ProfitLine indicator: finding the breakeven level

When trading, every novice trader, and even experienced ones, sooner or later encounters a situation where, after opening a profitable trade, the price reverses and moves against the trader, closing the trade on a stop order.

To prevent this from happening, it is necessary to always move the stop order to a break-even point.

However, while everything is perfectly clear with a single market transaction, since it is enough to move the stop order after a certain period of time to the point where the transaction was opened, when working with a series of orders, things become more problematic.

This problem is especially critical for traders who use it in their trading averaging strategies and elements of martingale.

What happens if a trader uses a grid strategy and has orders open in different directions at the same time?

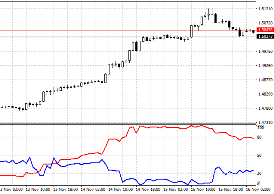

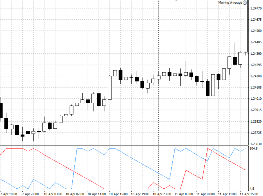

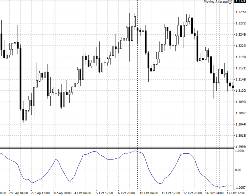

Price Channel Oscillator: A Tool to Facilitate Pairs Trading

The goal of any trader and investor is to minimize risks as much as possible while still achieving acceptable returns.

Large hedge funds achieve this goal through smart hedging risks, creating the most market-neutral portfolios of stocks and other assets, as well as by searching for a direct relationship between assets, their correlation and, most importantly, spread or swap.

However, in pairs trading, everything is far from as simple as it seems at first glance, because knowing the direct relationship between assets is necessary to catch the very moment of profit due to the spread that occurs when the charts diverge significantly.

To simplify pair trading and find expansion zones for different assets, traders overwhelmingly use specialized assistants. We'll learn about one such assistant in this article.

The Price Channel Oscillator indicator is an auxiliary technical analysis tool whose main task is to build a price oscillator based on two currency pairs.

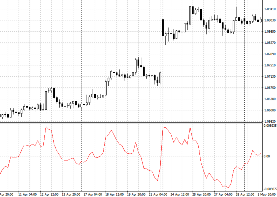

Days of the week indicator

Trading in financial markets, and especially the Forex market, is based in one way or another on the search patterns.

The unique appearance of a candle, the intersection of indicator lines, the breakout of a level, the opening of a position at a certain time of day, and so on – all this is the development of discovered patterns.

One of the most obvious patterns is the movement of an asset's price at a certain time of day, day, or even month.

Traders have added the concept of seasonality to some assets, as the price abnormally increases its activity during certain months of the year.

However, searching for such patterns takes a lot of effort, so traders resort to auxiliary indicators that create markings on the chart.

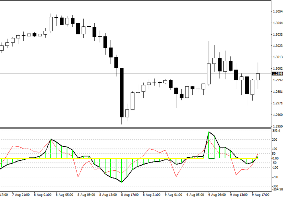

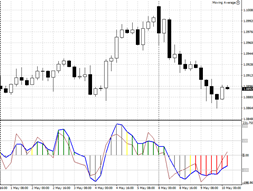

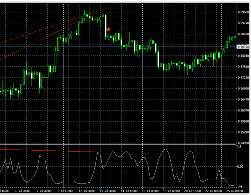

LeMans Variation: Market Signal Source

Any trading strategy cannot do without its most important element – a signal indicator.

For this role, as a rule, all kinds of oscillators or custom tools based on them are used.

The LeMan Variation indicator is a technical analysis tool that belongs to the category of oscillator indicators.

It's worth noting that the LeMan Variation indicator is a unique development, as its creator didn't use standard tools during its creation, but implemented his idea from scratch.

Like all indicators belonging to the oscillator group, LeMan Variation can be safely used on absolutely all time frames, and it demonstrates particularly high efficiency on small time frames, which are most often used when scalping.

FractPrice indicator

Based on research by numerous traders and analysts, the price spends almost 70 percent of its time in so-called sideways or wide flats.

Market activation usually occurs after the breakout of the next extreme or support and resistance levels.

One of the first traders to recognize the importance of identifying extreme points and to refine the process by creating his own indicator was Bill Williams.

It was he who introduced the concept of Fractals to the stock and currency markets, proposing the concept of taking as a basis five candles and the highest point, which is usually in the middle of the candle combination.

Thanks to the fact that Bill published his own book in which he revealed the secrets of his trading strategy.

The GentorCCI indicator. A multi-tasking forex indicator

Standard indicators are a great source of ideas for many traders and programmers who are trying to create technical analysis something newer, unique and inimitable.

However, it's not always necessary to completely alter standard indicators to create something unique. Sometimes, it's enough to take a creative approach to their use, and most importantly, their combination.

One of these extremely common approaches to creating custom indicators is combining oscillators of different periods in a single window, which produces a completely new type of signal when they cross.

In this article, you will learn about one such indicator, the basis for which was a non-standard approach to using a standard indicator.

WolfWavesFind indicator

It's no secret that the market has a wave structure. One of the first traders to discuss this more than twenty years ago was Charles Dow.

Now that there is no need to draw graphs manually, as was previously the case, everyone can see this for themselves.

Any growth is sooner or later followed by a decline, and while the wave sizes may vary in both the number of candles and the dynamics of their occurrence, the overall structure of the trend is practically identical in all markets.

It was this pattern that Ralph Elliott first noted when he created his own wave theory of five trend waves and three correction waves.

This theory has found millions of followers around the world, but as practice has shown, everything is far from ideal as described in books.

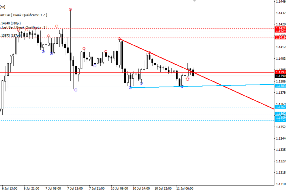

4PMA Indicator. Automatic Channeling

Channel strategies are rightfully considered one of the most effective technical analysis tools.

The fact is that prices almost always trade within a certain range, sometimes deviating toward one of the invisible boundaries, sometimes bouncing back from it to conquer new extremes.

Thus, the emergence of trading tactics within a channel, which represents two strong support and resistance levels, is a common pattern in price observation.

However, while there is no doubt about the effectiveness of using channels to find market signals, many people have difficulty plotting them on a chart independently, especially when choosing extreme points and the prices at which to draw these lines.

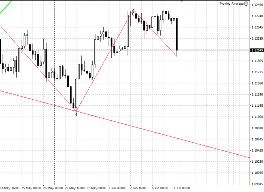

The Mouteki indicator. An implementation of Thomas DeMark's famous trend line construction

Thomas Demark became famous throughout the world not only for his phenomenal profitability and successful trading,

The most interesting thing is that DeMark himself never resorted to complex technical analysis techniques in his trading; moreover, he placed a huge emphasis on the most common trend lines.

However, while traders are still puzzled over which two extremes to use to construct a line, Thomas DeMark has clarified the construction rules, creating the concept of a pivot point and a clear algorithm for finding them.

It was the specification of DeMark's construction rules that allowed programmers to recreate many indicators using his methods, and the Mouteki indicator is one of them.

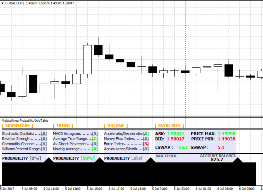

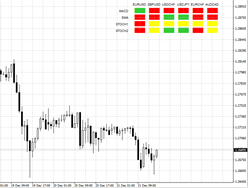

Multi Info Table. Signals from 12 trading indicators in a single window

The indicators that are included by default in the MT4 trading terminal are worth considering, but it is impossible to use such a large number of tools simultaneously.

If you apply a large number of indicators to a chart, you will simply lose the ability to fully track price movements and apply graphical elements.

To avoid cluttering the chart's workspace, special information indicators were developed. They provide data from multiple indicators simultaneously in the form of a table or panel, without taking up much space on the chart.

The Multi Info Table indicator is a special information indicator that, like a radar, tracks changes in more than 12 standard indicators simultaneously and displays information on emerging signals to the trader.

In addition to tracking many indicators simultaneously, Multi Info Table also summarizes their data and displays the probability of price movement as a percentage in one direction or another.

The Wolfen indicator. Automatically plots Wolfe waves

Unlike other methods of market analysis, wave theory allows for clear predictions of future price movements and long-term forecasts.

Inspired traders and followers of the wave theory developed their own approaches, and one of the most popular wave offshoots became the famous "Wolfe Waves".

The Wolfnen indicator is a technical analysis tool that allows you to plot Wolfe waves completely automatically.

It is worth noting that Wolfe Waves are equally effective on any time frame you use.

Given that the wave structure is present on any timeframe, it's also worth mentioning that the tool is multi-currency and allows for automatic marking not only on currency pairs but also on CFDs.

Kagi chart indicator

Many traders are constantly searching for additional tools that will help them cut through the so-called market noise in Forex.

Indeed, the presence of market noise and constant sideways movements manage to confuse even experienced professionals.

The only sure way to eliminate this kind of noise is to decouple price movement from the time frame and base the chart on distance traveled rather than time frames.

The Kagi chart indicator is a technical analysis tool that allows you to separate price movements from time periods and create the famous Kagi chart based on past price ranges.

It is worth noting that the Kagi indicator is plotted both directly on the price chart and below it as a separate line.

Woodies CCI indicator

Standard indicators are the most popular tools technical analysis on the Forex market.

However, as they gain experience and knowledge, sooner or later every more experienced trader begins to doubt their informativeness and effectiveness.

This is simply due to the fact that each trader develops their own view of the market, their own ideas and developments.

Standard indicators reflected the ideas of the traders who created these instruments.

A lack of information and the trader's self-realization lead to popular standard indicators being constantly improved, refined, and modified beyond recognition.

Aroon indicator.

Price movement occurs only due to the actions of two categories of traders in the market, which form supply and demand.

Buyers are actively opening buy deals, thereby creating demand, and sellers are placing orders for sale, increasing the supply of currency on the forex market.

It is the predominance of a particular category on the market that forms the main trend towards which transactions are usually opened.

This is why, when analyzing the market, it is very important to determine the dominant crowd, and it is very important to consider the category of sellers and buyers both simultaneously and separately.

This can be achieved in only two ways: by reading the order book, which is impossible in the Forex market, or by using technical indicators.

One such indicator that tracks both sellers and buyers in the market is Aroon.

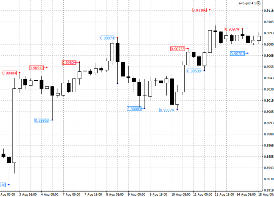

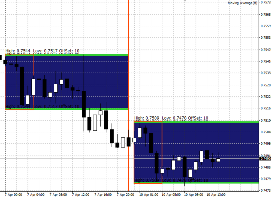

Breakout Panca Indicator: Trading the Morning Flat

Every currency pair has its own time zones of activity. This is due to the simple presence of trading Forex sessions, which arose because traders from different countries trade at completely different times of the day.

This characteristic creates certain patterns in the market. For example, the market always remains in a very tight trading range during the Asian trading session, which typically occurs overnight and early in the morning.

This is caused by the fact that Europeans and Americans are simply sleeping at this time of day, while Eastern countries are conducting their trades.

The established range of the Asian trading session serves as a kind of reference point for many traders, and a breakout of one of the range boundaries is an indicator that shows which direction the market will move throughout the day.

The Breakout Panca indicator is a technical analysis tool whose main purpose is to visually outline the morning range for the trader flatA.

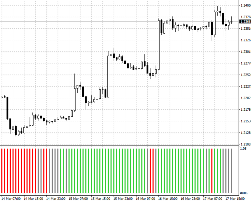

BB Trend Flat. Identify flats in seconds

Trading financial assets always involves building positions in the direction of a certain trend.

However, the market isn't as linear as we'd like, characterized by range-bound movements, accumulations, and price movements into what's known as a Forex flat .

For most trend-following strategies, a flat is comparable to a loss, as the price can repeatedly break a trader's protective order, and re-entering the market from virtually the same point forces the trader to constantly reassess their signals.

Once caught in a flat cycle, a strategy can generate a huge number of false signals, and in the best-case scenario, the position will simply languish with fluctuating profits, accumulating negative swaps.

To avoid such situations, it's essential to correctly identify flats, and the BB Trend Flat indicator can help with this.

InstaForex Indicator Collection

Technical analysis It is very difficult to imagine the use of various Forex indicators, since otherwise, without measuring any technical characteristics of the price, the analysis itself would simply not exist.

Naturally, to trade effectively, a trader must skillfully combine technical indicators, as each has both strengths and weaknesses, allowing them to compensate for each other's shortcomings.

Today, you can find thousands of different unauthorized indicators online, all of which lack any useful instructions for use, let alone a description of the basis on which the tool was built.

Such chaos and abundance of instruments leads even experienced market participants to base their strategies on unknown sources, which naturally leads to disastrous consequences and the loss of deposits.

Chaos Reversal Indicator

The market has extremely unpredictable behavior, and price movements are more reminiscent of chaos than the well-known phase of a trend or flat.

Unfortunately, or perhaps fortunately, it is precisely its unpredictability and chaotic movement that allows millions of traders around the world to earn money.

Just imagine if the market had not a chaotic price movement with a tendency to a certain trend, but a clear directional trend that everyone could identify.

In that case, no one would be able to make money, since in financial markets people only make money when everyone else is losing.

Indicator - three screens

The emergence of the famous strategy "Elder's Three Screens" made a kind of revolution in the field of technical analysis.

Previously, traders could only occasionally see what was happening on higher time frames. Thanks to the principles outlined in the strategy, the number of signals opened against the trend has significantly decreased.

In fact, the fundamental principle of the strategy was to measure the trend and direction of the trend on higher time frames, and to enter the market directly based on signals from a lower time frame and necessarily in the direction of the higher time frame.

SpearmanRankCorr indicator

Today, there are dozens of different approaches to market analysis and thousands of indicators based on them.

However, almost all technical indicators have one thing in common: they are based on statistics.

One way or another, when using any signal tool, we hope that the situation that previously occurred on the chart will repeat itself again.

Despite this, mathematical and statistical approaches are subject to unhealthy criticism from traders.

At the same time, almost no one disputes the graphical analysis (http://time-forex.com/tehanaliz/graf-analiz).

The SpearmanRankCorr indicator is a technical analysis tool based on complex mathematical calculations. The SpearmanRankCorr indicator is based on the Spearman rank correlation coefficient, which is implemented as a smoothed oscillator.

Spearman indicator

Traders who often criticize technical indicators and refuse to use them, pointing out that they are not based on an effective algorithm.

Also critics technical analysis They argue that indicators use historical prices in their calculations, so the signals will always be lagging.

The development of Forex trading has given rise to the creation of thousands of ridiculous tools that are quite colorful in appearance but offer no practical benefit, but not all indicators are as toothless as critics paint them.

For example, the Spearman indicator contains a complex mathematical formula that is designed to search for rank correlation.