be the Meta Trader 4 trading terminal. This platform has a simple and unobtrusive design, very wide functionality and huge trading opportunities.

Non-standard timeframe in MT4

Every trader at the beginning of his development is faced with the problem of choosing a specific asset and time frame.

If with the choice of an asset everything is quite simple, namely, you need to trade only the instrument whose movement structure you understand and can explain the processes taking place, then the choice of time frame mainly depends only on the desires of the trader.

I think each of you has encountered a situation where we don’t have much time to trade, we work on higher time frames, and when we have free hours, we all move to five minutes and try to take more from the market.

Unfortunately, such throwing around creates enormous chaos in our trade, and productivity, as a rule, in this chaos is an order of magnitude lower.

How to connect multiple monitors for trading

All of you, repeatedly viewing analytics or news, have seen how professionals work behind two or more monitors. The fact is that scientific research on this issue has shown that if a person works behind two or more monitors, his efficiency and productivity increases by an average of 33 percent.

The fact is that scientific research on this issue has shown that if a person works behind two or more monitors, his efficiency and productivity increases by an average of 33 percent.

This is especially true for creative individuals, as well as people with engineering professions. Just imagine, such a simple little thing as an additional monitor can significantly increase your work efficiency.

If we talk about trading, having two or more monitors allows you to more closely monitor the situation on the market.

Just remember how you switch one currency pair after another every five to ten minutes and at the same time lose concentration and composure in search of a market signal.

Page 2 of 4