The best software for Forex and stock market trading

A selection of Forex programs that will help make your trading more convenient and profitable. Almost all scripts are free and easily installed on any version of Windows.

Forex programs include advisor and indicator designers, non-standard trading platforms, programs for forex market analysis, and calculators for calculating important indicators.

Tetris Indicator: Have a good time without breaking your schedule

Forex trading, despite the beautiful slogans about financial independence, is full of routine work that must be done day after day.

The vast majority of day traders or scalpers spend virtually every minute staring at their charts, spending days in front of their monitors.

Of course, in rare cases, an audio alert can save them from this drudgery, but experience shows that strategies with this feature are few and far between.

To provide some distraction during the endless boredom of waiting, the Tetris indicator was created.

The Tetris indicator is an auxiliary and entertaining program for the MT4 trading terminal that allows you to play this well-known game, created back in the Soviet Union, directly within the MT4 trading terminal.

It's worth noting that the game doesn't interfere with your trading process in any way; in fact, you can play it even on a day off and there's no market movement.

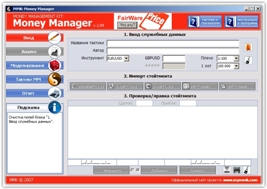

Money manager program

Finding optimal capital management models and analyzing your own trading tactics are ongoing, routine work that is necessary to identify weaknesses in your trading strategy and work on correcting mistakes.

identify weaknesses in your trading strategy and work on correcting mistakes.

Yes, it's true that working on your own mistakes allows you to discover many nuances in your work that you and I never notice, but it's precisely these small flaws that can radically distort our trading results.

Many people don't even realize that by analyzing their report at the end of the week with a cool head, they can, without any additional knowledge, find out why a trade didn't work out, what the consequences of a breach of discipline were, and understand, in general, whether a trading strategy is capable of delivering consistent results.

A money manager eliminates the need for time-consuming self-analysis by modeling our trading strategy, displaying and analyzing our trades. Suitable for both Forex and stock markets, it displays balance changes and provides recommendations for better capital management.

Lacus TstopandBE. An MT5 assistant that's hard to imagine a scalper without

Intraday trading requires a trader to act quickly, as it is necessary not only to quickly open a trade, but also to place a stop order or use a trailing stop .

Scalpers, in particular, face particular difficulties when working with orders, as positions are sometimes held for less than a minute, and during this short period of time, money management must be kept in mind. Grid

traders also face challenges, as locking in profits requires simultaneously closing a series of orders, a process that takes a significant amount of time manually.

This is why professional traders use auxiliary Forex programs—expert advisors—to automate the entire routine trading process.

System Creator. Automatic robot generation

Automating trading strategies is the only path to progress. When the market became hyper-liquid and robots entered the trading arena, it became very difficult for ordinary people to compete with machines.

Naturally, automation and progress have made the market more unpredictable, and it is becoming increasingly difficult for traders to profit from specific algorithms year after year.

Constant variability and cyclicality makes any Forex strategy and the advisor are fickle, so any trader is in a constant state of searching for a working algorithm.

Creating strategies on a regular basis isn't easy, so special programs come to the rescue, allowing you to generate robots automatically and without programming knowledge.

Forex informer programs - Insider Indicator

It's no secret that the market is driven by the crowd, or, more simply, the overwhelming majority of players. Traders are conventionally divided into bulls and bears, and pricing occurs based on the principle of balancing the scales: when bullish orders outnumber bears, the market rises, and when bearish orders outnumber bulls, the forex market declines.

This arbitrary division perfectly captures the internal processes that occur during pricing, but does this model really work today?

After all these years, does the simple principle of "whoever has the most wins" really work in the age of modern technology?

Based on this hypothesis, a person who knows the number of applications and their direction could become a millionaire in a matter of days.

Trainyourself EA: A Simple Manual Strategy Tester

Testing trading strategies allows traders to explore many nuances, experience various trading situations, understand the underlying mechanics, and, most importantly, develop an action plan.

Forex testing programs also allow you to understand the effectiveness of a chosen strategy and simulate its profitability and drawdown in the future.

However, while MT4 developers have created a robust tester for trading advisors, testing a manual strategy with the same speed using standard software is not possible.

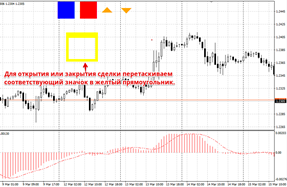

In this article, you'll learn about one such simple manual strategy tester. Trainyourself EA is an auxiliary tester that allows you to backtest manual trading strategies in visual mode by dragging and dropping graphical objects on the chart.

It's worth noting that Trainyourself EA also has an additional feature: it allows you to automatically draw trend lines on the chart.

Trading simulator

In any professional field, what distinguishes a beginner from a professional is the presence of experience, which allows them to apply acquired theoretical knowledge in real life.

Due to the nature of the trader's profession, gaining experience is always proportional to the amount of money lost, since the learning process is ultimately tied to trading real money.

However, online trading allows you to quickly overcome the learning process and evaluate your capabilities for free, and special historical testing simulators help us do this.

A trading simulator is a specialized Forex advisor program that allows you to test your own developments and strategies against historical data.

A notable feature of this simulator is the ability to test and hone your skills against historical data at an accelerated pace.

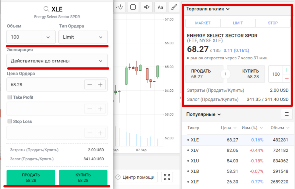

R Trader Platform. A web terminal with revolutionary features

Trading on the stock exchange often requires a trader to be very passionate about the process, constantly monitoring the market, and keeping an eye on the situation around the trader's existing trades.

It so happens that successful trades, those that truly bring profit, are very rare. Therefore, no matter how much a trader might want to free themselves from the constant routine, they still need to be in the market.

Until recently, proper trading could only be accomplished on desktop platforms that were tied to a single workstation.

However, the development of internet technologies and the emergence of new gadgets have made it possible for traders to become more independent and break away from the desk.

However, most mobile and web-based versions of these platforms are only suitable for tracking open positions, as the technical analysis functionality of such Forex programs is poor and very limited.

Forex Tester 3: A Quick Start to Trader Development

One of the biggest myths that brokerage is the claim that becoming a trader is very easy, and that minimal training is enough to achieve success.

However, after entering the market, even after being infused with theoretical knowledge, it dawns on you that things aren't so simple, and in most cases, this happens after a large sum of money has been lost.

Yes, to become a successful trader, you need to gain real-world trading experience, as practical experience is crucial in any profession.

Of course, you can spend years trying to trade independently and acquire skills, as was done decades ago in the computer age.

However, you can significantly accelerate the development process, and Forex Tester 3, a special program, can help you with this

. Forex Tester 3 is the latest version of the renowned Forex program, which allows traders to quickly backtest strategies , indicators, or ideas in a mode similar to real-time trading.

PIAdviser Analyzer Advisor

To become a successful trader in the Forex, stock, or cryptocurrency markets, a trader must have a sufficient deposit, knowledge, and, most importantly, experience.

Many beginners tend to believe that the biggest challenge is the deposit size , citing a very small account size as the reason for all their failures.

However, the reality is that while theoretical knowledge and the required deposit size can be remedied, practical experience and the ability to apply this knowledge to the exchange are far from universal.

Experience ultimately comes at a cost, as traders either progress from novice to professional over many years, constantly losing money while learning from their mistakes, or they pay professionals to train them for the necessary experience.

However, there is another option: using specialized Forex analysis programs that provide comprehensive analysis and signals based on their built-in technical algorithm. We will explore one such advisor in this article.

Umstel Trading Platform (Stocks)

Today, traders have access to a wide range of trading platforms, making trading convenient not only for conducting transactions, but also for conducting in-depth technical and fundamental analysis.

In the forex market, the MT4 and MT5 trading platforms are considered the flagships, allowing traders to trade directly through the program on their PC, tablet, or smartphone.

Web versions of these programs are particularly popular, as traders don't need to be tied to a desktop or specific software.

However, despite the web versions being very convenient from a practical standpoint, they have one major drawback: the lack of automated trading and a tester.

Page 2 of 6