Best channel indicator, comparison, review and basic settings

The price, as trivial as it may sound, follows certain patterns in its movement.

It is no secret that the wave theory, like many others, is based precisely on observations, but one of the most important patterns is the channel price movement.

You may ask, how does this pattern manifest itself?

I think it’s no secret to you that the price almost never moves only up or down. No matter what chart you open, you will always see various pullbacks and meandering charts. The thing is that, according to many theories, the price always tends to balance after strong fluctuations in different directions.

During these fluctuations, the channels that technical analysis so often uses are formed.

Fibonacci levels, practical points.

Fibonacci levels are one of the most common technical analysis tools for predicting price corrections. Actually, dozens of books have been written about Fibonacci levels, and the world-famous wave theory, one way or another, is based on these levels.

predicting price corrections. Actually, dozens of books have been written about Fibonacci levels, and the world-famous wave theory, one way or another, is based on these levels.

However, despite the popularity of the tool, opinions about it are quite contradictory.

This is actually connected with the very theory of creating the instrument, because modern economists and mathematicians simply cannot explain the patterns of movement of financial markets, and the theory of the “Golden Ratio”, which is so applicable to living and non-living nature, at first glance is not comparable with financial markets.

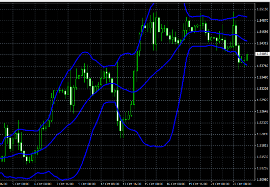

Bollinger Bands

Bollinger Bands are a technical analysis tool, or to be more precise, they are an indicator consisting of three lines that form a channel and show price deviation. The world first learned about Bollinger Bands thanks to the publication of the famous book “Bollinger on Bollinger Bands” by author John Bollinger.

a channel and show price deviation. The world first learned about Bollinger Bands thanks to the publication of the famous book “Bollinger on Bollinger Bands” by author John Bollinger.

In the book, the author describes in detail how to use his tool, provides statistical information and gives interesting instructions to investors that will allow them to avoid typical mistakes.

Initially, the indicator was intended for trading stocks and futures on the stock exchange, but due to its high popularity and effectiveness, stripes also began to be used in the Forex market.

The well-known trading rule, sell at a higher price and buy at a lower price, turned out to be difficult to apply in practice when trading, since it is always difficult to choose the maximum and minimum points. John Bollinger tried to solve this problem, so the top line should be taken as the market minimum, and the top line as the maximum.

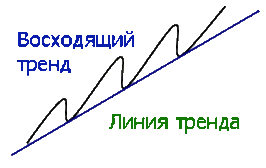

Forex trend line

The trend line is one of the oldest and most effective tools of technical analysis, which dates back to the first definition of the trend by Charles Dow.

Before moving on to the trend lines themselves, I suggest you remember what a trend is and what types of trends are identified by technical market analysis.

According to the Dow, a trend can be upward, downward, or horizontal. An uptrend is a successive increase in peaks, with each new peak and trough higher than the previous one.

A downward trend is characterized by the gradual appearance of downward peaks, with each new peak forming lower than the previous one.

A horizontal trend, also called a flat , is characterized by the fact that all new peaks and troughs are in the same vertical plane and practically at the same level.

Dow theory for forex trading

Before you start learning technical analysis, you need to study the history and postulates on the basis of which it is built.

After all, if you start studying such a broad area, a lot of questions arise that are related precisely to the foundations and foundation on which it is built.

The world first learned about the Dow theory thanks to the world-famous publication of the book “The ABC of Speculation in the Stock Market,” which was written by S. Nelson.

It is in it that for the first time you can come across the mention of such a term as “Dow theory”. The author of the book took as a basis articles that were written by Charles Dow in the Wall-Street-Journal, where the author shared his theoretical vision of the stock market.

Gann instruments

Gann is one of the most legendary traders in the history of trading. In a short period of time, he managed to amass a fortune of $50 million, and you can always see his portrait when entering the stock exchange.

In a short period of time, he managed to amass a fortune of $50 million, and you can always see his portrait when entering the stock exchange.

In addition to his enchanting success, Gann went down in history for the fact that he made a significant contribution to the development of technical analysis, raising it to a new level and introducing new approaches to working with financial markets.

The most interesting thing is that Gann left us behind a bunch of different tools that are still used in technical market analysis, but, unfortunately, due to the difficulty of writing books on them, no one really fully understands which of the approaches actually helped him make such a fortune .

There is even an opinion among traders that Gann is not telling something, and has not revealed the main secrets of using his tools.

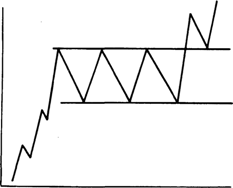

Forex figure is a rectangle.

Proper use of graphical analysis figures is a big plus in a trader’s working tools pocket.

a trader’s working tools pocket.

Surely you have heard that graphical analysis is based on the patterns of behavior of the crowd, which, although becoming smarter from year to year, its basic instincts and thirst for profit do not change.

Therefore, when using graphical analysis figures, you always rely on crowd analysis, and if you understand where the market can move the majority of players, you will always remain in the black despite intermediate losing trades.

The Rectangle figure is considered a classic trend continuation figure in Forex. Every trader is tormented by doubts whether it is worth closing a position, since the trend may end or, on the contrary, a new order will be added due to the continuation of the current trend.

Graphic analysis for Forex.

When analyzing financial markets, price movement charts are widely used; one of the ways to study these charts is graphical analysis.

charts is graphical analysis.

Graphical analysis is a component of technical analysis, a method of studying the market using graphical constructions that make it possible to identify the existing trend and more fully present the picture that has developed over the analyzed time period.

The main tools of graphical analysis are lines and figures constructed with their help.

Trend continuation patterns

Often we are faced with a situation when the price began to roll back from the main trend with renewed vigor.

trend with renewed vigor.

At this moment, you are faced with the eternal question: will the price go further in a new direction and the trend is over, or will the price return to the direction of the trend after a minor pullback? Traders face this situation every day and many, unfortunately, make serious mistakes, entering a position in the hope that it is at the source of a new trend or, conversely, in the hope that now there is a pullback, we hold our positions until the profit is completely reset .

Today I would like to introduce you to two of the most common trend continuation patterns that will help you predict the further development of the trend with a high probability.

Almost all traders are familiar with various trend reversal patterns, because the long-standing dream of entering at the bottom always haunts a stockbroker, but only true pros know that they should not chase a reversal, but rather look for strong trends and opportunities to enter using them.

The best indicators for Forex.

Currently, there are a lot of different indicators for working on Forex, the total number of scripts is already in the thousands, and from this mass it is quite difficult to select the most worthy options.

this mass it is quite difficult to select the most worthy options.

When trading various strategies, I often had to use indicators, and in the process, my favorite options emerged.

The best Forex indicators usually combine a number of qualities - they fully meet the tasks for which they were written, have simple settings, and give a minimum number of false signals.

These include the following scripts:

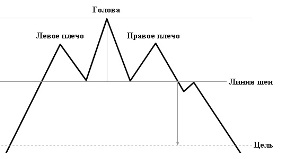

Head and Shoulders Figure

The Head and Shoulders pattern is the most common reversal pattern in graphical analysis.

analysis.

Every beginner who comes to the Forex market one way or another comes across training on graphic figures, whether it be seminars, books, or just a video, the basics begin with graphic analysis.

The fact is that many traders use patterns without realizing how they are based and, especially, do not think about what facts they were created on. The figures appeared based on traders’ observations, namely, on patterns of price movement.

Sperandeo method

Many critics of technical analysis always argue that the construction of certain figures and lines depend on the subjective opinion of the trader.

depend on the subjective opinion of the trader.

This kind of analysis does not have clear rules, and if one trader sees support in one place, then another can build it at a completely different point. If we consider the construction of trend lines, the situation is completely sad.

According to the rules, at least two extreme points are required to draw a trend line. But here’s the catch, everyone chooses this extremum for themselves and attaches importance to it, which leads to the line being drawn incorrectly, and its signals are either false or you simply miss the real reversal and enter the market too late.

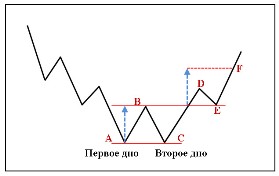

Figure Double bottom

The double bottom pattern is a reversal pattern that is most often found in the forex market. pattern occurs in a bear market when a trend begins to run its course.

pattern occurs in a bear market when a trend begins to run its course.

All traders know about this pattern, since books on graphical analysis talk about it as the very first of the reversal patterns .

Due to the fact that it is familiar to everyone, as a rule, the crowd begins to act like a textbook, so in real trading conditions in most cases it really works itself out. In real life, you encounter it quite often, since, unlike the Head and Shoulders reversal pattern, large players do not have to make as much effort to reverse the trend as happens with the above-mentioned pattern.

Fibonacci Fan

All trading applications have a number of tools that are necessary for analysis. This group is called “Fibonacci Tools”. These tools help you design your price map with high accuracy.

This group is called “Fibonacci Tools”. These tools help you design your price map with high accuracy.

Among these tools are: • Fibonacci levels;

• Fibonacci extensions;

• Fibonacci fan;

• Fibonacci channels.

•

These graphical models require correct construction, otherwise their readings will be incorrect and therefore ineffective.

The basis of the Fibonacci fan is the Fibonacci grid - these are three lines at levels equal to 38.2, 50, 61.8 percent. All lines originate from a common point, creating a grid of supporting and resisting lines. On the chart, these lines look like a fan.

Figure "Wedge"

The use of graphical analysis in the Forex market is no less effective way of predicting price fluctuations than the use of various indicators or fundamental analysis.

the use of various indicators or fundamental analysis.

The entire analysis is based on drawing various figures on the chart, which can tell us about a possible continuation or change in the direction of the trend.

Where exactly did these figures come from and why are they so actively used? The fact is that graphical analysis was one of the very first; therefore, over the course of decades of trading, traders noticed a number of patterns, which actually developed into teaching aids in the form of various figures.

The “Wedge” figure is a reversal figure in graphical analysis, which, as a rule, appears at the peak of the end of a trend and signals us about a possible price reversal. There are two types of wedge, namely bearish and bullish. Each of them appears on the trends by which they are named.

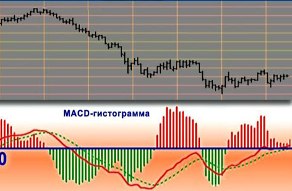

MACD histogram

The MACD histogram is the difference between the MACD line and its signal line:

• When the MACD line exceeds the signal line, the histogram is depicted with a positive value, exceeding zero;

• When the MACD line is less than the signal line, the histogram passes through zero.

The MACD technical indicator belongs to the class of technical analysis indicators, that is, it is an oscillator and is used to calculate the trend. The MACD histogram is constructed using exponential moving averages (EMA): fast (up to 12) and slow (up to 29). It is depicted on a graph in the form of columns.

Page 2 of 4