The best indicators for forex trading strategies.

The rapid development of exchange trading through various trading terminals has opened up new horizons for the creation of various indicators. While previously a trader's toolkit consisted of no more than 20 indicators included in the terminal by default, hundreds can now be found online.

for the creation of various indicators. While previously a trader's toolkit consisted of no more than 20 indicators included in the terminal by default, hundreds can now be found online.

After visiting various stock market websites, you'll see for yourself that there are truly a huge number of indicators, and it's difficult to prioritize from this wide selection.

Our website is no exception, so we've decided to compile a simple ranking of the best indicators, all of which are free to download.

Each instrument described is intended for trading according to a specific trading strategy.

Indicator for options

Options trading is a relatively new innovation. As you can imagine, anything new is usually a continuation or improvement of something old.

is usually a continuation or improvement of something old.

Binary options trading is very similar to trading on the Forex market or the stock exchange, as it is based on the asset price, which remains constant regardless of which exchange you trade on.

But, unfortunately, many newbies, deceived by advertising, often treat options as a simple game of guessing high or low, and do not even suspect that options themselves can only bring in money in the hands of a professional.

Almost everyone who begins to delve into options faces the problem of which instrument to use for market entry. The vast majority of brokers don't offer a modern trading platform, and beginners typically see a bare chart and two up or down buttons.

Trendwave indicator

Trendwave is a unique development by a foreign trader, which is an oscillator indicator based on overbought and oversold zones.

an oscillator indicator based on overbought and oversold zones.

Just a year ago, this indicator was impossible to find freely available, as its author was selling it on various trading platforms for a rather large sum.

Of course, as is usually the case in trading, sooner or later everything paid for becomes free, since it only takes one dissatisfied person for this miracle to become freely available.

Scalper MA indicator – scalping available to everyone.

Your success in forex trading depends largely on choosing the right tactics. Scalping is the most popular method due to its high profitability and speed of achieving results. However, applying these skills to a fast-moving, volatile instrument is not always easy, despite the various strategies widely circulated online.

profitability and speed of achieving results. However, applying these skills to a fast-moving, volatile instrument is not always easy, despite the various strategies widely circulated online.

Almost all novice traders try to scalp, chasing quick profits, without even understanding what drives the price or how it reacts to various economic and political indicators.

Even professionals try to avoid scalping , as its entire essence is based on profiting from market noise rather than trading in line with global trends. Market noise movements are quite difficult to predict based on fundamental indicators, so technical indicators are indispensable tools, and it's hard to imagine a scalper without them.

Trend Magic Indicator – A Trend Guide

Many beginners often face the problem of identifying a global trend. Almost all traders focus on local price movements, mistaking pullbacks for a new trend and vice versa.

Almost all traders focus on local price movements, mistaking pullbacks for a new trend and vice versa.

As a rule, entering against the market always backfires on us all, because, as many psychologists say, “You can’t fight the crowd.”.

Indeed, there are various tools such as trend lines or channels, but often the market diverges so much in different directions that constructing any figures simply does not give us objective information.

The Trend Magic indicator is a trend indicator whose main task is to show the direction of the trend.

Parabolic SAR indicator

Most traders often find themselves in a situation where they don't know where to exit the market or place a stop loss. While entering a position correctly is certainly a good idea, exiting it correctly without doing so too early, or as they say, when it's too late (a new reversal takes away all the profit), is one of the most difficult challenges every trader faces.

entering a position correctly is certainly a good idea, exiting it correctly without doing so too early, or as they say, when it's too late (a new reversal takes away all the profit), is one of the most difficult challenges every trader faces.

Welles Wilder once faced this same challenge, and his solution resulted in his new Parabolic SAR indicator. The indicator was introduced to traders in 1976 in the author's new book, "New Concepts in Technical Trading Systems.".

At that time, this book became a real boom in the trading industry, so most beginners start their journey with it.

If you translate the abbreviation SAR literally, you can understand the whole essence of the indicator, since its translation sounds like this: “Stop and Reverse”.

Indreverse indicator.

A signal indicator that alerts you to a market reversal using multicolored arrows. It allows you to anticipate an impending price reversal and close existing positions.

price reversal and close existing positions.

This is another attempt by the script's author to predict the upcoming trend. A review of the signal history shows that over 60% of the signals have been accurate.

This rather poor performance precludes recommending the Indreverse indicator as a signal provider for opening new positions. To verify signals, it is recommended to use an additional filter.

This could be another technical analysis indicator that also analyzes the trend and estimates the likelihood of a reversal.

Tick indicator.

Most traders are accustomed to the fact that the minimum timeframe on a Forex chart is M1, but even within one minute, the price undergoes a significant amount of movement, which is called a tick.

undergoes a significant amount of movement, which is called a tick.

A tick is a price change, the distance between two subsequent quotes, making it the smallest unit of measurement for the price of a currency pair.

The tick indicator allows you to display a tick chart in the standard trader's terminal, clearly showing even the slightest price changes.

It's only practical to use the indicator on a one-minute time frame; on longer timeframes, the tick curve simply becomes a nearly straight line and offers no useful information.

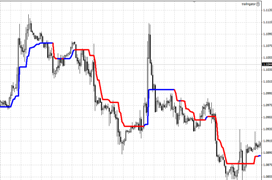

VininI LRMA color (reversal indicator).

An interesting indicator option that will warn you about trend reversals and the start of a new trend, allowing you to close old trades without losses and open new ones at the most advantageous moment.

old trades without losses and open new ones at the most advantageous moment.

The reversal indicator alerts the trader by simply changing the color of the trend line. If you analyze the history, the signals are quite accurate.

The tool can be used equally effectively for both market entry and timely closing of existing positions, and it has no restrictions on currency pairs or trading timeframes.

VininI LRMA color works as follows: after adding it to the trader's terminal , a curved line appears on the chart that follows the trend, but:

Improved Stochastic.

It's hard to find a trader who isn't familiar with the Stochastic Oscillator. This technical analysis tool is built into every MetaTrader terminal and is quite effective.

every MetaTrader terminal and is quite effective.

Stochastic works by using overbought and oversold levels, which are formed by supply and demand.

Overall, the tool is quite good, but it can be improved if desired.

This improved Stochastic is an attempt to make the familiar script more efficient.

Indicator - Fractal Price.

Trading using fractals has long been one of the most popular strategies, but not everyone can easily spot this pattern on a currency chart. Therefore, a specialized indicator can be used to solve this problem.

pattern on a currency chart. Therefore, a specialized indicator can be used to solve this problem.

One such indicator is the Bill Williams Indicator, also known as the Fractals Price Indicator.

As its name suggests, Fractals_Price displays the most important fractal price levels on the chart of the selected currency pair.

It is installed using a standard template and requires no additional configuration; you can only change the text colors.

Japanese candlestick indicator.

Japanese candlestick trading is often used in Forex; a new candlestick pattern can confirm a current trend or warn of an impending reversal. However, constantly monitoring a currency pair's chart can be tedious; a specialized indicator can make the process easier.

trend or warn of an impending reversal. However, constantly monitoring a currency pair's chart can be tedious; a specialized indicator can make the process easier.

The Japanese Candlestick Indicator uses multicolored shapes to alert traders to the emergence of a new candlestick pattern, significantly simplifying trading.

All indicator parameters are set by default; the user can only change the displayed bar interval; the default setting is 1000.

DC signals indicator.

Finding entry points into the market has always been the primary task of any trader; it is, in fact, half of a successful trade. There are many options for solving this problem, but the easiest way to do this is with a special indicator.

There are many options for solving this problem, but the easiest way to do this is with a special indicator.

The DC signals indicator is a script for finding market entry points. It analyzes the current trend over a specified timeframe and generates a signal to open a trade, indicating its direction.

All you need to do is download and install it on your chart, then monitor for signals. The indicator operates according to the following principle and has the following settings.

iVAR indicator.

The iVAR indicator is easy to use and quite effective in its operation, allowing you to assess the strength of a current trend.

of a current trend.

The iVAR indicator automatically switches and recalculates the trend strength over the selected timeframe, allowing you to optimize your trading and find the most favorable market entry points.

The tool can also be used as a source of exit signals, warning you in advance of a major pullback or trend reversal.

The script's operation is based on fractal analysis; this is the secret to its effectiveness and versatility; it can be used on any time frame and for any currency pair.

Heiken ashi indicator.

One of the most well-known indicators used with Japanese candlestick charts, it's used for visual trend analysis. According to its authors, it creates a more realistic picture of the existing trend.

visual trend analysis. According to its authors, it creates a more realistic picture of the existing trend.

The main advantage of this tool over standard candlesticks is that it operates with a slight delay, analyzing the received data and displaying the results on the currency pair chart . While it's not a leading indicator, it does provide a realistic assessment of the trend.

The Heiken Ashi indicator operates on a fairly simple principle, using the average price of the previous candlestick to filter out sharp price jumps and make the movement cleaner.

Indicator for determining the trend.

The indicator combines two functions: measuring the strength of an existing trend and forecasting it short-term. This means you can not only assess the strength of the current trend but also see the expected continuation of the trend line.

can not only assess the strength of the current trend but also see the expected continuation of the trend line.

The trend indicator is based on the popular Moving Average , meaning its calculations utilize the same Moving Average, a proven tool for analyzing historical price data.

After you add the indicator to the desired chart, two lines will appear:

The best trend indicator.

There are many different trend indicators, each of them good in its own way, but basically they all just show the current trend.

show the current trend.

The best trend indicator doesn't simply display the current situation but also attempts to extend the trend line several bars into the future, providing a short-term forecast, so to speak. This is done based on the historical exchange rate movements over a given time frame.

The script's operation is based on Wave Theory and statistical data on the most important highs and lows over the selected time period.

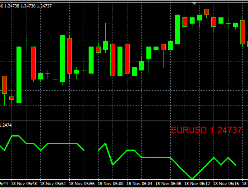

Trend direction indicator.

Continuing with the topic of trend indicators, we present to you another tool that allows you to determine the current trend direction in Forex or another financial market.

trend direction in Forex or another financial market.

The trend direction indicator analyzes historical price values and continuously monitors their changes, allowing you to quickly display signals on the trading terminal chart indicating the likelihood of a trend reversal.

The script combines ease of use with relatively high efficiency, making it suitable for trading even for inexperienced traders.

Immediately after installation and launch, the trend direction indicator will appear in a separate window below the currency pair chart. Its operation is conveyed by two horizontal curves, one red and one green.

Trend strength indicator.

When opening a new trade, every trader wants to know how long the existing trend will last and whether it will reverse immediately after the order is placed.

it will reverse immediately after the order is placed.

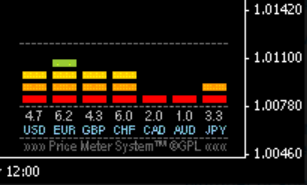

The trend strength indicator provides a way to determine this; it shows how actively a given currency is being bought and sold.

Unfortunately, the indicator displays information specifically for currencies, not currency pairs, so traders must draw their own conclusions about the trading instrument.

“Trend all period” indicator.

The name of this indicator speaks for itself: it is designed to simultaneously determine the trend on all periods.

Needless to say, this approach provides a more complete picture of the market situation.

The "Trend for All Periods" indicator is one of the best trend-tracking tools that requires no additional configuration.

Elder indicator.

This indicator is often called "Bulls-Bears", since its main task is to identify a change in trend.

The Elder indicator signals trend changes and evaluates their strength, allowing traders to anticipate market reversals in advance.

It's a fairly advanced tool with simple settings and excellent visual display of the data.

The indicator can be classified as an oscillator, as it attempts to slightly anticipate the market and warn traders of upcoming changes.