Useful Forex articles about trading

In this section you will find more than a hundred Forex articles devoted to trading on the Forex currency exchange, as well as trading on other financial markets. The given articles about Forex will be useful both to a novice trader and to a person already familiar with this type of activity.

Lowest spreads in NPBFX: broker test drive

The size of the spread is one of the main factors by which millions of traders around the world select a broker for further trading.

This is due to the fact that most financial market participants use short-term trading strategies (scalping, pipsing).

This is due to the fact that most financial market participants use short-term trading strategies (scalping, pipsing).

For such strategies, the size of the spread plays a key role, because... the profit is sometimes only a few points. High spreads can simply “eat” it.

In practice, choosing a high-quality and reliable broker is not so easy. Often, the spread sizes indicated on the official websites of companies differ significantly from real trading ones.

A look at stock trading from a professional trader

It is quite difficult to learn something on your own; it is much easier to use the experience of other people who have already achieved some success in their chosen business.

Despite the fact that I myself have been involved in stock trading for quite a long time, I cannot call myself a true professional.

Therefore, I will give several recommendations, even more thoughts, that I found in an interview with one of the American traders.

Evan Craig can truly be called a professional, since this man manages more than several tens of millions of dollars.

Features of stock trading using leverage

The main advantage of modern stock trading is the ability to use leverage.

Thanks to margin trading, you can increase the transaction volume by tens, hundreds and even thousands of times, while simultaneously increasing the amount of possible profit.

Today there are practically no traders left who refuse such an opportunity as leverage, but at the same time, not everyone takes into account the peculiarities of trading using this instrument.

It seems to beginners that if you open an account with a leverage of 1:1000, then you can trade using the unlimited features of margin trading .

The impact of fake news on stock prices

Fake news has become an integral part of the modern information space. They spread at tremendous speed and can have a serious impact on various areas of life, including the stock market.

Fake news is information that is published to mislead people or create an illusion about something that is not actually true.

They can be in the form of articles, videos, photos or social media posts. Fake news is often created using manipulative techniques and misinformation.

In this article, we will look at the significance of fake news in the modern stock market and its impact on investors and traders.

Dependence of the price of gold on the trading session on the stock exchange

This is not the first day that the price of gold has been moving in a price corridor, sometimes rising by several tens of dollars, then falling again.

It would seem that you can make money in the absence of a clearly defined trend, but for short-term trading there is nothing better than stable patterns and movement in the price corridor.

If the price repeats its movement day after day, then you can take this pattern when opening transactions and make good money on it.

At the same time, the main trend that can be noticed now is that futures are becoming more expensive or cheaper depending on the trading session.

Relationship between leverage size and stop loss level

Stop loss is an integral part of any transaction; setting this stop order allows you to protect your position from large losses.

When calculating the size of the stop loss, they usually focus on two parameters, the first of which is the allowable amount of losses from one transaction, and the second is the location of the stop order.

Most financiers recommend limiting losses from one transaction to 2-3%, with the exception of positions opened as part of high-risk strategies, such as pipsing.

The second indicator is the very place where the stop loss is set, usually these are likely price reversal points, for example, for buy transactions, these are the support line, after breaking through which the price will begin to fall or levels near which a reversal may occur.

Nikkei 225 stock index

We are already accustomed to the fact that most often the news talks about American stock indices, which reflect sentiment in the US stock market.

But it is logical that in other countries there are also tools like Dow Jones and NASDAQ 100 , which help assess the situation in certain sectors of the economy.

Today, the attention of many investors is focused on the Japanese economy, so many will be interested in what the Japanese analogue of Dow Jones is.

The Japanese stock index Nikkei 225 (Nikkei 25) is one of the most significant indicators of the Japanese economy and is widely known throughout the world.

Available indicators for trading gold from MetaTrader 4

Gold is one of the most popular instruments for exchange trading, and due to the fact that the asset is available in the MetaTrader trading platform, almost any strategy can be applied to it.

Most traders prefer, when trading gold, to use fundamental analysis based on factors influencing the price of gold

But the best results in trading can be achieved if you combine fundamental analysis with technical analysis, therefore, when trading precious metals, the use of indicators from the MT4 trading platform will be fully justified.

There are many different indicators in metatrader that can be used to trade gold, but we will focus on three that complement each other.

Investors increasingly want to use ChatGPT in their work; can AI replace the trader?

The advent of artificial intelligence has revolutionized many areas of human activity; programs like ChatGPT successfully write texts, draw pictures, translate texts, and analyze finances.

Because of this, many professionals doubted their future, fearing that their jobs would eventually be taken over by artificial intelligence.

Can the influence of AI spread to such an area of activity as biz trade? To study this issue, a survey of traders from one of the largest brokerage companies was conducted.

The study revealed that 40% of traders surveyed are already ready to use ChatGPT to make analytical forecasts or create trading strategies . And some investors are now using AI recommendations in their work.

Features of stock trading in summer that should be taken into account in a trader’s work

Exchange trading is a dynamic process that is influenced by various factors, including seasonal fluctuations.

Summer is a period when certain changes often occur in financial markets.

In this article we will look at the features of stock trading in the summer and what factors should be taken into account when making trading decisions.

Low market activity - one of the important aspects of exchange trading in the summer is a decrease in trading volume and liquidity.

Often the summer months are characterized by low market activity due to holidays and a decrease in trading volumes on the part of investors.

How to secure a pension for a trader

When you are 20 years old and full of energy, you have no desire to think about old age and retirement, but when you are already 60, it’s too late to think about what to live on if you haven’t earned enough for your old age.

Therefore, you should start ensuring a comfortable old age at a young age, especially if you are engaged in stock trading.

Unlike official employment, traders do not always use a scheme to legalize their income, which involves payments to a pension fund.

And even if you pay income tax to the state, this does not mean that you will receive payments when you retire.

Standard advisors in the metatrader trading platform

The metatrader trading platform is a multifunctional tool and one of its functions is automatic trading.

For this purpose, special scripts called advisors or experts are used; they independently analyze the market and open positions.

By default, the metatrader 4 trading platform contains several installed advisors that can be used in your trading completely free of charge.

Unfortunately, the number of these scripts is only decreasing every year, and now you will rarely find a broker whose trading platform has more than 2 advisors.

What is Bloomberg and how can it be useful for stock trading?

Almost everyone who is interested in finance or economics knows the website bloomberg.com; news and analytics are constantly published on this resource.

Moreover, the site invites its users to choose from which region of the world they want to receive information - Europe, America, Asia or Africa.

But not everyone knows that Bloomberg is not only an online resource, but also a manufacturer of software for stock trading.

the Bloomberg Terminal trading platform , the software is designed to organize professional trading with a payment of 24,000 US dollars per year:

Description of the Bloomberg trading platform and its main features

The most popular trading platform at the moment is Metatrader, but it is always interesting to explore alternative stock trading software options.

Bloomberg is an international trading platform that provides information on financial markets as well as companies and industrial sectors in general.

The platform allows you to receive real-time data, as well as conduct market analysis and make investment decisions.

The history of the Bloomberg trading platform involves a multi-step process, starting with the company's founding in 1981 by Michael Bloomberg.

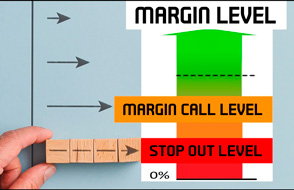

Margin level in the trader’s trading platform, its optimal size

The margin level is an extremely important indicator that characterizes the level of risk for open transactions in the trader’s trading platform.

It is he who warns that a margin call or stop out may soon be triggered, protecting the broker’s funds and forcibly closing the position.

Also, the margin level can be a kind of guideline when opening new transactions; thanks to it, the trader gets an idea of whether there are enough funds to open a new transaction.

How is the margin level calculated in the metatrader trading platform

This indicator is calculated automatically in modern trading platforms. True, this happens only after the first order is opened.

What is the Kelly formula and how is it used in trading?

In any investment field, money management is always an integral part of the process of profitable investment.

There are quite a few experts who argue that a good trading system may not contain elements of money management.

But in practice, ignoring the rules of money management usually results in large losses or complete loss of the deposit.

Money management is most simply understood as constructing an effective plan that allocates the investor's available funds, taking into account risks and potential returns.

A state of fear of missing out

Almost everyone who has been trading on the stock exchange for quite some time is familiar with the situation when it seems that almost everyone is more successful, and you are just wasting time.

In fact, this happens to traders so often that this psychological state even got its name “Fear of Missing Out,” which translates as “Fear of missing out.”

FOMO is experienced by most new investors, a psychological state that occurs when traders think they are missing out on big opportunities or feel inferior to other investors.

The main reason for FOMO is high expectations, lack of a long-term action plan, overestimation of one's own strengths and unwillingness to wait.

Number of people trading Forex today

With the advent of the Internet and software for making transactions online, the Forex market has become accessible not only to banks and corporations, but also to ordinary users of the World Wide Web.

Today, anyone who has reached the age of 18 and has at their disposal a sufficient amount of money to open a transaction can trade on the foreign exchange market.

The popularity of exchange trading was also added by the emergence of such an asset as cryptocurrencies, some of which are also traded on Forex.

Therefore, many people have a logical question: how many traders are currently trading on the Forex currency market?

Top 5 world financiers

In any field there are the most successful, the best, and of course stock trading is no exception.

The most successful traders have earned huge fortunes amounting to billions of dollars.

Most of the people who have achieved success in trading began to engage in stock trading literally from scratch and managed to achieve success only thanks to their work.

Therefore, their experience is a valuable lesson and example for traders who also want to become one of the world's top financiers.

The character of the trader and the peculiarities of trading on the stock exchange associated with him

Lately, we very often come across articles in which the authors tell what a real trader should be like.

According to most people, a real trader is a reasonable person who knows how to analyze, wait and make informed decisions.

But as life shows, it is practically impossible to change a person’s character; it is much easier to find a type of activity that takes into account individual character traits.

This approach can also be applied to stock trading, since today there are simply a huge number of trading options.

Broker server time, what does it matter?

Very often, when opening an order in the metatrader trading platform, you notice that the time the trade was opened does not coincide with what is on your watch.

Many people immediately have suspicions about the integrity of their broker and the reality of the quotes provided.

In fact, the reason for the discrepancy does not lie in the evil intentions of the DC, it’s just that your local time does not match the time on the metatrader server.

Today, the time in the metatrader 4 and 5 platforms of most popular brokers coincides with Eastern European time, which corresponds to GMT+2 in winter or GMT+3 in summer.

An exception may be if you trade through a dealing center that uses its own terminal to open transactions, then you will have to check the time with consultants or determine it empirically by opening an order on a demo account.

How much can you earn on a positive swap, Carry trade strategy

When trading on Forex, there is such a thing as a swap; brokers charge a fee for transferring open positions on the exchange to the next day.

This commission is quite specific, its essence lies in the difference in discount rates between currencies in a currency pair, for this reason the swap value can be either positive or negative.

This aspect was described in more detail on our website in an article located at - https://time-forex.com/praktika/svop-fx

If there is a positive option for a swap, it means that there are people who want to make money on it; at one time, an entire strategy called Carry trade was even developed.

Exchange trading from a legal entity: pros and cons

Not all traders know that trading on the stock exchange can be done either by an individual or a legal entity, firm or company.

That is, you carry out all operations on the stock exchange not on your own behalf, but on behalf of the company for which your personal account will be registered.

If everything is clear about trading from an individual, then when using a company account, a lot of questions arise, the main one of which is what is this for and do I need it?

Therefore, before starting the registration process, you should understand the main advantages and disadvantages of speculative trading of exchange assets through a legal entity.

VIP status in stock trading, benefits and conditions for obtaining

When you have money, you begin to understand that its value lies not only in the fact that money can be used to purchase goods and services, but also in the status itself.

Possession of a certain capital allows you to receive better service and other pleasant VIP privileges.

If we talk about brokerage services for clients with VIP status, they usually receive better trading conditions, extended customer support and a lot of other useful bonuses.

Moreover, quite often you can get a privileged status simply by replenishing a trader’s account with a certain amount.

The most secure way to trade cryptocurrencies in the current situation

The bankruptcy of the FTX exchange was unpleasant news for many investors involved in exchange trading.

As a result, everyone who held funds on this site lost their money and it is not known whether they will be able to return at least some of it.

This is not the first bankruptcy of such organizations, and it is likely that soon we may again hear unpleasant news about another collapse of the cryptocurrency exchange.

After all, most crypto exchanges are uncontrolled organizations and use investor money at their own discretion.

In this situation, many exchange players are wondering what method to use to conclude speculative transactions on cryptocurrency pairs?

Best Alternatives to Crypto Currency Exchanges

One of the most popular options for trading cryptocurrencies is cryptocurrency exchanges.

But for a number of reasons, this option is not suitable for everyone; some do not want to advertise their identity and citizenship, while for others the tools offered are not enough.

Today, there are two alternative options for trading cryptocurrencies, each of which has its own advantages and disadvantages and can be used depending on the objectives.

The first is ordinary crypto-currency wallets, which many gradually began to forget about after they acquired an account on the exchange.

TRON cryptocurrency, possible prospects

Against the backdrop of events in Ukraine, the popularity of cryptocurrencies as an investment asset has noticeably dropped, while at the same time the share of electronic money in financial transactions has increased significantly.

Stablecoins are especially popular because their exchange rate is stable, which allows you to avoid losses when the exchange rate declines.

Stablecoins are not inherently separate cryptocurrencies, but are based on the blockchains of Bitcoin, Ethereum, Tron and some other cryptocurrencies.

At the same time, stablecoins using the protocol from Ethereum and Tron are in the lead; every day the turnover in Tether, USD Coin, Binance USD is only growing, which means that the demand for cryptocurrencies that support transactions is also growing.

The best account type for professional stock trading

The longer you spend trading, the more surprised you become at how many important nuances there are in this matter.

Most beginners, when starting to trade, first of all pay attention to choosing a broker, without particularly thinking about what account they will be trading on.

But this question is just as important, since the number of account options available to choose from is expanding every day, and a correctly made decision can affect the amount of profit received.

Depending on your tasks, you can open the following types of real accounts with a broker - cent, standard, ECN, VIP or PRO, PAMM and Segregated.

The optimal amount of leverage for stock trading on different assets and timeframes

The amount of leverage often plays a decisive role in stock trading and is one of the most important aspects of trading.

An incorrectly chosen ratio of transaction volume to deposit will lead not only to an increase in profit, but also to an increase in risk.

Recently, brokers have begun to compete with each other by providing the maximum amount of leverage; now you can open an account even with a leverage of 1:3000.

At the same time, the motives of brokers are quite clear - the greater the volume of transactions transmitted by the brokerage company to the exchange, the more spread and commission remains with the intermediary.

Leverage 1:1000, features of use and brokers providing it

Exchange trading on Forex has become popular primarily because of the ability to use broker leverage.

It was leverage that made trading more accessible and reduced collateral requirements when opening transactions, thereby allowing even small investors to enter the market.

Every year the amount of leverage provided is only growing, and if previously it was difficult to find a broker with a leverage of more than 1:100, now quite a few brokers provide leverage of 1:1000 or more.

In exchange trading, the size of 1: 1000 is used for peeping on the M1, but besides the strategy itself there are many other features.

Features of stock trading during a crisis

The most useful character trait of any trader is flexibility or the ability to change trading strategy in time.

Markets are constantly changing and therefore failure can be caused by persistent adherence to the usual trading strategy.

By mid-2022, the economic crisis had reached its apogee and many traders had a question: how to trade in this situation?

If at the beginning of the falling markets everything was simple, open sell trades and hold positions until the bottom is reached, now the situation is quite ambiguous.