Asset information indicator for MT5 - GeoInfo5

One of the most common types of indicators for a trader’s trading platform are information scripts.

Thanks to them, you can quickly obtain information on the selected asset, or obtain any other information that helps in trading.

I have already given examples of such indicators more than once, and today I came across a rather interesting tool, the main advantage of which is its expanded information content.

The GeoInfo5 script, after adding the selected asset to the chart, displays the following information - the current spread and swap size, collateral size, tick size, stop order levels, minimum lot and ATR/SPR ratio.

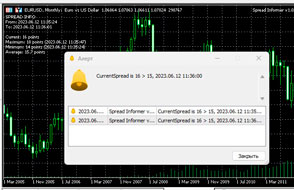

Spread Informer signal indicator

One of the important points when trading Forex is the size of the spread. Since today almost all brokers have switched to a floating spread, it is necessary to constantly monitor this parameter.

The easiest way to do this is with the help of a special indicator; on our website we have already described one of these scripts - the Spread Indicator

It fully meets the requirements, but the previously published indicator is intended for installation only in the MT4 trading platform and does not have an alert function.

Therefore, today we are publishing a similar spread indicator called Spread Informer for metatrader 5, which not only shows the current size, but also reports if the spread has expanded beyond a specified value.

New Donchian channel indicator “Modern Donchi”

Price on the market rarely moves constantly in the same direction; most often it forms price channels.

Therefore, the trading strategy in the price channel is one of the most popular in stock trading.

Today, few people build price channels manually; traders prefer to use technical analysis indicators in their work.

One of these indicators is the Donchian indicator developed by the famous trader Richard Donchian.

The tool is used to analyze market volatility and determine support and resistance levels.

Accurate Forex indicator – check on different timeframes

The search query “accurate Forex indicator” is one of the most popular in the financial markets.

It is difficult to find a trader who has not at least once entered it into the Yandex or Google search bar at various stages of his FX career, trying to find a suitable script.

It is difficult to find a trader who has not at least once entered it into the Yandex or Google search bar at various stages of his FX career, trying to find a suitable script.

The essence of the problem is that the scripts available today are not always of high quality and can objectively assess the market situation.

Many of the technical analysis indicators give an unreliable forecast, and then correct the history of their work in order to improve the result.

New fractal indicator “Full Fractals MT5”

The standard fractal indicator, developed by Bill Williams , is one of the most effective tools for trend analysis.

It is not for nothing that it was added to the most popular trading platform today, metatrader 5, and is used in fractal strategies.

But many traders often complain that the standard script from the trading platform lacks additional settings, so you can find modified versions of the Fractals indicator on the Internet.

One of the interesting options is the “Full Fractals MT5” indicator, developed in 2023; it allows you to independently set the number of bars on the basis of which the fractal will be built.

Spread indicator, which allows you to estimate how large the spread is at the moment

One of the most important indicators in Forex trading is the spread, which you have to pay when opening a new transaction.

If you trade scalping and open a lot of trades, then you know how much you have to pay to open trades and how important it is to control the size of the spread.

Depending on the market situation, this commission can increase tens of times and it can be a shame when, having become carried away by the trading process, you discover that you paid more than usual.

You can control the size in the market window, but this is quite inconvenient; it is more practical to use the Spread indicator.

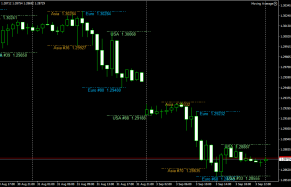

Advanced trend indicator for MT5, trend strength for a specific currency

In the Forex currency market, it is quite difficult to determine the real direction of the trend for a specific currency.

The reason for this lies in the fact that the price of a certain monetary unit can simultaneously rise against one currency and fall against another.

For this reason, it is not always clear how strong the existing trend is and what its reason is: the strengthening of the analyzed currency or the fall of the second currency in the currency pair.

Therefore, in order to objectively assess the existing trend direction, you need to do this comprehensively, in relation to several assets at once.

New resistance and support indicator “Support-Resistance-MT5”

One of the most effective technical analysis tools in trading are support and resistance lines.

Thanks to these lines, it becomes possible to determine probable trend reversal points or ensure its continuation.

These lines can be plotted on the chart either manually or using special indicators that independently perform calculations.

Over the years of using trading platforms for trading, a large number of indicators that allow the construction of support and resistance lines, but despite this, new modifications of such scripts are being developed every day.

Transaction risk indicator

Most traders associate the work of indicators in a trading platform only with trend analysis and sending signals to open trades.

But there is also a category of forex indicators that perform auxiliary functions and simply make trading more comfortable.

The tool presented today belongs precisely to this category of auxiliary indicators; it displays the degree of risk on the chart of a currency pair.

Moreover, he does this not in abstract points or percentages of the deposit, but in the currency of the deposit.

Allowing in this way to assess probable profits and losses relative to the trend line, to evaluate possible prospects.

That is, find out how much you will be able to gain or lose if the price changes to one or another indicator.

Currency heat map indicator for metatrader 4

A heat map of currencies is a color display of the direction of the trend for various currency pairs over a certain time period.

You can find a similar tool on many information portals, but it will still be more convenient to use a special indicator.

Thanks to which all the necessary information about the trend will be displayed directly in your trading platform.

The devisen-heatmap indicator presented in this article is intended for installation in the metatrader 4 .

After you have downloaded the zipped file with the script itself at the end of this article and unpacked it, proceed to the standard installation by copying it to the directory with indicators called “Market”.

The most effective indicators for forex

The main tool with which technical analysis is carried out is the indicator; it is it that allows you to speed up this process.

The main thing is to find the most effective tool for these purposes, since you will have to choose among several thousand different scripts.

The task is quite difficult even for an experienced trader, and if you are just starting to trade Forex, it is not at all feasible.

What forex indicators can be called the most effective for technical market analysis?

Each trader has his own list of preferences, here are the indicators that I use:

Margin Call and Stop Out indicator.

Almost all traders know about such concepts in stock trading as margin call and stop out; the broker is responsible for these parameters and their size can be found on his website.

Margin call is the level of losses on the client’s account, upon reaching which the broker will be obliged to notify the trader.

For example, the margin call is 40%, as soon as the loss reaches this level the broker will call you (in theory).

Stop out is the level of losses upon reaching which the broker will forcefully close the transaction in order to preserve his own funds that were provided as leverage.

Usually equal to 10%. These levels play a greater role for the broker than for the trader, as they protect his funds, but still many investors prefer to monitor such levels.

It is best to use special forex indicators to monitor this parameter.

Triple Exponential Average Oscillator

Market irregularities, its constant deceptive maneuvers and oscillatory movements around an invisible axis are the main reasons for losses for most traders.

It would seem that the entire trading process comes down to identifying a trend and opening a trade in its direction.

However, in practice, kickbacks are perceived as new trends, and side kicks are perceived as something separate, and not as a regular break that players took for a while.

The so-called market noise is to blame, which can be combated in several ways.

Change the principle of presenting information, as happens with the use of Renko charts, or average the price, using the average price as the basis for analysis.

Average Directional Movement Index indicator

A trader needs to clearly understand which direction the market is moving, where it is heading at the moment and where it will go in the near future.

trend forex indicators can cope with this task .

However, despite this, traders continue to suffer losses.

The answer why this happens lies right on the surface, but no one wants to notice it. It is easier to think that forex indicators are wrong about the direction of the trend than to realize that the trend itself has been misjudged.

After all, the effectiveness of the signal in a strong and weak trend will be completely different.

Info indicator for intraday trading

The key problem for newcomers who have just entered the market is a complete lack of understanding of what they are doing, why they are opening a deal and what is behind the performance of certain forex indicators.

In fact, all market analysis is based on the search and implementation of patterns.

One of these fundamental patterns is the manifestation of price activity at certain times of the day, as well as the formation of strong levels and ranges by traders.

It is trading sessions and price behavior during each of them that can become an excellent core for building an intraday strategy .

In today's article we will look at a script included in the category of forex indicators for intraday trading, which will allow us to visualize a particular trading session on a chart.

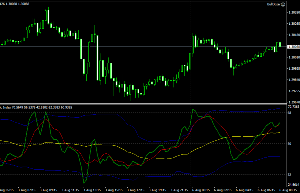

TDI indicator

Market analysis and forecasting is difficult to perform without technical analysis tools at hand.

After all, all factors, one way or another, are interconnected and can influence each other.

The direction of the trend, the speed of price movement, volatility, overbought or oversold - all these factors determine the further movement of the price.

That is why in recent years many traders have gradually moved away from using standard forex indicators, which determine one characteristic of the market.

Instead, complex hybrids are increasingly being used. Their essence is that the hybrid can combine from two to five forex indicators in one window and conduct a more professional market analysis.

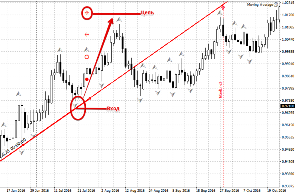

Fibo Levels Indicator - Trade Channel

The mathematical approach in market analysis is one of the most common, since any strategy is based on the analysis of statistical data, as well as the correct formula for the distribution of capital and risk.

However, behind dry mathematical calculations you can often find the use of so-called magic numbers, often referred to as Fibonacci numbers.

A rather interesting relationship between the proportions of various bodies in living and inanimate nature, which was repeated many times and had the same numbers, excited the minds of many mathematicians.

Naturally, such mysticism did not escape the Forex market, since similar percentage ratios began to be used to analyze the behavior of the crowd, and most importantly, to determine the degree of market correction.

All these tools require the trader to plot them on the chart themselves. As a result, many beginners not only practically do not understand the essence of such tools, but also use them completely incorrectly.

Cayman indicator – trading against the crowd

There are various forex strategies and indicators designed to trade against the crowd in the Forex market.

This is not surprising, because this strategy allows you to make good money.

But at the same time, it has increased risks. Therefore, in order to truly make a profit trading against the crowd, it is necessary to have reliable forex indicators.

One of these is the unique Cayman indicator.

What is this script for, what principles are embedded in it and how it can help traders, further in our article. What does it mean to trade against the crowd?

Despite all the variety of strategies and tools for technical or fundamental analysis, most traders move in one direction. Accordingly, they all get the same, disappointing result.

End of trend indicator on Forex

The nature of the movement of any price asset consists of a certain cyclicality, because any trend ends sooner or later, and then after a while it begins again with greater or lesser force.

Therefore, in addition to standard indicators, there are also indicators of the end of a trend in Forex. The most interesting thing is that traders, knowing that the market is cyclical, never think about the end of the trend.

Indeed, any price movement is nothing more than a projection of the actions of exchange participants.

Consequently, when the majority of players achieve their goals, for example, to buy an asset at a certain price, the price movement is completed.

Thus, by predicting the end of a trend, a trader can save himself from losses on already open positions.

First RSI level

When trading with oscillators such as RSI or Stochastic, sooner or later you have to face such a problem as indicator lines hanging in overbought and oversold zones.

At such moments, the price actively continues its movement towards the trend, while the indicator shows us a reversal.

Many people consider this phenomenon to be a strong drawback and fight it in every possible way, changing the calculation periods and supplementing the script with other technical analysis tools.

However, there were also those traders who conceptually turned this disadvantage around, making it an advantage.

The First RSI level script is a prime example of one of these indicators on forex. The First RSI level indicator is a conceptually new

technical analysis , which is based on the so-called theory of pushing through RSI overbought and oversold zones. In fact, the First RSI level finds the levels of the base of trends, upon the breakdown of which a trader can open positions towards global markets.

MACD Squeeze. An interesting hybrid based on trading zones for MT5.

Standard indicators for forex are not just classics of technical analysis that every trader should take into account, but also a huge field for creating new developments.

The most interesting thing is that sometimes standard forex indicators can be transformed in simply unimaginable ways, from their appearance to the very concept of creating an indicator.

However, if in most cases the modified versions can only boast of a beautiful appearance and, as a rule, unchanged logic, then in today’s article we will look at a fundamentally new MACD.

Which in appearance is practically no different from the standard one, but carries a completely different concept.

The MACD Squeeze indicator is a technical analysis tool that belongs to the group of trend oscillators and is an upgraded version of MACD for the MT5 trading terminal.

A notable feature of MACD Squeeze, which distinguishes it from the standard version, is the search for trading zones, within which the signals of the standard instrument become more accurate.