Trade Position, a calculator for managing stock exchange risks

Continuing the theme of reviewing the most useful and free scripts for effective trading, today we will look at the Trade Position and Back Testing Tool MT5.

At its core, this is a script that allows you to quite accurately calculate the ratio of probable risk and possible reward, taking into account the size of the deposit.

Thanks to Trade Position, you can calculate the following important parameters of an exchange transaction:

Transaction size – taking into account the established risk percentage, the riskier the planned transaction, the larger its size.

Take profit and stop loss – taking into account the set risk level, displaying changes in the risk level when moving stop orders.

Tick indicator for M1 timeframe

A tick in stock trading is the minimum change in the price of a financial instrument. For example, if the stock price is $20.00 and the minimum tick is $0.01, then the next possible stock price could be $20.01 or $19.99, but not $20.005.

Tick counting in stock trading is used to analyze market volatility , that is, the degree of its variability.

A large number of ticks in a short period of time may indicate high volatility, while a small number may indicate low volatility. This is important for traders, since volatility directly affects the potential profitability and risks of transactions.

Ticks are also used to create tick charts, which allow traders to see every price change and analyze market dynamics in more detail.

MMTrade script assistant in placing limit orders

In the trader’s trading platform, you can place both market orders with immediate opening and deferred ones, which will open when the price reaches the specified parameters.

The simplest orders are buy stop and sell stop , because they are placed in the direction of the trend, above or below the current price.

Another thing is limit orders buy limit and sell limit , which are placed against the existing trend in the expectation of a price reversal or that the current trend is just a correction.

Apart from the installation location, it is not always clear what parameters should be set for stop loss and take profit indicators.

Real-time market overbought and oversold indicator

As you know, the formation of prices in any market is influenced by the amount of supply and demand; it is these factors that determine the direction of the trend.

The more trading participants want to sell, the higher the probability of a price decrease, and conversely, a large number of people wanting to buy an asset increases the likelihood of an upward trend.

When the number of people willing to buy reaches a maximum, the market enters an overbought state, but if there is a significantly larger number of sell orders on the exchange, then this state is called oversold.

Read more about the various market conditions in the article at - https://time-forex.com/tehanaliz/perekuplenost-pereprodannost

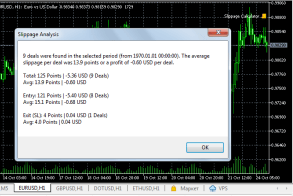

Script for determining the size of slippage when opening orders

Not always placed market orders are executed at the price that we see when opening a transaction; the opening price may differ by several points from the quote price.

This process is called slippage. There are many reasons for the occurrence of slippage, but the size of the price deviation is more important.

Since this deviation can affect the financial result of the transaction when opening short-term transactions using the scalping strategy.

Therefore, it is so important to know how many points the price deviates in your trading platform and if the slippage is quite large, then you may need to think about changing your account or broker.

Script minimum trailing stop step, from 1 point

Most professional traders prefer using trailing stops instead of stop losses in their trading.

The advantages of a floating stop are more than obvious; its use allows you to get maximum profit from one transaction while controlling the level of risk.

In general, the tool does not cause any complaints, only sometimes traders complain that brokers limit the minimum size of trailing stops and they cannot set the step at their own discretion.

The minimum level is often limited to 15 points, and in trading platforms, some brokerage companies, the minimum step is 5-10 points.

Indicator for displaying the Stop Out line on the chart

Almost everyone who starts trading on the stock exchange using leverage asks the question - what will happen if I lose the broker’s money?

To prevent such situations from happening, there is a kind of stop loss from the brokerage company that protects its money.

This stop order is called Stop Out and its size usually ranges from 10 to 50 percent of the collateral amount for the transaction.

And everything would be fine, but it is quite inconvenient to calculate each time when a forced closure of a position will occur. A Stop Out script was created to automate and visualize the process.

Forex margin calculator, simple calculation of funds required for collateral

You've probably often encountered a situation when opening a deal, when an attempt to open an order is rejected.

And in the window for opening a new order, an unpleasant inscription appears: “Not enough money”; in this case, the fault is due to the excessively large volume of the position being opened.

Or, to be more precise, there is not enough funds on deposit to open a new transaction, even taking into account the available leverage.

The collateral that is blocked during a new transaction is called margin, and it is better to know in advance how much funds are needed so that a refusal does not occur.

A script that helps you place an order when the market is closed

Sometimes in life there are situations when you need to place an order, but the market is closed at that time.

Therefore, when you try to open a new deal in the trading platform, you receive a refusal and a message that trading is not currently taking place.

It is logical to place a shortcut order after the start of a new trading session, but, firstly, this is not entirely convenient since Forex sessions after the weekend begin at night, and secondly, this is not always possible.

What to do in such a situation?

The answer is quite simple - use a special script that allows you to schedule the opening of a time-delayed order. The tool is quite simple, so it will not be difficult for any trader to understand its basic settings.

A simple script for installing Trailing Stop on Forex

There are many ways to make Forex trading more efficient and secure, one of these ways is a trailing stop order. This feature of the trading platform allows you to take maximum profit from an open order while at the same time protecting against losses.

This feature of the trading platform allows you to take maximum profit from an open order while at the same time protecting against losses.

The only condition for using this tool is the profitability of the open position and the running of the trading program.

Previously, we told you how to set a Trailing Stop directly using the trading platform itself.

But many beginners still ask questions on this topic; to simplify this process as much as possible, you can use the script below.

Scripts for working on Forex

The Metatrader 4 (5) trading terminal has many additional functions, but for comfortable work it is still required to use additional Forex scripts. These programs make it possible to greatly facilitate trading, and therefore increase its effectiveness. They do not analyze the trend and do not supply trading signals, but only add some functions to the operation of the trader terminal.

Forex scripts - allow you to place pending and instant orders using the mouse, close all orders with one click, calculate the level without loss, manage already open positions, and also provide a lot of other opportunities. All presented programs are absolutely free; by selecting the necessary program, you can download it on our website.

Tipu Stops assistant script for setting Stop Loss

The greatest number of questions for traders always arises when placing a Stop Loss order, which helps limit losses.

Previously, we have already published several scripts and Forex indicators that help determine where a given stop order will be placed.

Today you will also get acquainted with a similar script, the main advantage of which is the ease of working with it.

Tipu Stops can be called an advanced script; it does not just randomly determine the stop loss setting points, but acts on the basis of classic technical analysis indicators.

This approach allows you to draw setup channels for buy or sell trades, depending on the direction in which you decide to open an order.

Make the wait more enjoyable with Game Fiftee Puzzle

In trading, there are often times when you have to wait a long time for the price to reach a certain level on Forex.

To keep yourself busy, someone is talking on the phone, someone is listening to music, but you can also play a simple game right in the trader’s terminal.

So to speak, spend time usefully training your mental and logical abilities, since this is what this game is aimed at.

We are all familiar with tag from childhood in its offline version; you just need to place 15 numbers in a certain order on a square field.

The game developers have made a script that can easily be used in the MetaTrader 5 trading platform, directly on top of the currency pair chart.

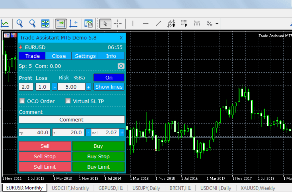

Trade Assistant MT5

It just so happens that someone trades on Forex, and someone tries to make this trading simpler by creating various programs and Forex scripts.

Today we will talk about the Trade Assistant program, which acts as a trader’s assistant when placing orders.

That is, it helps to place market and pending orders taking into account the risk in relation to the deposit, as well as set the size of stop orders.

That is, now you don’t need to think about the size of the transaction every time you change the amount of funds on deposit, but rather simply set the risk percentage in relation to the balance.

But this is only a small part of the capabilities of the script, which is simply amazing in its functionality and visualization.

Script gap statistics for a currency pair

Such a phenomenon as a gap in Forex has brought quite a lot of trouble to many traders; it is this phenomenon that prevents stop orders from being triggered.

To be more precise, they work, but only after the price gap has ended and at the price of its completion.

There are also a lot of strategies that use gaps as entry signals, and are guided by a pattern that says that every price gap must necessarily close.

Therefore, it is so important to choose a currency pair for which price gaps rarely occur or, conversely, to find an instrument with the largest gap size.

For these purposes, a script for statistics of gaps on Forex in the context of currency pairs was invented.

Script pending orders at a specified time

Trading using pending orders is quite multifaceted; there are simply a huge number of strategies based on them.

At the same time, the standard capabilities of the metatrader trading terminal only allow you to limit the lifetime of a pending order.

But sometimes, on the contrary, it is required that the order begins to act from a certain time, that is, to delay the placement of a pending order.

This is done in order to allow the price to travel a certain distance, after which open a position at a more favorable price.

You can add a new function to the trading terminal by installing scripts for placing pending Forex orders, which will set Buy Stop and Sell Stop on a certain day and at the right time.

Money management script

Most professional traders say that making money on Forex is quite easy, but it is much more difficult to save the money you earn.

One unprofitable trade can easily destroy the profit that was received from five successful ones.

One unprofitable trade can easily destroy the profit that was received from five successful ones.

Therefore, the money management system, which regulates aspects of capital management and the ratio of profits and losses, comes first.

Many beginners neglect this point, preferring to plan transaction volumes only based on the size of the desired profit.

This is largely due to the process of calculating safe transaction volumes, nothing if we are talking about one or two positions, but what if you have a dozen orders open?

A simple script that allows you to determine volatility for a period

An indicator such as the volatility of a currency pair or other trading asset very often raises a lot of questions among traders.

Its value helps when planning future profits and more successfully finding entry points into the market.

You can also use volatility to choose the most dynamic instrument for trading.

The process of determining volatility is quite painstaking and time-consuming, but thanks to special scripts, everything can be done in a matter of minutes.

Previously, we provided a similar Forex script on the page - http://time-forex.com/skripty/skr-volotilnost it provides data by hours and days of the week.

What the AccountInfoSample script shows in the trader’s terminal

The online trading industry does not stand still and every year new auxiliary tools appear, the use of which will significantly simplify the analytical process.

In addition to indicators and tools for technical analysis, it is possible to integrate Forex scripts into the MT4 platform - special programs written in MQL4.

Such add-ons can be used to perform various tasks:

trade automation:

• placing or canceling pending orders

• making trading more comfortable

• information functions

The last group of scripts is used most often.

These programs are designed to systematize information about trading, which allows the trader to objectively evaluate the effectiveness of the strategy, work on errors and make appropriate adjustments.

Automatic stop loss and take profit

Dynamic trading in the style of scalping , pipsing or grid trading requires maximum performance from the trader.

However, at such a huge pace, especially when it comes to pips, it is almost impossible to set the correct stop order or profit values in a timely and quick manner.

Naturally, such a situation leads to the fact that the trader suffers losses, because a huge number of unprofitable transactions have to be closed manually and not everyone can be kept track of.

Naturally, not everyone can withstand such conditions, so many simply refuse scalping and pipsing as such.

However, professionals have long found a solution to this problem, and special auxiliary advisors or Forex scripts help them with this.

Trailing Master script

One of the techniques for maintaining profits and minimizing losses is to use a “ Trailing Stop ” order in trading.

However, in many cases, the standard and familiar trailing does not satisfy all the requirements and does not solve the tasks that a trader may set for it.

Therefore, auxiliary scripts and advisors come to the rescue, which significantly expand the functionality of a standard order.

You can get acquainted with one of these Forex scripts in this article.

The Trailing Master script is an auxiliary advisor for a trader, the essence of which is to automatically perform both mass and single trailing orders when the price reaches a specified profit value for the order.

Page 1 of 4

- To the begining

- Back

- 1

- 2

- 3

- 4

- Forward

- In the end