Useful Forex articles about trading

In this section, you'll find over a hundred Forex articles dedicated to trading on the Forex currency exchange, as well as trading in other financial markets. These Forex articles will be useful for both beginner traders and those already familiar with this activity.

Pipsing on Forex without mistakes. How to avoid losing your deposit?

Pipsing has been one of the most popular strategies among traders with varying levels of trading experience for several decades.

They're scalping in Russia, they're scalping in Europe, and they're scalping in African countries, too. This massive interest is driven by only one reason.

This trading strategy (TS) allows you to realize the desire that most traders bring to the market – to earn quickly and a lot.

Indeed, scalping within a week can bring profits amounting to several hundred, or even thousands of percent of the invested funds.

Warren Buffett's Biggest Mistakes That Cost Him a Lot of Money

Warren Buffett is one of the world's most successful investors. Over the course of his career, he has earned billions of dollars investing in company stocks.

Brief bio of the investor - https://time-forex.com/treyder/uorren-baffet

However, even an experienced investor like Buffett has made mistakes that have cost him billions of dollars.

But this did not stop him from moving forward and earning even more money; the mistakes he made brought invaluable experience and did not become the basis for depression.

In this article, we will look at some of the major mistakes Warren Buffett made that resulted in him losing his money and the money of his investors.

Lowest Spreads at NPBFX: Test Drive the Broker

The spread size is one of the main factors that millions of traders around the world use to select a broker for further trading.

This is due to the fact that most financial market participants use short-term trading strategies (scalping, pipsing).

This is due to the fact that most financial market participants use short-term trading strategies (scalping, pipsing).

For such strategies, the spread size is crucial, as profits can often amount to just a few pips. High spreads can simply eat them away.

In practice, finding a high-quality and reliable broker isn't easy. Often, the spreads listed on companies' official websites differ significantly from actual trading spreads.

A professional trader's perspective on stock trading

It's quite difficult to learn something on your own; it's much easier to use the experience of other people who have already achieved certain success in their chosen field.

Despite the fact that I have been involved in stock trading for quite a long time, I cannot call myself a true professional.

Therefore, I will provide several recommendations, even more thoughts, that I found in an interview with one of the American traders.

Evan Craig can truly be called a professional, as this man manages a sum of more than several tens of millions of dollars.

Peculiarities of stock trading using leverage

The main advantage of modern stock trading is the ability to use leverage.

Margin trading allows you to increase your trade volume by tens, hundreds, or even thousands of times, while simultaneously increasing your potential profit.

Today, there are virtually no traders who refuse the opportunity of leverage, but at the same time, not everyone takes into account the specifics of trading using this instrument.

Beginners may think that if they open an account with 1:1000 leverage, they can trade using the unlimited features of margin trading .

The Impact of Fake News on Stock Markets

Fake news has become an integral part of the modern information landscape. It spreads at breakneck speed and can have a significant impact on various aspects of life, including the stock market.

Fake news is information that is published with the intention of misleading people or creating an illusion about something that is not actually true.

They can take the form of articles, videos, photographs, or social media posts. Fake news is often created using manipulative methods and disinformation.

In this article, we will examine the importance of fake news in the modern stock market and its impact on investors and traders.

Gold price dependence on the trading session on the exchange

For several days now, the price of gold has been moving within a price corridor, sometimes rising by several tens of dollars, then falling again.

It would seem that it is possible to make money in the absence of a clearly defined trend, but for short-term trading there is nothing better than stable patterns and movement within a price corridor.

If the price repeats its movement day after day, then you can take this pattern when opening trades and make good money on it.

The main trend that can be noticed now is that futures rise or fall in price depending on the trading session.

The relationship between leverage and stop-loss levels

A stop loss is an integral part of any trade; setting this stop order allows you to protect your position from large losses.

When calculating the size of a stop loss, two parameters are usually used: the first is the acceptable amount of loss from one transaction, and the second is the location where the stop order is placed.

Most financial experts recommend limiting losses per trade to 2-3%, with the exception of positions opened as part of high-risk strategies such as scalping.

The second indicator is the stop-loss placement itself, which is usually a likely price reversal point. For example, in buy trades, this is a support line, after which the price will begin to fall, or levels near which a reversal may occur.

Nikkei 225 stock index

We have become accustomed to the fact that the news most often talks about American stock indices, which reflect the mood on the US stock market.

But it is logical that in other countries there are also tools similar to the Dow Jones and NASDAQ 100 , which help assess the situation in certain sectors of the economy.

With many investors' attention focused on Japan's economy today, many will be interested in what the Japanese equivalent of the Dow Jones is.

The Japanese stock index Nikkei 225 (Nikkei 25) is one of the most significant indicators of the Japanese economy and is widely known throughout the world.

Available indicators for gold trading in MetaTrader 4

Gold is one of the most popular instruments for stock trading, and thanks to the fact that the asset is available on the MetaTrader trading platform, almost any strategy can be applied to it.

Most traders prefer to use fundamental analysis when trading gold based on the factors that influence the price of gold.

However, the best trading results can be achieved by combining fundamental and technical analysis, so when trading precious metals, using indicators from the MT4 trading platform is entirely justified.

MetaTrader offers a variety of indicators that can be used for gold trading, but we'll focus on three that complement each other.

Investors are increasingly looking to use ChatGPT in their work. Can AI replace traders?

The advent of artificial intelligence has revolutionized many areas of human activity; programs like ChatGPT successfully write texts, draw pictures, translate texts, and analyze finances.

This has left many professionals questioning their future, fearing that their jobs will eventually be taken over by artificial intelligence.

Could AI's influence extend to the world of stock trading? To explore this question, a survey of traders at one of the largest brokerage firms was conducted.

The study found that 40% of surveyed traders are already willing to use ChatGPT to generate analytical forecasts or develop trading strategies . Some investors are already using AI recommendations in their work.

Features of stock trading in summer that a trader should consider

Exchange trading is a dynamic process that is influenced by various factors, including seasonal fluctuations.

Summer is a period when certain changes often occur in the financial markets.

In this article, we'll look at the specifics of stock exchange trading during the summer and what factors to consider when making trading decisions.

Low market activity is one of the important aspects of stock trading in the summer - it means a decrease in trading volume and liquidity.

The summer months are often characterized by low market activity due to holidays and reduced trading volumes from investors.

How to secure a trader's retirement

When you're 20 years old and full of energy, you don't want to think about old age and retirement, but when you're already 60, it's too late to think about what to live on if you haven't earned enough for your old age.

Therefore, you should start ensuring a comfortable retirement while you are still young, especially if you are involved in stock trading.

Unlike formal employment, traders do not always use income-legalization schemes that involve payments to a pension fund.

And even if you pay income tax to the state, this does not mean that you will be assigned payments when you retire.

Standard Expert Advisors in the MetaTrader Trading Platform

The MetaTrader trading platform is a multifunctional tool, and one of its functions is automated trading.

For this purpose, special scripts called advisors or experts are used; they independently analyze the market and open positions.

By default, the MetaTrader 4 trading platform comes with several pre-installed expert advisors that you can use in your trading completely free of charge.

Unfortunately, the number of these scripts is only decreasing every year, and now you will rarely find a broker whose trading platform has more than two advisors.

What is Bloomberg and how can it be useful for stock trading?

Almost everyone interested in finance or economics knows the website bloomberg.com, which regularly publishes news and analysis.

Moreover, the site offers its users the choice of which region of the world they want to receive information from – Europe, America, Asia, or Africa.

But not everyone knows that Bloomberg is not only an online resource, but also a manufacturer of software for stock trading.

The main product is the trading platform " Bloomberg Terminal ", software designed for organizing professional trading with a fee of 24,000 US dollars per year:

Description of the Bloomberg trading platform and its main features

Metatrader is currently the most popular trading platform, but it's always interesting to explore alternative trading software options.

Bloomberg is an international trading platform that provides information on financial markets, as well as on companies and industrial sectors in general.

The platform allows you to receive data in real time, as well as conduct market analysis and make investment decisions.

The history of the Bloomberg trading platform involves a multi-stage process, beginning with the company's founding in 1981 by Michael Bloomberg.

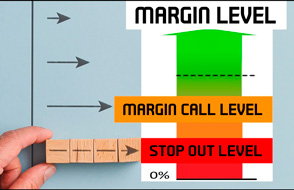

Margin level in a trader's trading platform, its optimal size

The margin level is an extremely important indicator that characterizes the level of risk for open transactions in a trader's trading platform.

It is this that warns that a margin call or stop out may soon be triggered, protecting the broker's funds and forcibly closing the position.

The margin level can also serve as a guideline when opening new trades, allowing the trader to determine whether there are sufficient funds to open a new trade.

How is margin calculated in the MetaTrader trading platform?

This indicator is calculated automatically in modern trading platforms. However, this only occurs after the first order is opened.

What is the Kelly formula and how is it used in trading?

In any investment area, capital management is always an integral part of the process of profitable investment of money.

There are quite a few experts who argue that a good trading system may not contain any elements of money management.

But in practice, ignoring money management rules usually results in large losses or the complete loss of the deposit.

Capital management is most simply understood as the development of an effective plan that allocates an investor's available funds taking into account risks and potential returns.

Fear of missing out

Almost everyone who has been trading on the stock exchange for a long time is familiar with the feeling when it seems that almost everyone is more successful, and you are just wasting your time.

In fact, this happens to traders so often that this psychological state has even received its own name, “Fear of Missing Out.”.

FOMO is experienced by most beginning investors, a psychological state that occurs when traders believe they are missing out on big opportunities or feel less successful than other investors.

The main causes of FOMO are inflated expectations, lack of a long-term action plan, overestimation of one's own strengths, and an unwillingness to wait.

The number of people trading forex today

With the advent of the internet and software for online trading, the forex market has become accessible not only to banks and corporations, but also to ordinary internet users.

Today, anyone over 18 years of age and with sufficient funds to open a transaction can trade on the foreign exchange market.

The emergence of cryptocurrencies, some of which are also traded on Forex, has also added to the popularity of stock trading.

Therefore, many people have a natural question: how many traders are currently trading on the Forex currency market?

Top 5 global financiers

In any field there are the most successful, the best, and of course, stock trading is no exception.

The most successful traders have made huge fortunes, amounting to billions of dollars.

Most people who have achieved success in trading started trading on the stock exchange literally from scratch and were able to achieve success only through their own hard work.

Therefore, their experience is a valuable lesson and example for traders who also want to become one of the world's top financiers.

The character of a trader and the specifics of trading on the stock exchange associated with it

Lately, I've been coming across a lot of articles in which the authors describe what a real trader should be like.

Most people believe that a real trader is a reasonable person who knows how to analyze, wait, and make informed decisions.

But as life shows, it is practically impossible to change a person’s character; it is much easier to find a type of activity that takes into account individual character traits.

This approach can also be applied to stock trading, as today there is a huge number of trading options.

Broker server time, what does it mean?

Very often, when opening an order in the MetaTrader trading platform, you notice that the trade opening time does not match what is shown on your watch.

Many people immediately have doubts about the integrity of their broker and the reality of the quotes provided.

In fact, the reason for the discrepancy is not due to the DC's malicious intentions; your local time simply does not match the time on the MetaTrader server.

Today, the time in the MetaTrader 4 and 5 platforms of most popular brokers coincides with the Eastern European time, which is GMT+2 in winter or GMT+3 in summer.

An exception might be if you're trading through a dealing center that uses its own terminal to open trades. In this case, you'll need to check the time with consultants or determine it empirically by opening an order on a demo account.

How much can you earn with a positive swap? Carry trade strategy

When trading on Forex, there is a concept called swap. Brokers charge a fee for carrying open positions on the exchange over to the next day.

This commission is quite specific; its essence lies in the difference in the interest rates of the currencies in the currency pair; for this reason, the swap value can be either positive or negative.

This aspect was described in more detail on our website in an article located at https://time-forex.com/praktika/svop-fx

If there is a positive swap option, then there are those who want to make money on it; at one time, an entire strategy was even developed called Carry trade.

Stock trading from a legal entity: pros and cons

Not all traders know that trading on the exchange can be done by both individuals and legal entities, firms, or companies.

This means you conduct all transactions on the exchange not on your own behalf, but on behalf of the company to which your personal account will be registered.

While trading as an individual is straightforward, using a company account raises a host of questions, the main one being: why is this necessary and do I need it?

Therefore, before beginning the registration process, it is necessary to understand the main advantages and disadvantages of speculative trading of exchange assets through a legal entity.

VIP status in stock trading, benefits and conditions for obtaining it

When you have money, you begin to understand that its value lies not only in the fact that money can be used to purchase goods and services, but also in the status itself.

Having a certain amount of capital allows you to receive better service and other pleasant VIP privileges.

When it comes to brokerage services for VIP clients, they typically receive better trading conditions, enhanced customer support, and a host of other useful bonuses.

Moreover, quite often you can obtain privileged status simply by replenishing your trader account with a certain amount.

The safest way to trade cryptocurrencies in the current situation

The bankruptcy of the FTX exchange was bad news for many investors involved in exchange trading.

As a result, everyone who held funds on this platform lost their money, and it is unknown whether they will be able to recover even part of it.

This is far from the first bankruptcy of such organizations, and it is quite possible that we may soon hear unpleasant news about another cryptocurrency exchange collapse.

After all, most crypto exchanges are unregulated organizations and use investors' money at their own discretion.

In this situation, many stock market players are wondering what method to use to make speculative trades on cryptocurrency pairs?

The Best Alternatives to Cryptocurrency Exchanges

One of the most popular options for trading cryptocurrencies is cryptocurrency exchanges.

However, for a number of reasons, this option is not suitable for everyone: some do not want to advertise their identity and citizenship, while others find the tools offered insufficient.

Today, there are two alternative options for trading cryptocurrencies, each of which has its own advantages and disadvantages and can be used depending on the objectives.

The first is regular cryptocurrency wallets, which many gradually began to forget about after getting an account on an exchange.

TRON cryptocurrency: potential prospects

Against the backdrop of events in Ukraine, the popularity of cryptocurrencies as an investment asset has noticeably declined, while the share of electronic money in financial transactions has grown significantly.

Stablecoins are particularly popular because their exchange rates are stable, which helps avoid losses when the exchange rate drops.

Stablecoins are not, in essence, separate cryptocurrencies, but are based on the blockchains of Bitcoin, Ethereum, Tron, and some other cryptocurrencies.

At the same time, stablecoins using the Ethereum and Tron protocol are leading the way; turnover in Tether, USD Coin, and Binance USD is only growing every day, which means that demand for cryptocurrencies that support transactions is also growing.

The best account type for professional stock trading

The longer you trade, the more you are amazed at how many important nuances there are in this business.

Most newbies, when starting to trade, first focus on choosing a broker, without giving much thought to the account they will be trading on.

But this question is just as important, as the number of account options available to choose from is expanding every day, and the right decision can impact the amount of profit you receive.

Depending on your goals, you can open the following types of real accounts with a broker: cent, standard, ECN, VIP or PRO, PAMM, and Segregated.

Optimal leverage for stock trading on different assets and timeframes

The amount of leverage often plays a decisive role in stock trading and is one of the most important aspects of trading.

An incorrectly chosen ratio of transaction volume to deposit will lead not only to an increase in profit, but also to an increase in risk.

Recently, brokers have begun competing with each other to offer the highest leverage possible; now, you can even open an account with leverage as high as 1:3000.

At the same time, the brokers' motives are quite clear: the larger the volume of transactions transferred by the brokerage company to the exchange, the greater the spread and commission that remains with the intermediary.