Useful Forex articles about trading

In this section, you'll find over a hundred Forex articles dedicated to trading on the Forex currency exchange, as well as trading in other financial markets. These Forex articles will be useful for both beginner traders and those already familiar with this activity.

Why women are more successful in trading.

In any profession, there are people who quickly reach the pinnacle of their skills and those who struggle for years.

Trading is no exception: some newcomers manage millions of dollars within a year, while others spend decades losing money.

But beyond the fact that stock trading requires a certain personality, it's also worth noting that gender plays a significant role.

Statistics show that approximately 70% of women who decide to pursue a career in the stock market achieve success, while men's results are significantly less impressive.

Why has this situation arisen? Men tend to be more logical and reflective, while women are more emotional and often rely on intuition.

How realistic is it for a beginner to make money on Forex?

If you believe the advertising, anyone can make money on Forex; all you need to do is open and fund an account with one of the brokerage companies.

The broker will then quickly and freely teach you how to open trades on the trading platform, and its managers will advise you on what to buy or sell to make a profit.

But if everything were so simple and easy, broker websites wouldn't be full of warnings like "Trading on foreign exchange markets using leverage carries high risks.".

At the same time, we all know the stories of people like George Soros, Larry Williams, Warren Buffett, and many other successful financiers. They were able to make fabulous fortunes by playing the stock market.

But before jumping to conclusions, it's worth taking a closer look at the biographies of these traders - http://time-forex.com/treyder . And find out how long it took them to achieve success.

How to make money on Alpari

Lately, more and more people are interested in making money on Forex; online trading has been around for about 20 years. Moreover, Forex's popularity has only grown over its existence, indicating that making money is indeed possible, and that accusations from losers are simply the dissatisfaction of unqualified traders.

Moreover, Forex's popularity has only grown over its existence, indicating that making money is indeed possible, and that accusations from losers are simply the dissatisfaction of unqualified traders.

One of the most common questions I hear from beginners is: Who is the best place to start making money?

- What is the Alpari broker?.

- Why Alpari?.

- How to make money on Alpari.

Alpari has been a prominent presence in the financial markets since 1998, and was one of the first to offer trading services to ordinary citizens.

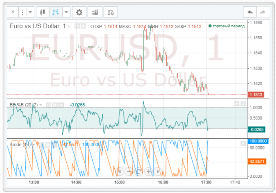

Trend reversals depending on trading sessions.

It's rare forex traders to associate a trading session with a trend reversal and the disruption it brings.

But in reality, the forex market is no less tied to fundamental news than the stock market, and these events can have just as strong an impact on exchange rates as they do on stock prices.

Therefore, it's possible to observe how a significant event changes the exchange rate of a given currency pair, with a clear correlation between currency pairs and the sessions in which the reversal occurs.

Trend reversals most often occur during sessions that coincide with the business hours of banks and government agencies in the countries that issue the currency.

For example, changes in the dollar exchange rate most often occur during the US session, while the Japanese yen exchange rate most often changes during the Asian trading session.

This is not to say that these currencies are not influenced by news at other times of the day, but during sessions that coincide with working hours in the US and Japan, this influence will be stronger.

Forex myths and reality.

Forex is an over-the-counter interbank currency market where, thanks to rapid technological advances, anyone can make money.

There's a myth that a degree in economics is required to achieve stable profits in Forex.

While this is partly true, a university degree isn't necessary.

All the necessary knowledge can be acquired online or through paid, or sometimes free, training at a brokerage firm.

You can also study on your own; at the moment, a lot of useful information is posted on specialized Forex websites.

It is important to pay attention to:

- principles of fundamental analytics;

- methods of technical analysis of price charts;

- study the functionality of indicators to confirm the accuracy of the forecast.

On specialized websites, you can find numerous "profitable" strategies that supposedly guarantee monthly profits of 100%.

Using Stock Indices in Forex Trading

Fundamental analysis of the currency market is effective for long- and medium-term trading.

Such analysis involves more than just an overview of macroeconomic factors. News reports don't always reflect reality.

There are more effective methods for forecasting currency pair prices, particularly stock indices.

The relationship between the currency and stock markets:

Forex brokers' liquidity providers are large investment companies or commercial banks.

The best exchanges for trading cryptocurrencies

The gold rush remembered from textbooks and historical accounts has once again engulfed the entire public, which is eager to earn money and move forward on the wave of trends.

However, while people once traveled to distant lands in search of precious gold, now everyone is buying up cryptocurrencies en masse, trying to profit from the enormous rise in the exchange rate of new currencies.

Just think: whether a housewife or an IT specialist, a trader or a businessman, or even a working person, everyone has heard about the record growth of Bitcoin, Ethereum, and other new currencies on every news channel.

Bloggers, media outlets, information and educational sites are all discussing the new topic of cryptocurrencies, and the entire internet is simply overflowing with advertisements offering to invest in this or that project.

However, when a potential investor decides to invest in a new, unfamiliar field, the most important question arises: how to participate in the trading, where are the exchanges located, and how can they become involved?

Stocks or currencies, the choice is based on the trader's personality.

When deciding to pursue a career as a trader, most beginners are faced with a choice between stocks or currencies, the stock exchange or the forex market.

It would seem that there is no significant difference between which instruments are traded in the MetaTrader terminal: the orders are the same, the indicators are the same, and often the brokers are the same.

But if you analyze both types of trading, you can find a lot of differences that influence the choice of one asset or another.

1. Leverage – when trading currencies, it's typically several times, sometimes hundreds of times, higher. This means that profitability and risk in Forex are also proportional to leverage. While leverage of more than 1:5 is rare in stock trading, currencies are often traded with leverage as high as 1:100.

Risk-Free Stock Trading. Binary Options Loss Reimbursement

Speculative trading always involves risks, whether it is trading on the forex market or binary options.

Naturally, anyone entering these markets is fully aware that, in addition to the desired profits, a trader may also face massive losses.

However, during the learning process, beginners in most cases hone their skills on demo accounts, without risking a penny from their pocket.

As a result, a trader can demonstrate high profitability on demo accounts and develop a profitable strategy, but as soon as they switch to a real account, that same unexpected loss of deposit occurs.

There are several ways for the vast majority of traders to minimize risks when trading binary options: by forgetting about turbo options and opting for longer-term trades, or by using various promotions.

Demo options trading

Every trader undergoes training and tests their acquired skills, developments, and strategies. It is for this purpose that brokers have introduced demo accounts, allowing traders to gain all the necessary skills without risk.

Demo accounts have never been a problem in the Forex market, as no matter which terminal you downloaded, even on the developer's official website, opening a demo account took literally one minute.

Unfortunately, with binary options, demo accounts are a completely different story. Firstly, many specialized binary options brokers offer a dummy demo account, where no matter where a trader opens a trade, they'll always make a profit.

Secondly, brokers require full registration and authorization, and some unique companies require not only a real account, but also a certain amount on deposit.

Trading against the market.

Most recommendations advise trading with the trend; trend-following strategies are considered less risky and more profitable.

But there is also a category of traders who prefer to trade contrary to the existing trend, and such trading in most cases turns out to be more profitable than the classic one trading.

The reason for this situation is that when you open a trade following a trend, you very rarely enter the market at the best price. In most cases, you're already too late and caught in the middle of the trend.

By opening a trade against the trend, the investor expects a quick reversal, and if their expectations are met, the order is opened in the best place.

The cyclical nature of the Forex market and the patterns of fluctuations.

Most traders think that making money on Forex is only possible using technical and fundamental analysis, but experience shows that these research methods can be used without them.

It is quite difficult to find a currency that has moved in only one direction throughout its existence; most world currencies rise or fall in price with a certain cyclicality.

Typically, the price movement of a currency pair occurs within a certain price channel, which determines the minimum and maximum price levels.

The boundaries of a price channel are determined by government monetary policy and the influence of economic factors. However, for a trader, it's not about studying the factors themselves, but rather about identifying the existing boundaries.

Indicator redrawing and how to choose an indicator without redrawing

When trading on the stock exchange using technical analysis, and especially indicator strategies, every trader has at least once encountered the phenomenon of indicator redrawing.

This phenomenon, or more accurately, technical feature, has harmed thousands of traders, as after believing in the strategy's algorithm and opening a trade based on a signal, the signal instantly disappears, as if it never existed.

However, if the trend continues and the signal works, no such disappearance is observed on the chart.

Most interestingly, these tools instill enormous confidence in traders that they have finally found the Holy Grail, as such indicators appear flawless in historical data.

However, using such algorithms can lead to the loss of a deposit, and their main drawback is the inability to conduct a more detailed analysis of the trade, as negative signals received are not saved in the historical data.

Cryptocurrency Correlation: A Method of Determination

Cryptocurrencies are represented by a huge number of digital currencies, which have both similarities and radical differences from each other.

However, the enormous excitement caused by the daily introduction of new electronic money into all areas of the economy, and especially the banking sector, has led to enormous demand and, as a consequence, to incredible rates of exchange rate growth.

Now, not only forward-thinking investors are actively investing in this area, but also ordinary citizens, who can see daily that Bitcoin has reached another new high and is once again rising in price.

However, investing is a rather complex science, so it is very important to structure your portfolio in such a way that in the event of sudden market changes, you do not lose everything you have accumulated through hard work.

Brokers who are no longer with us

Stability in global financial markets, as well as macroeconomic stability in most post-Soviet countries, are providing a huge boost to business development.

Every month, more and more new companies enter the financial brokerage services market, and leading brokers are constantly improving their trading conditions.

However, the quiet and calm atmosphere in the brokerage industry only reduces traders' vigilance, leading to newcomers depositing their funds into companies without any doubt about their solvency.

In this article, we wanted to remind you of the biggest broker bankruptcies that occurred just a few years ago, so you can avoid making the same mistakes that happened to thousands of traders recently.

Forex scams

It's worth noting that the fraudulent technology itself is clearly visible and right under the trader's nose. However, behind the clever terminology, many people can't figure out how the broker operates and how they can actually make money off of you.

In this article you will learn about classic work schemes Forex brokers, as well as methods of deceiving traders in the Forex market.

How black brokers operate

Kitchen LayoutThe most common deception scheme used by most dealing centers, which traders call "The Kitchen," is that all trades made by traders are not actually sent to the market and are nothing more than virtual transactions within the company.

Jesse Livermore's Timeless Trading Rules.

For those traders accustomed to trading using various scripts, it is simply unimaginable that it is possible to do without them.

It should be noted that there are many examples in the history of trading where huge profits were achieved not only without technical analysis indicators, but also without using a trader's terminal.

An example is the legendary trader Jesse Livermore, which traded on the stock exchange back in the early twentieth century.

Moreover, he traded quite successfully, his best performance being earnings of 3 million dollars in one day.

Like many successful people, Jesse Livermore willingly shared his secrets with others, some of which were included in the book "The Life and Death of the Greatest Stock Speculator" http://time-forex.com/knigi/gizn-biga-spekulant

Trading: Why it's important to control your actions, not your emotions.

Success in the Forex market doesn't depend solely on the system or strategy you use; it largely depends on your mindset and how you react to market changes.

There are now countless market analyses and hundreds of opinions available online. Hundreds of websites will tell you how the market will behave next, and they'll convince you that their trading strategy is the most profitable.

Being knowledgeable doesn't necessarily mean being a successful trader. While the information you gain is crucial for market analysis and decision-making, achieving success requires much more.

Having studied and absorbed all the relevant information, a trader seeks to apply it in practice. Typically, mastering something new is accompanied by a mixture of excitement and fear. In the best-case scenario, the trader makes several successful trades and gains greater confidence.

This result will encourage you to place more trades and perhaps serve as the basis for more aggressive trading tactics... However, you will quickly understand why over 90% of traders fail.

What is futures expiration?

The creation of futures contracts revolutionized the exchange. Their original purpose was to create a completely new financial relationship between buyer and seller.

A futures contract allowed entrepreneurs to negotiate future deliveries of products at a pre-determined price by a specific date.

This innovation on the commodity exchange made the relationship between the parties transparent, while the exchange simultaneously acted as a guarantor of contract execution.

Naturally, over time and with the active development of the exchange, so-called cash-settled futures emerged in parallel with the delivery futures (which are still present on the commodity exchange).

The primary purpose of these contracts is speculative trading and hedging risks associated with the underlying asset. However, the only thing these two different types of contracts still have in common is the expiration of futures.

How to choose an options broker

Choosing a broker is the very first important step a trader takes on the path to future success.

Today, the options trading brokerage services sector is represented by dozens of different companies, each with its own advantages and disadvantages.

As in any business segment, this market is also plagued by fraudulent companies that, under the guise of offering market access, deceive traders and, through every possible manipulation, cause them to lose their deposits or even deny withdrawals of earned funds.

That's why, to avoid falling into the clutches of scammers and to make your trading as comfortable as possible, we suggest reviewing the most important criteria to consider when choosing an options broker.

1. Company certification. Availability of certificates from major regulatory authorities

Forex trading or making money on the exchange rate

It's been more than five years since I first started trading Forex. At that time, earning money on exchange rates was still an exotic idea for most internet users, and it was quite difficult to obtain the necessary information.

users, and it was quite difficult to obtain the necessary information.

But over time, the necessary knowledge was accumulated, and practical work experience appeared.

Now I can confidently say that I know what Forex trading is and whether it is possible to actually make money with a small starting capital.

Since I started trading, my deposit has increased from $100 to $10,000, although the growth has not always been solely due to profit.

There were times when I simply deposited spare cash into my account. Now I manage to consistently earn between $2,000 and $2,500 monthly—not as much as I'd like, but still a steady income

Forex trading involves making a profit by buying and selling currencies; the difference between the price of a currency pair is what generates that profit.

Earning on the exchange rate is currently the most profitable and less risky trading option compared to similar investment methods.

Confrontation between brokers and traders.

It's no secret that 95 percent of novice traders in the Forex market typically lose their deposit.

Many people will probably be surprised to learn about these statistics, because on every website you can find advertisements about how anyone can become financially independent.

However, the reality is that 95 percent of losers are fed by the very five percent who earn huge amounts of money.

By the way, 95 percent is not such a terrible statistic, because even when starting their own business, only five percent of entrepreneurs become successful.

Naturally, dealing centers and brokers are also aware of such statistics and begin to abuse their knowledge.

Spread Rebate Services and Should You Use Them?

A rebate is a return of a portion of the broker's commission to the trader for each trade; it's a kind of cashback on the money paid to open a trade.

A spread rebate allows a trader to receive a portion of this commission back after the trade is completed.

This can be a fixed or percentage income depending on the volume and frequency of trading operations.

This technique is one of the tools for attracting clients and can help reduce trading costs, increasing the trader's overall profit.

The rapid development of forex brokers and their affiliate programs has led to a completely new phenomenon: the emergence of so-called "rebate services.".

What is more profitable: Forex or the stock market?

You've decided to become a trader, but you're faced with the question of what and where is most profitable to trade, as you want to maximize your initial capital. Furthermore, the complexity of the work and the risk of losing your money are also significant factors.

Currently, there are two main options available to the average trader: Forex trading or stock trading.

Pros and cons of forex trading.

Like any activity, forex trading has its pros and cons, and a full understanding of them can only be gained through personal experience. For those who haven't, I'll share my impressions as a trader familiar with the currency market for over five years.

them can only be gained through personal experience. For those who haven't, I'll share my impressions as a trader familiar with the currency market for over five years.

First, it's important to distinguish between those traders for whom forex trading is merely a hobby and those who make a living from it. I fall into the latter category.

The profits I receive are my main source of income, so my opinion is based on that fact.

The relationship between price and volume in stock trading. Equivolume chart

Many traders, when conducting their stock market analysis, use only one indicator: volume. Market volume is the market's driver, the face of the market, and characterizes many of the processes occurring on the chart.

Volume reflects the liquidity of an instrument, reveals the opportunity to buy or sell at a favorable price, and acts as a magnet that attracts numerous players.

Anyone who has ever observed stock movements and volume has likely seen a scene where a large influx of players, building a large position, simply devastates the price and pushes it far beyond its established range.

This situation often occurs when a key group of players attempts to break through a certain psychological price level. The appearance of large volume can signal the end of a trend and a market reversal .

Market volume is the fuel that drives prices. Knowing how to correctly read market volume allows you to recognize the fading of a trend, confirm the strength of a market breakout, or determine whether it is a false one.

Women traders.

It so happens that in the financial world, men occupy the top rankings; everyone knows the names of Soros, Trump, Cohen, and other major financial moguls.

the names of Soros, Trump, Cohen, and other major financial moguls.

The question arises: are there female traders, or is trading and achieving success in the stock market a male-only pursuit?

Why is it so rare to see the names of female traders in the media? Are there any successful examples of women making a fortune in forex?

Russian Forex.

Like most things, Forex trading in Russia has its own unique characteristics that should be considered when opening an account with a Russian brokerage company.

with a Russian brokerage company.

Russian Forex is not quite the typical currency and asset trading offered by domestic dealing centers.

Particular care should be taken to avoid getting into trouble with this type of activity; no one will be responsible for your safety.

Now, let's discuss the specifics of Russian Forex.

The success of turtle stock trading.

The question "What makes a professional trader?" is a recurring theme for every Forex novice. Some believe a specialized education is necessary, while others insist that only millionaires trade.

only millionaires trade.

The Turtles trading system, or rather its history, completely refutes these preconceptions. Its creator, Richard Denis (a renowned financier), was able to introduce a new approach to stock trading through unconventional solutions.

It all began with him placing recruitment ads in several stock market publications, with no specific requirements regarding education or experience.

Over three thousand people applied, and 14 candidates were selected, most of whom had absolutely no knowledge of stock trading. Among those selected were two poker players, a security guard, a computer graphics designer, and a little-known actor.

Russian Stock Exchange

Many traders who have been burned at least once on the Forex currency exchange become forever disillusioned with the possibility of making money and abandon this type of activity.

Also, most beginners who first encountered the world of exchanges through the foreign exchange market for some reason dismiss the stock exchange, claiming that its financial instruments are rather complex and difficult to forecast.

However, the stock exchange actually emerged much earlier than the foreign exchange market, and instruments that seem complex at first glance are significantly more valuable and much easier to forecast than the highly liquid foreign exchange market.

Have you ever considered becoming a shareholder in Gazprom or Lukoil, or are you interested in other oil companies or the banking sector?

Acceleration of the deposit with options

Every beginning trader, as a rule, gets into the world of binary options through rather attractive advertising about very fast money in a relatively short time.

Admit it, if you're reading this article, you're probably tired of your boss and want to earn a good chunk of money quickly.

After delving into a ton of literature—and by the way, few people do this, simply becoming disillusioned when they lose money—you realize that no matter how enticing and attractive the advertising,

the average professional trader is simply happy to see their balance grow by 5-10 percent per month, and such a trader is simply inundated with investors.