Forex trading tactics

Like any other endeavor, stock trading requires a plan of action that outlines all the key aspects of trading. These are the foundation of profitable trading and prevent you from losing your deposit.

the key aspects of trading. These are the foundation of profitable trading and prevent you from losing your deposit.

Forex tactics are an integral part of a trading strategy. While a strategy covers only general aspects, tactics focus on the details—though there are no details in forex trading.

In our case, this discipline encompasses all the preparatory aspects of trading and also regulates the key performance indicators.

This includes calculating the optimal trade size, the maximum loss and profit that will be reached when the order is closed, and methods for securing profits.

Adverse tactics.

Tactica Adversa is a relatively new direction in the field of graphical analysis, and this approach has been on its way since the early 2000s.

If you start searching Google and try to find useful information about strategy, you will probably come across a number of abstruse words about esotericism and sacred points, as well as all sorts of expressions in this spirit.

It's worth noting that the author's explanations of the strategy are so abstruse and mystical that after reading a couple of paragraphs, any sane person will close the book.

Perhaps this approach has become a thing of the past, and traders have lost interest in it due to unclear and sometimes illogical explanations, while a clear algorithm of actions for a trader is out of the question.

However, despite the author's verbal exaggeration of the technique, it is based on just two simple patterns that you may have also observed repeatedly on the chart.

Pyramid of pending orders.

There are different approaches to making certain trading decisions. As a rule, among traders, any strategy is usually divided into indicator ones, which are based on one or another combination of indicators, and also non-indicator ones.

As a rule, among traders, any strategy is usually divided into indicator ones, which are based on one or another combination of indicators, and also non-indicator ones.

Without indicators, they are built on the principle of patterns of price behavior, various candlestick patterns and graphic figures.

However, there is another type of strategy that does not even try to show us the entry point into the market or predict the further behavior of the price, and all trading comes down to opening a grid of orders in both directions, so that, regardless of where the price goes, try to take as much profit as possible.

In the professional language, such traders are also called “griders”, but the method itself is makeshift.

Tactics for waiting out losses. Death for a beginner and salvation for professionals

It is no secret that the choice of trading tactics depends on more than 50 percent of your future success, but the remaining 30-40 percent, which can affect the effectiveness of your strategy.

They directly depend on the chosen capital management model, and to a greater extent on how you will accompany the transaction and limit risks.

Today, there are more than a dozen models of capital management, as well as approaches to transaction support, but they can be conditionally divided into two groups, namely the tactics of cutting off a loss or the tactics of waiting out a loss.

Waiting out losses is an approach to risk management, in which the trader either does not use a stop order, or there is a very small profit and a very large stop order.

Order flow. Universal false signal filter

Order flow is a truly powerful tool that allows most traders to see through the market.

allows most traders to see through the market.

The ability to recognize a major player and the size of their order, and an understanding of who is really in the market, namely the bulls or the bears, always allows for a general understanding of the future price movement.

However, as with trading any instrument, false signals always arise, which must be properly filtered. In the forex market, you won't be able to see the order flow as such, except for information shared by the dealing centers themselves. However, the topic of a universal filter for eliminating false signals is relevant, regardless of your trading style.

Tactics – quick acceleration of the deposit on Forex, advisors and indicators

The main problem that faces most traders starting their journey in Forex is the lack of funds for trading.

funds for trading.

Some people have only a few hundred dollars in their account, while others have a much smaller amount.

In this case, the problem can be solved in only one way - by accelerating the deposit.

Accelerating a deposit on Forex is a rather risky tactic, which allows you to increase a trader’s deposit several times in a short period of time.

In fact, this is scalping , all profits from which are added to the amount of the main account and then used in trading.

Break-even trading tactics.

Every trader would like his transactions to be closed only with a profit, but the standard version of the trading terminal provides two options for closing transactions - by take profit with a profit and by stop loss with a loss.

two options for closing transactions - by take profit with a profit and by stop loss with a loss.

An additional solution is trailing stops, but working with this tool has some disadvantages that are not entirely suitable for traders.

To reduce the number of unprofitable transactions and thereby increase the overall financial result, you can use other approaches.

First of all, this is moving the stop loss to the break-even zone, or even fixing a certain amount of profit.

Tactics of partial closing of a position.

When trading Forex, you often encounter a situation where a successful trade becomes unprofitable after a sharp trend reversal.

unprofitable after a sharp trend reversal.

You're left regretting that you didn't close the position in a timely manner, but at the time, you were thinking about maximizing your profit and there was no indication of a potential reversal.

In such a situation, it's best to find a compromise that allows you to profit without closing a promising order.

This can be achieved by partially closing the position, without opening any counter orders, which would increase the spread and further complicate your trade.

Trading on pullbacks.

Almost every second article on Forex trading recommends trading with the trend, since trend trading is less risky.

is less risky.

But for some reason, instead of the promised profit, the trader only receives stop losses; as soon as a new deal is opened, the trend immediately rushes in the opposite direction, and suspicions immediately arise about the dishonesty of the Dealing Center.

But there is no crime in such a phenomenon, since we are talking about ordinary rollbacks or trend corrections.

Why do most authors so persistently recommend opening trades with the trend? Because their articles talk about trading on medium and long-term time frames, and most traders conduct intraday trading using fairly large leverage.

Tactics - stop loss plus take profit.

This is one of the most common tactics on Forex; most traders, without even knowing it, use it intuitively using stop orders in their work.

stop orders in their work.

At its core, the Stop Loss Plus Take Profit Tactics implies that no matter what trading strategy is used to make a profit, these two stop orders are set in any case before starting a trade.

Moreover, they are installed according to the same rules; this will be a tactic; there are many variants of these rules; below we will talk about them.

First of all, you should remember that stop loss and take profit are set at the moment of opening a position, and not after the order has already been placed. Both stop loss orders are important - it protects the deposit, take profit - it allows you to take profit and eliminate market pressure on the trader.

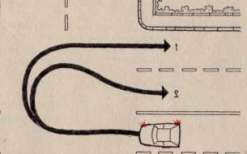

Reversal with doubling.

A Forex trend consists of fluctuations in the exchange rate, some of which occur against the main trend. For example, if the price of a currency pair is rising, it's highly likely to fall soon, even if only by a few pips. The "Reversal and Double" tactic is based on this fact.

occur against the main trend. For example, if the price of a currency pair is rising, it's highly likely to fall soon, even if only by a few pips. The "Reversal and Double" tactic is based on this fact.

When opening a position, traders are confident they've chosen the right direction, but this belief isn't always true, and losses on a recently opened order continue to mount. In this case, the position reversal tactic is used.

The key to using this tactic is choosing the right place to close a Forex position and reenter the market to avoid making another mistake.

A practical example illustrates the use of a reversal tactic:

Averaging in Forex.

There are many different trading tactics on Forex, including some quite dangerous ones, one of which is averaging. In some ways, this trading option is reminiscent of Martingale, but at the same time it has its own differences.

Averaging in Forex is a game against the trend in the hope of a quick reversal or a large correction.

When using this technique, the trader, despite current losses on existing positions, opens new ones for the same trading instrument and in the same direction. The essence of the technique is to equalize the financial result by concluding a second transaction at a more favorable price. For example, having bought one lot of euros at the rate of 1.2545, you received a loss of 10 points and the current price was 1.2535. If you open a new order at the existing rate, then if it grows by only 5 points (excluding spread ), both transactions can be closed with a zero result.

Multiple Lot Tactics in the Forex Market.

There are several tactics in the forex market designed to increase profits . One such tactic is the multiple-lot strategy, though its catchy name conceals well-known techniques.

. One such tactic is the multiple-lot strategy, though its catchy name conceals well-known techniques.

A more accurate term for this tactic would be position expansion. It's a rather risky method of profit generation, whereby gains are achieved not through time, but by increasing trading volumes.

Almost every forex trader who doesn't have a large capital base but wants to quickly make a significant profit employs something similar.

Anti-Martingale tactics in action

As is already clear from the very name of this term, this concept has some relation to the Martingale trading tactics, but unlike the latter, completely opposite trading principles work here.

Anti-Martingale - in a global sense, this is an approach to money management that involves increasing a position after each successful transaction and reducing the volume of orders after each unsuccessful transaction.

Unlike the classic martingale system, where each subsequent trade is doubled, anti-martingale allows investors to increase their trades only after winnings and not after losses.

Using the anti-martingale approach allows traders to better manage their capital and reduce the risk of losses.

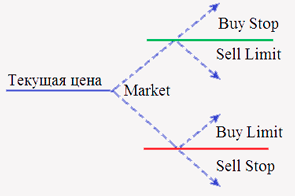

Forex pending orders and trading tactics using them.

There are many strategies using this trading tactics; the deferred trading option allows you to conduct automatic trading without the use of extraneous scripts.

allows you to conduct automatic trading without the use of extraneous scripts.

But in this case, all the work of analyzing the trend and making forecasts lies entirely with you.

Pending orders make it possible not only to set the price at which a transaction will be opened, but also to set take profit and stop loss levels after reaching which the Forex order will close on its own.

Elements of such tactics can be found in various strategies and play both a main and an auxiliary role.

Some traders trade exclusively using them, placing pending orders at levels after crossing which the price will definitely move towards the breakout and bring profit.

The number of successful transactions when using this tactic sometimes exceeds 70%, and with a successful combination of circumstances, even more.

Locked positions, tactics for locking positions in exchange trading

There are many options for reducing losses when trading Forex or other financial markets, but all of them are designed to be taken before opening a new order.

In contrast, locking allows you to significantly reduce losses, and sometimes even make a profit from an already open, unprofitable transaction.

Locked positions are those transactions in which, during the execution of the transaction, another order was opened with the same volume, but in the opposite direction to the already opened, unprofitable order.

This method of reducing losses is sometimes also called “Hedging” and should be used with caution, taking into account the market situation.

Before using this method to reduce losses, be sure to ensure that the losses arose as a result of a price reversal, and not due to a trend correction, otherwise you will only make the situation worse.

Adding profitable positions

The tactic of adding positions has long been familiar to Forex traders; it is based on a gradual increase in the volume of profitable positions, which improves the overall financial result.

increase in the volume of profitable positions, which improves the overall financial result.

Very often, having opened the first order, you notice that the trend is moving in the desired direction and several dozen points have already been earned, nothing foretells a change in the trend, and after the first order, another one is opened in the same direction, this step is called adding a position.

But despite the apparent simplicity of the actions, there are many nuances that should be taken into account when opening a new order.

Adding Forex positions includes the following main points: correct calculation of the size of the second order, measures to preserve profits on the first position and selection of the most favorable entry point into the market.

We should not forget about control over the existing trend of exchange rate movement.