Yuan's outlook based on economic growth.

China's economy has been growing rapidly in recent decades, and is in fact one of the most dynamic economies in the world.

It is true that since 2011 there has been a slowdown in economic development, and the global crisis has reached China.

It’s not that the slowdown is critical, but still, compared to other years – in 2010 – 10.4%, 2011 – 9.4%, 2012 – 7.8%, 2013 – 7.7%, 2014 – 7.4, 2016 – 6.7%, as you can see, the trend is obvious.

Analysts' forecasts for 2017 are being fully confirmed; according to preliminary data, China's economic growth this year will be in the region of 6.2-6.5%.

There are many reasons for this decline, the most significant of which is the decline in exports of Chinese goods to foreign markets.

How does the economic slowdown affect the Chinese currency exchange rate?

Bitcoin's popularity: causes and consequences.

Bitcoin cryptocurrency has seen unprecedented growth over the past few years, with the virtual currency's value increasing thousands of times.

How did it happen that data in computer memory became real money, and its value surpassed that of gold?

This happened for two obvious reasons: the relative anonymity of cryptocurrency and the massive advertising campaign launched by those who release new cryptocurrencies.

Advertising is the engine of trade.

Lately, not a day goes by without news about cryptocurrencies: a major company has decided to use this instrument in its transactions, or another state has recognized crypto as a means of payment.

Why are most binary options brokers located offshore?

When starting to work on the exchange, few people wonder why most binary options brokers are located offshore. This is, of course, due to the legal address and company registration. There are several reasons for this practice.

Offshore regulators

The popularity of binary options is undeniable. But not everyone can understand the intricacies of brokerage practices to choose the most reliable company to work with.

You can get your bearings on this issue by reading the information on the website plugins/system/oyl/src/Redirect.php?oyl=aZZfCwAJMIIFAHZQoDcc1xacmebwRJ%2Blp5X8uyxQQAGmvcHi7xfCeQ%3D%3D.

Having certificates and licenses means that companies are checked and regulated by financial associations and commissions that may revoke or refuse to issue a license if violations are detected.

Inspections of such organizations can be conducted secretly, with the inspector registering as an ordinary trader. Most organizations are located in offshore economic zones.

Stopping the devaluation of the Euro currency.

Devaluation is an artificial reduction in the value of one currency relative to a number of other significant currencies.

This usually occurs due to an increase in the unsecured money supply, which leads to a decrease in the exchange rate and an increase in inflationary processes.

Until recently, the European Central Bank pursued a policy of devaluation of the euro, which allowed it to significantly decrease its exchange rate against the US dollar and a number of other currencies.

Thanks to this policy, the euro has lost about 20% of its value over the past two years, thereby stimulating the European economy to grow.

But last week, the Central Bank's leadership decided to suspend this process, meaning measures will be taken to reduce the flow of unsecured money into circulation.

What's in store for the US dollar in the long term?.

The dollar remains one of the most popular world currenciesFor decades now, the US dollar has been the focus of traders' attention.

This currency is one of the components in most currency pairs, so it is extremely important to anticipate what awaits it when planning long-term transactions.

The recent presidential election created a picture of long-term dollar strengthening, with most analysts predicting an upward trend in 2017.

The forecast is based on plans to improve the business climate, protect domestic producers, and reduce social spending.

However, the situation is rather ambiguous, since if we analyze the latest data, we can say that the economic situation in the European Union, Japan and Russia is gradually improving, while at the same time, China is slowing down its rate of economic growth.

What to choose for investments - Visa or MasterCard?

Most brokers allow you to trade shares of the largest and most popular companies that issue Visa or MasterCard plastic cards.

The trading process itself is as simple as possible, in order to buy shares it is enough choose a broker and make a transaction through the trading terminal.

But which investment will bring more profit, Visa or MasterCard?

Last year, the stock prices of these companies soared to record highs, with Visa gaining 23% and MasterCard adding a whopping 27%.

The main reason for the price increase is the growing popularity of electronic payments, and many countries have also introduced restrictions on cash payments.

China vs. Bitcoin.

The Chinese government, or more precisely its People's Bank, has been waging war against the Bitcoin cryptocurrency for years, and these actions have shown remarkable consistency.

In 2013, the cryptocurrency suffered its first blow, its price falling from $1,112 to $727, and the decline continued thereafter.

On Friday, February 11, 2017, several Chinese exchanges that trade Bitcoin ceased trading under pressure from the People's Bank of China.

These actions led to a sharp collapse on Monday, February 13, with the cryptocurrency losing several percent.

In the morning, the price dropped to $983 per Bitcoin; considering that on Friday the rate was at $1007, the drop was about 2%.

What awaits gold in 2017.

Almost every investor considers gold as an alternative to existing investments.

Typically, these are long-term investments lasting more than just a month, sometimes even a year. The key is to choose the right moment to buy.

Gold prices have risen several times over the past few decades, although after peaking at $1,886 per ounce in 2011, they began to decline.

The bottom was reached in 2015, and the market resumed its upward trend. The start of 2017 was particularly encouraging, with gold prices already up 6% this year.

So, what's in store for gold prices in 2017 if further growth is expected?

America doesn't like the low Euro rate.

It would seem that a strong currency is always beneficial for the country it represents, but in practice the opposite is true.

A strong national currency is always a blow to exports, since strengthening the national currency leads to a proportional increase in the price of goods.

For this reason, most countries try to prevent their currencies from strengthening excessively by intervening.

The Euro has seen a significant decline in value over the past few years, which has been beneficial for the European economy.

Recently, the head of the US National Trade Council, Peter Navarro, saw some reasons in the fall of the Eurocurrency patterns, which could only be caused artificially.

He blamed the German government for undervaluing the exchange rate.

Ruble forecast for 2017.

There are many opinions about what the ruble exchange rate will be in 2017, as many decisions depend on this information.

The national currency's exchange rate affects deposit and loan rates, decisions about which currency to use for holding money, and the prices of food and other goods.

First and foremost, it's worth noting that the Russian ruble's exchange rate depends not only on the price of oil but also on the state of the Russian economy.

Its strengthening usually leads to a devaluation of the national currency, while declining economic indicators trigger inflation.

What do experts say on this issue, and what are the underlying factors?

How will the dollar react to Trump's inauguration?.

The euro/dollar rally has been going on for several months now, the dollar exchange rate is quite unstable, Forex trend changes literally in minutes.

But it is precisely this fact that helps many traders earn money on short-term euro/dollar trades.

One of the reasons for the sharp jumps in the exchange rate is news from the United States, namely about the political situation within the country, one of the most significant events will take place today.

The inauguration of the new President of the United States of America is scheduled to take place today at 17:30 Moscow time.

The event itself is unlikely to affect the US dollar exchange rate, but the mass demonstrations planned for that day could definitely lead to a weakening of the dollar.

The United States and the ever-growing national debt.

Not long ago, one of the hottest news stories was the possibility of a US default, which would mean a record fall in the dollar.

But after the passage of the fiscal cliff law, the situation improved significantly and the government continued to sell government securities.

The US national debt has now reached almost $20 trillion, but bonds are still in demand.

The growth of government debt is due to a decrease in interest rates on this type of security; borrowing at a low interest rate is quite profitable.

True, constant borrowing still leads to an increase in annual payments; in 2016, $220 billion was spent on servicing the external debt.

Every year, the number of players betting on the collapse of the US financial system is growing, with the number of long-term short-term trades already reaching $100 billion.

The pound was frightened by the news.

Despite the fact that UK GDP has shown good growth over the past six months, the British pound exchange rate is still sensitive to news about Brexit.

Monday, January 16, was no exception, after it became known over the weekend that Prime Minister Theresa May would give a speech on Tuesday, January 17.

The market reaction to the news was a record gap of several thousand points, with the British pound reaching a three-month high of $1.1986.

True, by the evening the rate had risen by a couple of hundred points, but only tomorrow will show whether this is another correction or a change in sentiment.

The results of Britain's decisive actions to leave the European Union are quite mixed, and forecasts for the economic situation are diametrically opposed.

US banks are posting record profits.

A number of American banks significantly increased their profits in 2016, according to data reported by news agencies on Friday.

Moreover, the growth amounted to several billion dollars compared to last year, with profits coming mainly from large financial institutions such as:

JPMorgan Chase – America's largest bank's profit for 2016 amounted to $24.7 billion. In relative terms, profit increased by 1.2%.

The bank's main income came from traditional banking operations and its investment activities.

Bank of America – showed even greater growth, with operating profitability growing by as much as 13% in 2016, reaching $17.9 billion.

Trends on the American Stock Exchange.

It is the tendency that is the driving force behind any trend, in other words, it is the mood that reigns among players opening positions.

The last couple of months have seen the US stock market throw up a host of surprises for its participants, with trading no longer a languid affair but a dynamic race.

The main tone of trading here is set by the largest participants – banks and hedge funds, whose capital amounts to tens of billions of dollars.

By observing the behavior of market makers, one can understand where the market will move in the near future, that is, identify the main trend.

The very name - Hedge Fund - implies the use of hedging tactics, that is, funds try to open approximately the same number of long and short positions.

Oil forecast for 2017.

Recently, oil has become one of the most unpredictable assets, with its price sometimes falling rapidly, sometimes regaining lost ground.

The importance of the oil price indicator is simply invaluable, since most exchange-traded instruments have a close correlation with oil.

The economies of most world powers and the development of many economic sectors depend on the price of black gold.

What will be the forecast for oil prices in 2017?

If we evaluate the current trend, then most factors point in favor of rising oil prices.

Analytical company BMI Research also confirms the upward trend for 2017, with forecasts for oil prices to rise to $60 per barrel.

The trend will continue and reach $64 per barrel in 2018.

Great Britain is the leader of 2016.

Britain's exit from the European Union became the main topic of 2016, with even more economists interested in how the country's economy would perform.

Most analysts predicted a decline in production and GDP, as the majority of the UK economy is oriented toward the EU.

However, recent data has led to the UK being named the world's strongest economy for 2016.

It's worth noting that growth has accelerated over the past six months, with significant increases in the Business Activity Index and GDP .

The dollar reached a 14-year high.

The American currency will continue to break records on the forex market after the New Year. On January 3, 2017, the US dollar strengthened against the euro to $1.0336 per euro.

The price has not reached such a level since 2002, and the increase in price is linked specifically to the dollar, and not to the depreciation of the euro, as there was a simultaneous rise in the USDX index - which shows the currency's relationship to a basket of six currencies.

Overall, the American currency has risen in price by 6% over two months, which is a fairly significant indicator on the foreign exchange market.

It should be noted that on January 4, the euro currency showed significant growth, winning back about 1.5% from the dollar, but this is more likely correction of the existing trend on Forex, than a reversal to a new trend.

Why is the euro depreciating and what are its prospects?.

While not all Forex traders are scalpers, there are many players who prefer longer-term trades.

It is these traders who need to understand the fundamental basis for exchange rate formation, which will allow them to identify long-term trends and determine their prospects.

One of the most popular currencies on the forex market at the moment is the euro, whose exchange rate has been rapidly declining in recent months.

Whether there is a real reason for the euro's depreciation or whether the trend is driven by panic is a decisive factor.

The British Stock Exchange FTSE index is steadily rising.

The FTSE index reflects the share prices of the 100 largest companies in Great Britain and shows the situation in the country's economy.

Although in our case, the rise in value is most likely caused by investors transferring savings from the falling pound into shares of the most attractive companies.

Despite the fact that the pound has lost significant weight recently, the FTSE index surpassed its historical maximum on December 30.

The growth over the past day was 0.3%, which is quite a lot for such a short period of time.

Now the FTSE 100 has reached 7142.83, the index value has been growing steadily over the past month, with growth of 412.11 points in December.

Sweden is in favor of abandoning negative interest rates.

The introduction of a negative interest rate a year ago came as an unpleasant surprise to fans of the Swedish krona.

This means that now, for keeping money on deposit in the national currency of Sweden, the account owner lost 0.5% per annum.

This is quite a significant loss for a deposit, if you add to this the inflation rate of 1.5% and the currency’s decline by more than 15% compared to other currencies.

Recent statements have strengthened the position of those in the Swedish government who are ready to abandon this policy, even though it works well in combating deflation.

Sweden's key economic indicators have recently been showing signs of growth, suggesting that even abandoning negative interest rates will not lead to a sharp increase in inflation.

Bitcoin is gradually regaining its position.

A few years ago, the record rise in cryptocurrency prices surprised many skeptics, as Bitcoin rose thousands of times in value in just a few years.

A year ago, a massive correction occurred, resulting in the electronic currency losing half its value.

It would seem that further growth is impossible, but recently Bitcoin has once again shown stable growth, with the cryptocurrency rising by 5%.

Now its rate is 884 US dollars per one bitcoin.

Many experts attribute the current trend to the decline of the Chinese Yuan, as people seek alternative investment sources and often choose cryptocurrency.

Demand for the US dollar is growing in China.

The unprecedented strengthening of the US dollar has sparked increased demand around the world, even among those who are usually pessimistic about the American currency.

China was no exception; demand began to grow at the beginning of the year, and after Trump's victory in the election, the trend intensified even more.

There are several reasons for this situation:

1. Firstly, there is a massive outflow of capital from China, which is only intensifying as economic growth slows.

2. Mistrust of the yuan – the population has traditionally been accustomed to trusting the US dollar and not trusting the national currency, which can either rise rapidly or fall even more rapidly.

Parity between the dollar and the euro will soon be reached.

Not everyone remembers the times when 1 euro was worth less than a dollar; everything changed after the terrorist attacks in New York fifteen years ago.

Following the infamous events, the US dollar fell for a long time against most major world currencies.

How justified was this decline? After all, the American economy didn't suffer enough damage to cause the US currency to halve.

Confirming this fact over the past few years, the US dollar has been confidently regaining its position in global markets.

The euro/dollar exchange rate has now reached 1.03 dollars per euro, with many analysts stating that parity between the two currencies is likely to be reached.

Prospects for growth in the price of defense company shares.

Another period of relative calm has ended, and the world is once again entering a period of escalation. Most countries are sharply increasing their defense budgets.

EU countries spend 219 billion on defense per year, which is quite an impressive amount even for Europe, and in 2017, most EU members will increase their military budgets by 15-20%.

The Baltic states are also trying to keep up with their colleagues; starting next year, the Baltic countries will increase military spending by 50%.

After this, the total cost will be $1.45 billion.

Investments in Chinese tourism.

The tourism sector has been developing quite rapidly in recent years, mainly due to the popularization of active recreation.

The tourism market has enormous potential and is valued at hundreds of billions of dollars. It is no wonder that this industry has become a priority in many countries.

Recently, the Chinese government announced unprecedented investments in the tourism sector, with a total of up to $290 billion allocated to the tourism industry.

The financing program provides for a phased disbursement of funds, with the entire amount to be fully utilized by 2020.

The average annual investment will be around 100 billion dollars.

Black swans of 2017.

The term "Black Swan" is familiar to almost every stock market player; it describes an unexpected event that significantly impacts the economy or finances.

Black Swans are the events that cause the largest movements in exchange rates on the currency exchange or the largest changes in stock prices.

What surprises might 2017 bring, according to experts at one of the largest holding companies?

1. US economic growth – the US economy is currently at a relatively low level, meaning a change in president and government policies could lead to an acceleration of economic growth.

Decline in unemployment in the US.

The unemployment rate has always been one of the most important indicators characterizing a country's economy.

In most cases, an increase in unemployment causes a decrease in the exchange rate of national currencies, and vice versa, a decrease in the value of this indicator can lead to a strengthening of the national currency.

The latest news from the United States of America reports a positive trend, thanks to which unemployment in the US has fallen to a nine-year low.

Now this figure is 4.6%, which is 0.3% lower than the data for October 2016, the announcement was made on Friday, December 2.

Britain still pays.

The UK's controversial exit from the European Union continues to be one of the main news items in global news agencies.

The event is quite controversial for both the European Union and the United Kingdom; their markets are closely interlinked, and therefore the countries are doing their utmost to maintain established relations.

To maintain economic ties, Britain even agrees to pay contributions as a member of the European Union, according to a statement made by British Minister David Davis.

The government's primary objective is to prevent the cancellation of duty-free tariffs, which could lead to higher prices for goods and, as a consequence, to a refusal to extend them in 2017.

The price of gold hit investors.

There are many investment companies with thousands of clients and billions of capital, the main object of investment of which is investments in gold.

After all, this metal has been steadily rising in price for several decades. What could be more profitable and reliable than gold?

This strategy has proven successful until recently, with gold prices falling from $1,700 per ounce to $1,200 since 2013. The most dramatic decline, over 7%, has been observed in the last few months.

This situation is causing an outflow of funds from investment funds specializing in gold purchases.

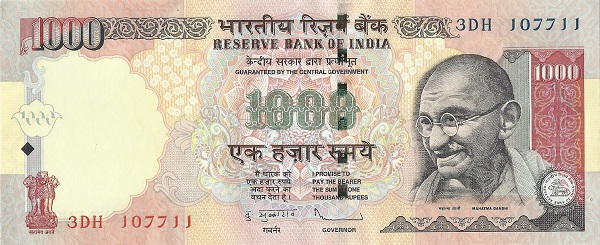

Monetary reform in India and its consequences.

For several weeks now, news about currency reform in India has been a key event in news agencies. As a reminder, this concerns the withdrawal of the largest banknotes from circulation.

While in the early days the discussion focused on the reform itself, its goals, and objectives, more attention is now being paid to its results. What is happening with the Indian economy now, and what impact is this having on global markets?

Page 5 of 6