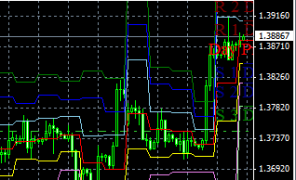

Trend forecast indicator.

Xprofuter is one of the most well-known trend forecasting indicators among traders. Although the accuracy of its predictions is rather questionable, editing the basic settings may improve the situation.

editing the basic settings may improve the situation.

The trend forecast indicator, according to its creators, outperforms the existing trend by 10-12 bars.

It works by creating its own trend line, which is displayed in a separate window, and a second line. Unlike the first, it simply extends the existing trend line on the chart.

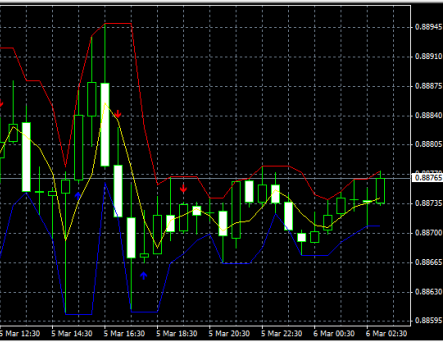

Trend trading indicator.

Another attempt to predict the trend's mood, an indicator with a fairly large number of indicators that allow you not only to receive entry signals, but also to set stop orders.

entry signals, but also to set stop orders.

The trend-following indicator alerts traders to trend changes, allowing them to successfully open new trades or close existing ones in a timely manner.

Its operation covers three time frames simultaneously, allowing for more comprehensive monitoring of the current situation.

Forex trend indicator.

One of the most effective indicators at the moment, in order to improve the quality of signal delivery, the authors of the script combined several popular trend indicators in it, which reduces the number of false signals.

several popular trend indicators in it, which reduces the number of false signals.

Forex trend indicator - gives a signal to open a transaction and at the same time indicates the preferred places for placing stop loss and take profit orders.

In this case, the signal itself is indicated in the form of an arrow, and stops are transmitted by multi-colored stars.

Trend oscillator.

The main difference between any technical analysis indicator and an oscillator is that the indicator simply analyzes the trend, while the oscillator also tries to predict further developments.

the oscillator also tries to predict further developments.

The trend oscillator lives up to its name: it attempts to predict the direction of a Forex trend.

It does this using a curved line displayed in a separate window below the currency pair chart. Additionally, a zero line is used during trading, serving as the primary reference point for opening trades.

Trend indicator.

An interesting script for determining trend direction allows you to automatically identify the direction of price movement for a currency pair across all available time frames.

for a currency pair across all available time frames.

A trend indicator analyzes not only different timeframes but also uses various technical analysis methods.

It utilizes tools such as the RSI and CCI indicators, as well as a moving average. The trader also receives information about the trend direction on the last bar and any price gaps that have occurred.

Breakout indicator

A combined technical analysis indicator that allows you to plot support and resistance lines and simultaneously reports a possible breakout.

reports a possible breakout.

The breakout indicator is designed for use in trading strategies of the same name and is easy to set up and use in trading.

It's essentially an advisor for opening trades, but the orders themselves must be opened and closed manually.

The trading system is based on a price channel and placing orders at suggested breakout points.

Reversal indicator.

In Forex, there's nothing more important than knowing in advance about an impending reversal. This allows you to close a trade immediately, rather than waiting for losses to reach your stop loss. This information can be obtained through fundamental or technical analysis.

losses to reach your stop loss. This information can be obtained through fundamental or technical analysis.

In the latter case, it's best to use a special reversal indicator, which will warn the trader of an imminent trend change.

Reversal indicator - works on the basis of the MACD script, which has been significantly modernized and improved.

Flat indicator.

Most traders consider the flat market unsuitable for trading on the forex market, but it's precisely at this moment that a guaranteed profit can be made. Trading can be done manually or using a special indicator.

a guaranteed profit can be made. Trading can be done manually or using a special indicator.

The flat indicator is a type of channel indicator that captures flat market lows and highs and plots price levels based on them.

Once installed, the indicator plots several levels of different colors, which are designed to characterize the situation on different time frames.

Pivots Daily.

Another version of the well-known indicator, which is designed to calculate Pivot levels , the resulting graphic lines can be used when conducting technical analysis of the Forex market.

be used when conducting technical analysis of the Forex market.

Pivots Daily is based on a standard script with some operational improvements.

The convenience of this tool lies in its lack of numerous settings; after launching, you simply enter the number of bars to use in the calculations.

This allows for a quick launch, and the resulting Pivot levels will perfectly match your timeframe.

Dinapoli indicator.

Dinapoli levels are calculated using rather complex formulas, requiring a lot of data to perform the calculations. Therefore, it would be more efficient to automate this process using a special script.

it would be more efficient to automate this process using a special script.

The DiNapoli indicator allows you to plot six levels, fully automatically. The downloadable instructions will help you fine-tune all the necessary parameters to suit your needs.

You'll also receive trade opening signals when switching between time frames and depending on market conditions.

Pivot points indicator.

If you want to simultaneously display several popular technical analysis levels on your trading terminal screen, this indicator is designed to solve this problem. The maximum timeframe for the indicator is H4, with no minimum timeframe limit.

indicator is designed to solve this problem. The maximum timeframe for the indicator is H4, with no minimum timeframe limit.

The Pivot Points indicator plots the following levels: Fibonacci, DeMark, Camarilla, and Woodie. While it's true that sometimes the plotting doesn't follow the usual pattern, this only makes the tool even more interesting.

Each level serves as a benchmark, and depending on the trading strategy used, reaching its boundaries signals the opening of a new trade. The direction is determined by whether the price has reversed or broken through the level.

Fractals and price channel indicator.

Trading using fractals has long been a common practice among Forex traders. This method of technical analysis allows one to identify patterns in trend movements and find their most significant points.

allows one to identify patterns in trend movements and find their most significant points.

The fractal indicator uses points identified through fractal analysis to construct price channels.

The initial impression of this tool is quite good, and it's immediately clear that it can be used for trading in many trading strategies.

Forex eye indicator.

One of the most popular indicators on the currency market, "Forex Eye" significantly simplifies the process of technical analysis, and therefore trading itself.

trading itself.

The Forex Eye indicator is a multifunctional tool that allows you to see indicators such as time frame time, trend direction on each individual candle, and the overall picture of the current trend.

The script not only calculates and plots levels but also provides trade recommendations, including sound alerts and email notifications.

Trend reversal indicator.

A fairly effective indicator that helps you notice a trend reversal in time and close an existing position or, conversely, choose the best moment to open a new order.

open a new order.

The trend reversal indicator uses a moving average when making forecasts; the operating principle is reminiscent of the popular MovingAverage, but a more advanced version.

Thanks to the change, the indicator is now displayed in a separate window below the main chart of the currency pair; all work is built on the basis of three lines.

Pivot indicator.

A tool that allows you to automatically calculate pivot levels, or in other words, levels upon reaching which significantly increases the likelihood of a price reversal.

the likelihood of a price reversal.

Pivot indicator - adds 7 important levels to the chart of your chosen currency pair, each of which has its own color for ease of perception.

The tool is absolutely universal and can be used on any currency pairs and time frames. The time of its use also does not matter.

Pivot point indicator.

Pivot points have always been the most suitable places to enter the market; identifying them is quite difficult, so it is better to use a special tool for these purposes.

to use a special tool for these purposes.

The turning point indicator is designed specifically to determine the places where the price will make a reversal; the indicator records both trend reversals and rollbacks, which allows you to increase the efficiency of its use.

In addition to signals for a trend change, the script draws three multi-colored lines on the chart, two of which are original support and resistance lines, and the third serves as a moving average.

Thanks to the variety of data, when using the reversal indicator, the possibilities of analysis are significantly expanded; the chart clearly shows not only the places of correction and reversals, but also monitors the overall dynamics of the trend.

Moving Average multi.

The indicator allows you to determine the current trend direction and its origin points based on the analysis of moving averages.

It works great on all time periods and currency pairs, which is why this tool received the multi prefix.

Unlike the standard version of the Moving Average indicator, it does not display one line, but reproduces several segments of different colors on the chart at once, which characterize the trend and its duration.

Working with this tool is quite simple; for maximum efficiency, you just need to configure the basic parameters of the moving average.

Price Alert indicator.

Trading using levels has always been one of the most effective strategies in

The Price Alert indicator isn't a fully-fledged indicator, as it doesn't perform any calculations or market analysis on its own. It's a simple script that sounds an alarm when the price reaches a specified point.

However, you'll have to find these points (levels) yourself. I'll provide a couple of recommendations on how to do this at the end of the article.

Camarilla indicator.

The Camarilla indicator is designed for reversal trading within daily time frames. It can also be used as a standard channel indicator.

Camarilla draws five multicolored lines, one of which is a trend line, while the others act as price channel boundaries. These lines are used to determine entry points.

RSI and Moving Average indicator.

Each technical analysis indicator has its strengths and weaknesses, and it's always a good idea

A script called "Stalin" is an attempt to achieve this. It combines two well-known indicators, the Moving Average and RSI .

The "Stalin" indicator is a signal indicator, meaning it signals the opening of positions, and does so in several ways - via arrows on the chart, an email, or a sound signal.

Trader's indicator.

Even if you are used to doing without technical analysis indicators in your work, this tool will not be an unnecessary addition to your chart.

tool will not be an unnecessary addition to your chart.

The trader’s indicator does not overload with unnecessary information, but simply provides the most necessary data about the current trend.

Its use will help you notice the changes that have occurred in time, and you will be able not to miss a change in trend or a major correction.