Useful Forex articles about trading

In this section you will find more than a hundred Forex articles devoted to trading on the Forex currency exchange, as well as trading on other financial markets. The given articles about Forex will be useful both to a novice trader and to a person already familiar with this type of activity.

Reasons for setting stop loss

Despite all the convictions, many of the newcomers to Forex stubbornly continue to ignore placing a stop loss order, not seeing any compelling reason to use it.

Those who assure that they will close the deal on their own in case of danger, others are confident in the correctly drawn up forecast and do not believe that the price will reverse.

In fact, setting a stop is necessary for several reasons that beginners do not always realize:

• Deposit protection - or a pre-planned amount of losses, the most obvious reason, allows you not to lose your deposit due to a rapid candle against the position.

• Hands-free – you get the opportunity to step away from the monitor and not constantly monitor your transaction, but only check the situation from time to time.

How we used to trade without leverage.

At the moment, it is simply not realistic to imagine trading on Forex or the stock exchange without using leverage.

After all, it expands earning opportunities tens and sometimes hundreds of times, allowing you to earn money even with limited capital.

But this was not always the case. Leverage, in our usual understanding, appeared only after it became possible to quickly control exchange rates.

Before this, traders used a cunning scheme with collateral to increase capital.

Allowing you to get much less money than now. What does the scheme of working with leverage look like at the moment?

The trader has a certain amount, which acts as collateral when receiving money from the broker.

How brokers protect their clients.

Trading in financial markets in itself is a rather difficult and dangerous activity, but in addition there is a possibility of losing money due to the bankruptcy of the broker.

Which have been happening with enviable regularity lately, one or another company disappears, leaving its traders without the money they earned.

It would seem that the situation cannot be corrected, but it can be prevented if you choose the most secure broker from the very beginning.

How do brokers take care of the safety of their clients' funds?

• Participation in compensation funds - that is, brokers enter into an agreement with similar companies and pay fees, at the same time, these companies guarantee a certain amount of payments in the event of bankruptcy of the broker.

Trading as a hobby or why traders lose

I am often asked what is the secret of my success, why 95% of traders lose money on the stock exchange, but I earn money consistently.

Unfortunately, the answer does not satisfy the majority of those asking, who expect to learn about some secret strategy or profitable robot.

The whole point is that you don’t need to expect much from the exchange and set the amount of earnings as the main goal.

My secret to success is that trading is a hobby for me.

That is, I have enough money to live on even without trading, I don’t want to earn more than everyone else, I’m just interested in making forecasts and seeing how well they come true.

The relevance of the “Buy and Hold” strategy

This is how the human brain and consciousness work, that it is much easier for any investor to buy assets than to make money on sales transactions. Everything is very clear with the purchase, I bought shares, and after they rose in price, I sold them for a profit, and even received dividends.

Everything is very clear with the purchase, I bought shares, and after they rose in price, I sold them for a profit, and even received dividends.

Buying cheaper and selling higher is, so to speak, the natural desire of every speculator, and even if everyone around is buying, it seems that it is almost impossible to make losses in this strategy.

This strategy is applicable not only to the stock market, but also to the precious metals or real estate market.

People often think about how much they could earn by buying and then selling, rather than how much they would have lost after the price of a particular asset fell.

How do millionaires make money?

Almost all advertising calls for making money on the Forex market, promoting currency trading on the foreign exchange exchange as the most profitable type of trading.

At the same time, it remains a mystery why most financiers who made a fortune used other assets as objects of trade.

In practice, currency pairs turn out to be the most risky and poorly predictable instrument than other assets from the arsenal of the MetaTrader 4 trading platform.

Moreover, it is not entirely clear why currency pairs are advertised when in MetaTrader 4, in addition to them, you can find several dozen interesting assets.

But, in order not to be unfounded, let’s look at how millionaires and billionaires earn money.

Trader's jargon.

Apart from the official terms, any profession has its own jargon, and the profession of a trader is no exception.

Here, as in other areas of activity, there are a lot of words that denote specific concepts and help to more subtly characterize a situation or subject in non-literary language.

Knowing trader's lingo will help you better understand forum posts, financial news, and trading literature .

Well, it will be useful for those who plan to trade not only via the Internet, but in the future start working on a real exchange platform.

Let's move on to the jargons for stock trading:

Why women are more successful in trading.

In any profession, there are people who quickly reach the pinnacle of excellence and those who cannot achieve success for years.

Such a specific field of activity as trading is no exception; some of the newcomers have millions of dollars under management within a year, while others have only been losing money for decades.

But besides the fact that stock trading requires a certain character, you can also notice that the gender of the trader plays an important role.

As statistics show, about 70% of women who decide to make a career on the stock exchange achieve success, while at the same time, the results of men are several times more modest.

Why did such a situation arise, since men have logical thinking and are more delayed, while women are more emotional and more often act on intuition?

How realistic is it for a beginner to make money on Forex?

If you believe the advertising, then anyone can make money on Forex, just open and fund an account with one of the brokerage companies.

And then the broker will quickly and free teach you how to open transactions in the trading platform, and its managers will advise you on what you need to buy or sell to make a profit.

But if everything were so simple and easy, brokers’ websites would not be full of warnings: “Trading in foreign exchange markets using leverage is associated with high risks.”

At the same time, we all know the stories of such people as George Soros, Larry Williams, Warren Buffett and many other successful financiers. They were able to earn fabulous fortunes by playing on the stock exchange.

But before drawing conclusions, you should take a closer look at the biographies of these traders - http://time-forex.com/treyder . And find out how long it took them to achieve success.

How to make money on Alpari

Recently, more and more people are interested in making money on Forex; online trading has existed for about 20 years. Moreover, during its existence, the popularity of Forex is only growing, and this suggests that it is really possible to make money, and accusations from the losers are just the dissatisfaction of unqualified traders.

Moreover, during its existence, the popularity of Forex is only growing, and this suggests that it is really possible to make money, and accusations from the losers are just the dissatisfaction of unqualified traders.

One of the most common questions that we hear from beginners is - Who is the best person to start earning money with?

- What is the Alpari broker?

- Why Alpari?

- How to make money on Alpari.

The Alpari company has been known in the financial markets since 1998; in fact, it was one of the first to provide trading services for ordinary citizens.

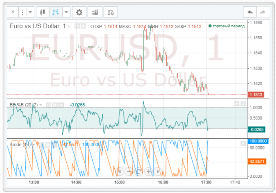

Trend reversals depending on trading sessions.

Quite rarely, Forex traders associate a trading session with a trend reversal and the troubles that this event brings.

But in reality, the Forex market is no less tied to fundamental news than the stock market, and events that occur can have just as strong an impact on exchange rates as on stock prices.

Therefore, you can observe how an important event changes the rate for a particular currency pair, while tracking a clear relationship between currency pairs and the sessions at which the reversal occurs.

Most often, trend reversals occur in those sessions that coincide with the opening hours of banks and government agencies in the countries that issued the currency into circulation.

For example, changes in the dollar exchange rate more often occur in the American session, and the Japanese yen in the Asian trading session.

At the same time, it cannot be said that these currencies are not influenced by news at other times of the day, but during sessions that coincide with the working day in the USA and Japan, this influence will be stronger.

Myths about Forex and reality.

Forex is an over-the-counter interbank foreign exchange market, in which today, thanks to intensive technical progress, everyone can make money.

There is a myth that to get a stable profit on Forex you will need a specialized economic education.

This is partly true, but it is not at all necessary to obtain a university diploma.

All the necessary knowledge can be obtained online or through paid and sometimes free training at one of the brokerage companies.

You can also study on your own; at the moment, a lot of useful information is posted on specialized websites about Forex.

It is important to pay attention to:

- principles of fundamental analytics;

- methods of technical analysis of price charts;

- study the functionality of indicators to confirm the correctness of the forecast.

On the Internet on specialized resources you can find many “profitable” strategies, the use of which supposedly guarantees a monthly profit of 100%.

The use of stock indices in Forex trading

Fundamental analytics of the foreign exchange market is effective for long-term and medium-term trading.

Such an analysis involves more than just a review of macroeconomic factors.

Because news reports do not always reflect reality. There are also more effective methods for predicting quotes of currency pairs, we are talking about stock indices.

Relationship between the currency and stock markets

Liquidity providers for Forex brokers are large investment companies or commercial banks.

The best exchanges for trading cryptocurrencies

The gold rush, which is remembered from textbooks and historical reports, has once again swept across the entire public, which strives to earn money and move forward on the wave of the trend.

However, if earlier people traveled to distant lands in search of precious gold, now everyone has started buying cryptocurrencies en masse, trying to make money on the huge ridge of growth in the rate of new money.

Just think, whether you are a housewife or an IT specialist, a trader or a businessman, as well as a hard worker, everyone has heard about the record growth of Bitcoin, Ether and other new money on all news channels.

Bloggers, media, information and educational sites are all, one way or another, discussing the new topic of cryptocurrencies, and the entire Internet segment is simply overflowing with advertising offers to invest in this or that project.

However, at the moment when a potential investor decides to invest in a new direction unfamiliar to him, the most important question arises, namely, how to take part in trading, where are the exchanges located and how to become their participants?

Stocks or currencies, the choice is based on the nature of the trader.

Having decided to make a career as a trader, most beginners are faced with choosing a stock or currency, stock exchange or forex market.

It would seem that there is no particular difference in which instrument to trade in the metatrader terminal, all the same orders, the same indicators, and often the same brokers.

But if you analyze both types of trading, you can find a lot of differences that affect the choice of one or another asset.

1. Leverage – as a rule, when trading currencies, it is several times greater, and sometimes hundreds of times. That is, profitability and risks in Forex are also proportional to leverage. If when trading stocks, rarely anyone trades with a leverage of more than 1:5, then currencies are bought at 1:100.

Exchange trading without risk. Compensation for losses on binary options

Speculative trading always involves risks, be it trading in the foreign exchange market or binary options.

Naturally, everyone who comes to these markets is fully aware that in addition to the desired earnings, the trader can be overtaken by continuous losses.

However, during the learning process, beginners in most cases hone their skills on demo accounts, without risking a penny from their pocket.

As a result, a trader can demonstrate high profitability on demo accounts, acquire a profitable strategy, but as soon as he switches to a real account, the same unexpected loss of deposit will occur.

There are several ways to minimize the risks of an increasing number of traders when trading binary options, namely, forget about turbo options and give preference to longer-term transactions, or use various promotions.

Demo trading options

Any trader undergoes training, tests acquired skills, developments and strategies. It is for this purpose that brokers have introduced demo accounts, on which you can gain all the necessary skills without risk.

There have never been any problems with demo accounts in the Forex market, because no matter what terminal you downloaded, right up to the official website of the developer, opening a demo account took literally one minute.

Unfortunately, with binary options in relation to demo accounts, everything is completely different. Firstly, many specialized binary options brokers provide a fictitious demo, where no matter where the trader opens a deal, there will always be a profit.

Secondly, brokers require full registration and authorization, and some unique companies require not only a real account, but also a certain amount on deposit.

Trading against the market.

Most recommendations advise trading with the trend; trend strategies are considered less risky and more profitable.

But there is also a category of traders who prefer to trade contrary to the existing trend, and such trading in most cases turns out to be more profitable than classic trading.

The reason for this situation is that when opening a trade following a trend, you very rarely enter the market at the best price. In most cases, you are already too late and in the middle of the trend.

By opening a trade against the trend, the investor expects a quick reversal, and if his expectations are met, the order is opened in a better place.

The cyclicality of the Forex market and the pattern of fluctuations.

Most traders think that they can make money on Forex only using technical and fundamental analysis, but as practice shows, they can do without these research methods.

It is quite difficult to find a currency that has moved in only one direction during its existence; most world currencies rise or fall in price with a certain cyclicality.

Typically, the price movement of a currency pair occurs in a certain price channel, which determines the minimums and maximums of the price.

The boundaries of the price channel are determined by the state’s monetary policy and the influence of economic factors. But, for a trader, it is important not to study the factors themselves, but to determine the existing boundaries.

Redrawing indicators and how to select an indicator without redrawing

When trading on the stock exchange using technical analysis, and especially indicator strategies, every trader has at least once encountered such a phenomenon as redrawing of indicators.

This phenomenon, or to be more precise, a technical feature, has caused damage to more than one thousand traders, since having believed in the strategy algorithm and opened a deal based on a signal, at some point the signal immediately disappears, as if it never existed.

At the same time, if the trend continued and the signal worked, such a disappearance is not observed on the chart.

The most interesting thing is that it is these instruments that instill great faith in the trader that he has finally found the Grail, since such indicators look simply flawless in history.

However, the use of such algorithms can lead to the loss of a deposit, and their main disadvantage is the inability to conduct a more detailed analysis of trading, since the received negative signals are not stored in history.

Cryptocurrency correlation. Determination method

Cryptocurrencies are represented by a huge number of digital currencies, which have both similarities and are radically different from each other.

However, the huge excitement caused by the daily introduction of new electronic money into all areas of the economy, and especially the banking sector, led to huge demand, and as a consequence to incredible rates of exchange rate growth.

Now, not only far-sighted investors are actively investing in this area, but also ordinary citizens who can see every day that Bitcoin has reached another high and has risen in price again.

However, investing is a rather complex science, so it is very important to structure your portfolio in such a way that in case of sudden market changes you do not lose everything you have accumulated through backbreaking work.

Brokers who are no longer with us

Stability in global financial markets, as well as macroeconomic stability in most post-Soviet countries, creates a huge impetus for business development.

Every month more and more new companies enter the brokerage financial services market, and leading brokers are constantly improving their trading conditions.

However, a quiet and calm environment in the field of brokerage services only reduces the vigilance of traders, and as a result, newcomers carry their deposits with the company without doubting their solvency.

In this article, we wanted to remind you of the largest broker bankruptcies that happened just a few years ago, which will allow you not to step on the same rake as happened to thousands of traders just recently.

Options for cheating on Forex

It is worth noting that the deception technology itself is in a prominent place and right in front of the trader’s nose, however, behind the clever terminology, many people cannot figure out what scheme the broker uses and exactly how he can make money for you.

In the same article you will learn classic work schemes forex brokers, as well as methods of deceiving traders in the Forex market.

Schemes of work of black brokers

Scheme "Kitchen"The most common scheme for deceiving most dealing centers, which is called “Kitchen” among traders, is that all transactions that traders make are not put into the market at all and are nothing more than virtual transactions within the company.

The Unchangeable Rules of Trading from Jesse Livermore.

For those traders who are accustomed to trading using various scripts, it is simply unthinkable to imagine that they can do without them.

Moreover, it should be noted that in the history of trading there are many examples when huge profits were obtained not only without technical analysis indicators, but also without using the trader’s terminal.

An example would be the legendary trader Jesse Livermore, who traded on the stock exchange at the beginning of the twentieth century.

Moreover, he traded quite successfully; his best results were earnings of $3 million per day.

Like many successful people, Jesse Livermore willingly shared his secrets with others, some of them were given in the book “The Life and Death of the Greatest Stock Speculator.” http://time-forex.com/knigi/gizn-biga-spekulant

Trading: why it is important to control your actions, not your emotions.

Success in the Forex market does not depend solely on the system or strategy you use; it mainly depends on your mindset and reaction to market changes.

There are currently many market analyzes and hundreds of opinions available on the Internet. There are hundreds of sites that will tell you how the market will behave next, and they will convince you that their trading strategy is the most winning one.

Being knowledgeable does not mean being a successful trader. Yes, the information obtained will be essential for market analysis and decision-making, but much more is required to achieve success.

Having studied and absorbed all the relevant information, the trader seeks to apply it in practice. As a rule, mastering something new is accompanied by a mixed feeling of interest and fear. In the best case scenario, the trader makes several successful trades and gains greater confidence.

This result will encourage you to place more trades and perhaps provide the basis for more aggressive trading tactics... However, you will quickly understand why over 90% of traders fail.

What is futures expiration?

The creation of futures contracts made a huge revolution in the stock market. Initially, the purpose of their creation was to provide a completely new financial relationship between the seller and the buyer.

Thanks to a futures contract, entrepreneurs could agree on future deliveries of products at a pre-fixed price by a certain date.

Such an innovation on the commodity exchange made it possible to make relations between the parties transparent, and the exchange at the same time acted as a guarantor of the execution of the contract.

Naturally, with the passage of time and the active development of the exchange, in parallel with deliverable futures (which are still present on the commodity exchange), so-called settlement futures appeared.

The main purpose of which is speculative trading, as well as hedging risks on the underlying asset. However, the only thing that these two different types of contracts still have in common is the expiration of futures.

How to choose an options broker

Choosing a broker is the very first important step a trader takes on the path to his future success.

Today, the segment providing brokerage services in the field of options trading is represented by dozens of different companies, which have both their advantages and disadvantages.

Just like in any business segment, there are fraudulent companies in this market that, under the guise of providing access to the market, actually deceive traders and use all possible manipulations to achieve the loss of a deposit, or even refuse to withdraw earned funds.

That is why, in order not to fall into the clutches of scammers and also to make your trading as comfortable as possible, we suggest considering the most important criteria that you should pay attention to when choosing an options broker.

1. Company certification. Availability of certificates from the main largest regulators

Playing forex or making money on the exchange rate

More than five years have passed since I first started playing forex, at that time making money on the exchange rate was still exotic for most Internet users, and it was quite difficult to get the necessary information.

users, and it was quite difficult to get the necessary information.

But over time, the necessary knowledge accumulated, and practical work experience appeared.

Now I can confidently say that I know what the Forex game is and whether it is possible to really make money with a small initial capital.

Since the beginning of trading, the amount of my deposit has increased from 100 to 10,000 dollars, although the growth did not always occur only due to profit.

There were times when I simply deposited free money into the account. Now I manage to consistently earn from 2000 to 2500 dollars a month, not as much as I wanted, but stable

Playing Forex involves making a profit by buying and selling currencies; the difference between the price of a currency pair is precisely what brings that profit.

Making money on the exchange rate is currently the most profitable and less risky trading option compared to similar investment methods.

Confrontation between brokers and traders.

It is no secret that in the Forex market, 95 percent of novice traders, as a rule, lose their deposit.

Many will probably be surprised to learn about these statistics, because on every website you can find advertising that every person can become financially independent.

However, the reality is that 95 percent of losers are fed by the five percent who earn a lot of money.

By the way, 95 percent is not such a terrible statistic, because even when starting their own business, only five percent of entrepreneurs become successful.

Naturally, dealing centers and brokers also know about such statistics and begin to abuse their knowledge.

Rebate spread return services and is it worth using them?

A rebate is a return of part of the broker’s commission to the trader for each transaction; it is a kind of cashback of the money paid for opening an exchange transaction.

A spread rebate allows the trader to receive a portion of this commission back after the trade is completed.

This may be a fixed or interest income depending on the volume and frequency of trading operations.

This technique is one of the tools for attracting clients and can help reduce trading costs, increasing the trader’s overall profit.

The active development of Forex brokers and their affiliate programs has led to a completely new phenomenon, namely the emergence of the so-called “Rebate services”.

What is more profitable: Forex or the stock market?

You have decided to become a trader, but you are faced with the question of what and where is more profitable to trade, because you want to use your initial capital with maximum benefit.

In addition, an important factor is the complexity of the work itself and the risk of losing your money. At this time, two main options are available to the average trader - trading on Forex or the stock exchange.

Page 4 of 7

- To the begining

- Back

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- Forward

- In the end