What is a dividend adjustment and when should it be taken into account?

You can make money on company shares not only in the classic way, but also using contracts for difference CFDs.

At the same time, CFDs make it possible to open transactions for both purchase and sale, allowing you to make money not only when the price rises, but also when it falls.

Dividends are accrued on purchase transactions, just as with physical ownership of shares, but on sale transactions an adjustment is made to the amount of accrued dividends.

That is, when you open a transaction on shares of a company that has paid dividends, this amount is debited from your deposit in the trading platform and sent to those traders who have opened purchase transactions on similar shares.

What to choose: CFD contracts or gold futures

Economic and geopolitical instability is causing more and more people to invest in precious metals.

Gold bars are extremely popular, while at the same time many investors prefer to buy gold on the stock exchange.

Buying precious metal on the exchange is much more profitable and easier than dealing with physical bullion; you invest in gold because you don’t have to think about how to ensure the safety of the bullion.

But when trading the exchange asset XAU/USD, the question arises: which option to choose: standard futures or contracts for difference?

The relationship between interest rates and the exchange price of gold

Gold is one of the most popular precious metals in the world. It is used as an investment, decoration and in industry.

But in order to earn the maximum, you should buy the precious metal at the most favorable moments, when the price of gold is at its minimum.

In order to determine this minimum and whether the price of the metal will rise or fall, you need to know the factors influencing the price.

One of these factors is interest rates or, as they are also called, discount rates of national banks . In this case, the greatest influence is exerted by the interest rate on the US dollar, the size of which is set by such a body as the Federal Reserve System of the United States

Revenue management in relation to stock trading

Lack of money is one of the main problems that makes us unhappy, but often the reason lies not in the amount of money, but in the inability to manage it.

After all, paradoxically, people who earn less than $500 a month and those who receive more than $100,000 monthly complain equally about not having enough money.

Therefore, it is very important to learn how to manage income, especially if it is not stable, as is the case with profits received from stock trading.

After all, one month you can earn 1000 dollars, and another 10,000, but in any case you will have to cover current expenses and do this, best of all, without resorting to loans.

Top 10 indicators for trading in the metatrader trading platform

Modern trading on Forex or any other market is almost impossible to imagine without the use of technical analysis indicators.

Most of the created tools are intended for installation in the metatreder trading platform, and this is not surprising because this program is the most popular today.

At the moment, Metatrader 5, by default, has 38 technical analysis indicators and oscillators installed.

Each of which, in its own way, analyzes the trend and helps the trader in stock trading, but among the presented tools there are also their leaders, so to speak, the top 10 best.

What is understanding an asset and why is this aspect important when trading on the stock exchange?

One of the components of successful trading on the stock exchange is the correct choice of the asset for which transactions will be made.

Most novice traders do not think much about this issue, relying more on intuition and, as a result, choosing currency pairs or shares of popular companies.

But the best results are obtained if you trade an asset that you have an idea about and know what influences this price the most.

Yes, if you wish, you can base your work solely on technical analysis data, but if you trade not only intraday, then fundamental analysis will help to significantly increase the efficiency of trading.

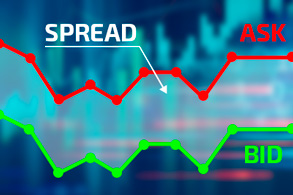

Exchange assets with the smallest spread

For each transaction opened on the exchange, you have to pay, be it a volume commission or a spread for opening a transaction; in any case, the paid amount is displayed as a debit from the deposit balance.

At the same time, the size of the fee for opening an order can differ tens of times, depending on the brokerage company or the asset being traded.

It is clear that it is most profitable to trade assets with the smallest spread for opening a transaction; this will allow you to implement any of the exchange strategies.

It is generally accepted that it is cheapest to open a transaction on currency pairs, since currencies have an almost zero spread.

Video guides in the MT5 trading platform

Learning to exchange trade involves, first of all, getting to know the trader’s trading platform; without this step it is difficult to start opening trades.

And although the most popular version of the metatrader 5 software today has an intuitive interface, in order to start working effectively in it you need to study the basic capabilities of the terminal.

This can be done using the built-in instructions; to do this, you just need to press F1 while MT5 is running.

But many people like to perceive information through video materials, so the information presented is perceived more easily.

How to stay healthy while working as a trader

Trading on the stock exchange is not a particularly dangerous disease, but still this type of activity causes a lot of health problems.

And now, after five years of stock trading, you begin to notice the consequences of this seemingly harmless activity.

In this case, first of all, the eyes, spine, blood vessels of the legs and joints suffer, the general condition of the body does not improve, and the nervous system is weakened.

It is easier to prevent any disease than to treat it afterwards, so you need to try to make the trader’s place of work, first of all, as comfortable as possible.

Automatic calculation of trading parameters

This is not the first time I have talked on my blog about various tools that help make trading more comfortable.

Today we will talk about such an important thing as planning trade transactions in stock trading.

It can be quite difficult for a novice trader to determine the volume of upcoming transactions and establish the level of risk and profitability for future positions.

In order to calculate all the necessary parameters of transactions, taking into account the desired profit and acceptable risk, the “Trading Plan” tool was invented.

Partial closing of positions in the metatrader trading platform without installing additional scripts

If you open a stock trade and after some time it begins to make a profit, then you are faced with the question: should you close the position or leave it in the hope of even greater profits?

But the trend can change at any moment and a profitable order can turn into a losing one. How to avoid such a situation? At the moment, there are two options to save your earnings.

The first is to place a trailing stop order, thereby fixing the existing profit, the second is to partially close the position.

Depending on the situation, you should choose the most suitable option; today we will talk about how to partially close a position.

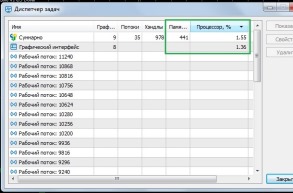

What can the task manager tell you in MT5?

Many traders who have been using metatrader 5 in their work for many years are not even aware of some of its interesting functions.

So it was a discovery for me that this program has its own “Task Manager”, with similar functionality as the standard Windows task manager.

Only, unlike the dispatcher we are used to, this one shows information only on the metatrader 5 trading platform, which allows us to optimize its operation for the least consumption of computer resources.

The task manager in MT5 is a script that allows you to monitor how much and which of the processes of the trading platform consumes your computer’s resources.

Which VPS is better for trading – built into metatrader or an external provider?

If you use trading robots in your Forex trading, then sooner or later you will be faced with the question of renting a VPS server.

It is quite inconvenient to keep your home computer on all the time, and there is no way to control the work of the adviser remotely.

Therefore, the advantages of a VPS server when trading using trading robots are simply obvious; all that remains is to choose the most suitable option.

At the moment, there are three possible options - a VPS built into the trading platform, a server provided by a broker, or rented from a hosting provider.

How to get distracted and not check the stock exchange rate every five minutes

Not long ago I met with a novice trader who was interested in trading cryptocurrency; during the hour of our meeting, he checked the Bitcoin rate more than ten times.

Perhaps this situation is familiar to almost every newcomer to the stock exchange, when after an open transaction you constantly check how the price has changed.

Gradually, this becomes a habit and now, even in the absence of open positions, the trader looks at stock quotes every five minutes.

This habit constantly keeps you on edge, you are afraid of missing a good moment to open a new deal, and you become restless.

And as you know, a stressful state provokes the onset of many diseases, so before it’s too late, it’s better to get rid of the bad habit of course control.

Organizing a trader's work, how to start your working day

Working as a trader has long been the dream of many people; feature films about successful stock market players have played an important role in the polarization of the profession.

Moreover, the majority of those who want to make a career on the stock exchange are attracted not only by the size of the monetary reward, but also by the opportunity to work without management and whenever they want.

But freelancing, and it is precisely this type of organization of the work process that modern trading can be classified as, has both its advantages and significant disadvantages.

You don't have to go to work, but at the same time you are always at home, and home is perceived as a place to relax, and not as a work office.

Anonymous trading on forex or stock exchange

Every year the state increasingly strengthens control over the income and expenses of its citizens.

Income received as a result of exchange activities, trading on the Forex currency market or the stock exchange is no exception.

You can learn the nuances of taxation from the article at - https://time-forex.com/info/nalogi-s-zarabotka-na-foreks

It would seem that there is nothing simpler - pay your taxes and sleep well, but only people who have never encountered our tax authorities say this.

It just so happens that integrity in our country is punished more often than various frauds.

We configure the opening of orders in the metatrader 4 platform and make trading more convenient

Most traders have been trading on the metatrader 4 platform for years without using all its capabilities.

But sometimes it’s enough to just click a couple of times to make your work more comfortable and simpler.

Today we will talk about what the “Trade” tab is, or more precisely, how to configure some of the necessary parameters.

You can get to the settings through the top menu of the trading platform - “service”, then from the drop-down menu we select “settings” and the corresponding window opens in front of us.

We trade bonds in the metatrader 5 trading platform

Exchange trading is much more diverse than most people think about it, it is not limited to currency pairs and company shares.

On the modern stock exchange there are a lot of other equally interesting and profitable assets, for example the same bonds or, to be more precise, Eurobonds.

Eurobonds are bearer securities that are issued for a specified period.

The metatrader 5 trading platform currently offers two similar assets: ten-year bonds BUND10Y and TNOTE.

They are traded using futures contracts, so the trading conditions are similar to those for other similar instruments.

Top bad advice for a beginner on Forex

When you start doing any new business, there are immediately many people who want to help you.

On the one hand, this is not bad, but on the other hand, it is not worse when help comes from incompetent people giving bad advice.

At one time, like many others, I encountered a large number of advisers and became convinced of how harmful their recommendations could be.

Now I would like to warn beginners against thoughtlessly doing everything that they might advise you on various forums or sites.

Now let’s move on to the top most harmful advice I’ve ever heard.

How to top up a demo account with virtual money when trading in metatrader

A demo account in a trading platform is one of the most necessary tools for both a novice trader and a professional.

On it, technical aspects of opening transactions are worked out, various strategies and scripts for automatic trading are tested.

When opening a new demo account, you can specify almost any balance amount; by default, the trading platform offers $5,000.

But what to do if, as a result of an unsuccessful transaction, you lost your deposit, because this is a fairly typical situation when trading on demo accounts?

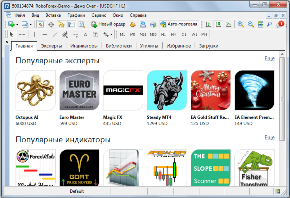

We use Market in the metatrader trading platform with maximum efficiency

There are many additional tools for the trading platform that make the trader’s work more efficient.

If you wish, you can always add the scripts, advisors or indicators you need to the software, depending on what task you need to solve.

The largest number of such tools have been written for the metatrader 4 and 5 trading platforms; not so long ago, the user had to search for them on his own on the Internet.

But with the advent of the “Market” tab in the metatrader, the situation has changed dramatically for the better.

Now the trader not only does not need to browse dozens of sites in search of the necessary script, but also does not need to manually add this script to the trading platform.

Protecting a trader's account from a negative balance

No matter how much they talk and write about the fact that using leverage it is practically impossible to lose the broker’s money.

But as practice shows, in some situations and in individual brokerage companies this option is possible.

After this happens, everything depends on the loyalty of the broker and the trading conditions specified in the client agreement, which rarely anyone reads.

In the worst case scenario, you will have to return your account balance to a positive state by depositing your own funds into it.

To prevent this from happening, you should choose the right broker and adhere to a few simple rules.

Why do you need chart shift, autoscrolling and volumes in metatrader 4

The price movement chart is the main tool of technical analysis in the forex or stock market.

It is the use of the graph that allows you to clearly assess the dynamics of the trend and determine its main parameters necessary for decision-making.

The effectiveness of the market analysis often depends on the appearance of price charts.

Metatrader4, one of the most popular trading platforms at the moment, has several features that make it easier to read information.

Beginners often simply do not know about these functions, and as always, they do not have enough time the instructions for the trading platform

We withdraw profits received on the exchange through cryptocurrencies

If you have already started making money on Forex or the stock exchange, then sooner or later you will be faced with the issue of taxation of the profits received.

This issue has been discussed in detail more than once on our website, you can read about it at this link https://time-forex.com/info/nalogi-s-zarabotka-na-foreks .

There are several options for reducing tax costs, but in any case, you will have to pay something.

But this was the case until recently; now, thanks to cryptocurrencies, there is a unique opportunity to completely avoid taxation when withdrawing profits.

Not long ago, brokers began allowing their clients to withdraw funds to cryptocurrency wallets, thereby charging only transaction costs.

If you work with a broker who is not a tax agent in your country, then he is not required to inform the tax authorities about your income.

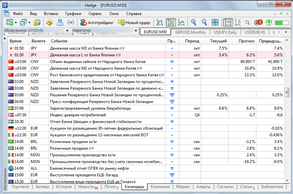

We use the economic news calendar built into metatrader

It's no secret how useful an application such as an economic news calendar is for fundamental analysis.

In it you can get information about current and future events, as well as find out the most likely forecasts for changes in the described events.

Today there are a lot of calendar options on various sites, including ours - https://time-forex.com/kalendar

But the most convenient option for work is the one located directly in the metatrader trading platform, or to be more precise, in its 5th version.

This application displays information on more than 600 important indicators that are necessary for forecasting exchange rates.

Short-term and long-term signals on the forex and stock market

Almost all exchange trading is based on various signals that cause trend strengthening or even reversal.

What could be simpler - some event happened, the price made a reversal and traders opened new transactions in the direction of the trend.

Almost everything can affect the price of an asset, from the financial results of the company and the economic situation in the country, to scandals and rumors related to the management of the corporation.

At the same time, different news affects the trend differently; one news can cause a long-term change in the trend, while another can change the price for just a couple of days.

It all depends on what impact this or that event has - fundamental or purely psychological.

How to change the broker's leverage up or down

The main tool that allows you to significantly increase the volume of Forex transactions is leverage. Its size plays a huge role in many trading strategies; it is also this parameter that is responsible for the amount of risk; it characterizes the ratio of the opened position to own funds.

Its size plays a huge role in many trading strategies; it is also this parameter that is responsible for the amount of risk; it characterizes the ratio of the opened position to own funds.

Many traders, when opening an account, choose the maximum available, and then independently set this ratio.

But there are also those who prefer that the size of the lever immediately correspond to their chosen strategy.

But what to do if this option was already selected when opening an account? There are several options for changing leverage in a trader’s personal account:

Setting up opening orders in metatrader

The most popular trading platform in which most traders open transactions is MetaTrader, version 4 or 5.

Everything in its operation is intuitive, many settings are installed by default and they are quite sufficient for most strategies.

But there are also trading options, the implementation of which requires more fine-tuning, which will make trading more comfortable and efficient.

For example, the same setting for opening new orders slightly expands the standard settings.

When setting up orders, you can set parameters such as one-click trading, the volume of opened transactions, the asset for which the position will be opened, the size of the deviation, etc.

Stable Forex trading or catching chances

Trading is one of the most difficult activities, despite its apparent initial simplicity.

But after you try to make money on the stock exchange, it will immediately become clear that it is not enough to just be able to open transactions.

And you need to have a strictly organized system in which entry signals and conditions under which the transaction will be closed will be specified.

At the same time, not everything is so simple here, since most professional traders can be divided into two categories:

The first are those who trade using exclusively technical or fundamental analysis , while indicator signals or the results of fundamental analysis are used to enter the market.

Setting up SMS messages from MetaTrader

Traditionally, the trading process is perceived as constantly monitoring the movement of the trend on the computer screen.

This observation allows you to identify when the price will make a sharp jump or reach a certain point on the chart of the currency pair.

But in fact, it is not at all necessary to constantly spend time in front of the monitor; it is enough to record only certain price movements and open trades at these moments.

In order to automate the process of receiving signals, the MetaTrader trader terminal provides the “Alerts” function.

It is this that allows you to report a desired event with a sound signal or even send messages to an email address.

But in the first case, you need to be at home in order to hear the sound signal, and in the second, you need to have a normally working Internet connection on your smartphone or iPhone.

Should you admit that you are a trader?

One of the most valuable things in life is peace, and one of the components of peace is how people treat you.

Having started earning money as a trader, I began to consider this occupation as my specialty and when asked “What do you do?” I boldly answered “Trader”.

In most cases, such an answer evoked only negative emotions in people, which affected their attitude towards me.

Some began to consider me a slacker who sat at home and did nothing and began to offer to go to a real job, others assumed that I had a huge amount of extra money and tried to borrow.

But in one case or another, honesty was punished by the negative attitude of these people towards me.

Page 1 of 4

- To the begining

- Back

- 1

- 2

- 3

- 4

- Forward

- In the end