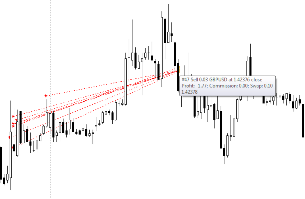

Limit orders Pro script. A universal grid trader assistant for all occasions

The profession of an analyst is to draw beautiful forecasts, and if they do not come true, then be able to competently explain why.

A trader rarely makes plans for a long time; moreover, most trading strategies are not focused on making forecasts, but on working with the consequences of one or another price behavior.

That is why, against the backdrop of the unpredictability of the market, grid trading strategies began to gain increasing popularity, where a trader, like a fisherman, sets traps for the price along its path and makes money from almost any of its movements.

However, working with grids has its drawbacks, and one of them is the huge amount of routine with pending orders, which not all traders can cope with.

The price of any mechanical error is huge losses. This is why most traders always use either advisors or auxiliary Forex scripts that allow them to solve a number of problems. You will get acquainted with one of these tools in this article.

Script for transferring history to chart

Investing in the Forex market is extremely risky, and even huge potential returns in many cases are broken by the realities of the efficiency and stability of managers.

How can you find out if a manager can conduct effective trading?

What is his strategy and, most importantly, aren’t these indicators inflated due to the competent use of risky capital management , which give a beautiful picture of the profitability graph, but at the same time the loss occurs suddenly and simultaneously?

In order to answer this question, you need to study in detail the trader’s trading principle, and additional programs for the trading platform - Forex scripts - will help you.

The script for transferring history to a chart StrategyViewer is an auxiliary program for your MT4 that allows you to extract history from an Excel report, which can often be downloaded by various services for copying transactions and PAMM sites.

It is worth noting that the script was developed specifically to pull transaction histories onto the chart from the signal copying service from the metatrader developer, which are still located directly in your platform.

Invisible feet. An expert who can keep your secret from a dishonest broker

One of the problems when working with brokers is the lack of transactions to the real interbank market, when all operations are virtual and are carried out inside the company.

You may ask, why would a broker do this? What’s the point of bringing traders to the real market if nine out of ten participants merge?

It’s easier for a broker to arrange virtual trading and take traders’ deposits for themselves rather than hand them over to the market. There is practically no difference in trading internally or on the interbank market if the broker withdraws the profit.

But such a work scheme represents a certain conflict of interest. After all, the company will never be interested in effective traders, so often unscrupulous brokers interfere in traders’ trading.

The most important tool in the hands of a dishonest broker is the stop order and the trader’s profit, which the company may not execute, transfer or fix, as it is convenient for it.

Manipulating quotes in modern conditions is not possible, since such facts would very quickly be identified and made public, but the stop order and profit still remain the most vulnerable point.

Script "Drawdown". Be aware of what's happening on your account

Many traders pay attention specifically to trading tools, ranging from trading strategies to Forex advisors . However, in pursuit of the Grail, stupid and ridiculous mistakes are often made, the price of which becomes a huge part of the trader’s deposit.

For example, many people don’t even think about how important it is to monitor the situation on the account, because they think that the established profits and stop orders will always work.

And if only manual trading is used on the account, such a careless attitude is still excusable, but when advisors and full automation are used, even the slightest failure that arose due to a temporary disconnection can simply lead to dire consequences.

However, not everyone can always be constantly at their monitor in order to track the drawdown on the account.

It is for this purpose that the trading terminal provides Push messages, and with their help you can monitor the situation using Forex advisor scripts.

Binary Option open trade script. Instantly opening binary options trades

In the trading process, it is very important to respond in a timely manner to emerging strategy signals, as well as to open a position in a timely manner so as not to miss a potential piece of profit.

It is especially important to work on the speed of opening transactions for scalpers, as well as traders trading on news, since at the moment a certain economic indicator is released, the market covers enormous distances at lightning speed.

However, if there are many scripts and Forex advisors created on the market that significantly realize this opportunity, then the binary options market can only dream of such opportunities.

Unfortunately, most binary brokers do not use a perfect trading platform, so many use additional terminals, which, of course, is reflected in the speed of opening a transaction.

However, some brokers allow options trading through MT4, but their system for opening a trade is not perfect.

Infopanel. Forex information script for MT4

During the trading process, it is very important to have basic information directly in front of your eyes.

The price of the asset, the size of the spread at the broker , the balance, as well as the profit on open positions, the number of open positions and the banal time until the candle closes - all these small details, one way or another, are used in trading.

However, in the basic functionality of MT4, in order to find out about the same spread for the selected asset, you need to independently subtract prices.

Moreover, if at four-digit quotes this is quite simple, then at five digits it is already difficult, and time is simply wasted when you need to make a decision and conduct active trading.

Also, the function of displaying the time until the candle closes is one of the most important for traders trading binary options, and the platform does not have it at all.

Script for moving stop loss on Forex

One of the biggest problems faced by both beginners and more experienced traders is closing a position prematurely.

Such an approach to the market, in which the trader closes a profitable position at the slightest opportunity, leads to the fact that the ratio of risk to potential profit changes far from the trader’s favor.

The real way to deal with this situation is to use a trailing stop.

However, trailing, which is present in its classic form in the MT4 trading platform, is far from ideal, since at the moment when the price begins to adjust, the position is closed early and profits are not received.

This is why many traders use two-way trailing, the essence of which is to move a stop order following the price at a certain distance from it. If desired, you can automate the process if you use Forex scripts.

For example, one of these tools is the stop loss StopLossMove.

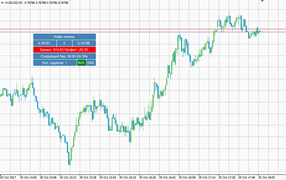

Strategy evaluation script

Any trading trading strategy sooner or later lends itself to better testing on various indicators by the trader.

Profit factor, mathematical expectation, a series of profitable and unprofitable trades, maximum and average drawdown, profit-to-loss ratio, as well as the average profitable and unprofitable trade - all these indicators characterize the strategy and make it clear to the trader, as well as the investor, about its potential.

Actually, in this article you will get acquainted with a special script that in a matter of seconds will evaluate your trading strategy based on the history of your transactions and give it a qualitative assessment.

Tradingsystemrating is a custom script developed for the MT4 trading terminal, the main task of which is to evaluate your trading strategy that is applied on your account.

The script evaluates the strategy to choose from using two methods. The first strategy evaluation technique was described by Van Tharp in the book “Super Trader.

Script advisor Trade Predator

The speed of opening a position plays a vital role for traders who prefer news trading or scalping in sharply moving markets.

However, if the extensions for the MT4 trading platform called “One Click” allow you to quickly open a position, then you have to spend a lot of time installing stop orders and profits.

For a trader whose profit amounts to several points of profit, such a delay is comparable to losses.

And if traders trading a static lot somehow smooth out this situation by quickly opening a deal in one click, then what should a trader who uses a dynamic lot do, risking a certain percentage of risk per position?

The only way to solve the problem is to use assistant programs, and in this article we will use one of them.

Trading statistics with the Iprofit Custom script

Each trader has its own goals, namely someone stops trading to achieve a certain sum of profit, someone upon reaching a certain percentage of the deposit, and someone stops trading after receiving a certain percentage of loss.

One way or another, no matter what strategy a trader uses, the main thing is to have clear goals and limits that allow you not to give in to the animal instinct and the desire to win back or conquer the Forex market.

However, in practice, maintaining such statistics is not easy, since you have to carry out additional calculations or register with special monitoring services on an ongoing basis.

That is why, in order to see all the trading statistics on the account and not resort to third-party services, special information assistant indicators were created.

Volatility script

The volatility of a financial asset is the most underestimated characteristic of the market, due to which many traders fail.

The fact is that volatility displays the range of price movement in points for a certain unit of time.

Thanks to this indicator, each trader will be able to outline for himself certain goals that a particular currency pair can achieve within a day or even a couple of hours.

VolScript volatility script is a special application for traders on the MT4 platform, thanks to which you can find out the current and average volatility in the market.

It is worth noting that, unlike many similar scripts and indicators that determine volatility, VolScript displays its hourly changes, and also provides statistics by day.

Range Bars script. Removing market noise

The difficulty of carrying out technical analysis, as well as using various technical indicators, is that the chart is simply oversaturated with market noise, which makes it quite difficult to assess the current market situation.

This is due to the fact that the charting we are used to, be it candles or bars, is trivially tied to a time interval.

Yes, each new candle appears not because the price has covered a certain distance, but because five or fifteen minutes have ended and even the minimum price shift is recorded on the chart.

That is why, at a time when the price is in a very narrow range, we can observe a series of horizontal candles, which do something that confuses every trader.

Due to the peculiarities of chart construction, indicators following the price can give a lot of false signals, because the tool simply does not understand what is on the market flat.

Script that flips positions

In the process of trading, every trader is faced with a fraudulent market maneuver, when a seemingly clear trend changes its direction in a matter of seconds.

Many traders accept defeat and wait to exit the forex market with a stop order.

But you can also reverse the position, which will make it possible to make a profit from a new trend, and the amount of profit directly depends on how quickly the revolution is made.

The position reversal script Revers is an excellent solution for traders who practice reversing positions. Unlike many analogues, the script automatically remembers the volume and number of previously opened orders and performs a reversal with exactly the same lot.

It is worth noting that this script is a universal tool and performs a one-time action, which does not overload your trading platform.

Indicator for screenshots of Forex transactions

In the process of studying stock exchange literature, almost every book author advises his readers to start their own diary. You've probably wondered more than once why this is necessary, since the entire history of transactions is stored directly in the trading terminal and can be retrieved at any time in the form of a report.

However, it is worth understanding that the diary is not intended to preserve history, but to analyze it. We doubt that any of you, a month later, will be able to say why he opened a deal, what judgments he was guided by and, banally, what mood he was in.

However, it is working on yourself and your mistakes that allows a trader to improve, improve his strategy and methodology for entering the market, identify patterns, and also identify his own vulnerabilities.

However, despite the fact that many agree to this step and start keeping a diary, they often do it incorrectly.

The vast majority of traders, especially the older generation, keep their diary in a regular notebook or notebook, forgetting about the most important object of analysis - the trading chart at the time of transactions. Naturally, it is possible to take a screenshot in the trading terminal, but this takes time and effort, which leads to the trader forgetting to do this.

The best place to take profits is EasyTakeProfit

Many traders pay excessive attention to the entry system of their own strategy, rather than exit points. No matter how strange it may sound, the number of traders changing trading tactics one after another is simply thousands, and in fact there are only a few of those who thought about the reason for losing their deposit.

Often, two banal parameters such as profit level and stop level can radically change statistics forex strategies.

Thus, succumbing to emotions, many beginners set a stop order that is too large, or abandon it altogether. In the first case, with a large stop order, the ratio is violated, which subsequently leads to the drain of the strategy.

In the second case, the absence of a stop order causes the accumulation of a huge loss, which sooner or later will have to be closed.

With the increasing popularity of scalping among many traders, the practice of setting too small a stop order has emerged due to the reluctance to lose a lot in one trade.

Price movement speed script

When analyzing the foreign exchange market, it is necessary to pay attention not only to such characteristics as trend, flat and direction of price movement, but also to its speed in Forex.

This is primarily due to the speed of price movement at a certain moment. So, if you drive news trading, the speed of reaching the stop order and profit will be significantly different than when a transaction is opened with the same goals and risks, but in quiet times.

The price movement speed factor can directly affect the effectiveness of your open trades, because even experienced traders they claim that a deal is considered successful if it goes into profit in the first seconds and does not remain in place.

How to write a script to work on Forex

Modern trading is already quite difficult to imagine without automation, and with today’s level of development of computer technology, not only simple programs, but even artificial intelligence that is capable of self-learning are coming to the stock exchange.

However, if complex programs are affordable only by large hedge funds, banks and other large financial institutions, then simple software solutions such as scripts are affordable even by a student, and in basic cases you can find a script for your tasks completely free of charge.

A script is a program that is designed to perform a one-time action.

For example, if you have come across trading advisors, then you probably know that this program performs certain tasks as long as it is on the chart. The script differs from the advisor in that it is a one-time execution of the command while plotting it on the chart.

Thus, the script can perform the task that the advisor cannot handle. For example, if you want to close only profitable trades from your series of open orders, then when you apply the script to the chart, the program will close only profitable trades once, when the adviser does this constantly.

GrailMeter script - measuring the grailness of your robot

Almost every trader who is actively interested in automated trading and various Forex advisors has encountered the so-called Grails.

Experts who show phenomenal results over a historical period, but in real trading conditions show a completely opposite result, are usually called the “Grail” among exchange players.

As a rule, naive newcomers who are prone to the desire to make quick money fall into the Grail trap.

The situation is quite typical, namely, that a person, having seen phenomenal results in the tester, places an advisor on a real account and, due to increased trust and hope, quickly loses his deposit.

To avoid such situations, professional players always advise testing the Expert Advisor on a demo account before betting it on real money.

GUI-Robot – automatic trading without programming knowledge

The modern realities of stock trading are such that programmed algorithms have almost completely pushed traders away from manual trading.

As a rule, in modern realities, a trader is assigned the function of monitoring and confirming signals, as well as a wizard who will promptly make changes to his pre-programmed algorithm.

However, creating an autonomous algorithm that can duplicate you and your strategy costs quite a lot of money, not to mention the fact that it is quite difficult for a programmer to explain what you want, since he writes programs and has nothing to do with trading on the stock exchange.

Exhausted nerves and wasted money are just a small part of the troubles that you have to face if you yourself do not speak a programming language. Of course, you can spend years learning to code, but there are other ways to go.

Pattern Graphix – advisor for graphical analysis

Today, it is quite difficult to discuss the importance of graphical analysis, since even the most inveterate critic knows that this tool has proven its effectiveness over time.

knows that this tool has proven its effectiveness over time.

However, graphical analysis is a rather complex approach, despite the clear, at first glance, principle of constructing figures.

Do you agree that the head and shoulders in the book look so realistic that you can’t tell it from a real person, but in the market, if you come across something like this once a year, it’s not any luck.

Advisor Assistant ArgoGuardian

The most common disease of traders, due to which dozens, or even hundreds of accounts are lost, is non-compliance with discipline in the field of money management.

discipline in the field of money management.

Moreover, I would like to separately note that no matter whether a trader uses an advisor or trades personally, the error of timely recording profits and losses is common to everyone.

Separately, I would like to touch upon advisors , which for the most part use highly risky money management models such as martingale or averaging, which leads to the immediate loss of all funds.

Those traders who have at least once encountered such robots know that in the event of a strong drawdown, they need to make a tough decision and fix the loss so as not to lose all their money. However, the banal hope that by opening the next order with an inflated lot will lead to the expected resolution of the force majeure situation, the result is a backlash that worsens it.

Page 2 of 4