The best software for Forex and stock market trading

A selection of Forex programs that will help make your trading more convenient and profitable. Almost all scripts are free and easily installed on any version of Windows.

Forex programs include advisor and indicator designers, non-standard trading platforms, programs for forex market analysis, and calculators for calculating important indicators.

VR Watchlist and Linker – a forex assistant program for multi-currency trading

Before starting trading, any professional trader conducts a market review and then selects suitable assets to trade at that moment.

The fact is that there are over a hundred different trading assets available for contract trading, ranging from currency pairs and crosses to all kinds of CFDs on stocks, commodities, indices, and more.

However, it's important to understand that not all instruments are suitable for trading, as many of them simply lack market activity.

Naturally, the lack of major players means that prices can move no more than 20-50 pips per day, making it difficult for even scalpers to profit under these conditions.

This is why selecting volatile pairs is a necessary preparatory step before starting trading.

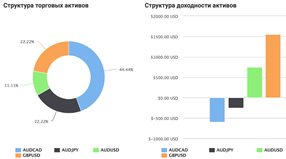

Make your trading more efficient with a trading analyzer

Many traders change trading strategies, indicators, and programs every day after suffering a loss in Forex.

For some, this search for a truly working algorithm can take years. However, as practice shows, not a single trader who daily puts their next trading strategy in a black box has conducted a comprehensive analysis of their own trading.

In fact, every professional knows that the devil, as always, is in the details, which few realize.

For example, the same Forex strategy can show completely different results on different currency pairs and even at different times of day.

Naturally, to understand the strengths and weaknesses of a strategy, it is necessary to conduct many hours of painstaking analysis.

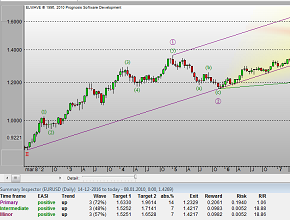

Identifying Elliott Waves with ELWAVE

A market pattern that almost all traders notice over time is that price movements create a wave-like structure.

Almost every strong movement is followed by a pullback, and after every pullback of the trend and market wave, another renewal of highs and lows begins.

Naturally, this obvious pattern of price movement in any financial market simply could not remain unexplored.

The pioneer who was able to structure all the observations turned out to be the famous financier Ralph Nelson Elliott, thanks to whom the world was able to learn about the wave theory and the practice of its application.

It's worth noting that the theoretical part of wave theory is very easy to understand even for beginners, since in books, waves are depicted as ideal curved lines.

Metatrader Indicator Generator

When creating their own trading strategy, any trader faces enormous difficulties in selecting such important elements as indicators.

To date, progress in the field technical analysis has advanced so much that the number of indicators is measured in hundreds, if not thousands.

Naturally, it's quite easy to get lost in such a huge selection, because in practice, no one except the authors themselves knows for what purposes these tools were created, what formula they are based on, and what the initial data for their construction is.

Of course, if you understand programming, you can easily determine what is behind a particular arrow on a chart, but if you do not have such knowledge, you need to be prepared for the fact that the arrow can disappear at any moment.

That's why it's often easier to create your own trading indicator, and a special Metatrader indicator generator can help you with this.

The Metatrader indicator generator is a specialized program that allows you to generate technical indicators based on digital filtering using two different methods.

Technical Analysis with Fibonacci Trader

For day-to-day trading on the exchange, a trader must have an effective trading platform, or more precisely, a professional trading environment that contains a wide range of functional capabilities.

The fact is that markets change daily, while the platforms familiar to traders are updated extremely rarely, not to mention that in many cases the functionality of the programs is morally outdated.

Naturally, a trader must be able to adapt to changing conditions, but to do this effectively, they need a wide range of tools that would allow them to conduct technical analysis.

That's why using specialized programs that expand the functionality of basic trading platforms is an integral part of any professional's trading routine.

The Fibonacci Trader program is a professional platform for conducting technical market analysis, both in real time and on historical periods.

It's worth noting that the platform will primarily be useful to traders who practice using Fibonacci tools and technical indicators in their trading.

An example of creating an advisor in the designer

Today, automating the Forex trading process is not just a whim, as it once was, but a vital necessity.

Creating an advisor is the best solution to a person's corrupted discipline, absent-mindedness and greed.

Many people avoid automating their systems because they believe that they need to know a programming language or pay a huge amount of money to a programmer to implement their own ideas.

In fact, traders who know programming languages have long since prepared solutions for people like you and me and created special advisor builders.

Thanks to them, you can realize almost any of your ideas.

Advisor Builder – Ensed Cor

Modern trading conditions make it possible to significantly simplify and automate the Forex trading process.

The emergence of various exchange terminals, and especially the series Meta Trader It allowed us not only to conduct trade via the Internet, but also to create our own software products, including full automation of trading by creating robots.

However, implementing one's own ideas requires a trader to either have programming knowledge or a large wallet to pay for the services of programmers.

Naturally, this couldn't continue for long, so special advisor builders were created, allowing you to create your own trading robots.

ForexClock program

It's no secret that the activity of certain assets is typically timed to coincide with a specific trading session, or more precisely, the opening and closing of various exchanges around the world.

Thus, the dollar and euro exhibit increased trading activity during the European and American trading sessions , while they enter a narrow sideways range during the Asian session. As for the yen, currency pairs involving this currency are active during the Asian trading session.

Almost all traders know about the pattern of increased activity during the opening hours of certain exchanges, but few apply this knowledge in practice. This is due to a simple lack of knowledge of the opening times of certain exchanges, as well as an incorrect comparison of their own time zone with the exchange's time zone.

Knowledge of the activity of a particular exchange allows traders to determine precise market exit targets, since if the activity of a currency pair directly depends on the trading session and the exchanges where trading occurs, it is possible to clearly identify moments when asset activity fades.

Optimal F forex risk management software

There are many different capital management models, but as practice shows, most of them are not used by traders, and either a static lot or a certain percentage of the deposit is used per position.

money management

method , in which a trader uses either a certain portion of the deposit or a certain percentage per trade—which are essentially the same thing—can actually lead to the loss of your deposit.

This may come as a shock to many, but the common rule of risking 2 percent of the deposit or $100 per trade has led to the loss of millions of traders.

Unfortunately, most traders, when choosing a particular capital model, don't even consider whether it's right for them, but use it simply because it's required or because most books say so.

Market Entry Calculator 1.1

If we consider traders and their actions when opening positions, then almost all of them can be divided into two conditional groups.

The first group of traders almost never think before opening a position. They see a signal and execute the trade immediately, only then calculating their profit or loss.

These traders never calculate the value of a pip or consider every minute detail.

Naturally, this category of traders, at best, operates with a static lot, but sooner or later, in the heat of the moment, they enter a position with an excessively large lot and lose almost their entire deposit.

The second group of traders, also known as professionals, always knows in advance how much they can lose or gain from a position, calculate everything down to the last detail, and practice strict money management.

TraderStar Program

The profession of a trader involves working with a huge volume of analytical and financial data, which is used to make trading decisions.

Typically, this material is found using various programs and applications. The more tasks a trader faces, the more applications and information sources they must utilize.

For example, as a trader, conducting technical market analysis, you might be looking directly at the trading terminal while simultaneously browsing a number of news sources,

as well as online quotes for important indices, which simply aren't available due to the specifics of your broker and the markets you trade.

Page 3 of 6